The Indiana Amendment to Oil and Gas Lease plays a crucial role in modifying or adjusting the terms and conditions of an existing lease, while ensuring compliance with state-specific regulations. This amendment is designed to be inserted into a standardized form and acts as a legal contract between the lessor and the lessee. Keywords: Indiana Amendment to Oil and Gas Lease, lease modification, terms and conditions, compliance, standardized form, lessor, lessee. There are different types of Indiana Amendment to Oil and Gas Lease, each catering to specific circumstances and requirements: 1. Royalty Amendment: This amendment focuses on modifying the royalty percentage, which is the portion of the overall oil or gas production that the lessor is entitled to receive. It outlines the revised royalty rate and any additional terms related to the royalty payment. 2. Surface Rights Amendment: This amendment addresses the rights and restrictions pertaining to the use of the surface land for oil and gas activities. It may include provisions related to access roads, pipelines, facilities, and environmental regulations. 3. Term Extension Amendment: If the original lease has a fixed term, this amendment allows for extending the lease term beyond its initial expiration date. It covers the revised duration, any associated costs, and potential provisions for termination or renewal. 4. Acreage Amendment: This type of amendment is used when the original lease needs to be altered regarding the acreage included in the leasehold. It may involve adding or subtracting acreage, adjusting corresponding rental payments, or modifying the minimum drilling obligations. 5. Assignment and Transfer Amendment: When there is a need to transfer or assign the rights and obligations of the lease to a different party, this amendment comes into play. It outlines the conditions for the transfer, the responsibilities of the assignee, and any associated fees or considerations. 6. Force Mature Amendment: In situations where unforeseen circumstances such as natural disasters or market shocks hinder oil and gas operations, this amendment addresses the impact on terms like production, rental obligations, or drilling commitments. It outlines the conditions under which force majeure can be invoked and the respective rights and responsibilities of the parties involved. These are some common categories of Indiana Amendment to Oil and Gas Lease. It is crucial to consult legal professionals or experts familiar with the specific lease agreement and state laws to ensure accurate and compliant modifications.

