This form is used by Claimant as notice of ownership and claim of title to additional interest of the mineral estate in lands, by having engaged in, conducted, and exercised the acts of ownership, which entitle Claimant to ownership of the additional mineral interest by limitations, under the laws of the state in which the Lands are located.

Indiana Notice of Claimed Ownership of Mineral Interest, by Limitations

Description

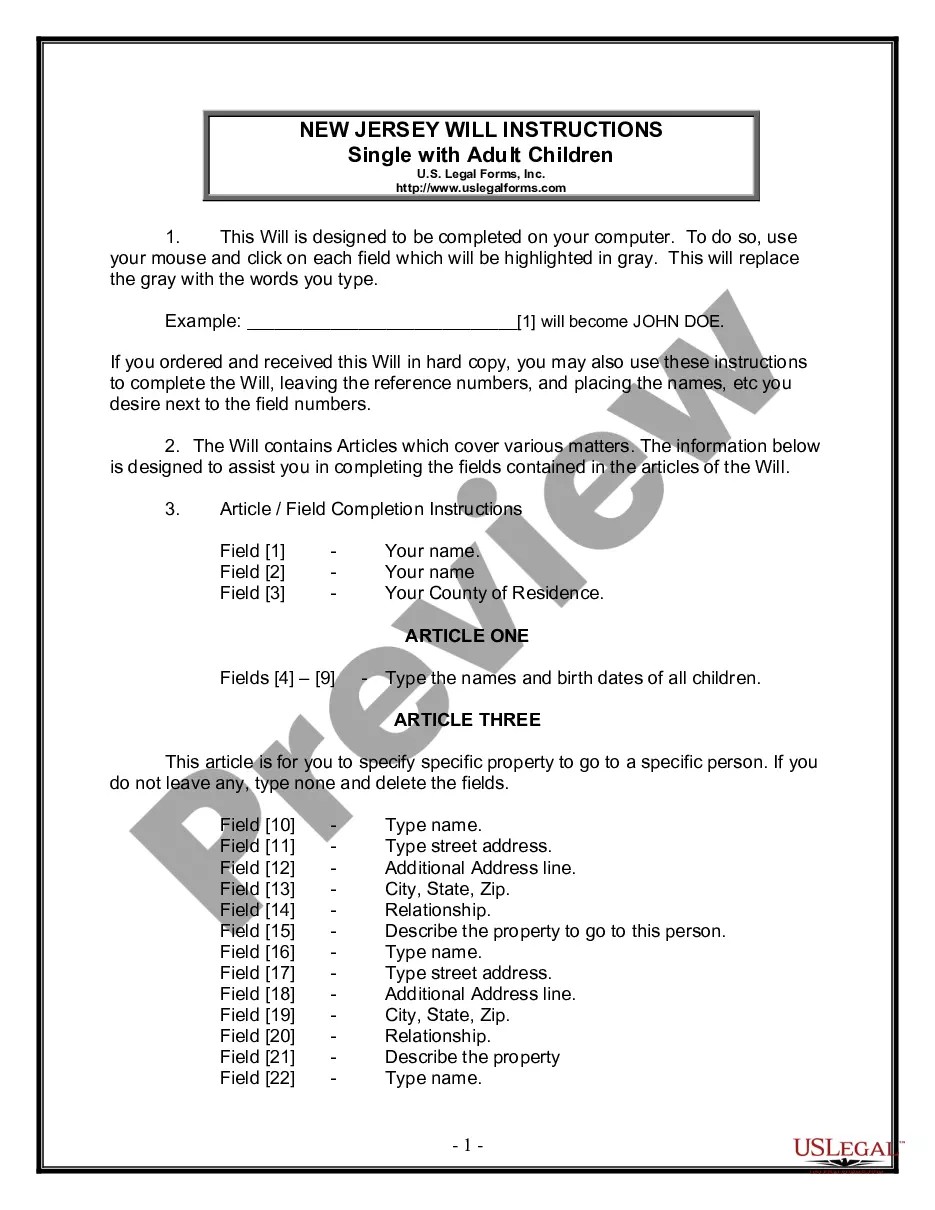

How to fill out Notice Of Claimed Ownership Of Mineral Interest, By Limitations?

Are you currently within a place the place you need documents for possibly enterprise or person purposes virtually every time? There are tons of authorized papers web templates available on the net, but finding kinds you can rely isn`t effortless. US Legal Forms offers a huge number of kind web templates, like the Indiana Notice of Claimed Ownership of Mineral Interest, by Limitations, which can be created in order to meet state and federal requirements.

In case you are currently knowledgeable about US Legal Forms web site and have an account, merely log in. Next, you are able to download the Indiana Notice of Claimed Ownership of Mineral Interest, by Limitations design.

If you do not have an bank account and need to begin using US Legal Forms, abide by these steps:

- Find the kind you will need and make sure it is to the appropriate area/state.

- Make use of the Preview option to review the form.

- Look at the outline to ensure that you have chosen the right kind.

- In the event the kind isn`t what you`re trying to find, utilize the Look for discipline to find the kind that fits your needs and requirements.

- Whenever you discover the appropriate kind, click Purchase now.

- Select the rates plan you desire, complete the necessary information to produce your bank account, and purchase the transaction utilizing your PayPal or charge card.

- Pick a handy data file structure and download your version.

Find each of the papers web templates you may have bought in the My Forms food selection. You can aquire a extra version of Indiana Notice of Claimed Ownership of Mineral Interest, by Limitations whenever, if necessary. Just go through the necessary kind to download or printing the papers design.

Use US Legal Forms, one of the most extensive variety of authorized forms, to save lots of time as well as stay away from errors. The support offers expertly produced authorized papers web templates that you can use for a variety of purposes. Create an account on US Legal Forms and commence making your lifestyle a little easier.

Form popularity

FAQ

Surface rights determine who owns the rights to the surface of the land, while mineral rights determine who has the right to mine the minerals below the surface of the property. Mineral rights include oil and natural gas resources. Mineral rights can be completely separate from land rights.

When mineral rights are inherited, the value basis is not what the previous owner bought the land for- it is the value at the time of the inheritance. The value of the inherited mineral rights should be reassessed at the time of inheritance to reflect current market value.

Whether mineral rights transfer with the property depends on the estate type. If it's a severed estate, surface rights and mineral rights are separate and do not transfer together. However, if it's a unified estate, the land and the mineral rights can be conveyed with the property.

The Indiana Dormant Mineral Interest Act" was passed by the Indiana Legislature in 1971. The Act provides that severed mineral interests would automatically revert to the current surface owner of the land unless one of the following conditions was met: 1. Sufficient "use" of the mineral interest by the owner.

Minerals include gold, silver, coal, oil, and gas. If you want to transfer the rights to these minerals to another party, you can do so in a variety of ways: by deed, will, or lease. Before you transfer mineral rights, you should confirm that you own the rights that you seek to transfer.

The most common way is through a will or estate plan. When the mineral rights owner dies, their heirs will become the new owners. Another way to transfer mineral rights is through a lease. If the mineral rights are leased to a third party, the new owner will need approval from the current lessee to claim them.

3) Indiana Mineral Lapse Act ? Termination of Unused Estates Under the Act, mineral interests are automatically terminated if they go unused by the owner for a period of 20 years, although the owner can save its interest from terminating by filing a statement of claim to the interest with the county recorder.

After a death, assets like mineral rights often go through probate, which is a legal process to authenticate a will and distribute assets ing to it. If no will exists, probate helps determine how assets should be divided.