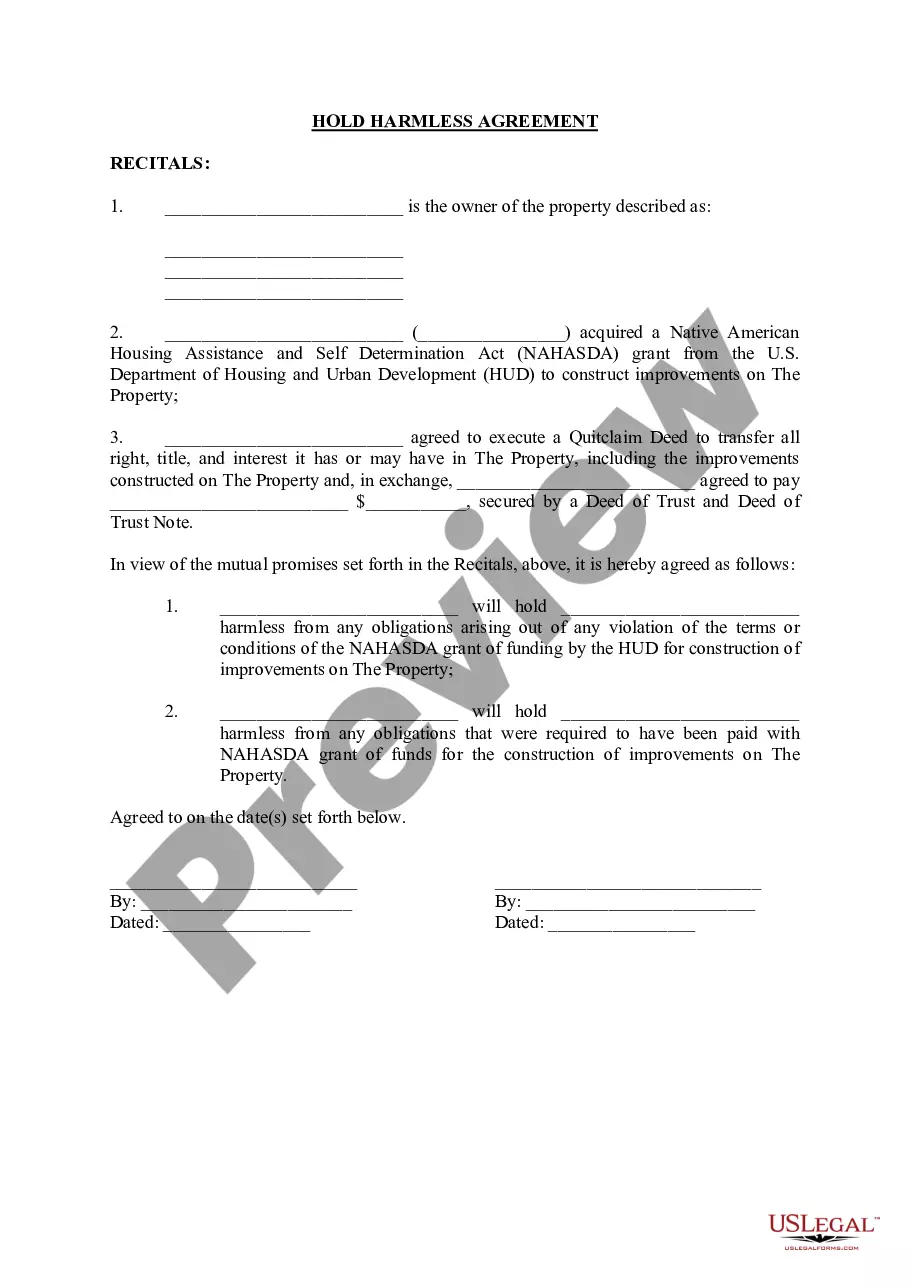

It is not uncommon to encounter a situation where a mineral owner owns all the mineral estate in a tract of land, but the royalty interest in that tract has been divided and conveyed to a number of parties; i.e., the royalty ownership is not common in the entire tract. If a lease is granted by the mineral owner on the entire tract, and the lessee intends to develop the entire tract as a producing unit, the royalty owners may desire to enter into an agreement providing for all royalty owners in the tract to participate in production royalty, regardless of where the well is actually located on the tract. This form of agreement accomplishes this objective.

