Indiana Self-Employed Independent Contractor Consideration For Hire Form

Description

How to fill out Indiana Self-Employed Independent Contractor Consideration For Hire Form?

Have you been inside a situation where you require papers for either organization or specific purposes just about every day time? There are tons of authorized record layouts accessible on the Internet, but discovering ones you can trust isn`t straightforward. US Legal Forms delivers a huge number of develop layouts, much like the Indiana Self-Employed Independent Contractor Consideration For Hire Form, which are created in order to meet state and federal demands.

Should you be previously acquainted with US Legal Forms site and get your account, simply log in. Next, you can down load the Indiana Self-Employed Independent Contractor Consideration For Hire Form format.

If you do not come with an account and need to begin using US Legal Forms, abide by these steps:

- Obtain the develop you want and ensure it is for your correct area/county.

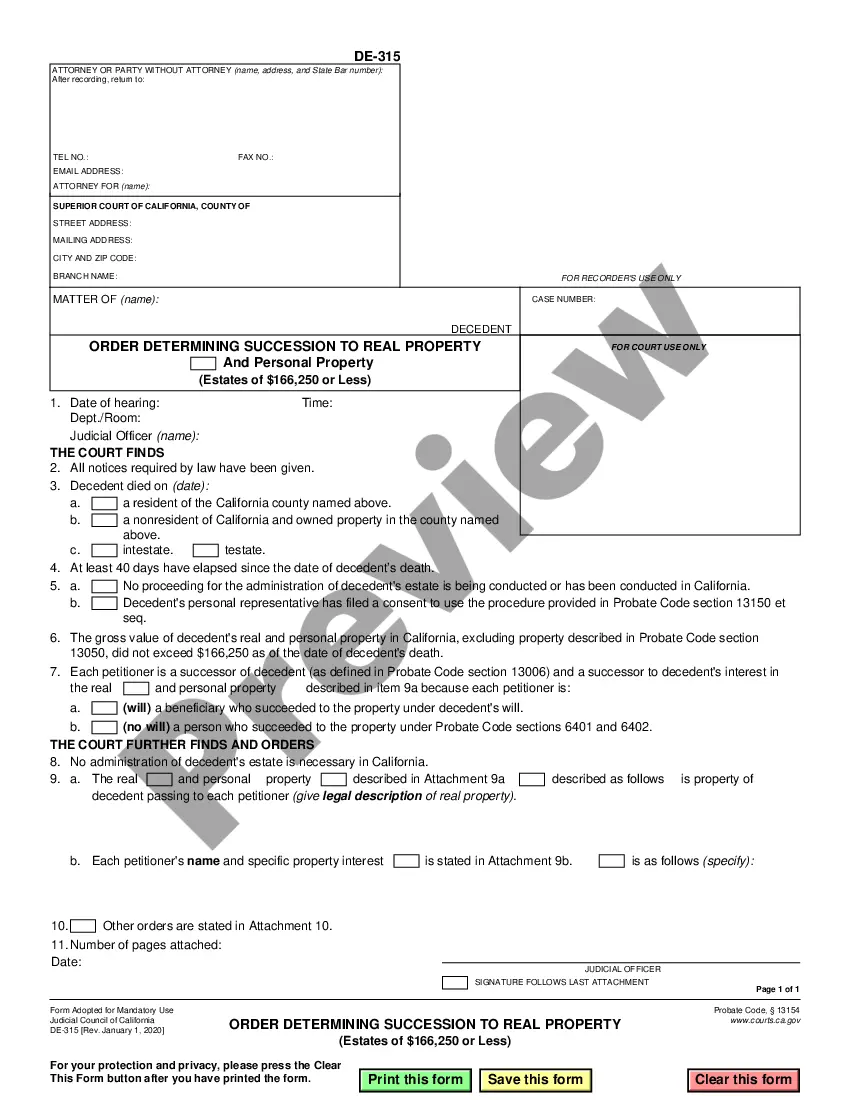

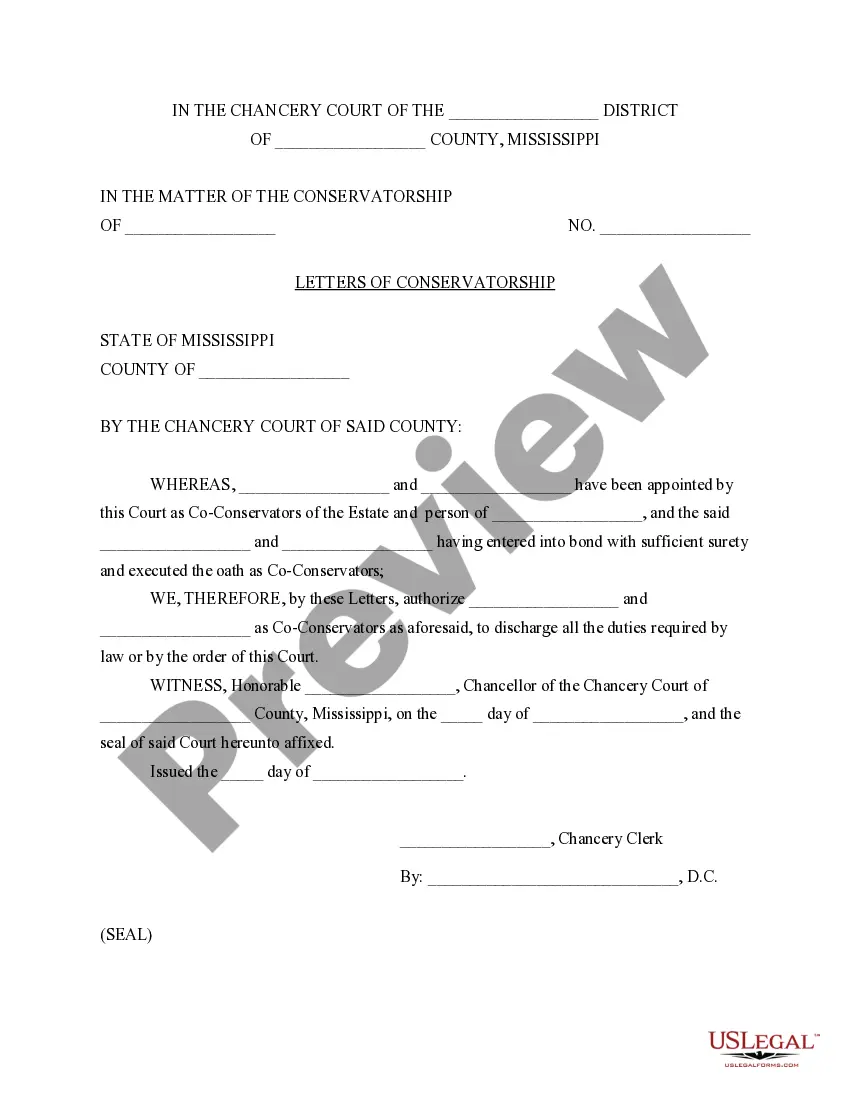

- Take advantage of the Review option to examine the shape.

- Look at the explanation to actually have selected the correct develop.

- If the develop isn`t what you`re seeking, make use of the Look for field to find the develop that meets your requirements and demands.

- Whenever you obtain the correct develop, just click Get now.

- Opt for the costs strategy you desire, fill out the necessary details to make your money, and pay for the transaction with your PayPal or bank card.

- Select a practical document formatting and down load your copy.

