Indiana Self-Employed Wait Staff Services Contract

Description

How to fill out Indiana Self-Employed Wait Staff Services Contract?

Are you in the placement the place you need to have documents for both organization or personal functions nearly every day time? There are tons of legal file templates available online, but getting types you can depend on is not easy. US Legal Forms gives a large number of type templates, much like the Indiana Self-Employed Wait Staff Services Contract, that are written to satisfy state and federal requirements.

If you are presently informed about US Legal Forms website and also have your account, basically log in. Afterward, you are able to download the Indiana Self-Employed Wait Staff Services Contract design.

Should you not come with an account and need to start using US Legal Forms, adopt these measures:

- Obtain the type you will need and ensure it is for that correct town/region.

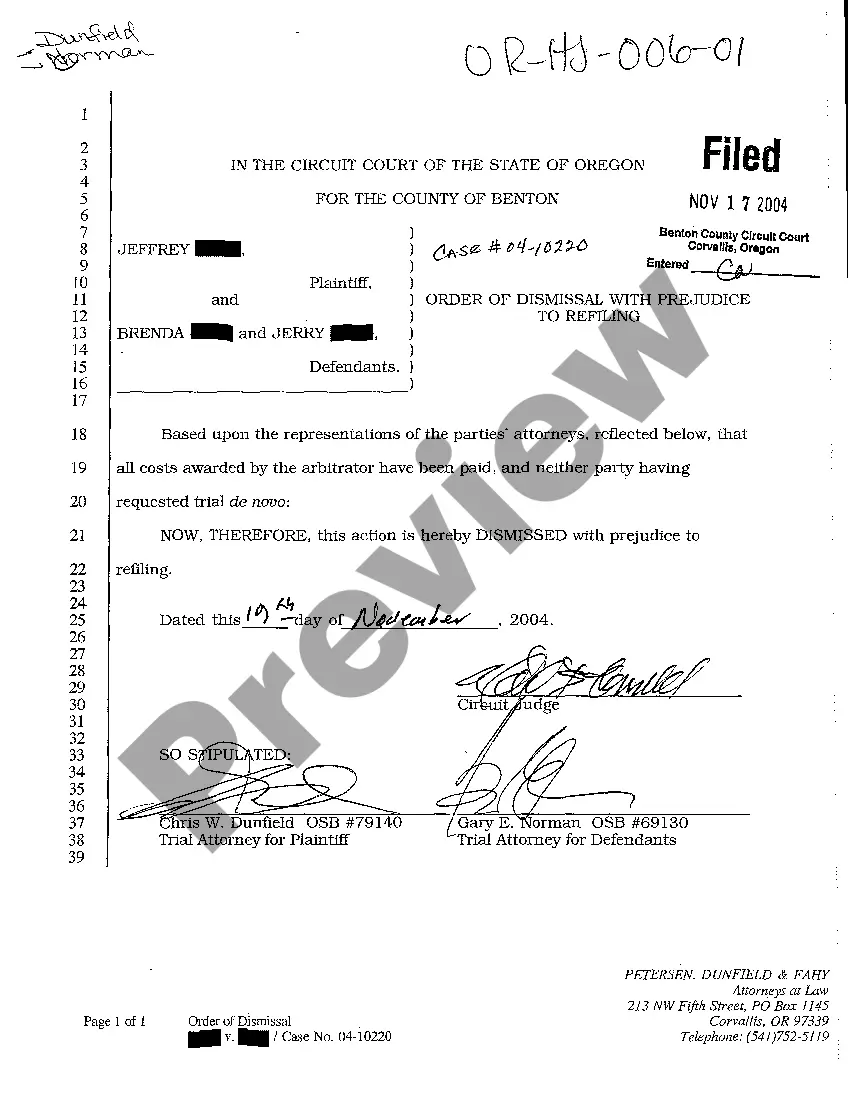

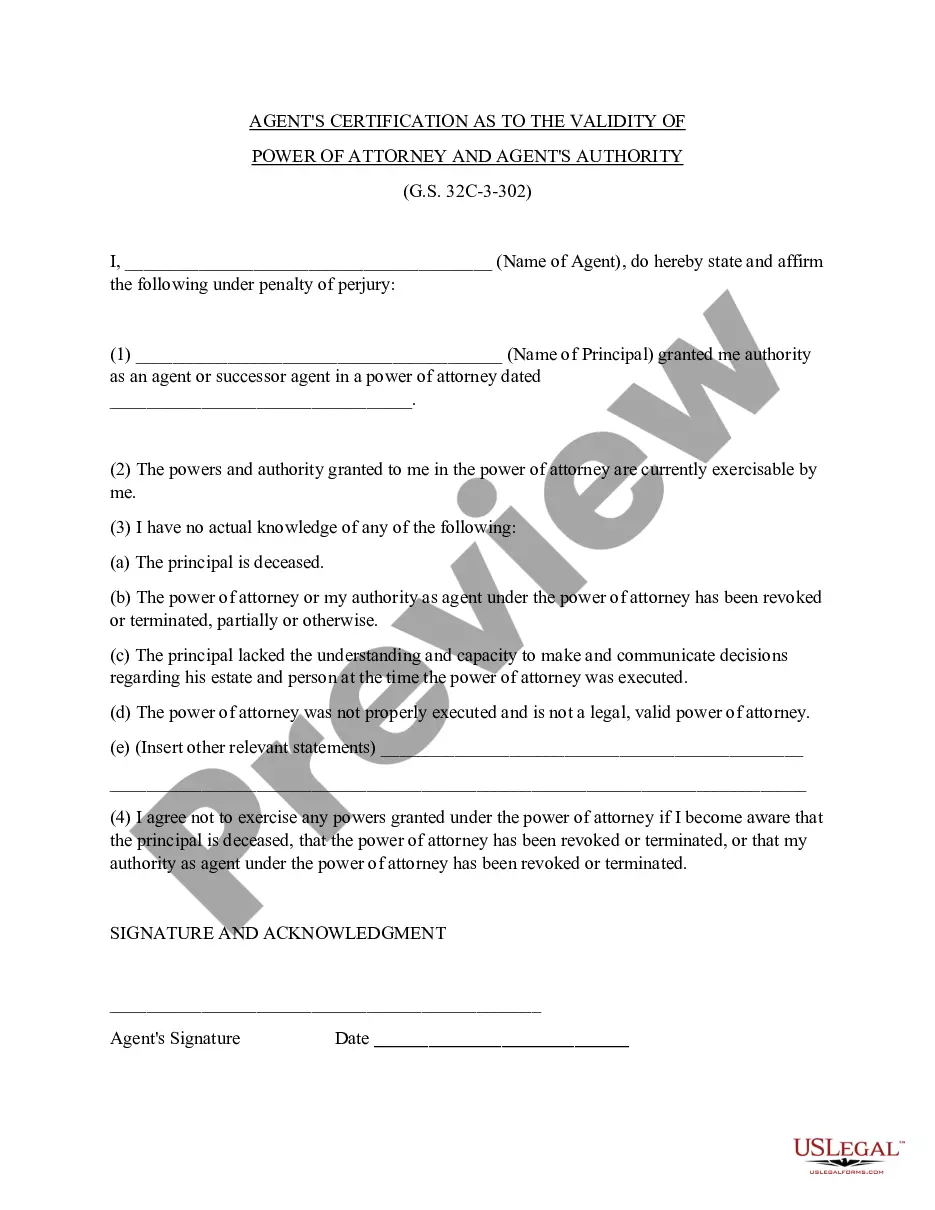

- Utilize the Review button to review the form.

- Browse the explanation to actually have selected the proper type.

- When the type is not what you`re seeking, take advantage of the Lookup discipline to obtain the type that meets your needs and requirements.

- When you get the correct type, click on Get now.

- Choose the pricing plan you want, fill out the specified information and facts to create your bank account, and purchase your order using your PayPal or charge card.

- Select a hassle-free document formatting and download your version.

Locate all the file templates you may have purchased in the My Forms menus. You may get a additional version of Indiana Self-Employed Wait Staff Services Contract any time, if required. Just go through the required type to download or print the file design.