Indiana Commingling and Entirety Agreement by Royalty Owners Where the Royalty Ownership Is Not Common

Description

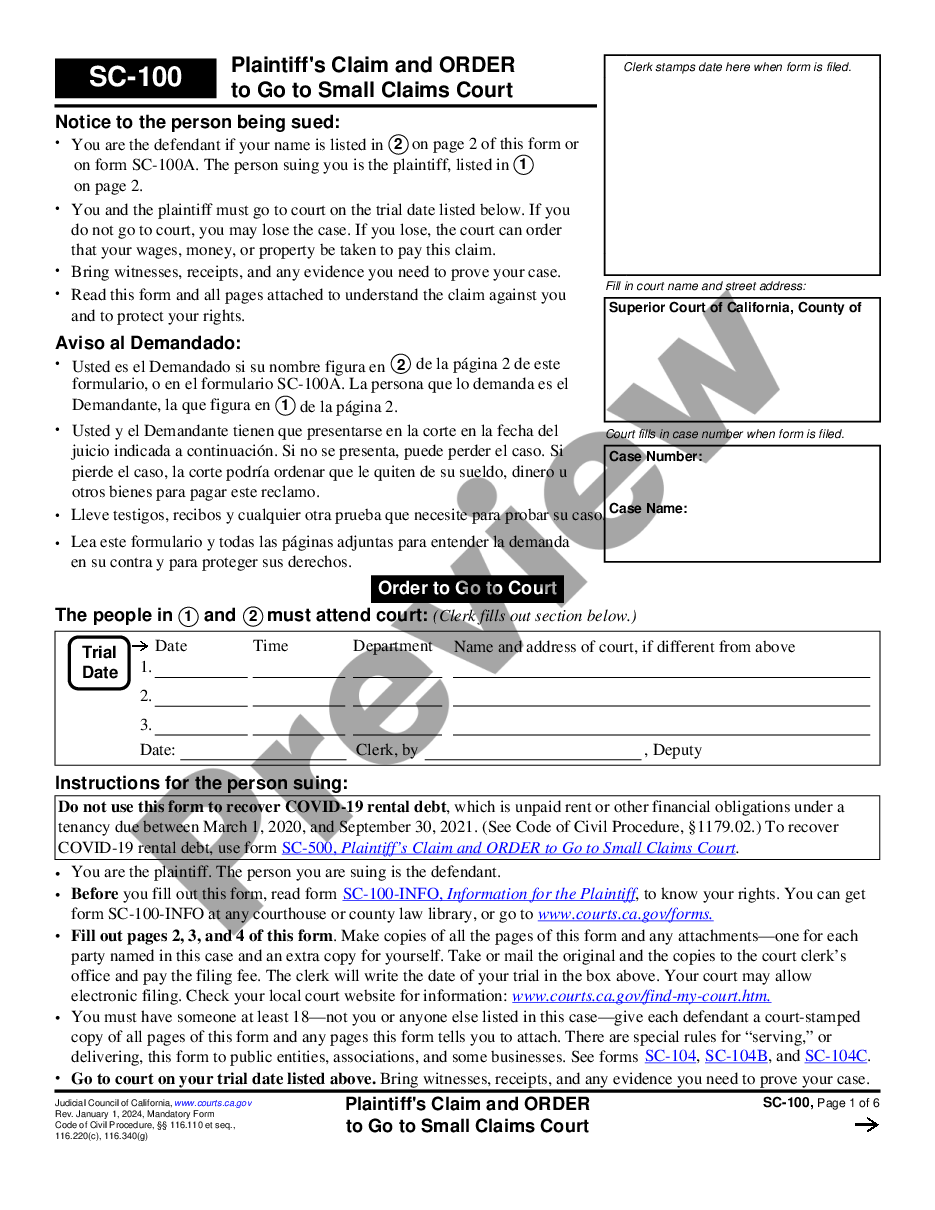

How to fill out Commingling And Entirety Agreement By Royalty Owners Where The Royalty Ownership Is Not Common?

If you have to complete, download, or print out legitimate record themes, use US Legal Forms, the largest selection of legitimate varieties, which can be found on the web. Make use of the site`s simple and handy research to get the papers you will need. Various themes for enterprise and person functions are sorted by categories and states, or keywords. Use US Legal Forms to get the Indiana Commingling and Entirety Agreement by Royalty Owners Where the Royalty Ownership Is Not Common with a number of click throughs.

If you are previously a US Legal Forms customer, log in for your bank account and click the Down load option to get the Indiana Commingling and Entirety Agreement by Royalty Owners Where the Royalty Ownership Is Not Common. You can also access varieties you formerly saved from the My Forms tab of the bank account.

If you are using US Legal Forms the first time, follow the instructions below:

- Step 1. Ensure you have chosen the form for your right area/nation.

- Step 2. Make use of the Review choice to examine the form`s content material. Do not overlook to see the information.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the display screen to discover other variations of the legitimate form design.

- Step 4. Upon having discovered the form you will need, click on the Buy now option. Opt for the costs strategy you choose and add your references to register for an bank account.

- Step 5. Method the transaction. You may use your Мisa or Ьastercard or PayPal bank account to finish the transaction.

- Step 6. Choose the file format of the legitimate form and download it on your own gadget.

- Step 7. Complete, modify and print out or signal the Indiana Commingling and Entirety Agreement by Royalty Owners Where the Royalty Ownership Is Not Common.

Each and every legitimate record design you buy is the one you have forever. You possess acces to each and every form you saved within your acccount. Select the My Forms portion and pick a form to print out or download once again.

Compete and download, and print out the Indiana Commingling and Entirety Agreement by Royalty Owners Where the Royalty Ownership Is Not Common with US Legal Forms. There are many expert and status-specific varieties you can use for your personal enterprise or person demands.

