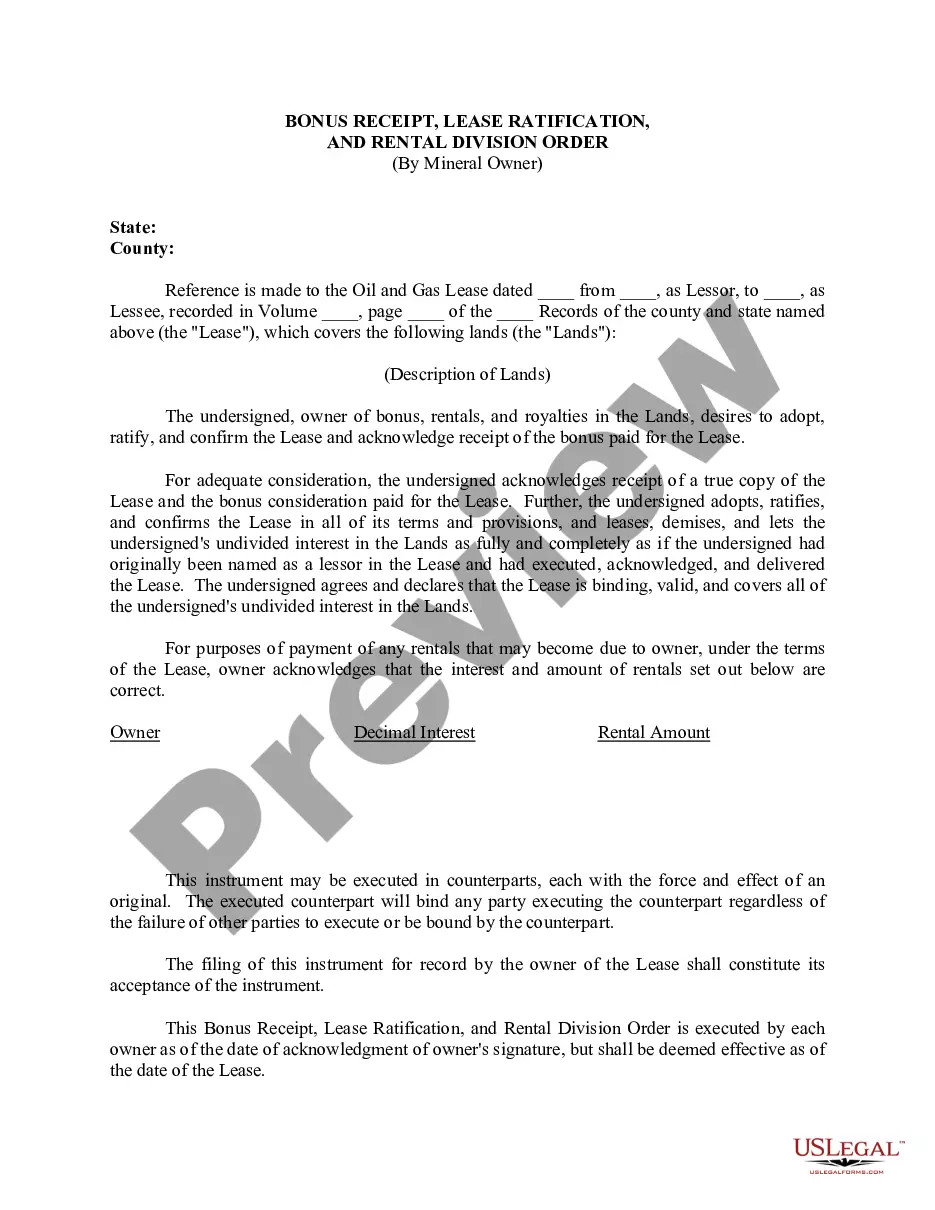

Indiana Bonus Receipt An Indiana Bonus Receipt refers to a legally binding document that confirms the payment made to a mineral owner by a lessee as a part of a lease agreement for the exploration and extraction of minerals on their property. This agreement typically involves the payment of a lump sum amount, known as a bonus, to the mineral owner in exchange for granting the lessee the right to explore and develop the minerals present on their land. The Indiana Bonus Receipt serves as proof of the payment made and outlines the key terms and conditions of the lease agreement. It includes details such as the amount of the bonus, the effective date of the lease, the duration of the lease, any royalty or rental obligations, and any other specific provisions agreed upon by both parties. This document ensures transparency and provides legal protection for both the mineral owner and the lessee. Different types of Indiana Bonus Receipts may include: 1. Surface Rights Bonus Receipt: This type of bonus receipt is specifically related to the surface rights of the property. It is applicable when the mineral owner solely grants the rights for exploration and extraction of minerals while retaining ownership of the surface rights. 2. Mineral Rights Bonus Receipt: This type of bonus receipt is focused on the ownership and rights related to the minerals present on the property. It involves the transfer of both the mineral rights and the surface rights to the lessee. Lease Ratification refers to the formal approval or confirmation given by both the lessor and the lessee to ratify and validate an existing lease agreement. It is a legally binding document that serves to confirm that both parties agree to the terms, conditions, and obligations outlined in the lease. When there is a need to make changes to an existing lease agreement or when there is ambiguity regarding certain terms, the parties may opt for a lease ratification to resolve any discrepancies and ensure clarity. This document helps in avoiding disputes and protects the rights and interests of both the lessor and the lessee. Rental Division Order by Mineral Owner A Rental Division Order (DO) by Mineral Owner is an official document executed by the mineral owner that acknowledges and stipulates the division and distribution of rental payments received from a lessee who is exploring or extracting minerals on their property. The Rental Division Order includes details such as the name and address of the lessee, the legal description of the property, the amount of rental payment, and the division percentages or amounts allocated to each co-owner or heir. It ensures that the mineral owner receives the correct amount of rental income based on their ownership share. Different types of Rental Division Orders may include: 1. Standard Rental Division Order: This type of DO is commonly used when the mineral owner is an individual or family and the distribution of rental income is straightforward, with no complex ownership structures involved. 