Indiana Clauses Relating to Venture Ownership Interests play a crucial role in defining the rights, obligations, and restrictions associated with owning a stake in a venture or business entity operating in the state of Indiana. These clauses are typically included in partnership agreements, operating agreements, or shareholder agreements and are designed to protect the interests of both the venture and its owners. Here are some key types of Indiana Clauses Relating to Venture Ownership Interests: 1. Transfer Restrictions: These clauses outline the conditions and restrictions on the transfer of ownership interests. They may require prior consent from other venture owners or limit transfers to certain qualified individuals or entities, ensuring that the venture's ownership remains with trustworthy and qualified individuals. 2. Buy-Sell Agreements: These clauses establish mechanisms for buying out a departing owner's interest in case of death, disability, retirement, or voluntary withdrawal. They define the valuation methods, offer processes, and other considerations to facilitate a fair and orderly transition of ownership, preventing disputes and ensuring smooth continuity of the venture. 3. Tag-Along and Drag-Along Rights: Tag-along rights, also known as co-sale rights, enable minority owners to sell their ownership stake if a majority owner receives an offer to sell their stake. Drag-along rights, on the other hand, allow majority owners to compel minority owners to sell their interests if a potential buyer is interested in acquiring a significant portion of the venture. Both clauses aim to protect the interests of minority owners and facilitate investment or exit opportunities. 4. Voting Rights: These clauses outline the voting rights attached to ownership interests, including the ability to vote on significant matters affecting the venture. They may also specify the voting thresholds required for approving certain decisions, such as amendments to the venture's governing documents or major strategic initiatives, ensuring balanced decision-making among owners. 5. Distribution and Profit Allocation: These clauses determine how profits and losses are allocated among the owners. They may establish preferred returns to certain owners, specify the timing and frequency of distributions, or outline profit-sharing arrangements based on ownership percentages or other agreed-upon methods. 6. Management and Control Rights: These clauses detail the rights and responsibilities of owners in managing the venture's operations and making key decisions. They may address the appointment of managers, the scope of their authority, and the mechanisms for resolving disagreements or deadlock situations. 7. Exit Mechanisms: These clauses describe the options available to owners when they want to exit the venture. They may include provisions related to selling their interests, rights of first refusal, or the ability to liquidate or dissolve the venture. In summary, Indiana Clauses Relating to Venture Ownership Interests encompass a range of provisions that balance the interests of venture owners and facilitate the effective management and growth of the venture. By clarifying rights, obligations, and restrictions associated with ownership, these clauses contribute to a stable and transparent ownership structure, paving the way for sustained success.

Indiana Clauses Relating to Venture Ownership Interests

Description

How to fill out Indiana Clauses Relating To Venture Ownership Interests?

Are you currently in a position that you need to have documents for sometimes enterprise or individual reasons just about every day time? There are a variety of legitimate document templates available on the net, but discovering kinds you can trust isn`t straightforward. US Legal Forms gives 1000s of form templates, just like the Indiana Clauses Relating to Venture Ownership Interests, that are composed to fulfill federal and state specifications.

Should you be presently knowledgeable about US Legal Forms web site and have your account, just log in. Afterward, it is possible to obtain the Indiana Clauses Relating to Venture Ownership Interests design.

If you do not have an bank account and want to begin to use US Legal Forms, abide by these steps:

- Find the form you will need and ensure it is for that right city/region.

