Indiana Appraisal Agreement - Self-Employed Independent Contractor

Description

How to fill out Indiana Appraisal Agreement - Self-Employed Independent Contractor?

Choosing the right legal papers web template could be a struggle. Naturally, there are a variety of layouts available on the net, but how do you discover the legal type you require? Take advantage of the US Legal Forms web site. The services gives 1000s of layouts, including the Indiana Appraisal Agreement - Self-Employed Independent Contractor, that can be used for company and personal demands. All the forms are inspected by professionals and satisfy state and federal specifications.

In case you are currently listed, log in to your account and then click the Obtain key to have the Indiana Appraisal Agreement - Self-Employed Independent Contractor. Use your account to search throughout the legal forms you possess bought formerly. Proceed to the My Forms tab of your own account and obtain an additional backup of your papers you require.

In case you are a whole new consumer of US Legal Forms, listed here are easy instructions that you can adhere to:

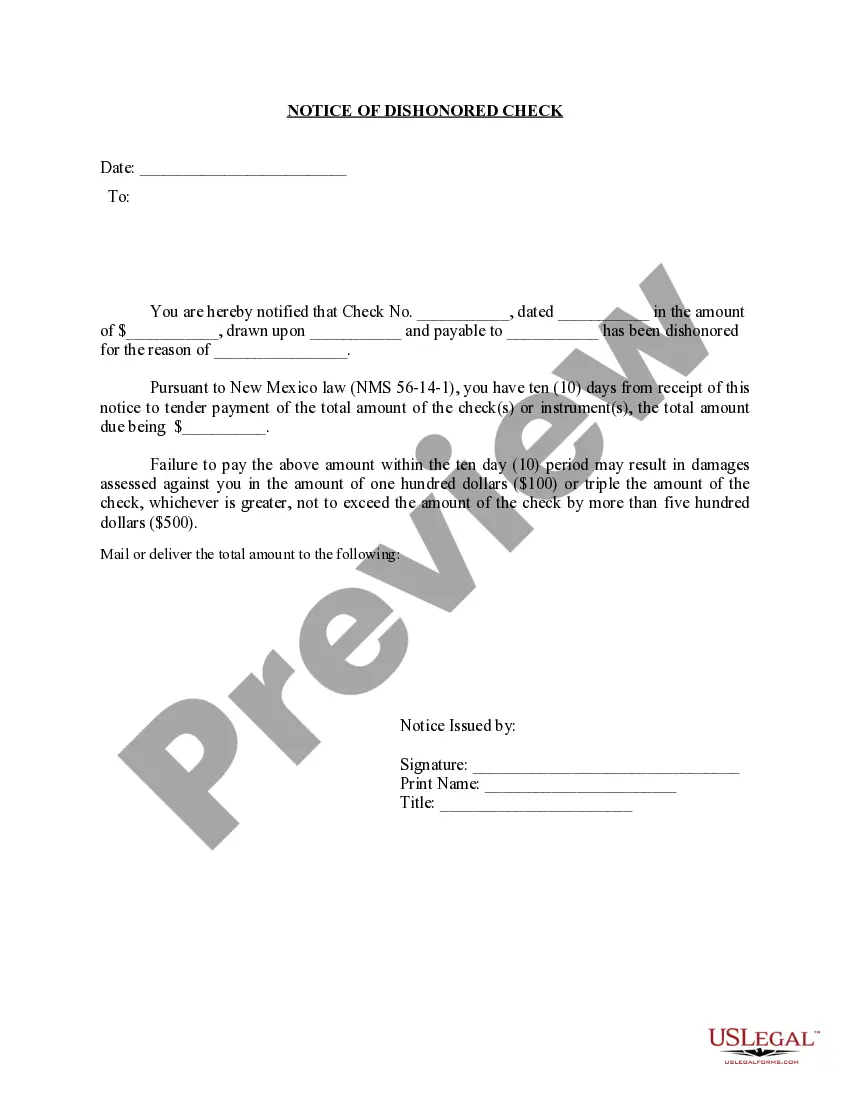

- First, make certain you have chosen the proper type to your city/region. You can check out the shape utilizing the Review key and look at the shape explanation to make sure this is the right one for you.

- In the event the type will not satisfy your preferences, use the Seach discipline to find the appropriate type.

- Once you are certain the shape would work, select the Acquire now key to have the type.

- Opt for the prices prepare you need and type in the necessary info. Create your account and buy an order making use of your PayPal account or bank card.

- Pick the submit file format and down load the legal papers web template to your system.

- Total, change and print out and signal the obtained Indiana Appraisal Agreement - Self-Employed Independent Contractor.

US Legal Forms may be the greatest library of legal forms that you will find various papers layouts. Take advantage of the service to down load appropriately-produced paperwork that adhere to status specifications.

Form popularity

FAQ

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

California Gov. Gavin Newsom on Sept. 4 signed AB 2257, legislation that clarifies how the state's employment laws apply to services provided by state-licensed and state-certified real estate appraisers, allowing them to work as independent contractors.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.