Indiana Assignment of Oil and Gas Lease (All Assignor's Undivided Interest in Nonproducing Lease - Short Form)

Description

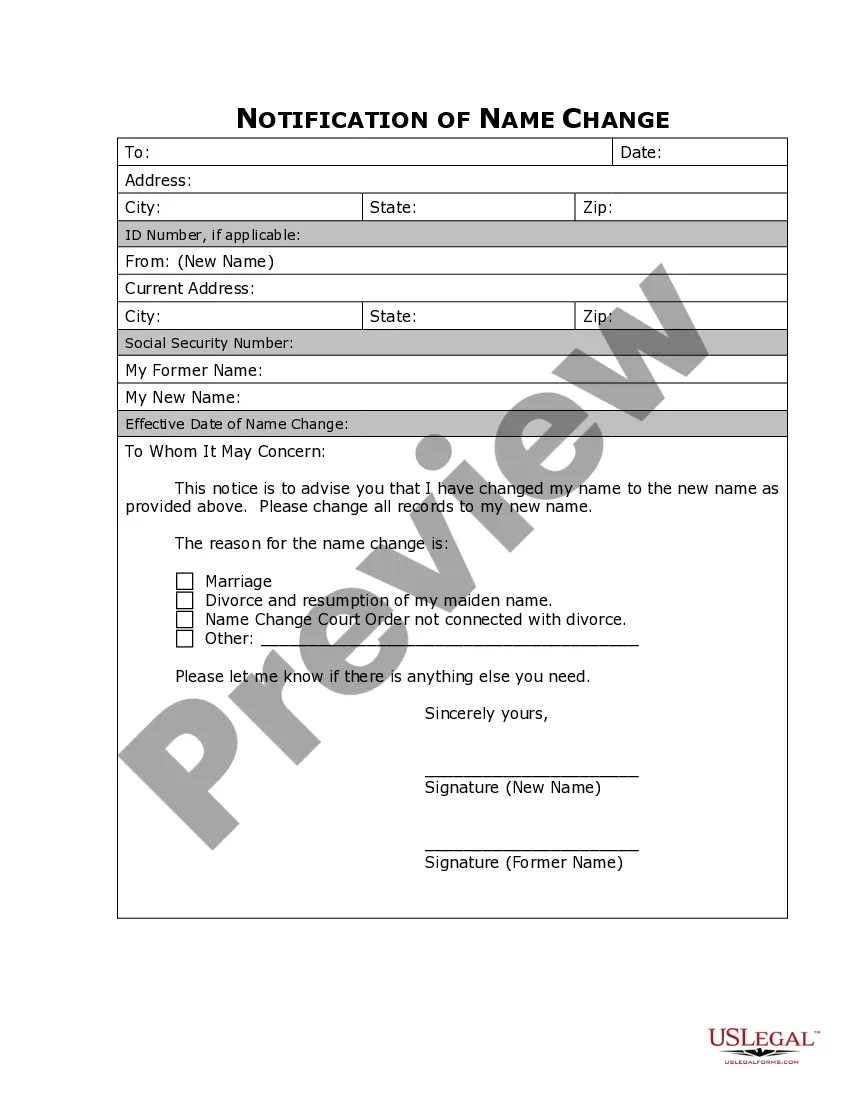

How to fill out Assignment Of Oil And Gas Lease (All Assignor's Undivided Interest In Nonproducing Lease - Short Form)?

If you need to comprehensive, download, or printing legitimate papers templates, use US Legal Forms, the most important collection of legitimate varieties, that can be found on the web. Make use of the site`s easy and hassle-free search to get the documents you will need. Various templates for enterprise and specific uses are categorized by classes and states, or search phrases. Use US Legal Forms to get the Indiana Assignment of Oil and Gas Lease (All Assignor's Undivided Interest in Nonproducing Lease - Short Form) in a handful of click throughs.

Should you be presently a US Legal Forms consumer, log in to the profile and click the Down load button to find the Indiana Assignment of Oil and Gas Lease (All Assignor's Undivided Interest in Nonproducing Lease - Short Form). You can even access varieties you earlier acquired within the My Forms tab of your respective profile.

If you are using US Legal Forms the very first time, follow the instructions under:

- Step 1. Be sure you have chosen the form to the right area/land.

- Step 2. Use the Review option to examine the form`s content. Do not forget to read through the explanation.

- Step 3. Should you be unsatisfied with all the type, make use of the Lookup industry near the top of the screen to find other versions of the legitimate type format.

- Step 4. Once you have discovered the form you will need, select the Acquire now button. Choose the pricing program you prefer and add your credentials to register to have an profile.

- Step 5. Process the transaction. You may use your Мisa or Ьastercard or PayPal profile to complete the transaction.

- Step 6. Pick the format of the legitimate type and download it in your product.

- Step 7. Full, change and printing or indicator the Indiana Assignment of Oil and Gas Lease (All Assignor's Undivided Interest in Nonproducing Lease - Short Form).

Every single legitimate papers format you buy is your own property eternally. You have acces to every type you acquired inside your acccount. Go through the My Forms segment and choose a type to printing or download again.

Contend and download, and printing the Indiana Assignment of Oil and Gas Lease (All Assignor's Undivided Interest in Nonproducing Lease - Short Form) with US Legal Forms. There are thousands of professional and condition-certain varieties you can utilize for your personal enterprise or specific needs.

Form popularity

FAQ

Wellbore. An assignment can be limited to the wellbore of a well. A wellbore limitation means that the assignor is assigning only those rights to production from the wellbore of a certain well, arguably at the total depth it existed at the time of the assignment.

Partial Assignments: When an assignor conveys 100% record title interest in a portion of the lands in a lease, it creates a partial assignment. Partial assignments segregate the lease into two separate leases. Normally we assign a new lease number to the conveyed portion of the lease.

The lessee of an oil or gas lease can assign the entire lease or part of it. In other words, the lessee can sell or transfer part of the estate or the entire estate to which they have the working rights. The assignee is assigned the working interest and lease obligations, including override royalty.

It is calculated as follows: Volume X Price ? Deductions ? Taxes X Owner Interest = Your Royalty Payment. Whether you are a mineral owner receiving royalty checks or just wanting to know what your minerals are worth, LandGate knows what they are worth and can market your minerals to get you the most money.

Royalty Interest (RI) The royalty interest owner is entitled to a percentage of the revenue from the sale of oil and gas without paying for any of the expenses associated with drilling or operating the well.

If you own mineral rights or royalties, it's important to know how much they're worth. One way to determine their value is through the income approach or discounted cash flow analysis method. In this method, the present value of all estimated future cash flows is calculated based on certain assumptions.

The oil and gas business; assignments are the documents used. to accomplish transfers of lease rights .1./ Although the. common form of assignment may appear to be a rather simple. document, the respective rights and obligations of the parties.

An assignment of oil and gas lease is a contractual agreement between a landowner and an oil or gas company in which the company gains the right to explore for, develop, and produce oil and gas from the property.