Indiana Self-Employed Excavation Service Contract

Description

How to fill out Indiana Self-Employed Excavation Service Contract?

Are you inside a place in which you need to have papers for both organization or specific functions almost every day time? There are a lot of legitimate document web templates available on the net, but getting types you can trust is not easy. US Legal Forms offers thousands of type web templates, much like the Indiana Self-Employed Excavation Service Contract, that happen to be composed to fulfill federal and state specifications.

When you are already informed about US Legal Forms site and have an account, simply log in. Afterward, it is possible to acquire the Indiana Self-Employed Excavation Service Contract web template.

Unless you offer an profile and need to begin to use US Legal Forms, follow these steps:

- Obtain the type you will need and ensure it is to the proper metropolis/region.

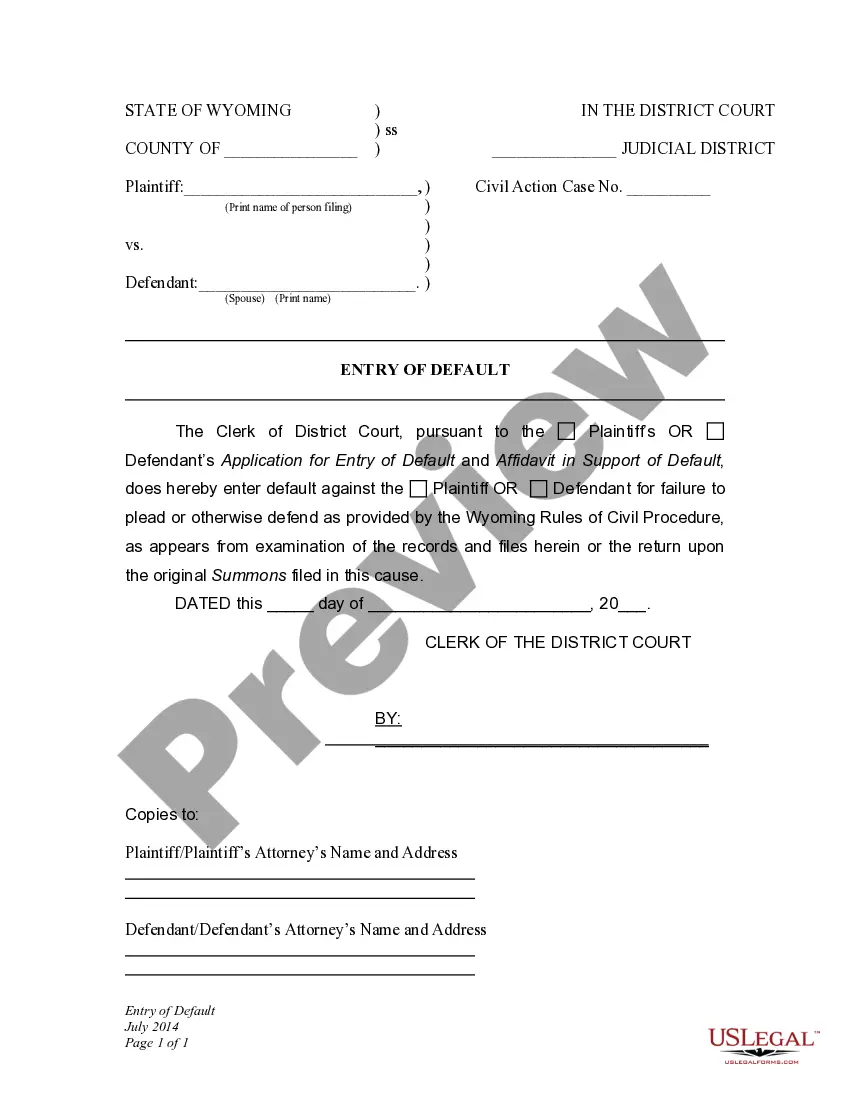

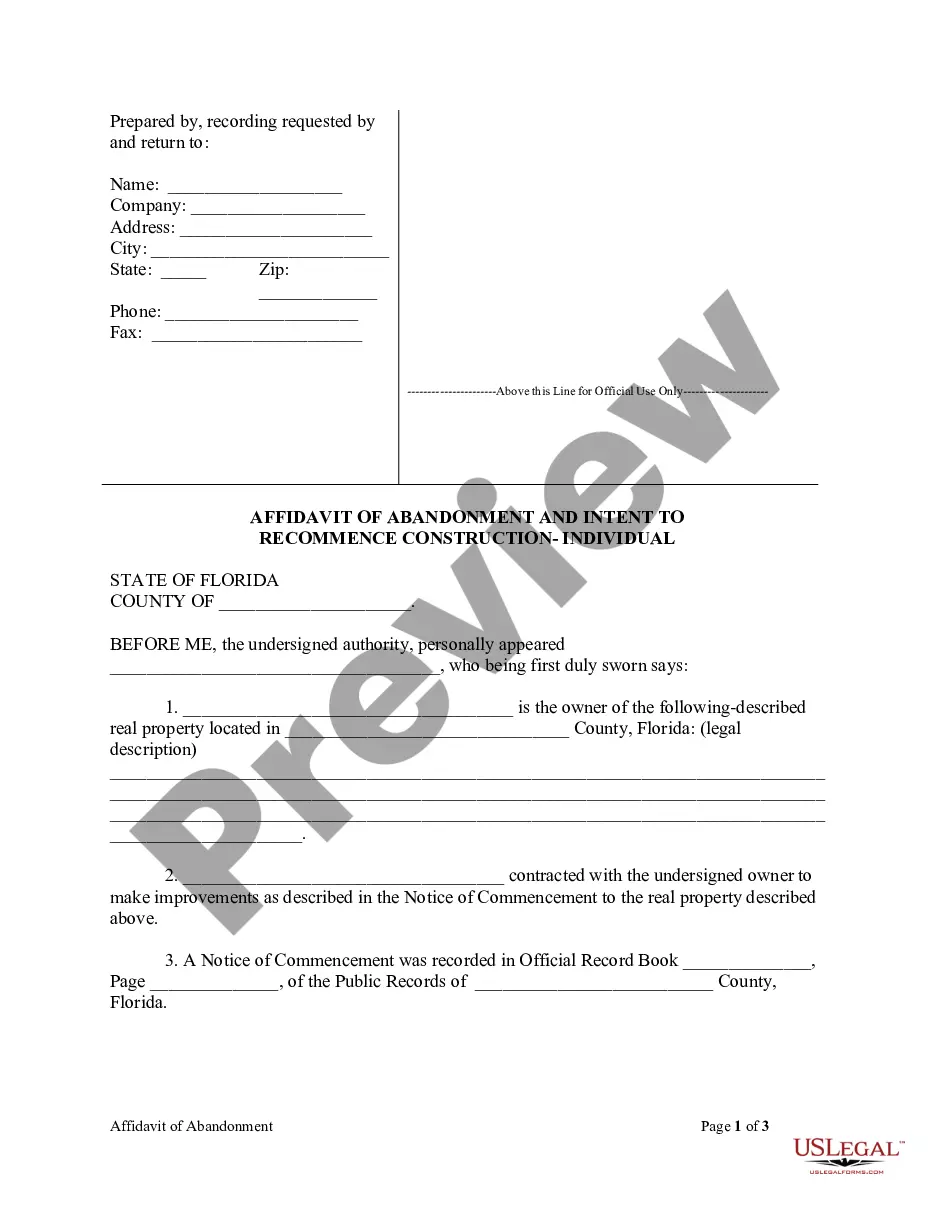

- Utilize the Preview switch to review the form.

- Read the information to actually have selected the correct type.

- When the type is not what you are searching for, make use of the Search field to get the type that fits your needs and specifications.

- If you obtain the proper type, click Get now.

- Opt for the rates strategy you need, fill in the necessary information to create your bank account, and purchase your order using your PayPal or charge card.

- Decide on a practical file formatting and acquire your copy.

Get every one of the document web templates you have bought in the My Forms food selection. You can aquire a more copy of Indiana Self-Employed Excavation Service Contract at any time, if needed. Just go through the necessary type to acquire or print out the document web template.