Use US Legal Forms, the most comprehensive variety of legal varieties, to save lots of time and steer clear of mistakes. The support gives appropriately made legal file templates that can be used for a variety of functions. Create your account on US Legal Forms and start making your way of life a little easier.

Form popularity

FAQ

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

As a freelancer, you also have to manage invoicing and following up on payments. When you work as an independent contractor, you work on an hourly or project-based rate that may vary from client to client or job to job. If you work independently, you have control over setting and negotiating your rates.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Self-employed people earn a living by working for themselves, not as employees of someone else or as owners (shareholders) of a corporation.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Step 3: Last Employer Self-employed individuals may enter "self-employed" for the last employer's name and include his/her own address and contact information in lieu of the "last employer's address and contact information."

The law defines a worker as an independent contractor if he/she meets the guidelines of the IRS (See statute quote above in section 2). Senate Enrolled Act 576, (Public Law 168), provides that all independent contractors, not just those in the construction trades, may now obtain a clearance certificate.

Not paying at the agreed time will often be a breach of contract. If you can prove you suffered a financial loss, for example, having to pay overdraft fees, you can claim this back as damages. Talk to your employer first. If it keeps happening, you could try to get a court injunction to stop them repeating this breach.

Your Rights Unpaid Wages. Unpaid wages occur when employers fail to pay employees what they are owed. This is often also referred to as withheld salary or wages.