Indiana Exhibit C Accounting Procedure Joint Operations

Description

How to fill out Exhibit C Accounting Procedure Joint Operations?

Choosing the right lawful record design could be a have difficulties. Of course, there are a lot of themes available on the net, but how will you discover the lawful form you require? Take advantage of the US Legal Forms web site. The service offers a large number of themes, including the Indiana Exhibit C Accounting Procedure Joint Operations, that you can use for organization and private demands. Every one of the types are examined by experts and meet up with state and federal specifications.

When you are previously signed up, log in to your bank account and click on the Download button to have the Indiana Exhibit C Accounting Procedure Joint Operations. Make use of bank account to check from the lawful types you possess ordered previously. Proceed to the My Forms tab of your respective bank account and get one more copy of the record you require.

When you are a new end user of US Legal Forms, allow me to share basic recommendations so that you can stick to:

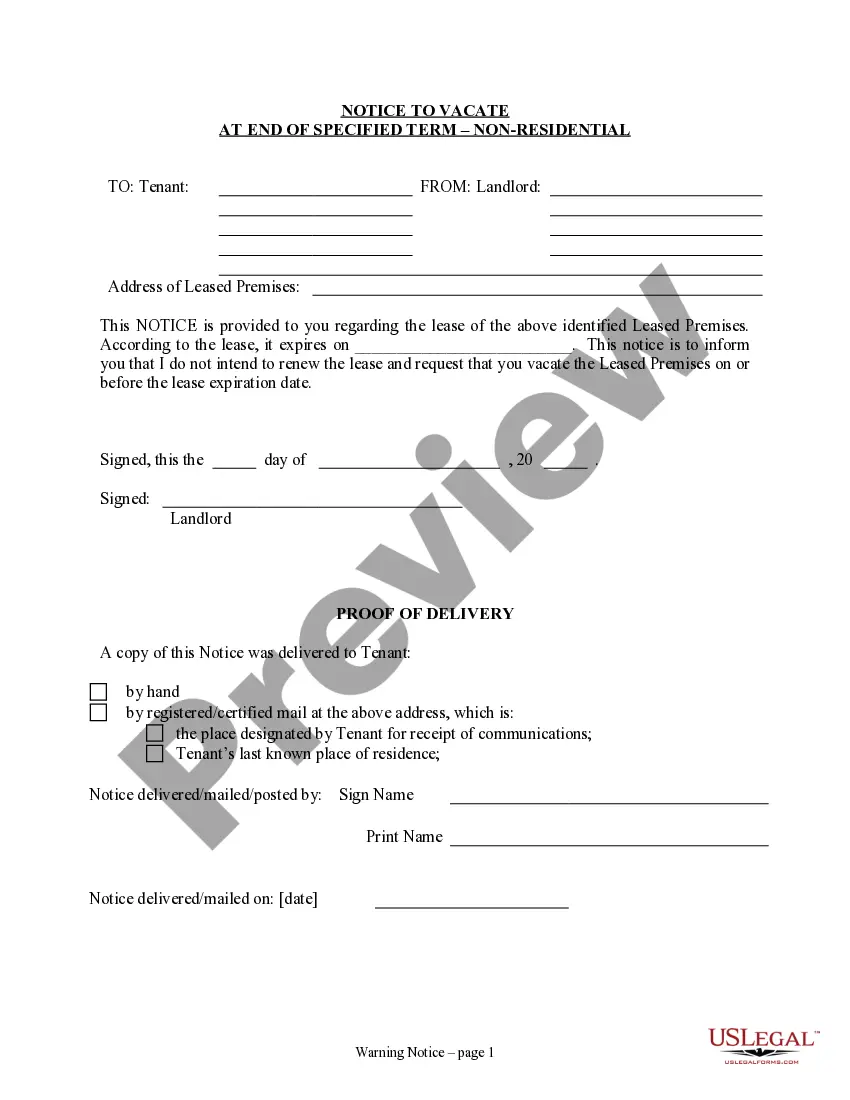

- First, make certain you have selected the proper form to your metropolis/region. You may check out the shape while using Preview button and browse the shape explanation to guarantee this is basically the right one for you.

- When the form will not meet up with your preferences, use the Seach area to find the proper form.

- When you are sure that the shape is proper, click on the Acquire now button to have the form.

- Select the rates prepare you want and enter in the essential information. Build your bank account and buy the order using your PayPal bank account or bank card.

- Opt for the document format and download the lawful record design to your device.

- Comprehensive, modify and print and indicator the acquired Indiana Exhibit C Accounting Procedure Joint Operations.

US Legal Forms is the largest catalogue of lawful types in which you will find a variety of record themes. Take advantage of the company to download expertly-created paperwork that stick to state specifications.

Form popularity

FAQ

Regulatory Accounting means record keeping rules and processes used for the preparation of accounts and reports for regulatory purposes (e.g. for the verification of cost-based pricing obligations).

Financial regulation refers to the rules and laws firms operating in the financial industry, such as banks, credit unions, insurance companies, financial brokers and asset managers must follow.

Accounting regulation consists of a legal framework, standards, education, and licensure. A legal framework is fundamental to accounting regulation. It determines the types of entities available under the law.

The regulatory basis of accounting is a comprehensive basis of accounting other than accounting principles generally accepted in the United States. Regulatory basis accounting rules and guidelines vary from one regulatory agency to another.

Sample 1. Accounting Regulations means the accounting laws, statutes, regulations, rules, standards and systems promulgated by any Governmental Authority.

Specific examples of accounting standards include revenue recognition, asset classification, allowable methods for depreciation, what is considered depreciable, lease classifications, and outstanding share measurement.