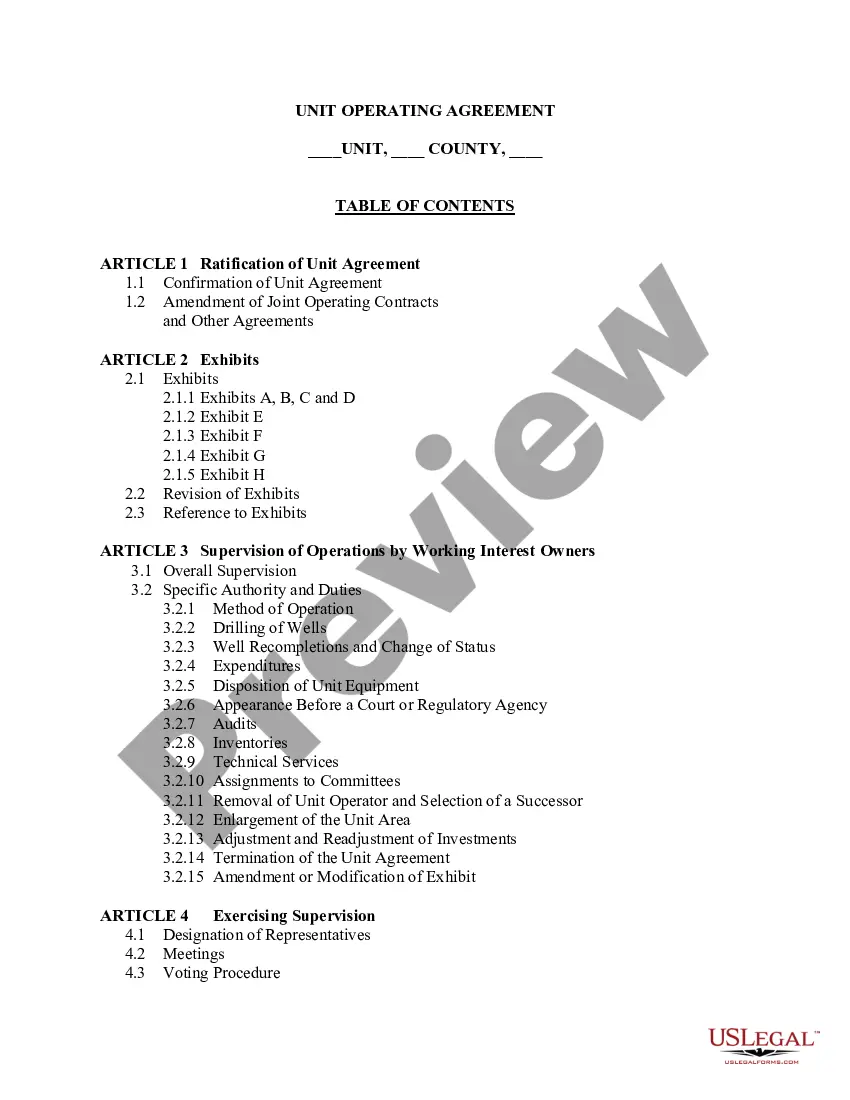

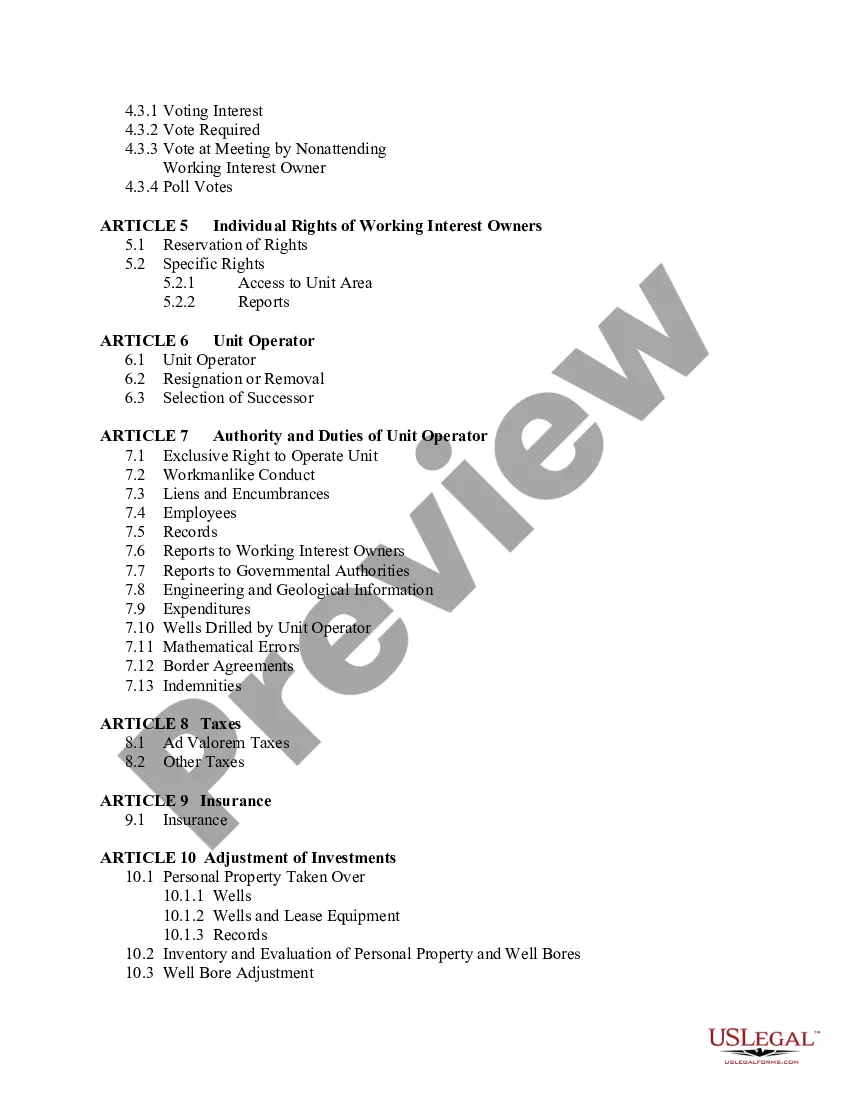

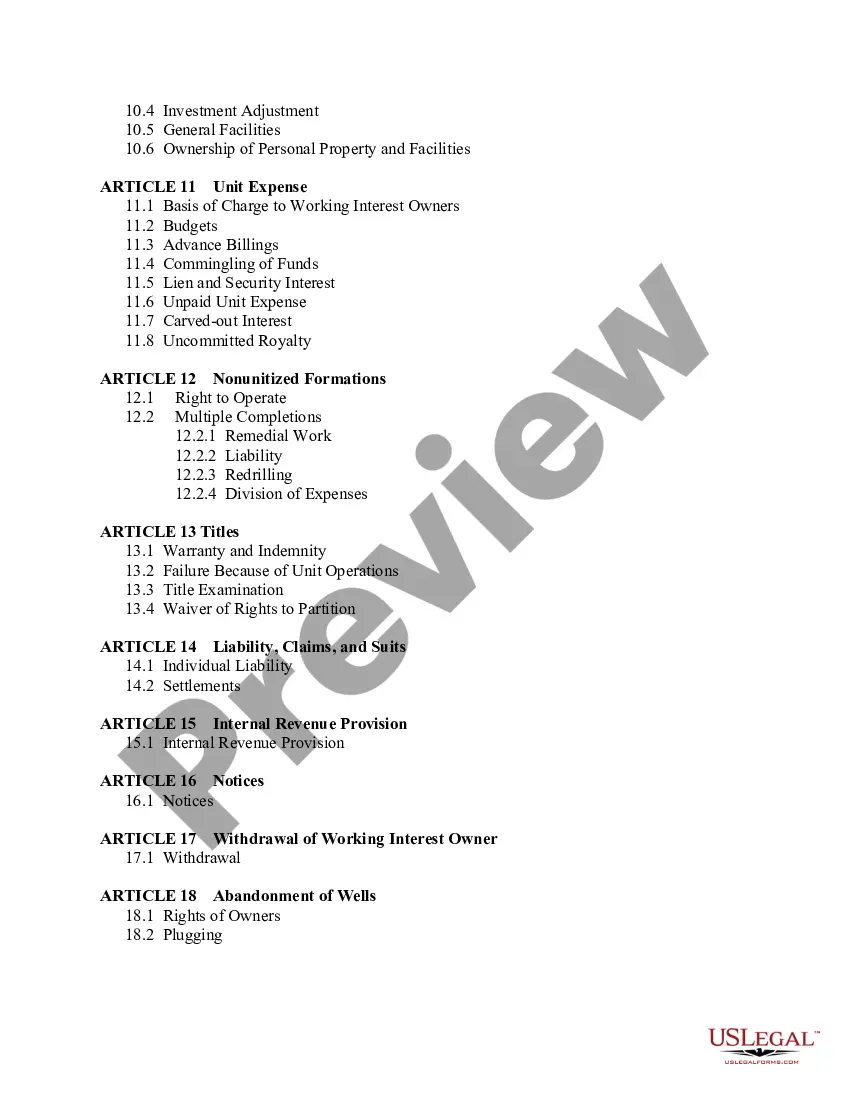

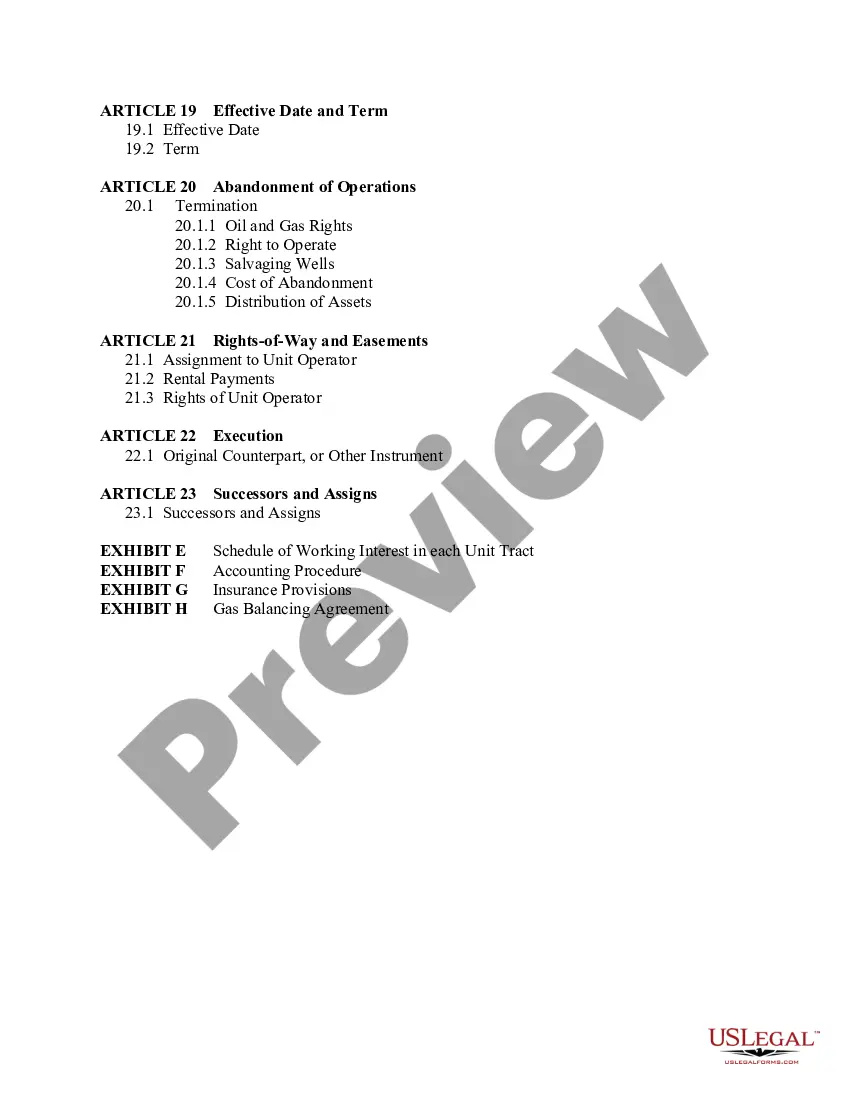

Indiana Unit Operating Agreement

Description

How to fill out Unit Operating Agreement?

Choosing the best legitimate file format can be quite a struggle. Obviously, there are a variety of web templates available on the Internet, but how do you obtain the legitimate type you want? Utilize the US Legal Forms internet site. The services gives thousands of web templates, including the Indiana Unit Operating Agreement, that you can use for business and personal requirements. Every one of the types are checked out by professionals and meet state and federal demands.

Should you be currently registered, log in in your accounts and then click the Acquire switch to get the Indiana Unit Operating Agreement. Utilize your accounts to appear throughout the legitimate types you might have ordered in the past. Check out the My Forms tab of the accounts and acquire yet another duplicate of the file you want.

Should you be a new consumer of US Legal Forms, allow me to share simple directions that you should adhere to:

- Initial, make certain you have chosen the correct type for the city/county. It is possible to examine the shape utilizing the Review switch and browse the shape description to ensure this is basically the best for you.

