Indiana Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease

Description

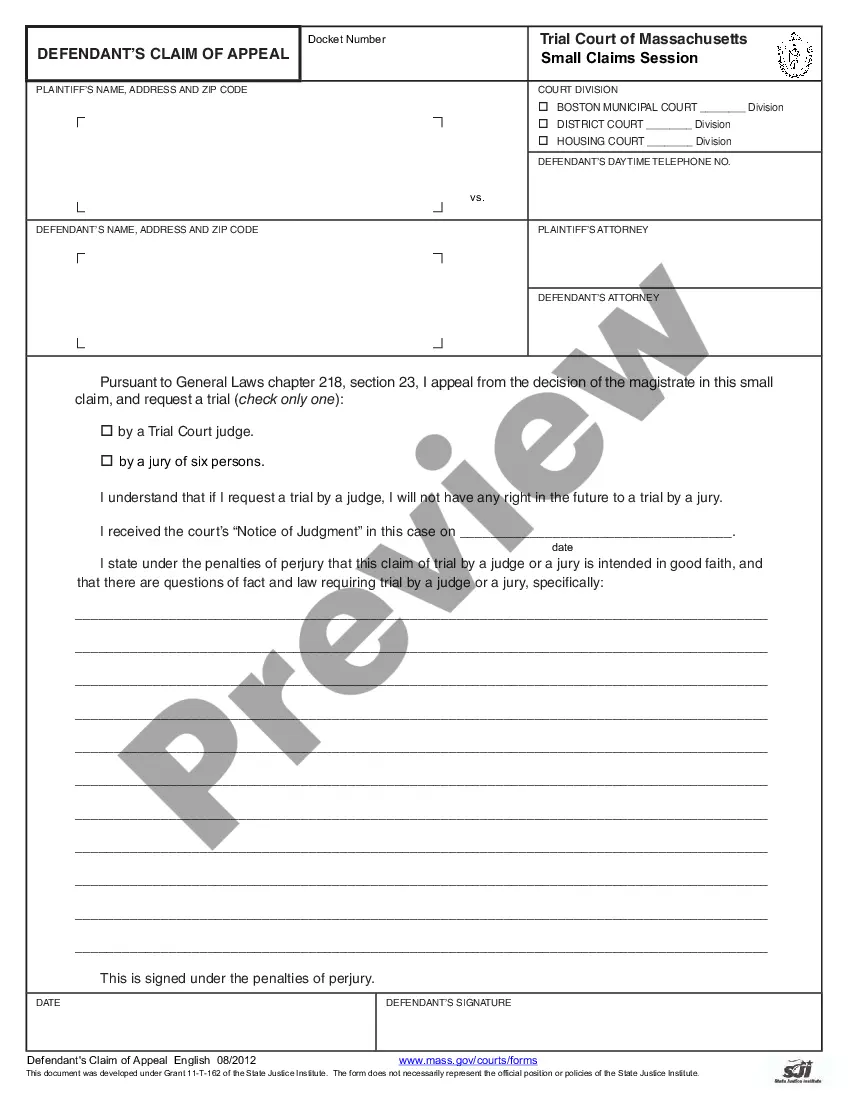

How to fill out Commingling And Entirety Agreement By Royalty Owners Where Royalty Ownership Varies In Lands Subject To Lease?

US Legal Forms - one of several most significant libraries of legal forms in the United States - provides a wide range of legal file themes you are able to download or print. Using the site, you can find 1000s of forms for enterprise and personal purposes, categorized by groups, suggests, or keywords and phrases.You will discover the most up-to-date variations of forms just like the Indiana Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease within minutes.

If you already have a monthly subscription, log in and download Indiana Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease through the US Legal Forms library. The Acquire button will show up on every kind you look at. You get access to all in the past saved forms from the My Forms tab of your respective bank account.

If you would like use US Legal Forms the first time, allow me to share basic recommendations to obtain started out:

- Make sure you have chosen the best kind for the town/county. Go through the Preview button to examine the form`s content material. Read the kind description to ensure that you have chosen the proper kind.

- If the kind doesn`t suit your needs, utilize the Lookup discipline near the top of the monitor to discover the one which does.

- If you are happy with the shape, validate your selection by clicking the Acquire now button. Then, select the costs plan you prefer and offer your credentials to register for an bank account.

- Process the transaction. Make use of Visa or Mastercard or PayPal bank account to finish the transaction.

- Select the format and download the shape on the product.

- Make changes. Fill up, edit and print and sign the saved Indiana Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease.

Each design you put into your bank account lacks an expiration date and is your own property forever. So, in order to download or print one more backup, just check out the My Forms section and click on about the kind you want.

Get access to the Indiana Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease with US Legal Forms, by far the most extensive library of legal file themes. Use 1000s of expert and status-distinct themes that meet up with your business or personal requirements and needs.

Form popularity

FAQ

Royalty Rates: The royalty agreement or rate is a percentage of total revenue gotten from the sale of oil and gas, and it's always outlined in the lease agreement. The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations.

Most states and many private landowners require companies to pay royalty rates higher than 12.5%, with some states charging 20% or more, ing to federal officials. The royalty rate for oil produced from federal reserves in deep waters in the Gulf of Mexico is 18.75%.

The right of governments to levy royalties from oil and gas companies derives from their ownership of natural resources. Through royalty payments, governments are compensated by oil and gas companies for the extraction of public natural resources.

Royalty Clause There are two types of royalties, a net and a gross royalty. Normally, the oil and gas lease contains a net royalty. If the lease provides for a net royalty, this means that post-production deductions will be taken from the royalty.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Royalty Clause: The Lessor's only right to receive payments in addition to the Bonus Payment is through Royalties. Royalties are calculated as a percentage of the value of all minerals produced, typically 25%.