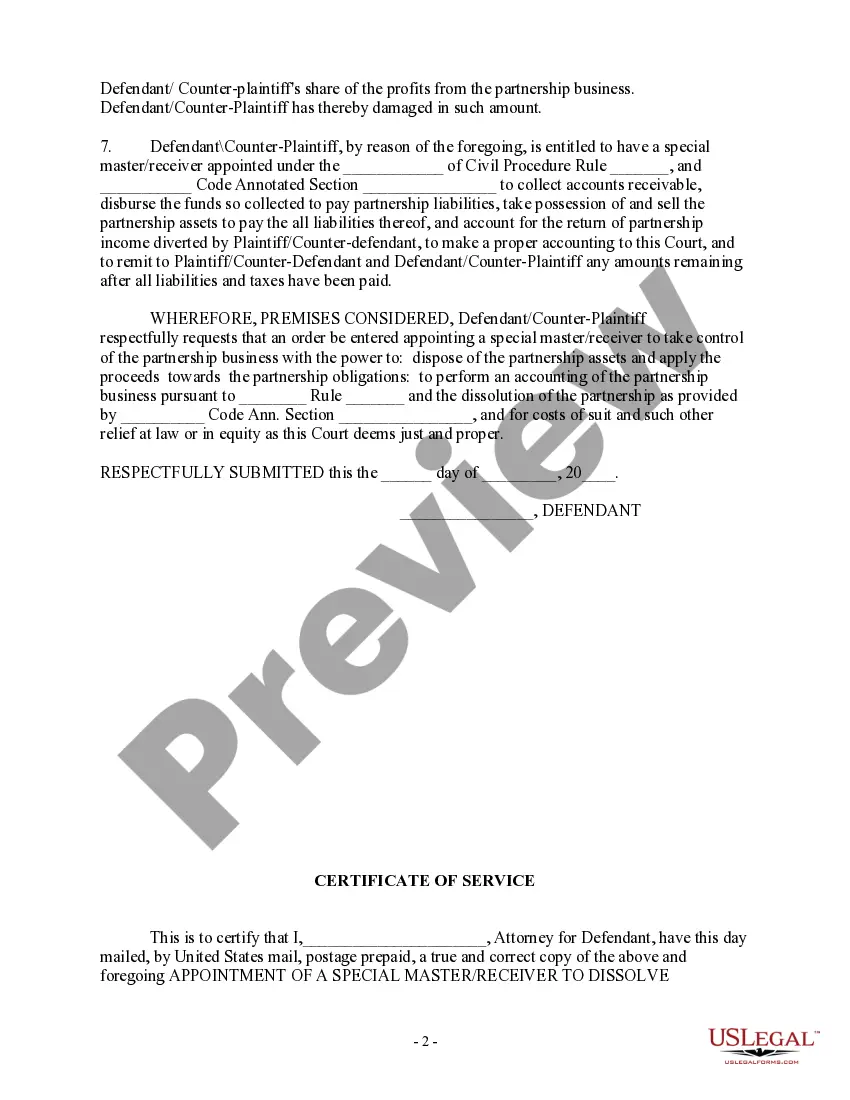

A "Motion for Appointment of Special Master Receiver to Dissolve Partnership, Dispose of Assets and Settle all Affairs as to Assets and Liabilities" in Indiana refers to a legal process used when partners in a partnership wish to end their business partnership and divide their assets and liabilities accordingly. This motion is typically filed in court to seek the appointment of a Special Master Receiver, who is an impartial third party responsible for overseeing the dissolution process. Here are some key aspects and considerations related to this motion: 1. Partnership Dissolution: When partners decide to dissolve a partnership, it means they are terminating the legal relationship between them. This is a significant step, and it requires meticulous attention to detail to ensure a fair and equitable division of assets and liabilities. 2. Special Master Receiver: A Special Master Receiver is an individual appointed by the court to act as a neutral third-party authority during the dissolution process. The receiver is responsible for overseeing the smooth settlement of a partnership's affairs and ensuring compliance with applicable laws and regulations. 3. Appointment Process: To initiate the appointment of a Special Master Receiver, a motion must be filed by one or more partners involved. The motion should contain a detailed description of the partnership, its assets, liabilities, and desired outcome. It is essential to outline the reasons for dissolution and provide any supporting evidence necessary for the court to rule in favor of appointing a Special Master Receiver. 4. Dissolution Plan: The partners should prepare a comprehensive dissolution plan that outlines how they suggest dividing partnership assets, settling liabilities, and addressing any other outstanding matters. This plan should consider the partners' individual and collective interests, as well as comply with applicable legal requirements. 5. Asset Disposition: Asset disposal is a critical aspect of the dissolution process. It involves determining the ownership of each asset, valuing them, and agreeing on a method for dividing or liquidating them. Partners may choose to sell assets, transfer them to one or more partners, or distribute them in-kind based on their agreed-upon value. 6. Liability Settlement: Partners must also establish a plan for resolving the partnership's outstanding debts, obligations, and liabilities. This may involve paying off creditors, negotiating settlements, or liquidating assets as necessary. It is crucial to ensure all liabilities are properly accounted for and settled to prevent any future legal disputes. 7. Resolution of Conflicts: In some cases, conflicts or disputes may arise during the dissolution process. The involvement of a Special Master Receiver can help resolve such disputes impartially and expeditiously. The receiver can act as a mediator, negotiate settlements, or make informed recommendations to the court. Different types or variations of this motion may arise based on unique circumstances or specific requirements within a partnership dissolution. For example, a motion may be tailored to dissolve a limited partnership, a general partnership, or a partnership involving multiple entities. The specific outcome sought by the partners may also influence the content and focus of the motion. Key Keywords: Indiana, Motion for Appointment of Special Master Receiver, Dissolve Partnership, Dispose of Assets, Settle all Affairs, Assets and Liabilities, Partnership Dissolution, Special Master Receiver Appointment, Dissolution Plan, Asset Disposition, Liability Settlement, Conflict Resolution, Limited Partnership, General Partnership, Multiple Entities.