Form popularity

FAQ

A royalty interest is a property interest that entitles the owner to receive a share of the production revenue. An individual or company that owns a royalty interest does not have to pay for any of the operational costs required to produce the resource, but they still own a portion of the revenue produced.

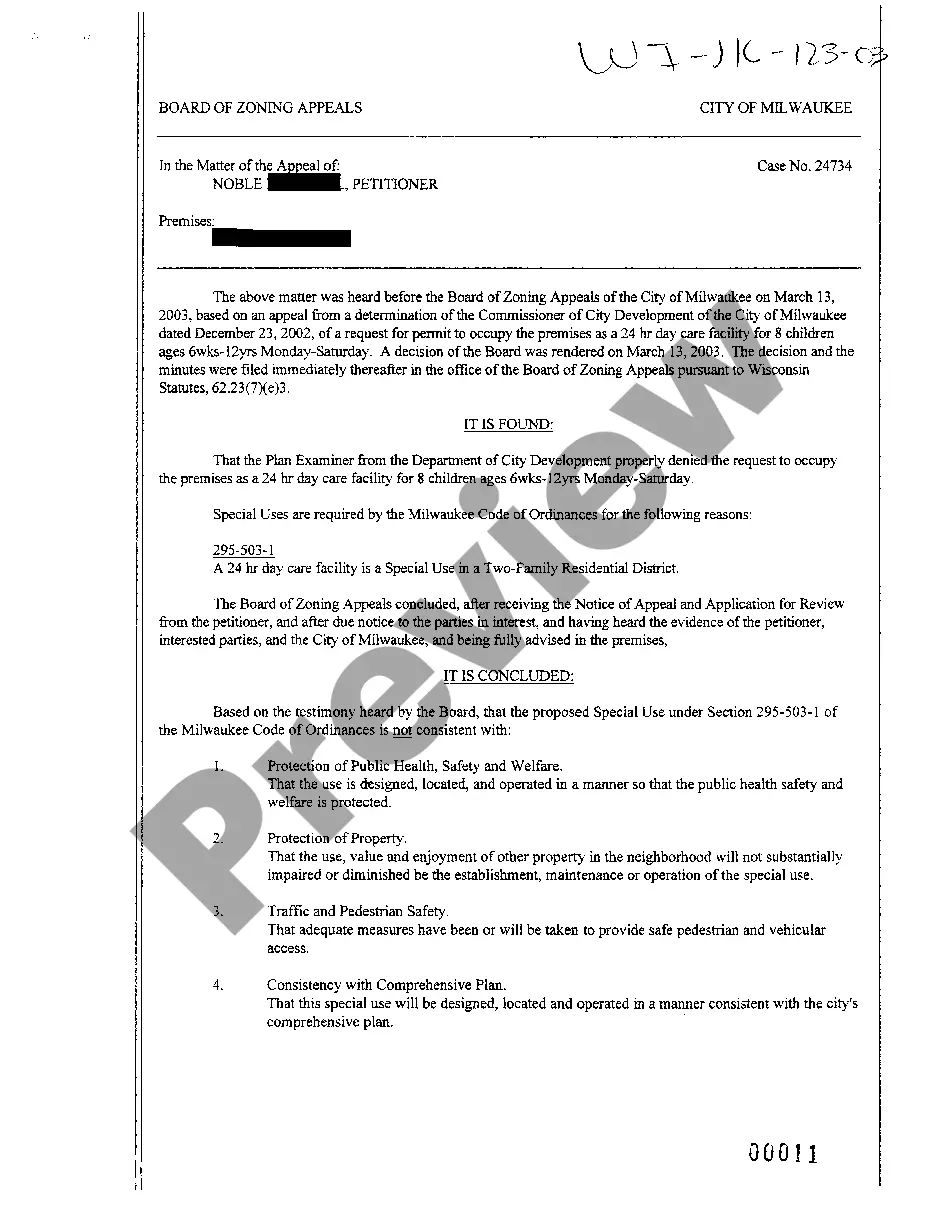

In such a circumstance, the Payor may elect to file what is known as an Interpleader action to determine the proper owner (or might be encouraged to do so). In an Interpleader, the stakeholder sues the parties who are asserting conflicting claims to the royalties due and deposits the royalties into the court.

A royalty is an amount paid by a third party to an owner of a product or patent for the use of that product or patent. The terms of royalty payments are laid out in a licensing agreement.

Parties in Royalties Accounting The person who creates or owns the asset and provides the right of using such an asset to the third party is known as the lessor or the landlord. Furthermore, lessor receives consideration from the third party for using the rights to use his asset.

A quick overview of the differences between mineral rights and royalty interests shows a mineral interest is a real property interest obtained by severing the minerals from the surface and a royalty interest grants an owner a portion of the production revenue generated.

Royalties are generated by many types of assets, including musical compositions, oil wells, gold mines, books, movies and TV shows. As passive income, royalties are taxed at lower rates than wages and salaries. Investors can invest in royalty income through auction sites and royalty income trusts.