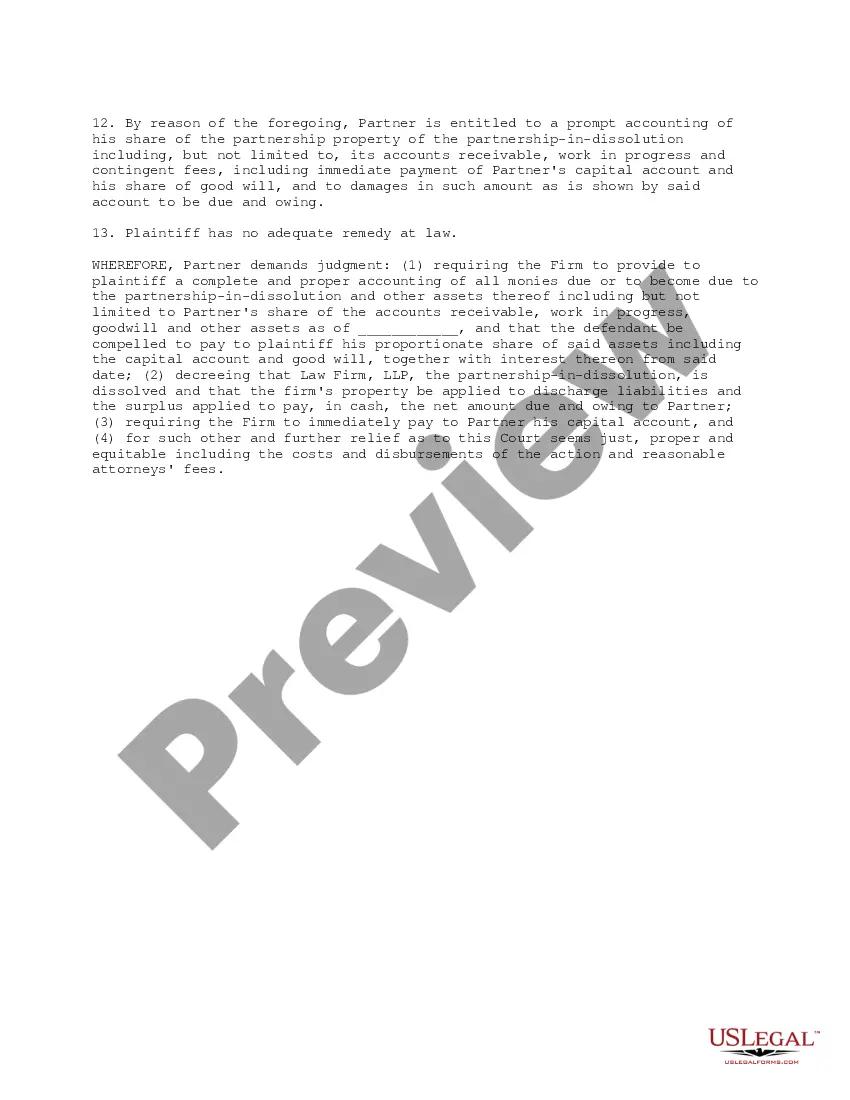

This is a complaint to be filed by a former law partner who has been expelled from his law firm. It calls for an accounting of the firm, where the firm's partnership agreement did not provide for an accounting. The former partner alleges that the partnership has failed to pay him what was rightfully due, and asks for an accounting to calculate damages owing.

Indiana Complaint for an Accounting Claim

Description

How to fill out Complaint For An Accounting Claim?

US Legal Forms - one of several biggest libraries of lawful types in the USA - offers a wide array of lawful papers templates you may acquire or print. Utilizing the website, you can find a large number of types for company and specific purposes, sorted by classes, claims, or keywords and phrases.You can find the newest models of types much like the Indiana Complaint for an Accounting Claim in seconds.

If you already have a subscription, log in and acquire Indiana Complaint for an Accounting Claim through the US Legal Forms catalogue. The Acquire button will appear on each and every form you see. You have accessibility to all previously delivered electronically types inside the My Forms tab of the profile.

In order to use US Legal Forms the first time, allow me to share straightforward guidelines to help you get started out:

- Ensure you have chosen the best form to your metropolis/region. Select the Review button to check the form`s content. Browse the form description to actually have selected the proper form.

- In case the form does not satisfy your requirements, use the Lookup area near the top of the display screen to obtain the one who does.

- When you are satisfied with the shape, confirm your choice by visiting the Buy now button. Then, choose the rates program you want and provide your references to register for an profile.

- Procedure the deal. Utilize your charge card or PayPal profile to complete the deal.

- Pick the format and acquire the shape on your own system.

- Make adjustments. Fill up, change and print and indicator the delivered electronically Indiana Complaint for an Accounting Claim.

Each format you put into your account lacks an expiration time and is your own for a long time. So, if you want to acquire or print an additional version, just go to the My Forms portion and click in the form you will need.

Get access to the Indiana Complaint for an Accounting Claim with US Legal Forms, one of the most comprehensive catalogue of lawful papers templates. Use a large number of expert and state-distinct templates that meet your business or specific demands and requirements.

Form popularity

FAQ

Filing a Small Claim Notice of Claim forms are available from the clerk's office without charge. 2) If your suit is based upon a written contract, you must provide to the clerk of the court one (1) copy of the contract for the court records and one (1) copy for each Defendant.

Change in venue/transfer to Indiana County: same as cost to file new case. Civil collection: $157. Civil plenary: $232. Civil tort: $232.

Consumer complaints against insurance companies must be received in writing. You may file a complaint using our Online Consumer Complaint Portal. You may print off our Insurance Complaint Form and mail or fax the completed form to the Consumer Services Division.

You can file a consumer complaint with the Indiana Attorney General's Office online or by filling out a printable form. You can also request a complaint form by calling 1.800. 382.5516 or 317.232. 6330.