Discover every one of the record layouts you possess bought in the My Forms food list. You can aquire a additional copy of Indiana Self-Employed Independent Contractor Consideration For Hire Form any time, if needed. Just go through the needed develop to down load or produce the record format.

Use US Legal Forms, the most considerable assortment of authorized kinds, to save efforts and stay away from errors. The services delivers appropriately made authorized record layouts that can be used for a variety of purposes. Make your account on US Legal Forms and initiate generating your life easier.

Form popularity

FAQ

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

Before you hire an independent contractor, you need to have three important documents: A W-9 form with the person's contact information and taxpayer ID number, A resume to verify the person's qualifications, and. A written contract showing the details of the agreement between you and the independent contractor.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

Companies often hire 1099 employees because they can help complete non-essential tasks quickly and allow businesses to grow and develop more easily. If you're hoping to work with independent contractors, it can be beneficial to understand their major benefits and the most efficient way to hire them.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

How to hire a 1099 employeeCorrectly classify the individual.Check credentials and employment history.Create a contract.Have them fill out the proper forms.Integrate into company.

If you paid someone who is not your employee, such as a subcontractor, attorney or accountant $600 or more for services provided during the year, a Form 1099-NEC needs to be completed, and a copy of 1099-NEC must be provided to the independent contractor by January 31 of the year following payment.

More info

ETF Options Roth Fundamental Analysis.