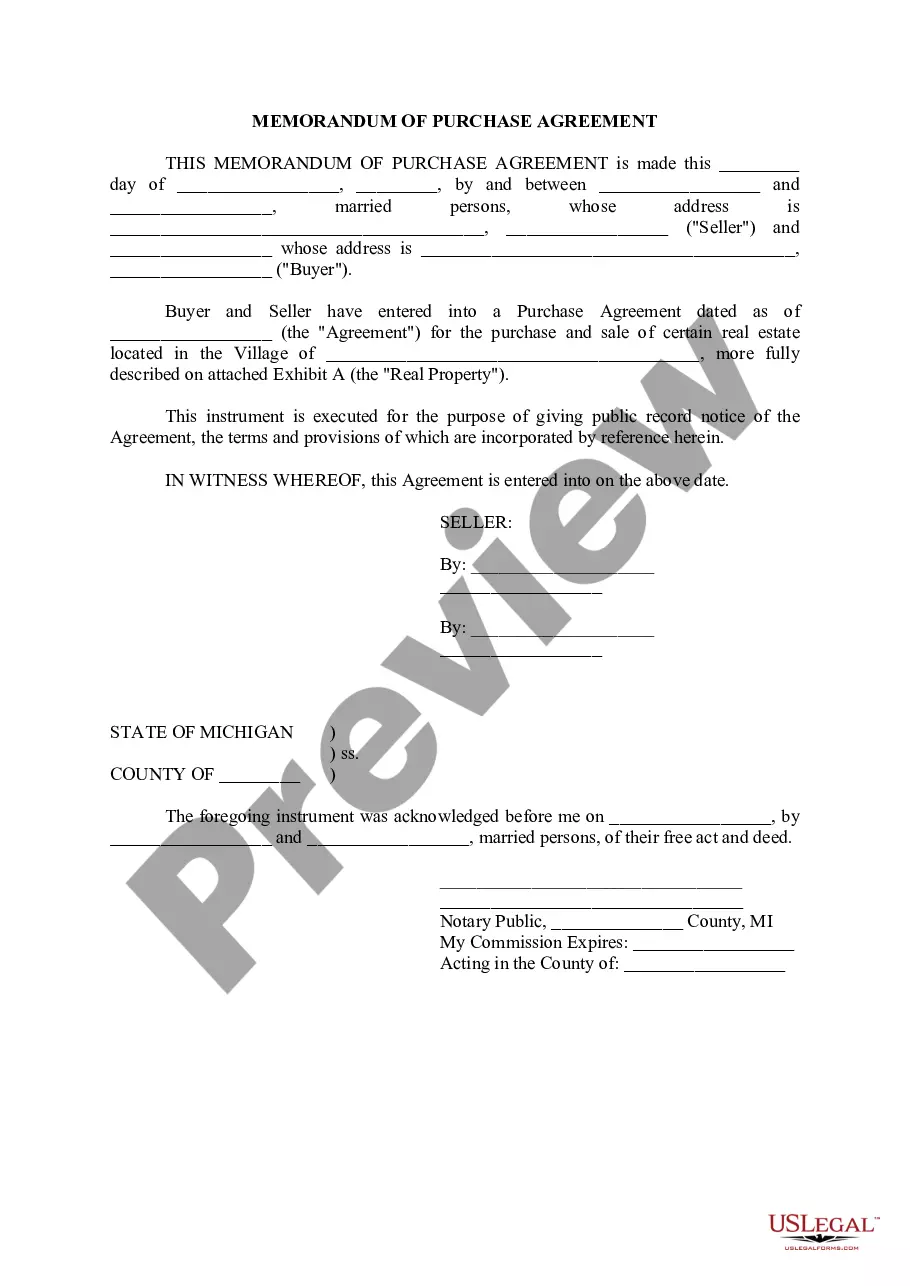

This form is used when an Assignor releases, relinquishes, and quit claims the Production Payment Interest to an Assignee, being the present owners of the leasehold interest in the leases that were the subject of the Assignment creating the production payment, so that from and after the Effective Date the released interest is owned in the manner provided for in the Assignment.

Indiana Release of Production Payment Reserved in An Assignment

Description

How to fill out Release Of Production Payment Reserved In An Assignment?

US Legal Forms - one of the greatest libraries of authorized kinds in America - gives an array of authorized document themes you can obtain or printing. Utilizing the website, you can get thousands of kinds for company and specific purposes, sorted by categories, claims, or key phrases.You can find the most recent versions of kinds such as the Indiana Release of Production Payment Reserved in An Assignment within minutes.

If you already possess a registration, log in and obtain Indiana Release of Production Payment Reserved in An Assignment from the US Legal Forms collection. The Down load option can look on each develop you look at. You get access to all previously downloaded kinds from the My Forms tab of the profile.

If you would like use US Legal Forms the first time, allow me to share simple recommendations to get you began:

- Ensure you have picked out the proper develop for the city/area. Go through the Review option to check the form`s information. See the develop description to ensure that you have chosen the appropriate develop.

- In the event the develop doesn`t satisfy your demands, take advantage of the Search area on top of the monitor to get the one who does.

- When you are happy with the shape, verify your choice by clicking on the Buy now option. Then, opt for the pricing strategy you prefer and supply your qualifications to register for the profile.

- Process the transaction. Use your bank card or PayPal profile to complete the transaction.

- Pick the format and obtain the shape on your device.

- Make adjustments. Load, modify and printing and indication the downloaded Indiana Release of Production Payment Reserved in An Assignment.

Every single web template you added to your money lacks an expiration date which is your own forever. So, if you want to obtain or printing an additional copy, just proceed to the My Forms portion and click on in the develop you require.

Get access to the Indiana Release of Production Payment Reserved in An Assignment with US Legal Forms, one of the most considerable collection of authorized document themes. Use thousands of professional and status-certain themes that fulfill your organization or specific requires and demands.