This checklist covers the typical areas to consider in a law firm's annual risk analysis. It includes: Admissioin of partners, capital contributions, withdrawal and retirement provisions, compensation, lease obligations, and many other matters. Each checklist item is followed by key questions to consider under each item.

Indiana Checklist of Law Firm's Annual Risk Analysis

Description

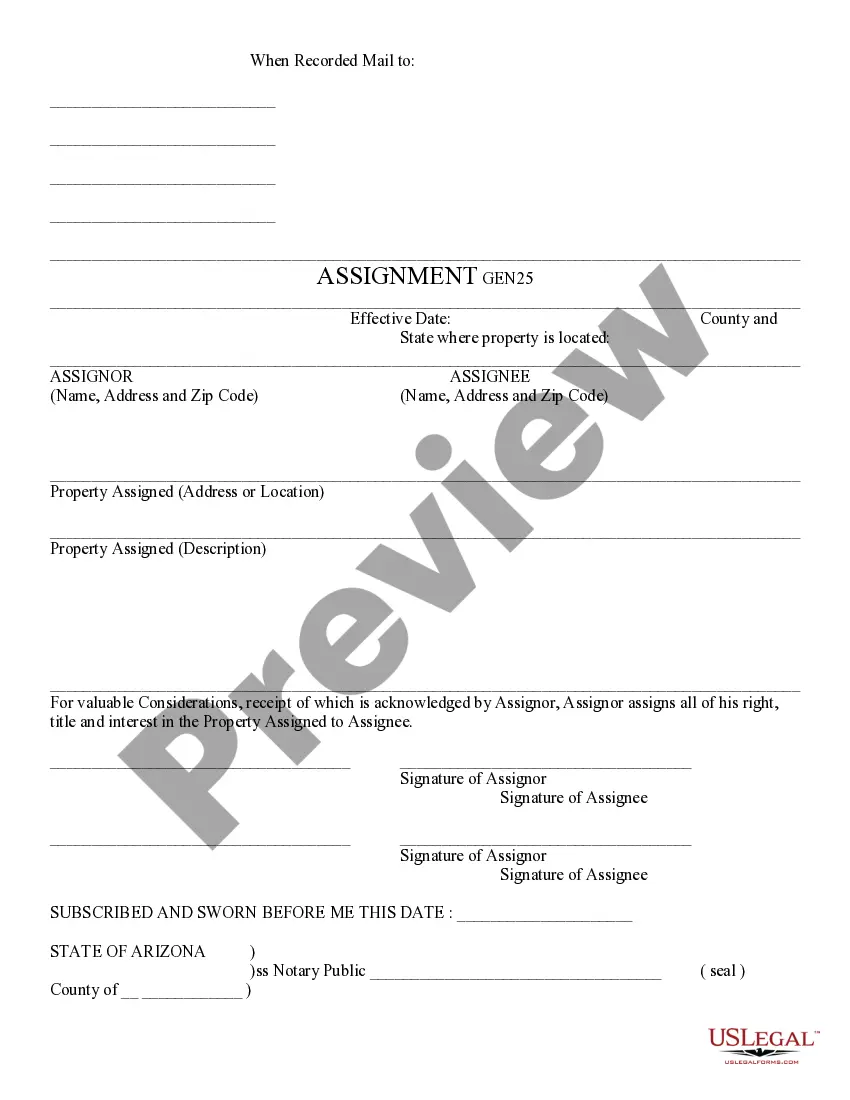

How to fill out Checklist Of Law Firm's Annual Risk Analysis?

Choosing the right legitimate record design might be a have a problem. Naturally, there are a lot of templates accessible on the Internet, but how will you obtain the legitimate develop you need? Utilize the US Legal Forms website. The service gives a large number of templates, for example the Indiana Checklist of Law Firm's Annual Risk Analysis, which can be used for enterprise and private requires. All of the types are inspected by specialists and fulfill federal and state needs.

When you are previously signed up, log in to the profile and click the Download switch to have the Indiana Checklist of Law Firm's Annual Risk Analysis. Make use of profile to search from the legitimate types you might have purchased previously. Check out the My Forms tab of your own profile and have an additional backup in the record you need.

When you are a whole new consumer of US Legal Forms, here are basic directions that you can comply with:

- Initial, ensure you have chosen the proper develop for your personal metropolis/county. You are able to look over the shape utilizing the Review switch and browse the shape explanation to guarantee it will be the right one for you.

- If the develop does not fulfill your requirements, make use of the Seach area to obtain the proper develop.

- Once you are certain the shape would work, go through the Buy now switch to have the develop.

- Choose the rates strategy you would like and type in the necessary information and facts. Design your profile and purchase your order making use of your PayPal profile or Visa or Mastercard.

- Choose the submit structure and acquire the legitimate record design to the device.

- Comprehensive, revise and produce and sign the received Indiana Checklist of Law Firm's Annual Risk Analysis.

US Legal Forms is the greatest catalogue of legitimate types where you can discover a variety of record templates. Utilize the service to acquire skillfully-made papers that comply with condition needs.