Indiana Amendment to Oil and Gas Lease With Amendments to Be inserted in Form

Description

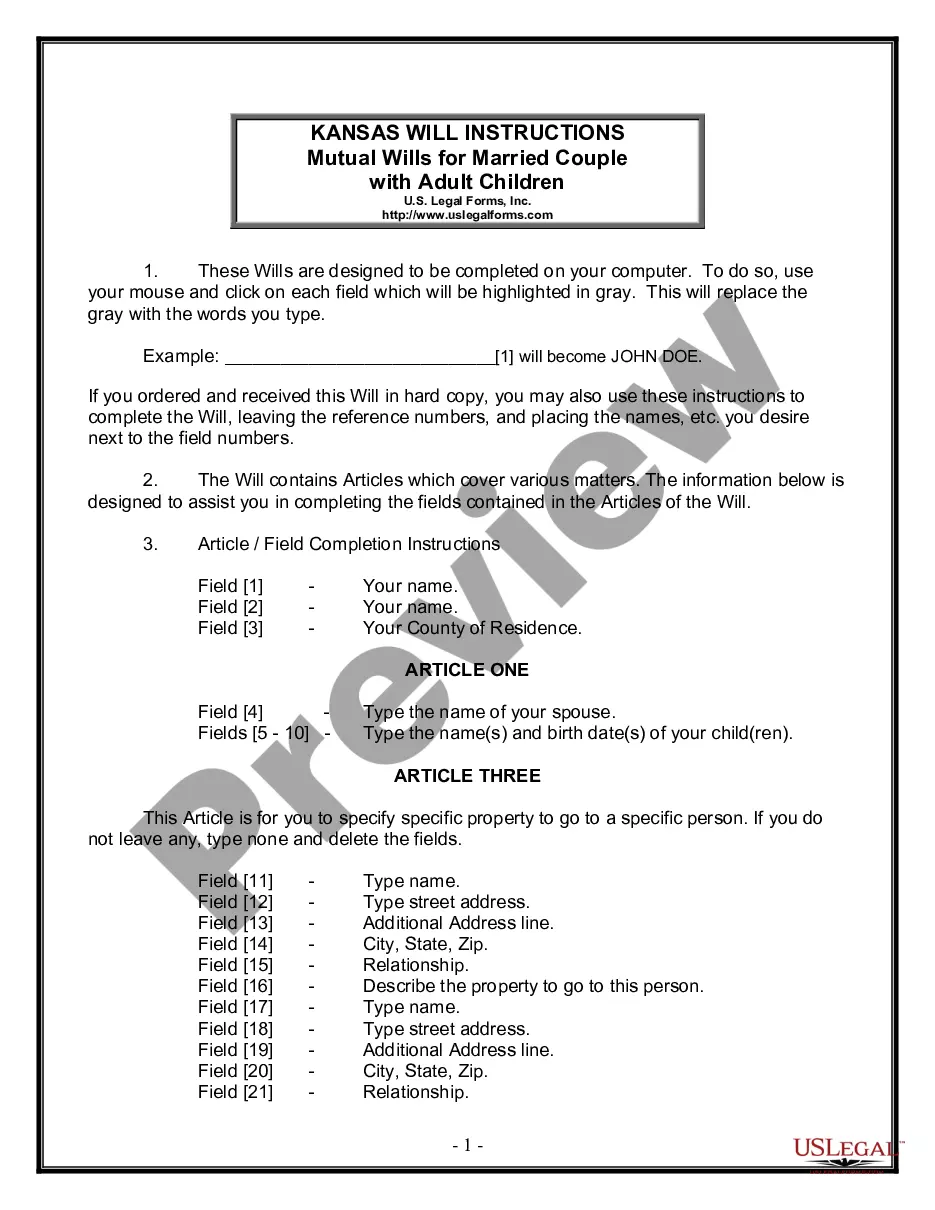

How to fill out Amendment To Oil And Gas Lease With Amendments To Be Inserted In Form?

US Legal Forms - one of the most significant libraries of lawful types in the United States - offers a wide range of lawful record layouts you are able to down load or print out. Making use of the site, you will get 1000s of types for organization and individual uses, categorized by groups, states, or search phrases.You will discover the latest types of types much like the Indiana Amendment to Oil and Gas Lease With Amendments to Be inserted in Form in seconds.

If you already possess a registration, log in and down load Indiana Amendment to Oil and Gas Lease With Amendments to Be inserted in Form through the US Legal Forms local library. The Download key will appear on every form you view. You have access to all in the past acquired types from the My Forms tab of your account.

If you wish to use US Legal Forms for the first time, listed here are basic recommendations to help you started off:

- Be sure you have chosen the proper form to your city/region. Click on the Review key to review the form`s content. Read the form description to actually have selected the correct form.

- When the form doesn`t satisfy your requirements, make use of the Search field at the top of the screen to obtain the one that does.

- When you are content with the shape, affirm your decision by simply clicking the Buy now key. Then, select the rates plan you prefer and give your credentials to register for the account.

- Procedure the purchase. Make use of credit card or PayPal account to complete the purchase.

- Find the file format and down load the shape on your own system.

- Make changes. Fill out, modify and print out and sign the acquired Indiana Amendment to Oil and Gas Lease With Amendments to Be inserted in Form.

Each and every format you included with your account does not have an expiration date and is your own for a long time. So, if you would like down load or print out one more copy, just proceed to the My Forms section and click on around the form you require.

Gain access to the Indiana Amendment to Oil and Gas Lease With Amendments to Be inserted in Form with US Legal Forms, one of the most extensive local library of lawful record layouts. Use 1000s of skilled and state-certain layouts that meet your company or individual demands and requirements.

Form popularity

FAQ

It is a legal process that allows the landlord and the tenant to modify the terms and conditions of the lease agreement in a mutually agreed-upon manner. The amendments are added as an addendum to the original document and signed by both parties.

Provide a written request: Prepare a formal written request to remove a name from the lease. In the letter, explain the reasons for the request and provide any supporting documentation, such as a signed agreement from the remaining tenant or proof of a terminated relationship.

How to Write a Lease Amendment Step 1 ? Enter Lease Agreement Details. ... Step 2 ? Fill in Landlord and Tenant Details. ... Step 3 ? Restate Lease Agreement Details. ... Step 4 ? Identify Provisions. ... Step 5 ? Document Sentence Amendments. ... Step 6 ? Note Sentence Deletions. ... Step 7 ? Confirm Section Deletions. Free Lease Amendment Template | PDF & Word legaltemplates.net ? form ? lease-agreement ? ame... legaltemplates.net ? form ? lease-agreement ? ame...

A modification of lease, also called a lease amendment or lease modification, is an agreement that formally changes the original terms and conditions of a lease. It allows the parties to agree to changes without having to sign an entirely new lease.

Hear this out loud PauseBy way of background, a ?free use? clause is a provision in an oil/gas lease which gives the lessee the right to use gas produced from the leasehold. Tenth Circuit Rules That Obligation To Pay Royalty On Fuel Gas Depends ... hh-law.com ? blogs ? oil-and-gas-addendum ? ten... hh-law.com ? blogs ? oil-and-gas-addendum ? ten...

A first amendment lease allows you to make a decision so that you can get the equipment you need and still have the option to buy it down the road. When the lease term expires, you are able to exercise the right to purchase the equipment at a fair market price.

Hear this out loud PauseWhat is the granting clause? The granting clause is the clause under which the owner of the oil and gas rights leases the oil and gas rights to the oil and gas company along with the right to develop the oil and gas on a specifically described piece of real estate. Fundamentals of an Oil and Gas Lease rothmangordon.com ? fundamentals-of-an-... rothmangordon.com ? fundamentals-of-an-...