Indiana Provisions Which May Be Added to a Division Or Transfer Order

Description

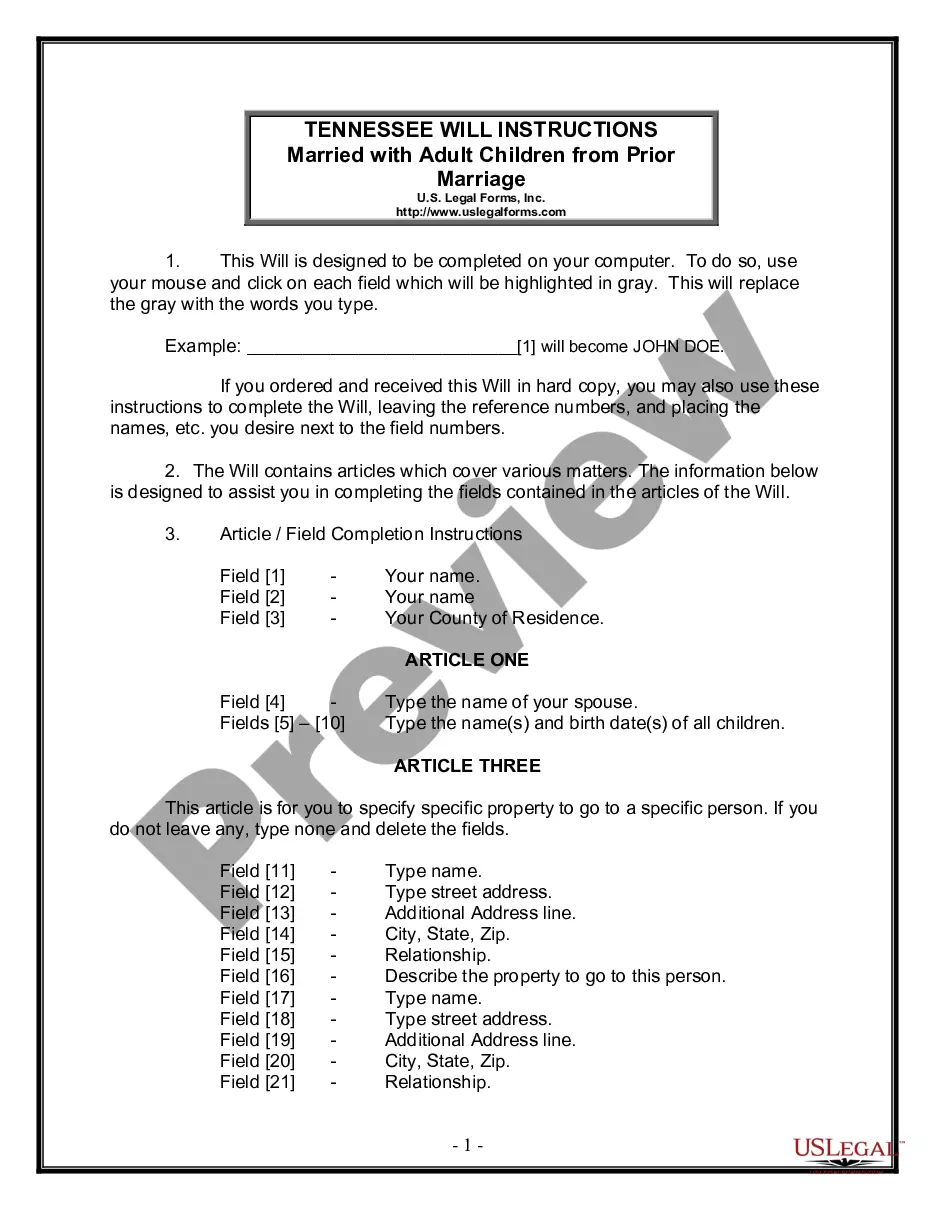

How to fill out Provisions Which May Be Added To A Division Or Transfer Order?

US Legal Forms - one of the most significant libraries of legal types in the USA - gives a variety of legal record templates it is possible to download or print. Using the website, you can find a huge number of types for organization and specific purposes, categorized by types, states, or key phrases.You will find the newest versions of types just like the Indiana Provisions Which May Be Added to a Division Or Transfer Order within minutes.

If you have a registration, log in and download Indiana Provisions Which May Be Added to a Division Or Transfer Order from the US Legal Forms library. The Download key will appear on each and every form you perspective. You gain access to all previously delivered electronically types inside the My Forms tab of the profile.

If you would like use US Legal Forms initially, allow me to share basic guidelines to help you get started off:

- Make sure you have picked the best form for the town/state. Select the Review key to review the form`s content material. See the form explanation to actually have selected the right form.

- In the event the form does not fit your needs, use the Look for discipline on top of the display to discover the one who does.

- If you are pleased with the shape, validate your decision by simply clicking the Get now key. Then, choose the rates program you favor and offer your qualifications to register for the profile.

- Approach the purchase. Make use of your charge card or PayPal profile to accomplish the purchase.

- Find the formatting and download the shape on your own device.

- Make changes. Complete, edit and print and indication the delivered electronically Indiana Provisions Which May Be Added to a Division Or Transfer Order.

Each and every format you put into your account does not have an expiry time which is the one you have forever. So, if you would like download or print yet another backup, just proceed to the My Forms portion and click on in the form you want.

Obtain access to the Indiana Provisions Which May Be Added to a Division Or Transfer Order with US Legal Forms, one of the most extensive library of legal record templates. Use a huge number of expert and state-specific templates that fulfill your company or specific demands and needs.

Form popularity

FAQ

An Administrative Rule is any regulation, standard, statement, or document of general applicability (that is not a policy) that describes the procedure or practice requirements of an agency; or implements, prescribes, or interprets an enactment of the general assembly or congress or a regulation adopted by a federal ...

(3) Information for Reports. The judge of a trial court, subject to this rule, may require clerks, court reporters, probation officers, or any employee of the court to furnish information required to complete and prepare the reports.

(6) Any party represented by a designated employee or trustee who fails to comply with these rules or local rules of court may be ordered by the court to appear by counsel and subject to sanctions, including the assessment of costs or reasonable attorney's fees, the entry of a default judgment, and the dismissal of a ...

Rule 5(B) provides the specific procedures for excluding Court Records from Public Access when the entire Court Record is filed, ?locked?, and excluded from Public Access.

Interim Administrative Rule 14 creates a presumption that testimonial proceedings will be held in person. Importantly, the rule also provides that trial courts ?may conduct the proceedings remotely for all or some of the case participants for good cause shown or by agreement of the parties.?

The Indiana Administrative Procedure Act is the law governing procedures for state administrative agencies to propose and issue regulations and provides for judicial review of agency adjudications and other final decisions in Indiana. It can be found in Title 4, Articles 21.5 and 22 of the Indiana Code.

Administrative Rule 7 is to provide an orderly procedure for the preservation and disposition of court records while protecting public and private rights.