Indiana Underwriter Agreement - Self-Employed Independent Contractor

Description

How to fill out Indiana Underwriter Agreement - Self-Employed Independent Contractor?

Finding the right authorized file design can be a have difficulties. Naturally, there are plenty of templates available on the net, but how do you find the authorized type you require? Take advantage of the US Legal Forms site. The service offers a huge number of templates, like the Indiana Underwriter Agreement - Self-Employed Independent Contractor, which can be used for organization and personal demands. All of the varieties are inspected by specialists and meet state and federal requirements.

When you are presently authorized, log in in your bank account and click the Acquire key to get the Indiana Underwriter Agreement - Self-Employed Independent Contractor. Utilize your bank account to appear through the authorized varieties you possess acquired earlier. Proceed to the My Forms tab of your own bank account and have one more backup of the file you require.

When you are a new user of US Legal Forms, allow me to share simple guidelines that you can stick to:

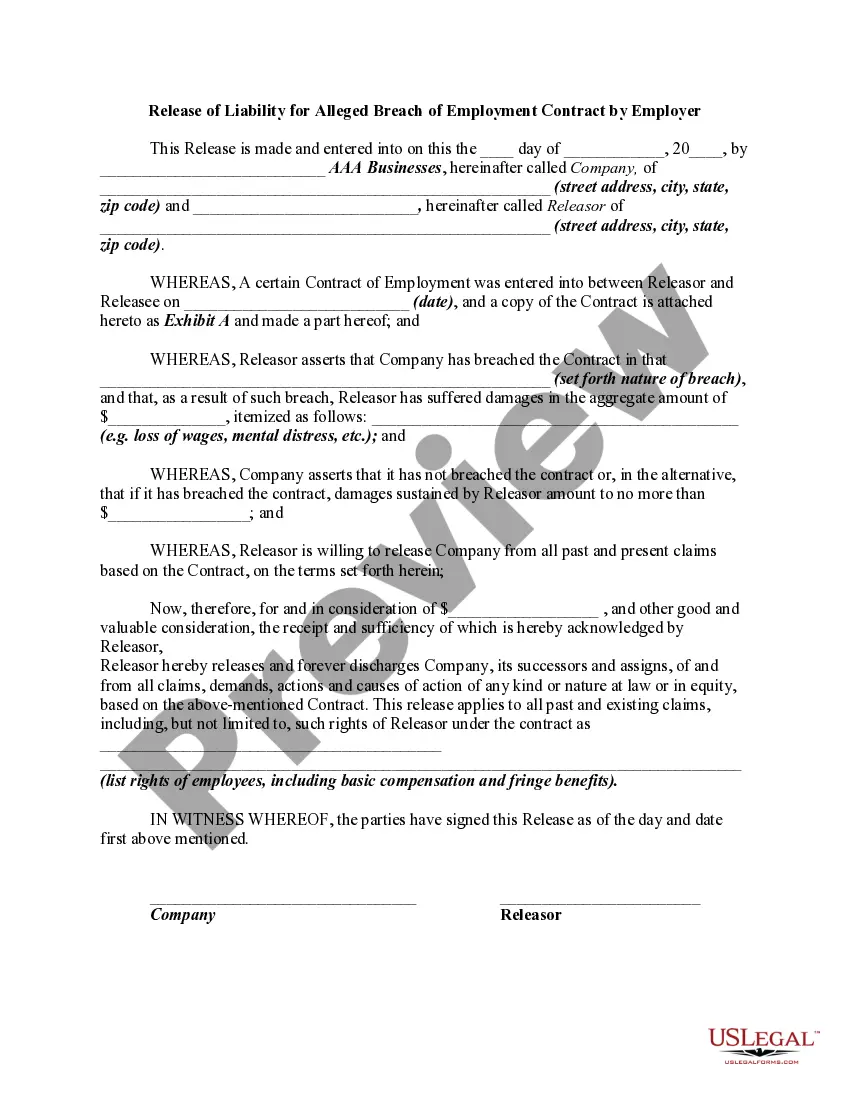

- Initially, make certain you have chosen the appropriate type for your personal town/state. You are able to examine the form using the Review key and study the form explanation to guarantee it is the best for you.

- In case the type does not meet your requirements, make use of the Seach area to get the appropriate type.

- When you are certain the form is proper, select the Get now key to get the type.

- Choose the rates strategy you would like and enter the essential info. Create your bank account and pay for the transaction utilizing your PayPal bank account or Visa or Mastercard.

- Opt for the submit formatting and obtain the authorized file design in your device.

- Comprehensive, change and produce and indicator the attained Indiana Underwriter Agreement - Self-Employed Independent Contractor.

US Legal Forms will be the greatest catalogue of authorized varieties that you can discover numerous file templates. Take advantage of the company to obtain expertly-made documents that stick to express requirements.

Form popularity

FAQ

The difference between the two designations is how they earn income: Independent contractors do specific tasks for clients for a set fee. Sole proprietors may do contract work, but may also have other revenue streams, like selling their own products to customers.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees. In contrast, actual company employees are considered W-2 employees.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

If you work for an employer, you're an employee. If you're self-employed, you're an independent contractor.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.