Indiana Self-Employed Travel Agent Employment Contract

Description

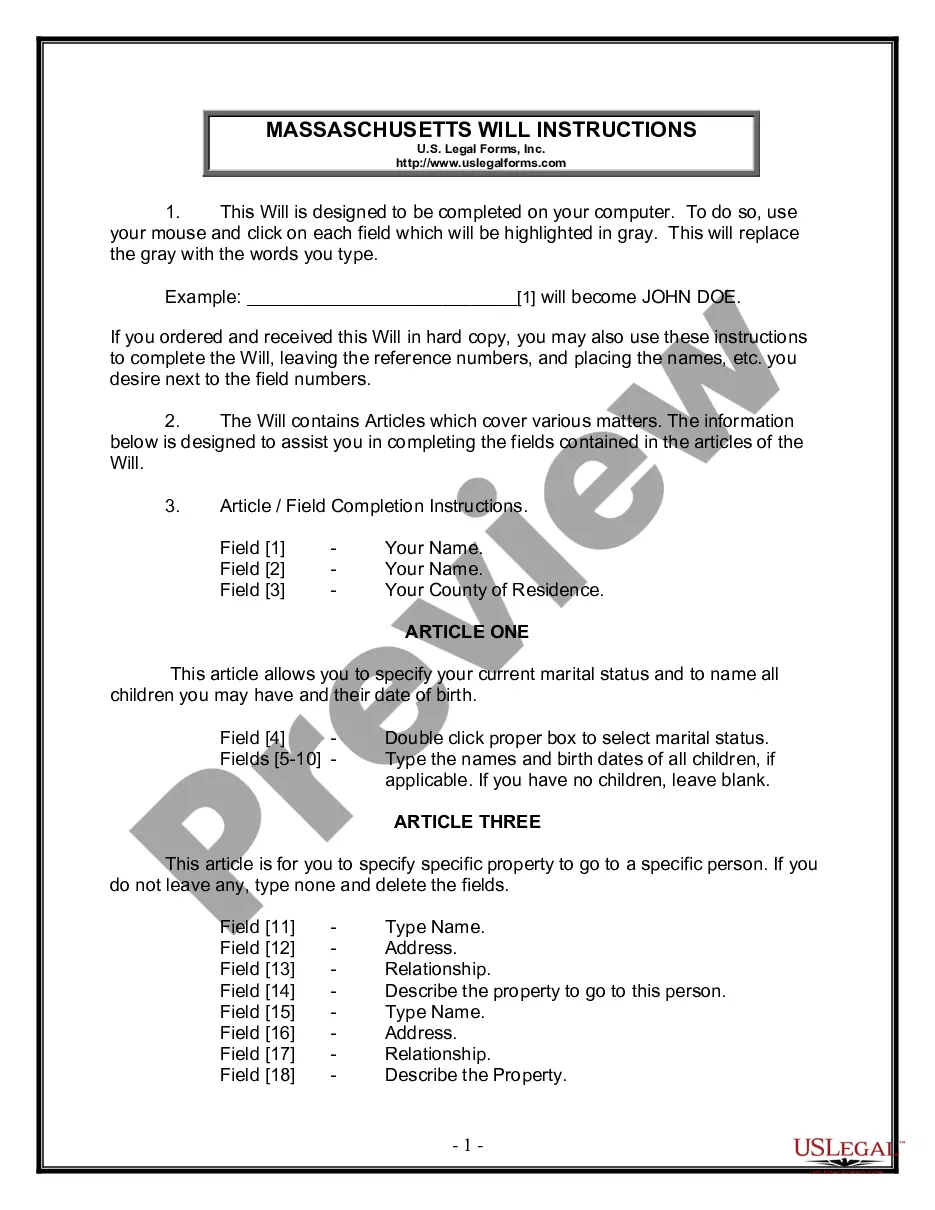

How to fill out Indiana Self-Employed Travel Agent Employment Contract?

If you wish to comprehensive, acquire, or printing authorized papers templates, use US Legal Forms, the biggest variety of authorized varieties, which can be found on the web. Use the site`s simple and easy practical search to obtain the documents you need. A variety of templates for company and person reasons are sorted by groups and says, or key phrases. Use US Legal Forms to obtain the Indiana Self-Employed Travel Agent Employment Contract within a couple of clicks.

When you are currently a US Legal Forms buyer, log in in your accounts and click on the Acquire switch to obtain the Indiana Self-Employed Travel Agent Employment Contract. Also you can entry varieties you previously saved in the My Forms tab of your own accounts.

If you work with US Legal Forms the very first time, follow the instructions under:

- Step 1. Ensure you have selected the form for the proper town/country.

- Step 2. Make use of the Review solution to examine the form`s articles. Do not forget to read through the explanation.

- Step 3. When you are not happy using the type, take advantage of the Research area on top of the display to find other models of the authorized type design.

- Step 4. Upon having discovered the form you need, select the Acquire now switch. Select the rates plan you prefer and put your qualifications to register to have an accounts.

- Step 5. Procedure the financial transaction. You can use your charge card or PayPal accounts to accomplish the financial transaction.

- Step 6. Pick the formatting of the authorized type and acquire it in your system.

- Step 7. Complete, modify and printing or signal the Indiana Self-Employed Travel Agent Employment Contract.

Every single authorized papers design you acquire is yours for a long time. You might have acces to every single type you saved inside your acccount. Go through the My Forms portion and decide on a type to printing or acquire again.

Remain competitive and acquire, and printing the Indiana Self-Employed Travel Agent Employment Contract with US Legal Forms. There are thousands of expert and status-certain varieties you can use to your company or person demands.

Form popularity

FAQ

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Contractors (sometimes called consultants) are self-employed people engaged for a specific task at an agreed price and with a specific goal in mind, often over a set period of time. They set their own hours of work and are paid a fee for completing each set assignment.

Reporting self-employment income Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

An independent contractor has almost absolute discretion whereas an agent is controlled by the principal. Due to the control of the principal, liability is more fairly attributed to the principal for the agent's actions.

You may not get a deduction for a home officeThe home office deduction is available to travel advisors that qualify as self-employed and those working as ICs as long as the taxpayer used a portion of the home exclusively for conducting business and the home is the taxpayer's principal place of business.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

While some travel agents are employees of the travel agencies that they work for, others are independent contractors. In fact, Travel Weekly reports that a 2017 study by the Travel Institute showed that 62 percent of travel agents are now independent contractors.

The company must provide a form 1099 and any applicable state income reporting forms. The contract should clearly indicate that both parties are able to contract with other business entities or individuals (more on this later!)

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

In fact, by definition, 2026 an independent contractor is an agent in the broad sense of the term in undertaking, at the request of another, to do something for the other. Id. As a general rule the line of demarcation between an independent contractor and a servant is not clearly drawn. Flick v.