Indiana Survey Assistant Contract - Self-Employed

Description

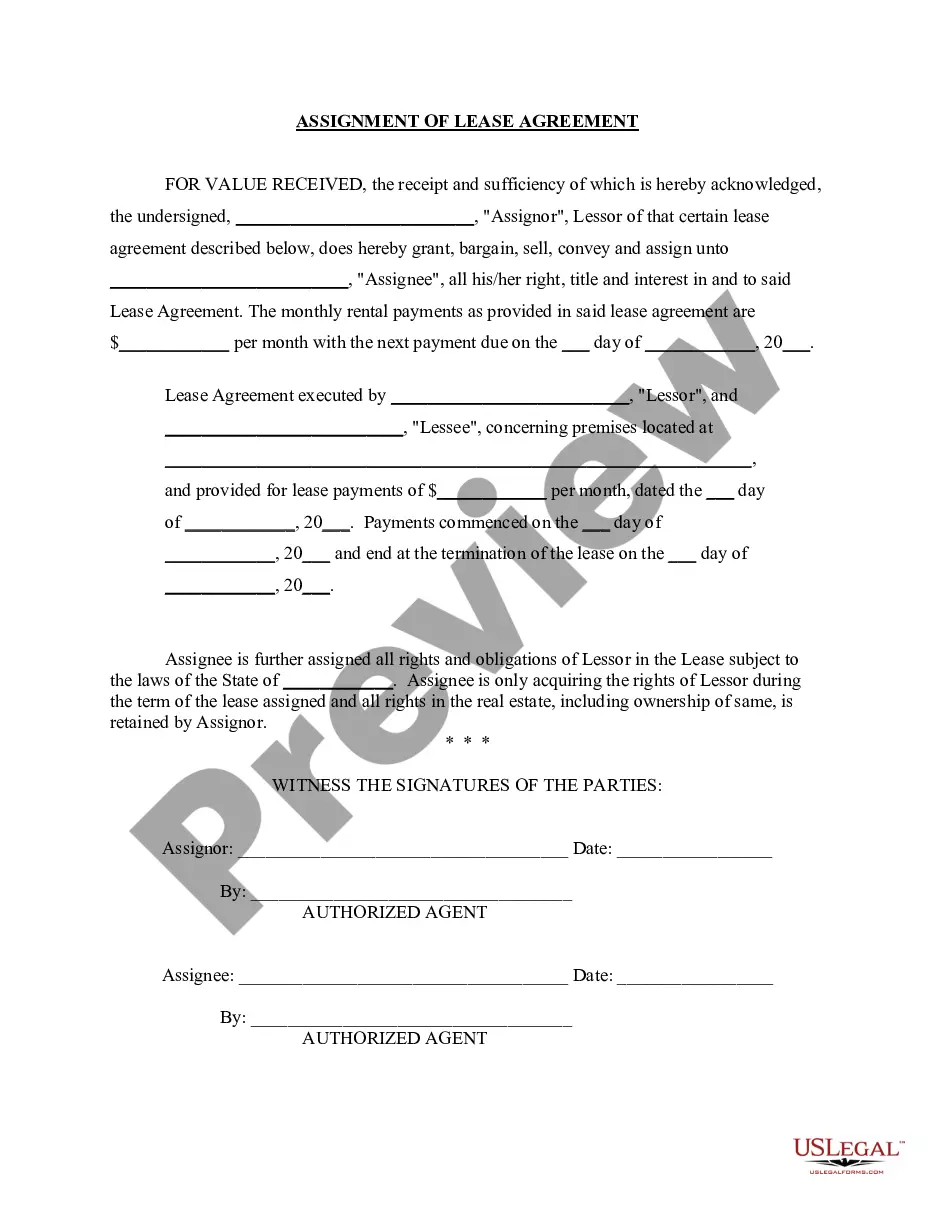

How to fill out Indiana Survey Assistant Contract - Self-Employed?

If you want to comprehensive, down load, or printing legal papers web templates, use US Legal Forms, the biggest selection of legal forms, that can be found on the Internet. Make use of the site`s basic and practical research to obtain the papers you need. Different web templates for organization and individual uses are categorized by classes and says, or search phrases. Use US Legal Forms to obtain the Indiana Survey Assistant Contract - Self-Employed in a handful of clicks.

When you are presently a US Legal Forms consumer, log in to the accounts and then click the Obtain button to obtain the Indiana Survey Assistant Contract - Self-Employed. You can even gain access to forms you formerly saved inside the My Forms tab of your respective accounts.

Should you use US Legal Forms the first time, follow the instructions under:

- Step 1. Be sure you have chosen the form for the proper area/nation.

- Step 2. Use the Review method to look over the form`s articles. Do not forget to learn the explanation.

- Step 3. When you are not satisfied together with the type, make use of the Lookup industry towards the top of the monitor to get other variations from the legal type web template.

- Step 4. Upon having found the form you need, click the Get now button. Opt for the pricing strategy you prefer and include your references to register on an accounts.

- Step 5. Process the purchase. You can utilize your Мisa or Ьastercard or PayPal accounts to accomplish the purchase.

- Step 6. Find the format from the legal type and down load it on your system.

- Step 7. Complete, edit and printing or indication the Indiana Survey Assistant Contract - Self-Employed.

Each and every legal papers web template you purchase is your own property for a long time. You possess acces to every single type you saved in your acccount. Go through the My Forms portion and decide on a type to printing or down load yet again.

Compete and down load, and printing the Indiana Survey Assistant Contract - Self-Employed with US Legal Forms. There are many professional and express-specific forms you may use for the organization or individual requirements.

Form popularity

FAQ

If you are a business owner or contractor who provides services to other businesses, then you are generally considered self-employed.

Being self-employed means that you earn money but don't work as an employee for someone else. It can include anyone from the owner of a convenience store to an artist who displays in galleries, to a freelance designer, to the founder of a large company.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Some ways to prove self-employment income include:Annual Tax Return. This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS.1099 Forms.Bank Statements.Profit/Loss Statements.Self-Employed Pay Stubs.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

The net income you earn from your own trade or business. For example, any net income (profit) you earn from goods you sell or services you provide to others counts as self-employment income.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.