Indiana Motion for Appointment of Special Master Receiver to Dissolve Partnership, Dispose of Assets and Settle all Affairs as to Assets and Liabilities

Description

How to fill out Indiana Motion For Appointment Of Special Master Receiver To Dissolve Partnership, Dispose Of Assets And Settle All Affairs As To Assets And Liabilities?

If you need to total, obtain, or print lawful record web templates, use US Legal Forms, the most important selection of lawful varieties, that can be found on-line. Utilize the site`s simple and easy convenient research to get the papers you need. A variety of web templates for business and individual functions are sorted by classes and says, or key phrases. Use US Legal Forms to get the Indiana Motion for Appointment of Special Master Receiver to Dissolve Partnership, Dispose of Assets and Settle all Affairs as to Assets and Liabilities in a couple of click throughs.

When you are previously a US Legal Forms customer, log in to the accounts and then click the Down load key to have the Indiana Motion for Appointment of Special Master Receiver to Dissolve Partnership, Dispose of Assets and Settle all Affairs as to Assets and Liabilities. You can also accessibility varieties you previously acquired from the My Forms tab of your respective accounts.

If you use US Legal Forms initially, refer to the instructions below:

- Step 1. Be sure you have selected the shape for your appropriate area/country.

- Step 2. Make use of the Review option to look through the form`s content. Never neglect to see the explanation.

- Step 3. When you are unhappy together with the develop, use the Search field on top of the display screen to get other models of your lawful develop design.

- Step 4. When you have discovered the shape you need, click on the Get now key. Pick the rates program you favor and put your credentials to sign up for an accounts.

- Step 5. Procedure the transaction. You can use your Мisa or Ьastercard or PayPal accounts to finish the transaction.

- Step 6. Choose the formatting of your lawful develop and obtain it on your device.

- Step 7. Total, edit and print or sign the Indiana Motion for Appointment of Special Master Receiver to Dissolve Partnership, Dispose of Assets and Settle all Affairs as to Assets and Liabilities.

Every lawful record design you get is yours for a long time. You might have acces to every develop you acquired with your acccount. Click on the My Forms portion and choose a develop to print or obtain again.

Compete and obtain, and print the Indiana Motion for Appointment of Special Master Receiver to Dissolve Partnership, Dispose of Assets and Settle all Affairs as to Assets and Liabilities with US Legal Forms. There are many specialist and status-certain varieties you can use to your business or individual demands.

Form popularity

FAQ

Rule 53 allows for a special master to be appointed only if one of the following exists: (1) the parties consent to the appointment, (2) to hold a trial without a jury or make recommended findings of fact where there is some exceptional condition or accounting or difficult computation of damages, or (3) address pre- ...

2 Essentially, the special master is someone who serves a limited purpose for the court to do things the parties want it to do, to make some difficult findings of facts, or do things that would be impractical for a judge to do or administer.

Judges appointed special masters in about 60% of these cases, that is, in fewer than 2 cases in 1,000 (0.2%).

The role of the special master (who is frequently, but not necessarily, an attorney) is to supervise those falling under the order of the court to make sure that the court order is being followed, and to report on the activities of the entity being supervised in a timely matter to the judge or the judge's designated ...

As a magistrate judge, Young was a salaried officer of the court?but special masters not on a court's payroll are paid for by the parties to the case. In fact, parties prepay for special masters in most cases, subject to repayment by the losing party if the judge decides to reallocate those costs.

Parties Can Agree to Use a Special Master Using a Stipulation and Order, the parties agree on the person they will use as a special master. The parties decide what issues the special master has the power to resolve.

In U.S. v. Microsoft, Judge Jackson appointed Lawrence Lessig as a special master (as an amicus curiae) to advise the court about technical issues, and to investigate certain claims, such as Microsoft's assertion that removing Internet Explorer from the Windows operating system would make the system slower.