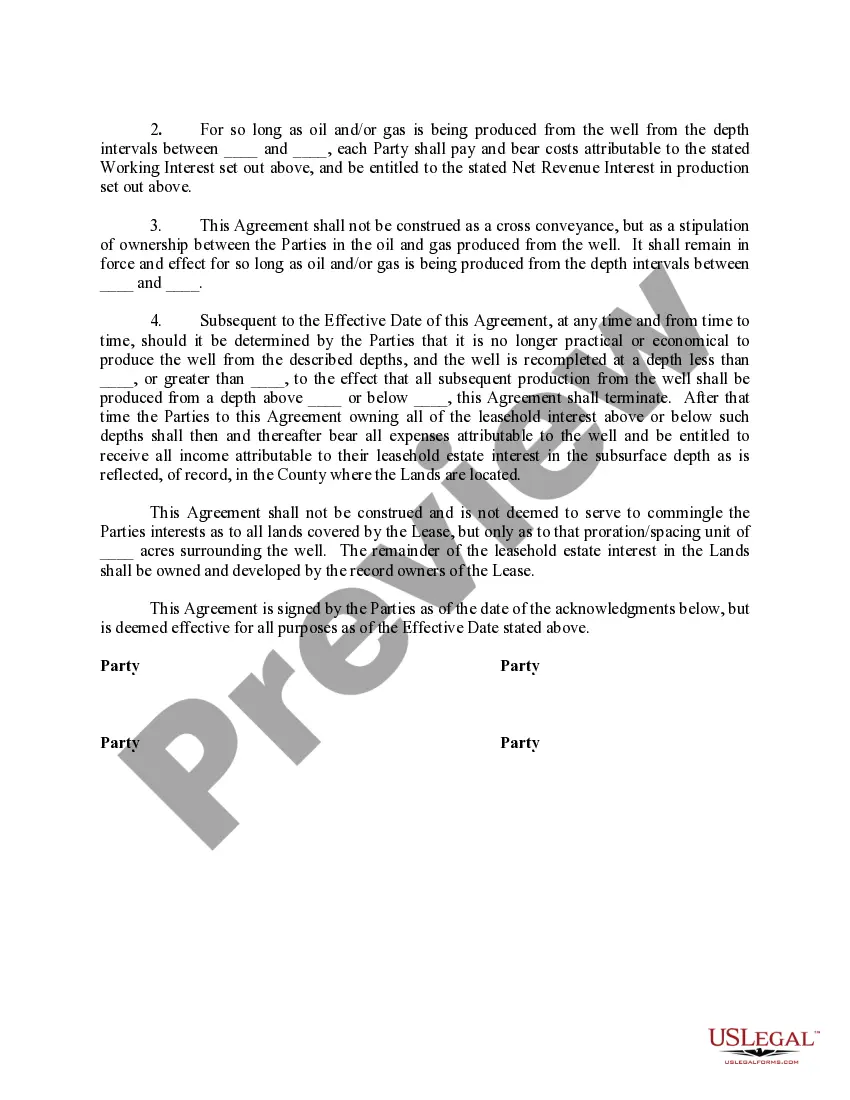

This form is used when the parties own undivided leasehold interests in the Lease as to depths from the surface of the ground to a Specific Depth. The parties acknowledge that the production from a well on the leasehold interest will be obtained from depths in which the ownership is not common. Thus, the parties find it necessary to enter into this Agreement to enable the parties to each be paid a proportionate part of the commingled production from the separate depths in which they own interests.

Indiana Commingling Agreement Among Working Owners As to Production from Different Formations Out of the Same Well Bore, Where Leasehold Ownership Varies As to Depth

Description

How to fill out Commingling Agreement Among Working Owners As To Production From Different Formations Out Of The Same Well Bore, Where Leasehold Ownership Varies As To Depth?

You can commit time on the Internet attempting to find the lawful papers format that suits the state and federal specifications you need. US Legal Forms gives a huge number of lawful varieties which are evaluated by professionals. It is simple to obtain or print the Indiana Commingling Agreement Among Working Owners As to Production from Different Formations Out of the Same Well Bore, Where Leasehold Ownership Varies As to Depth from the support.

If you already possess a US Legal Forms accounts, you are able to log in and then click the Obtain button. Following that, you are able to total, revise, print, or indicator the Indiana Commingling Agreement Among Working Owners As to Production from Different Formations Out of the Same Well Bore, Where Leasehold Ownership Varies As to Depth. Each lawful papers format you purchase is the one you have forever. To obtain an additional version of any obtained type, check out the My Forms tab and then click the related button.

If you work with the US Legal Forms site the first time, adhere to the easy instructions below:

- Initially, be sure that you have chosen the right papers format to the state/area that you pick. See the type outline to ensure you have picked out the right type. If readily available, use the Review button to search with the papers format too.

- If you wish to get an additional version from the type, use the Research discipline to discover the format that suits you and specifications.

- When you have identified the format you would like, simply click Buy now to move forward.

- Find the pricing strategy you would like, type your qualifications, and register for an account on US Legal Forms.

- Full the purchase. You can utilize your credit card or PayPal accounts to purchase the lawful type.

- Find the file format from the papers and obtain it in your product.

- Make alterations in your papers if necessary. You can total, revise and indicator and print Indiana Commingling Agreement Among Working Owners As to Production from Different Formations Out of the Same Well Bore, Where Leasehold Ownership Varies As to Depth.

Obtain and print a huge number of papers themes while using US Legal Forms site, that offers the greatest assortment of lawful varieties. Use skilled and express-distinct themes to take on your business or individual requires.