Indiana Milker Services Contract - Self-Employed

Description

How to fill out Indiana Milker Services Contract - Self-Employed?

Discovering the right legal record web template could be a struggle. Of course, there are plenty of templates accessible on the Internet, but how can you discover the legal type you will need? Take advantage of the US Legal Forms site. The assistance delivers a huge number of templates, such as the Indiana Milker Services Contract - Self-Employed, which can be used for organization and personal demands. Every one of the types are examined by experts and meet federal and state specifications.

If you are currently authorized, log in for your profile and click on the Down load switch to have the Indiana Milker Services Contract - Self-Employed. Make use of profile to search from the legal types you possess acquired earlier. Go to the My Forms tab of your own profile and have one more duplicate of your record you will need.

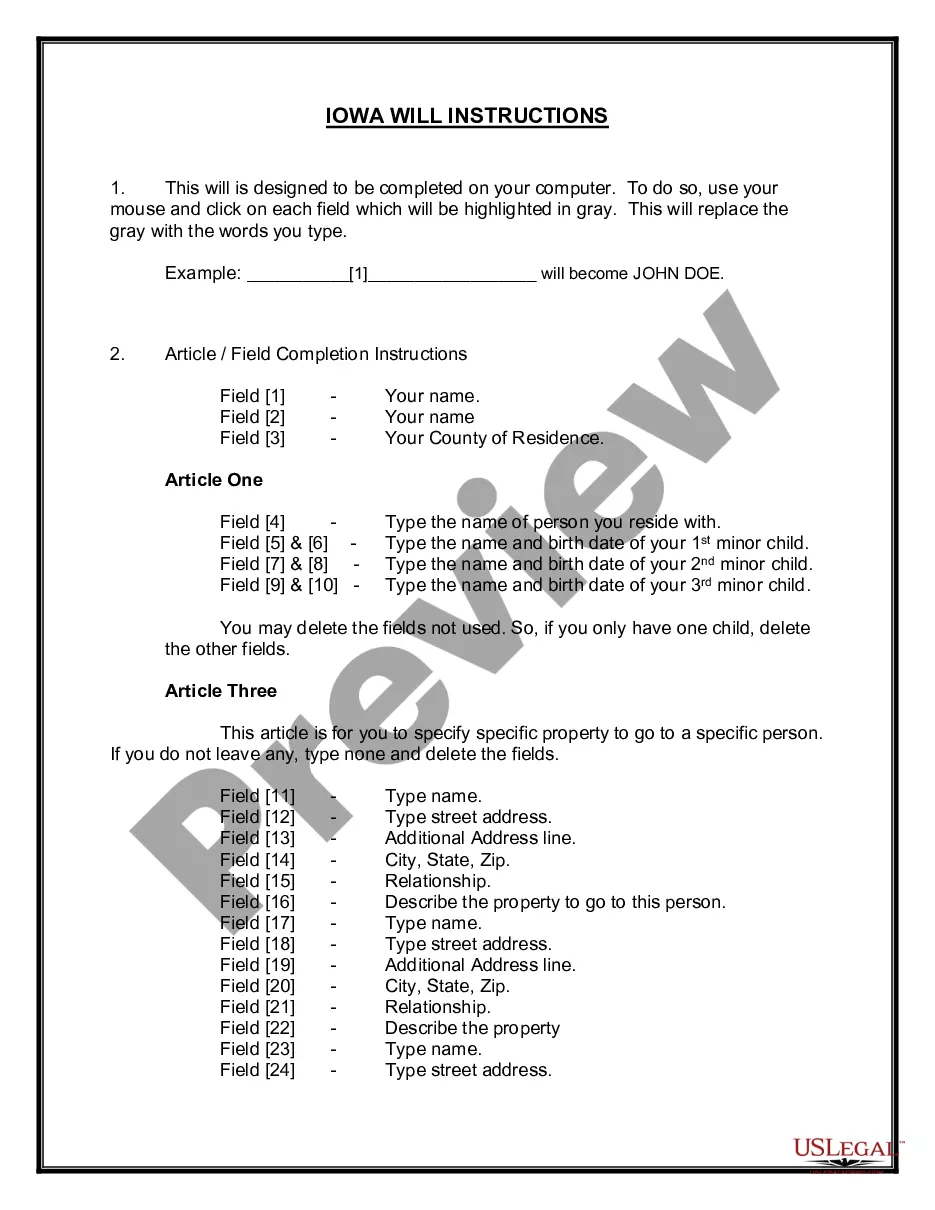

If you are a brand new user of US Legal Forms, here are easy directions for you to follow:

- Very first, ensure you have chosen the right type for your personal city/region. You may look over the form using the Review switch and look at the form explanation to ensure it is the right one for you.

- In case the type is not going to meet your needs, take advantage of the Seach field to obtain the right type.

- Once you are positive that the form is acceptable, click on the Purchase now switch to have the type.

- Select the costs program you desire and type in the needed details. Make your profile and pay money for the transaction utilizing your PayPal profile or Visa or Mastercard.

- Pick the submit formatting and down load the legal record web template for your product.

- Total, edit and printing and signal the obtained Indiana Milker Services Contract - Self-Employed.

US Legal Forms may be the greatest collection of legal types where you will find a variety of record templates. Take advantage of the service to down load skillfully-created documents that follow express specifications.

Form popularity

FAQ

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

The 5 personality traits that make a successful contractorConfidence. To become a successful contractor - it's important to have confidence in your own abilities.Personable.Flexibility.Problem Solving.Honesty.

It seems obvious, but make sure that you include in the contract the contractor's name, physical address, phone number, insurance company and account and license numbers.

§ 547.59. Definition of a Personal Services Contract. (a) A Personal Services Contract is defined as any contract, requisition, purchase order, etc. (except public works contracts) under which labor or personal services is a significant, separately identifiable element.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

Service Contracts are agreements between a customer or client and a person or company who will be providing services. For example, a Service Contract might be used to define a work-agreement between a contractor and a homeowner. Or, a contract could be used between a business and a freelance web designer.

There are three key documents you need from an independent contractor: a W-9 form, a written contract, and documentation of payment information. In case of an IRS audit, it's important to keep thorough documentation on your independent contractors. Learn more about each form you need, below.

The law defines an employee as someone who is engaged under a contract of service, while an independent contractor is one who is engaged under a contract for services.

This agreement should clearly state what tasks the contractor is to perform. The agreement will also include what tasks will be performed and how much the contractor will be paid for his or her work. A contractor agreement can also help demonstrate that the person is truly an independent contractor and not an employee.

Contract or otherwise in relation to any service. The burden of proving the deficiency in service is upon the personrendered under a 'contract of personal service'. Such service is service rendered under a 'contract for personal services. State Consumer Disputes Redressal Commission.