Use US Legal Forms, one of the most comprehensive selection of legitimate varieties, to save lots of some time and stay away from faults. The service offers skillfully produced legitimate document web templates that can be used for an array of functions. Make an account on US Legal Forms and begin creating your lifestyle easier.

Form popularity

FAQ

Independent contractors doing business in the State of Indiana are required to file a statement and documentation with the Indiana Department of Revenue (DOR) stating independent contractor status. There is a five dollar filing fee and the certificate is valid for one year.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Indiana is one of the few states that do not regulate general contractors directly with any statewide requirements. The only contracting work that does require a state license is plumbing.

Every independent contractor is a business owner. You run a business even if you are your only employee and you don't have a company name. There are significant differences, however, between a business that's just you as an independent contractor and running a company with employees and a registered name.

Elements of a Construction ContractName of contractor and contact information.Name of homeowner and contact information.Describe property in legal terms.List attachments to the contract.The cost.Failure of homeowner to obtain financing.Description of the work and the completion date.Right to stop the project.More items...

The 4 Different Types of Construction ContractsLump Sum Contract. A lump sum contract sets one determined price for all work done for the project.Unit Price Contract.Cost Plus Contract.Time and Materials Contract.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

5 Key Elements Every Construction Contract Should Contain1) The project's scope.2) The cost and payment terms.3) The project's time frame.4) Protection against lien law.5) Dispute resolution clauses.