Indiana Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease

Description

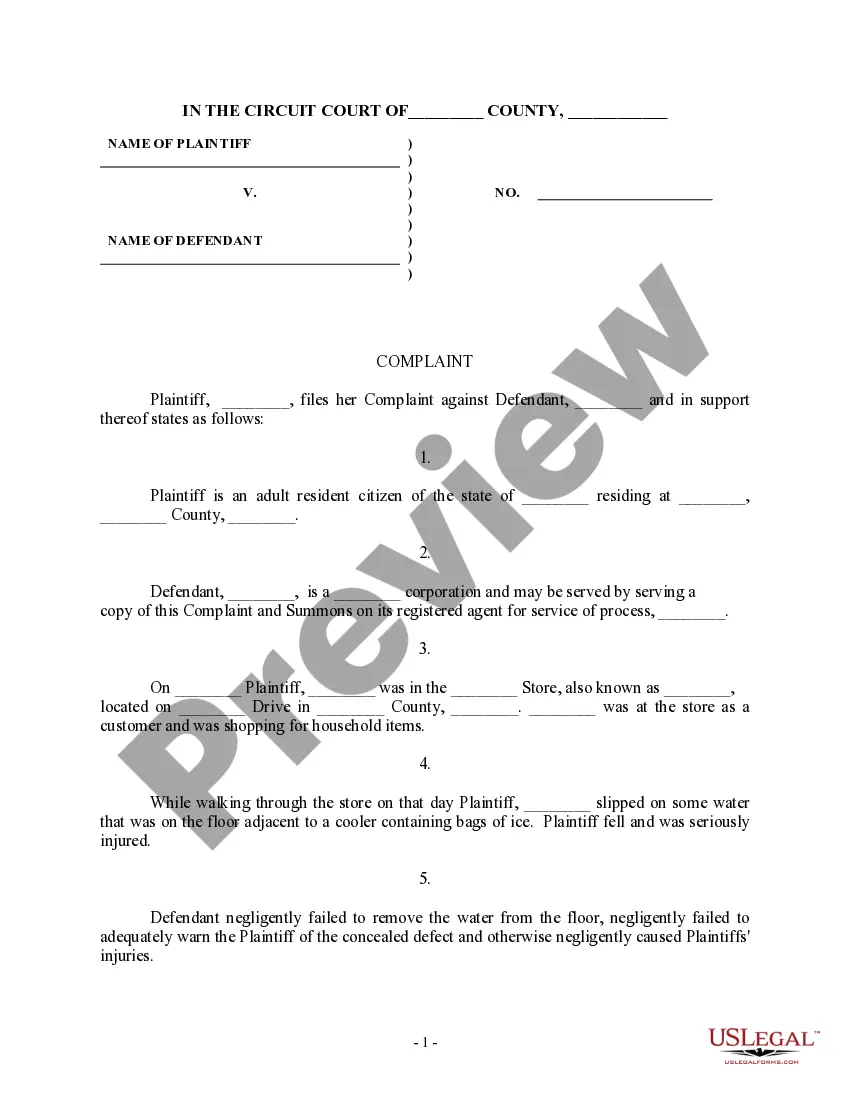

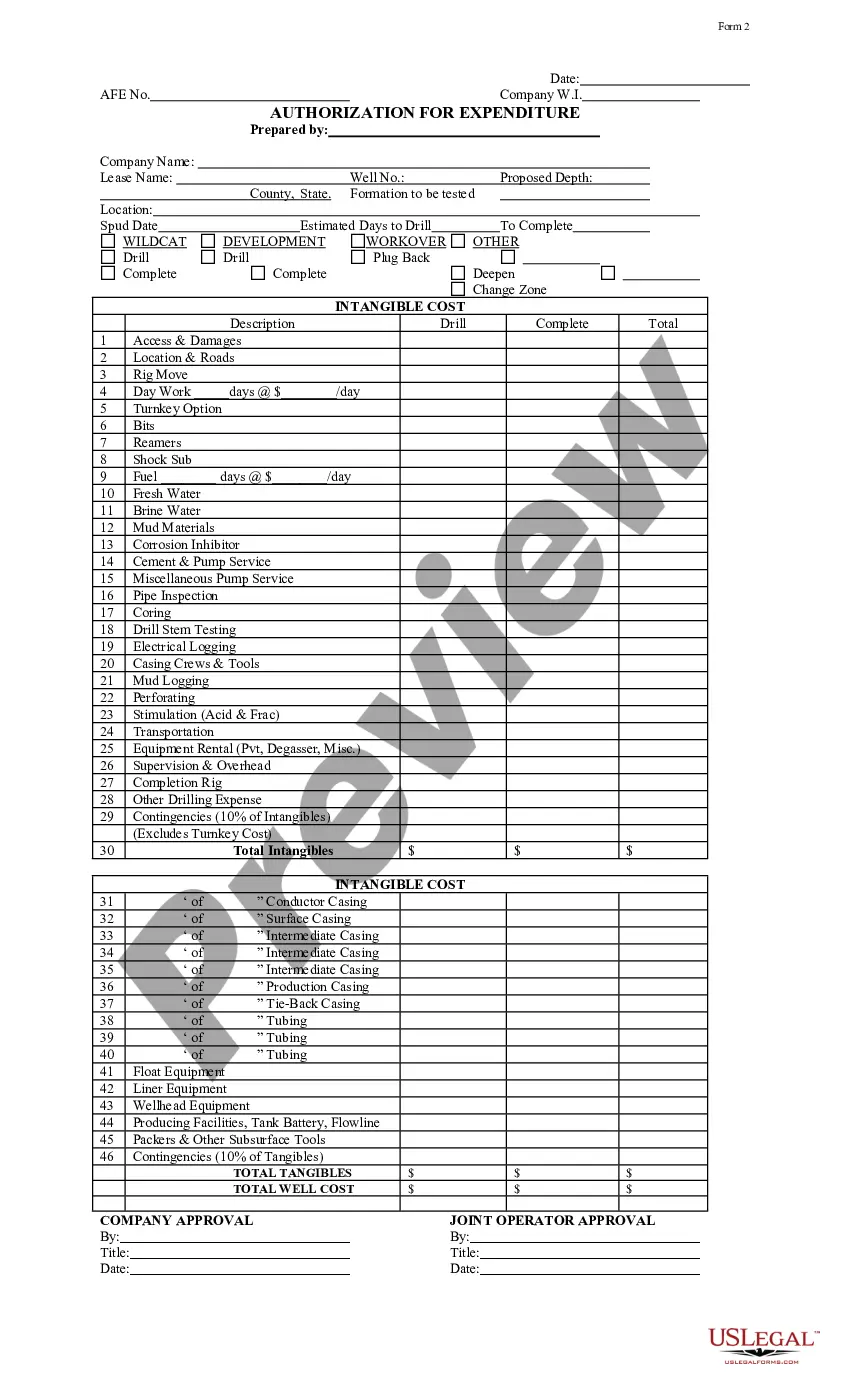

How to fill out Stipulation Governing Payment Of Nonparticipating Royalty Under Segregated Tracts Covered By One Oil And Gas Lease?

If you want to complete, acquire, or printing lawful record web templates, use US Legal Forms, the greatest variety of lawful forms, that can be found on-line. Take advantage of the site`s simple and convenient research to discover the files you want. Various web templates for enterprise and specific functions are categorized by classes and says, or key phrases. Use US Legal Forms to discover the Indiana Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease with a number of mouse clicks.

Should you be currently a US Legal Forms consumer, log in to the account and click on the Down load key to have the Indiana Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease. You may also accessibility forms you formerly delivered electronically from the My Forms tab of your own account.

Should you use US Legal Forms for the first time, refer to the instructions under:

- Step 1. Make sure you have selected the shape for that correct area/region.

- Step 2. Make use of the Review solution to examine the form`s information. Never forget about to read the description.

- Step 3. Should you be unsatisfied using the kind, make use of the Research field on top of the screen to find other models of your lawful kind web template.

- Step 4. When you have discovered the shape you want, go through the Acquire now key. Select the costs program you choose and add your references to register for the account.

- Step 5. Method the financial transaction. You may use your charge card or PayPal account to perform the financial transaction.

- Step 6. Select the format of your lawful kind and acquire it on your system.

- Step 7. Total, modify and printing or indicator the Indiana Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease.

Each and every lawful record web template you acquire is your own eternally. You may have acces to every single kind you delivered electronically with your acccount. Select the My Forms section and pick a kind to printing or acquire once again.

Be competitive and acquire, and printing the Indiana Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease with US Legal Forms. There are thousands of expert and express-certain forms you may use for your enterprise or specific demands.