- When the type is not going to meet your expectations, make use of the Seach area to get the proper type.

- Once you are certain the shape is proper, select the Purchase now switch to get the type.

- Pick the rates prepare you desire and enter in the needed information. Build your accounts and pay money for the order with your PayPal accounts or Visa or Mastercard.

- Opt for the file formatting and down load the legitimate file format in your gadget.

- Total, revise and print out and sign the obtained Indiana Unit Operating Agreement.

US Legal Forms may be the biggest catalogue of legitimate types where you can find different file web templates. Utilize the company to down load expertly-produced paperwork that adhere to state demands.

Form popularity

FAQ

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

The document required to form an LLC in Indiana is called the Articles of Organization. The information required in the formation document varies by state. Indiana's requirements include: Registered agent.

Another important part of the Operating Agreement is the provision that describes how profit is distributed to the members. Operating Agreements will also address the term of the LLC, how the initial capital is contributed, the tax status of the LLC, and other miscellaneous items such as the governing law.

An LLC operating agreement should contain provisions to cover: Basic information about the LLC. ... A profit and loss allocation plan. ... The LLC's purpose. The management structure. ... Ownership percentages of each member. ... Voting rights and procedures. ... Meeting frequency. Procedures for bringing in new members.

An operating agreement, also known in some states as a limited liability company (LLC) agreement, is a contract that describes how a business plans to operate. Think of it as a legal business plan that reads like a prenup.

Unlike your LLC Formation Agreement, you are not required to file an operating agreement with the State of Indiana. However, as an internal document, a copy should be kept with your records. The operating agreement names the members of the company and spells out what percentage, or membership interest, they own.

This document is similar to the bylaws of a corporation and is the set of default rules and procedures that govern how your company will operate.

Many LLC owners ask, "How do I make a simple LLC operating agreement?" It's a legal document, but you don't necessarily need a lawyer to help you, although legal expertise is a good idea.