2. Complex Rental Division Order: This type of DO is used when there are multiple co-owners, partnerships, or trust structures involved. It requires detailed documentation and legal expertise to accurately distribute rental income among various parties. In summary, Indiana Bonus Receipts, Lease Ratification, and Rental Division Orders by Mineral Owner are essential legal documents that ensure proper payment, ratification, and distribution of lease bonuses, terms, and rental income among mineral owners in Indiana.

Indiana Bonus Receipt, Lease Ratification, and Rental Division Order by Mineral Owner

Description

How to fill out Indiana Bonus Receipt, Lease Ratification, And Rental Division Order By Mineral Owner?

If you need to complete, obtain, or print out lawful papers web templates, use US Legal Forms, the biggest selection of lawful varieties, that can be found online. Make use of the site`s simple and practical search to discover the papers you require. A variety of web templates for company and person functions are categorized by types and suggests, or keywords. Use US Legal Forms to discover the Indiana Bonus Receipt, Lease Ratification, and Rental Division Order by Mineral Owner with a number of click throughs.

Should you be presently a US Legal Forms buyer, log in to the profile and then click the Acquire key to obtain the Indiana Bonus Receipt, Lease Ratification, and Rental Division Order by Mineral Owner. You can also gain access to varieties you earlier downloaded within the My Forms tab of the profile.

Should you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have selected the form for your correct town/region.

- Step 2. Take advantage of the Preview option to look over the form`s content material. Never forget about to read the explanation.

- Step 3. Should you be not satisfied with the develop, take advantage of the Search discipline on top of the screen to get other types from the lawful develop format.

- Step 4. Once you have found the form you require, click on the Buy now key. Select the costs program you choose and include your qualifications to sign up for an profile.

- Step 5. Method the transaction. You should use your credit card or PayPal profile to accomplish the transaction.

- Step 6. Choose the file format from the lawful develop and obtain it in your system.

- Step 7. Complete, change and print out or indicator the Indiana Bonus Receipt, Lease Ratification, and Rental Division Order by Mineral Owner.

Every lawful papers format you purchase is your own eternally. You might have acces to each and every develop you downloaded within your acccount. Click the My Forms segment and pick a develop to print out or obtain once again.

Contend and obtain, and print out the Indiana Bonus Receipt, Lease Ratification, and Rental Division Order by Mineral Owner with US Legal Forms. There are thousands of professional and state-specific varieties you can use to your company or person needs.