Form popularity

FAQ

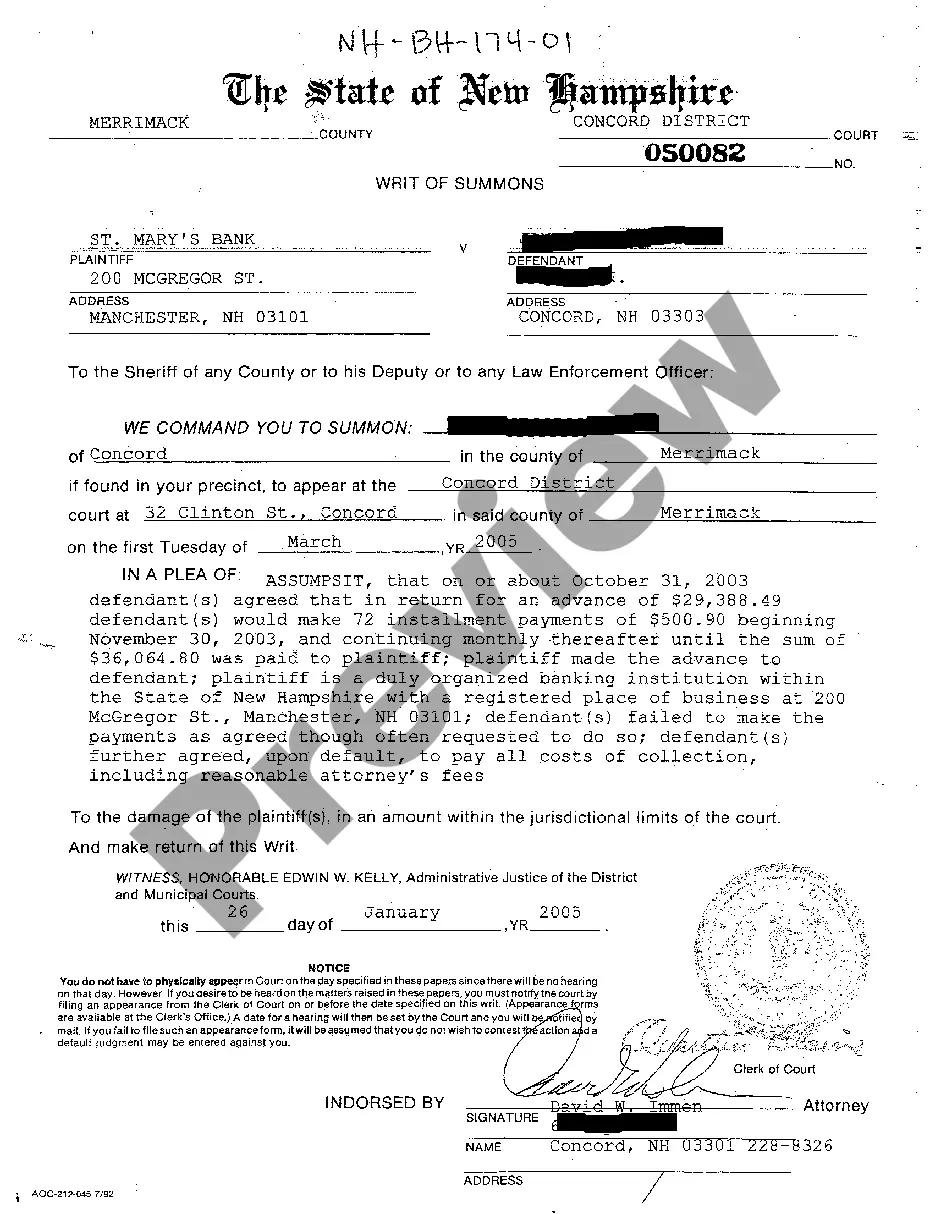

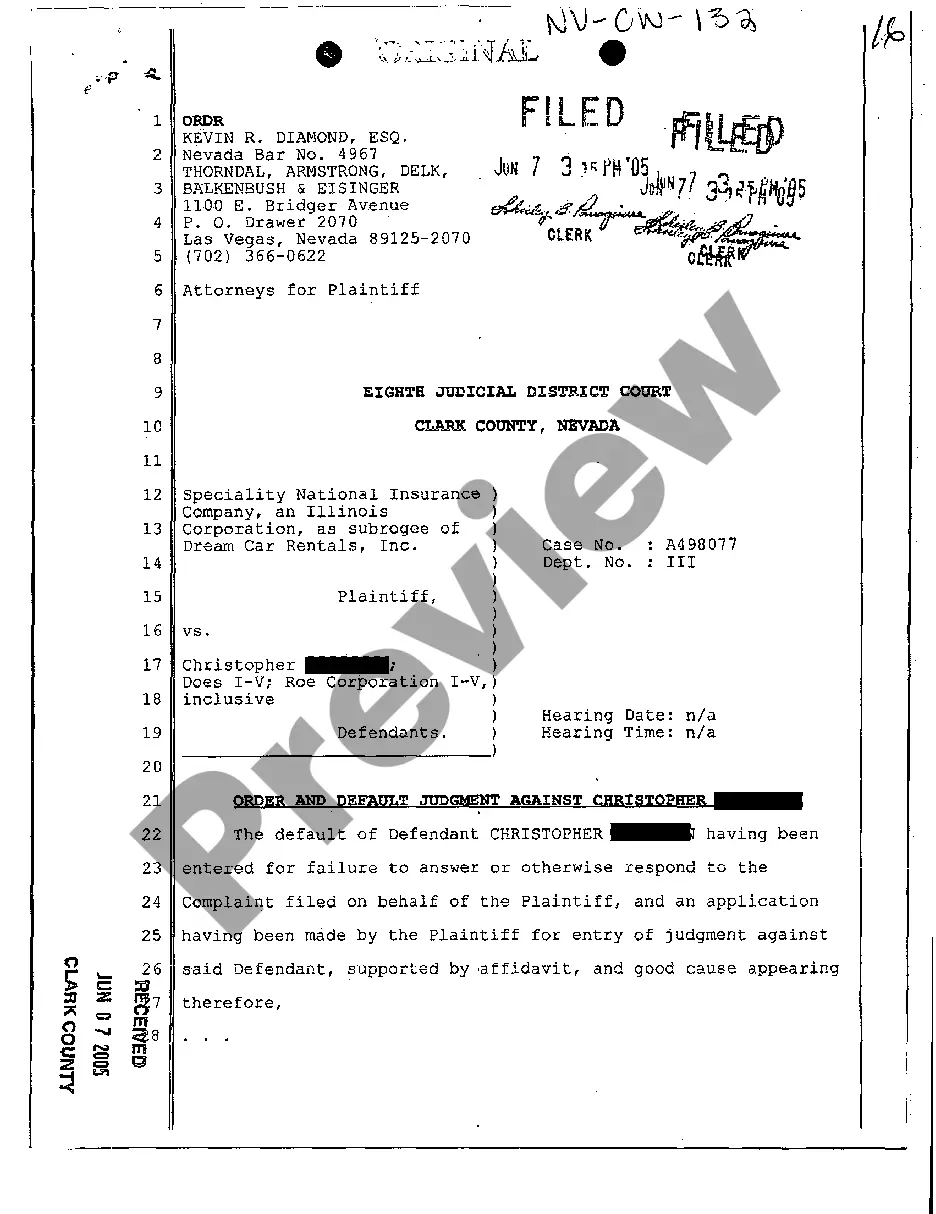

A stipulation of interest is a contract that consists of mutual conveyances, and therefore, it must conform to the requirements of both a contract and conveyance. Consequently, title to the property interest will be owned as set out in the stipulation, that is if it contains adequate granting language.

Average Oil Royalty Payment For Oil Or Gas Lease The federal government charges oil and gas companies a royalty on hydrocarbon resources extracted from public lands. The standard Federal royalty payment was 12.5%, or a 1/8th royalty.

Is there more than one type of oil and gas lease? Yes, there are three types: a surface use lease, a non-surface use lease, and a dual purpose lease.

The type used most often by oil and gas companies today is known as the ?Paid-Up? lease. In this type of lease form, no bonus payments are due from the company after the lease is signed... you get 100% of your lease bonus money combined with the annual rental payments up front.

An oil or gas lease is a legal document where a landowner grants an individual or company the right to extract oil or gas from beneath the landowner's property. Courts generally find leases to be legally binding, so it is very important that you understand all the terms of a lease before you sign it.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

An assignment of oil and gas lease is a contractual agreement between a landowner and an oil or gas company in which the company gains the right to explore for, develop, and produce oil and gas from the property.

Oil and Gas Interest means any oil or gas royalty or lease, or fractional interest therein, or certificate of interest or participation or investment contract relative to such royalties, leases or fractional interests, or any other interest or right which permits the exploration of, drilling for, or production of oil ...

Under the doctrine of indivisibility, a single well, capable of commercial production, would hold the entire acreage by production (HBP). This concept became more than an irritant to many land owners who unknowingly placed these large tracts of land on the same lease.

Oil and gas interests are interests in real property and thereby have the same attributes as other real property such as a home or a ranch. Although the ownership of oil and gas interests can take many forms, courts commonly analogize the ownership of oil and gas interests to a bundle of sticks.