Indiana Affidavit of Heirship for House

Description

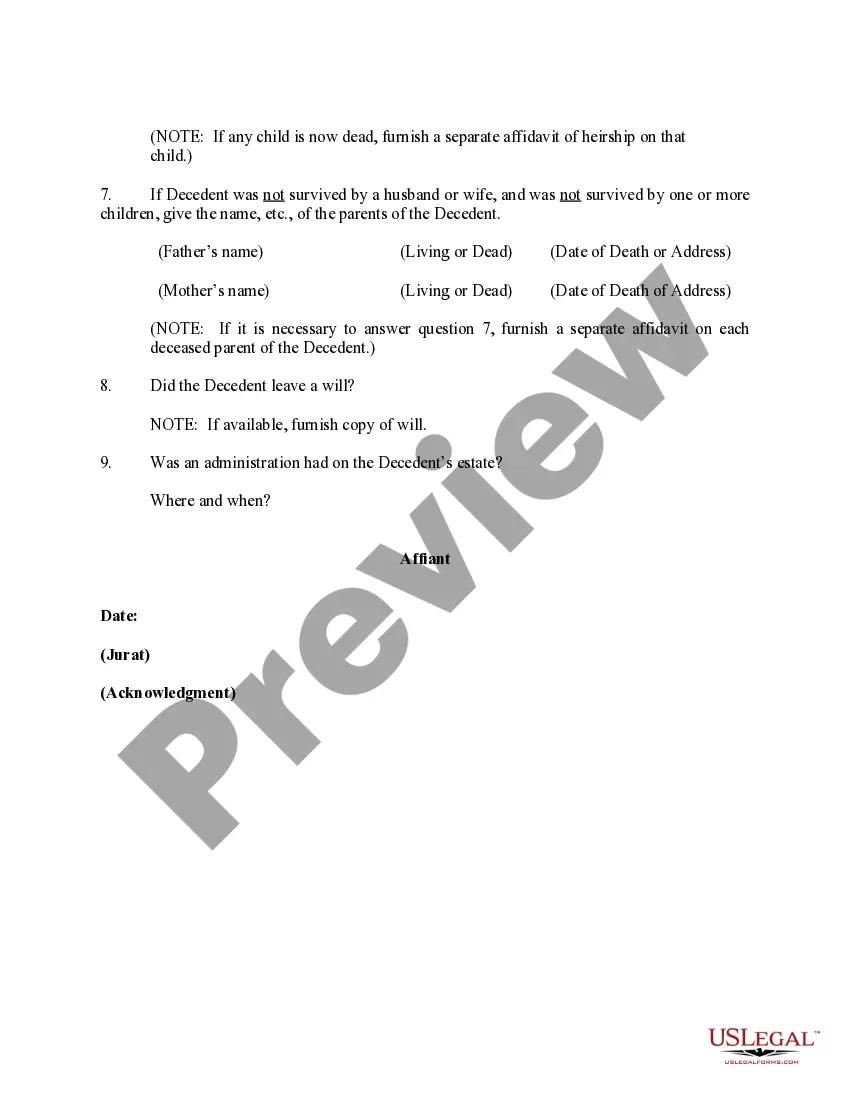

How to fill out Affidavit Of Heirship For House?

You may commit hrs on the Internet trying to find the legitimate document template that meets the federal and state demands you want. US Legal Forms provides a large number of legitimate types which can be analyzed by specialists. You can easily download or print out the Indiana Affidavit of Heirship for House from our assistance.

If you have a US Legal Forms bank account, you may log in and click on the Download button. Afterward, you may total, modify, print out, or signal the Indiana Affidavit of Heirship for House. Every legitimate document template you get is the one you have permanently. To acquire yet another duplicate of any bought develop, proceed to the My Forms tab and click on the related button.

If you work with the US Legal Forms website the very first time, adhere to the straightforward recommendations under:

- First, ensure that you have selected the correct document template for your county/city of your choice. Browse the develop information to make sure you have selected the proper develop. If offered, take advantage of the Preview button to appear with the document template at the same time.

- In order to locate yet another variation from the develop, take advantage of the Look for field to obtain the template that meets your needs and demands.

- Once you have found the template you desire, just click Buy now to move forward.

- Pick the rates program you desire, enter your credentials, and sign up for an account on US Legal Forms.

- Total the deal. You may use your credit card or PayPal bank account to fund the legitimate develop.

- Pick the file format from the document and download it to the device.

- Make alterations to the document if possible. You may total, modify and signal and print out Indiana Affidavit of Heirship for House.

Download and print out a large number of document web templates utilizing the US Legal Forms site, which offers the biggest assortment of legitimate types. Use specialist and condition-certain web templates to tackle your business or personal demands.

Form popularity

FAQ

In this situation, an heir can simply file what is called an affidavit of heirship with the court. You may find this form on your state court website or through the court clerk's office, or you may need to have an attorney or legal services firm create one for you.

Generally, the small estate procedure in Indiana is as follows: Wait 45 days after the death of the decedent; Prepare a small estate affidavit; Notify every person who is entitled to receive part of the property to be distributed; Get the small estate affidavit notarized in front of a notary public; and.

Small Estate Affidavit Requirements for Indiana Provide the name, address, Social Security number and date of the decedent's death. State that the value of the assets in the estate is less than $100,000. State that 45 days have passed since the death.

Indiana residents can use a transfer-on-death form to name beneficiaries for vehicles, securities, and real estate to bypass probate. Cars, small boats, stocks, bonds, brokerage accounts, land, and houses all qualify.

Access the Small Estate Affidavit Form (PDF). As of July 1, 2022, the value of the decedent's estate was increased to $100,000. This form is not required to be filed with the Court.

Increases the value of estates that may be distributed via affidavit from $50,000 to $100,000. Increases the threshold for summary procedures for unsupervised estates from $50,000 to $100,000.

Is Probate Required in Indiana? Any estate worth more than $50,000 is subject to probate in Indiana. Estates worth less than $50,000 transfer ownership to heirs through the small estate administration with a written statement proving entitlement to the assets.

Small Estate Affidavit Requirements for Indiana Indiana law says that a small estate affidavit must: Provide the name, address, Social Security number and date of the decedent's death. State that the value of the assets in the estate is less than $100,000. State that 45 days have passed since the death.