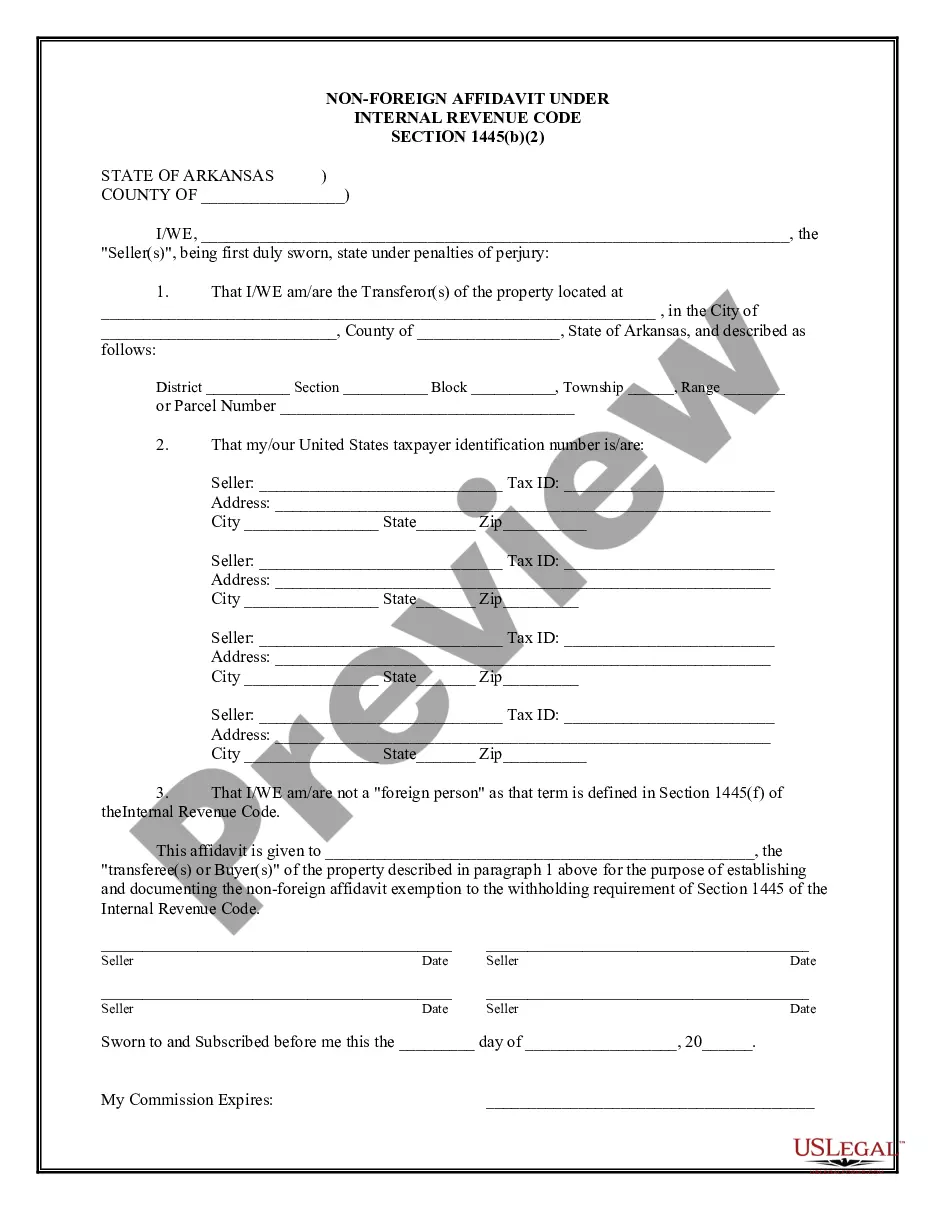

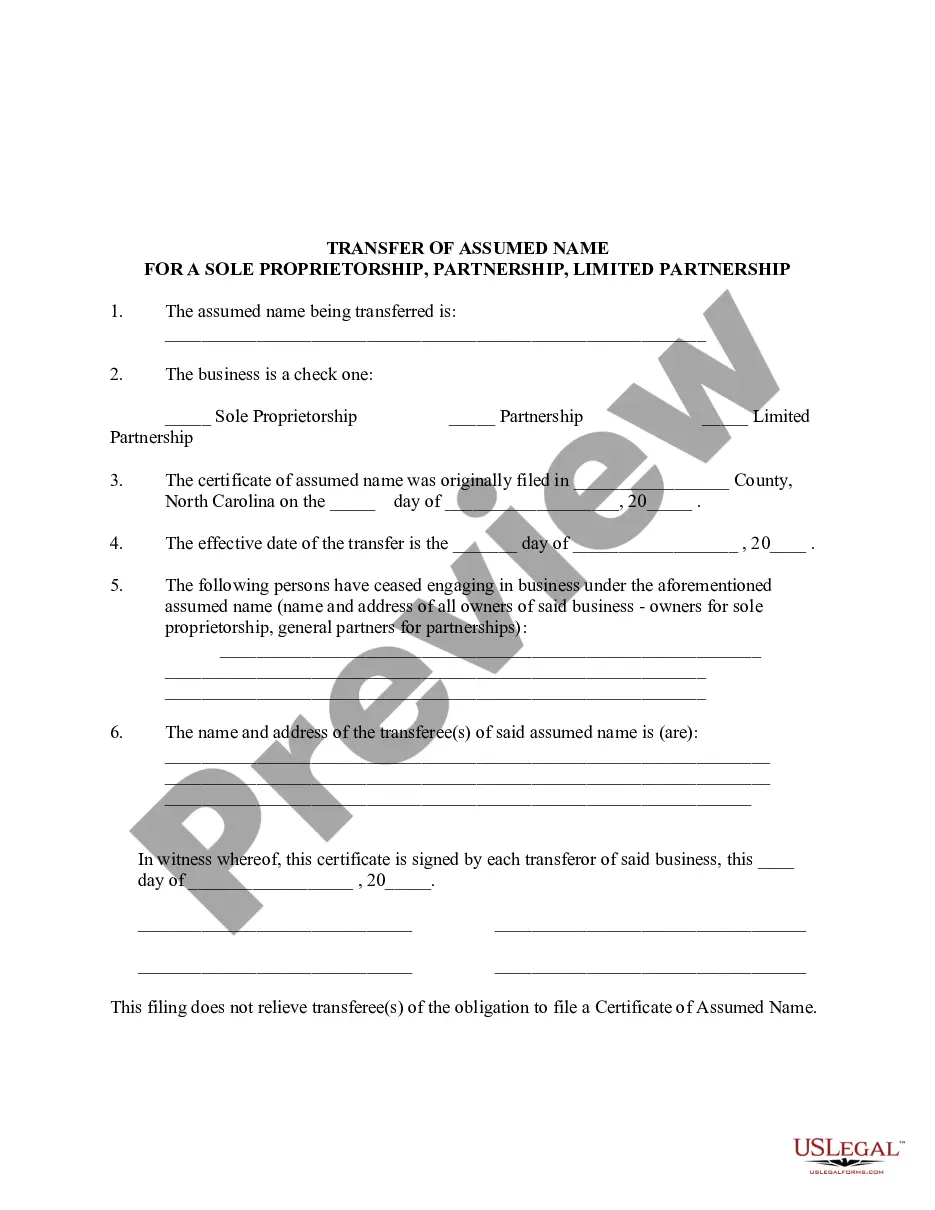

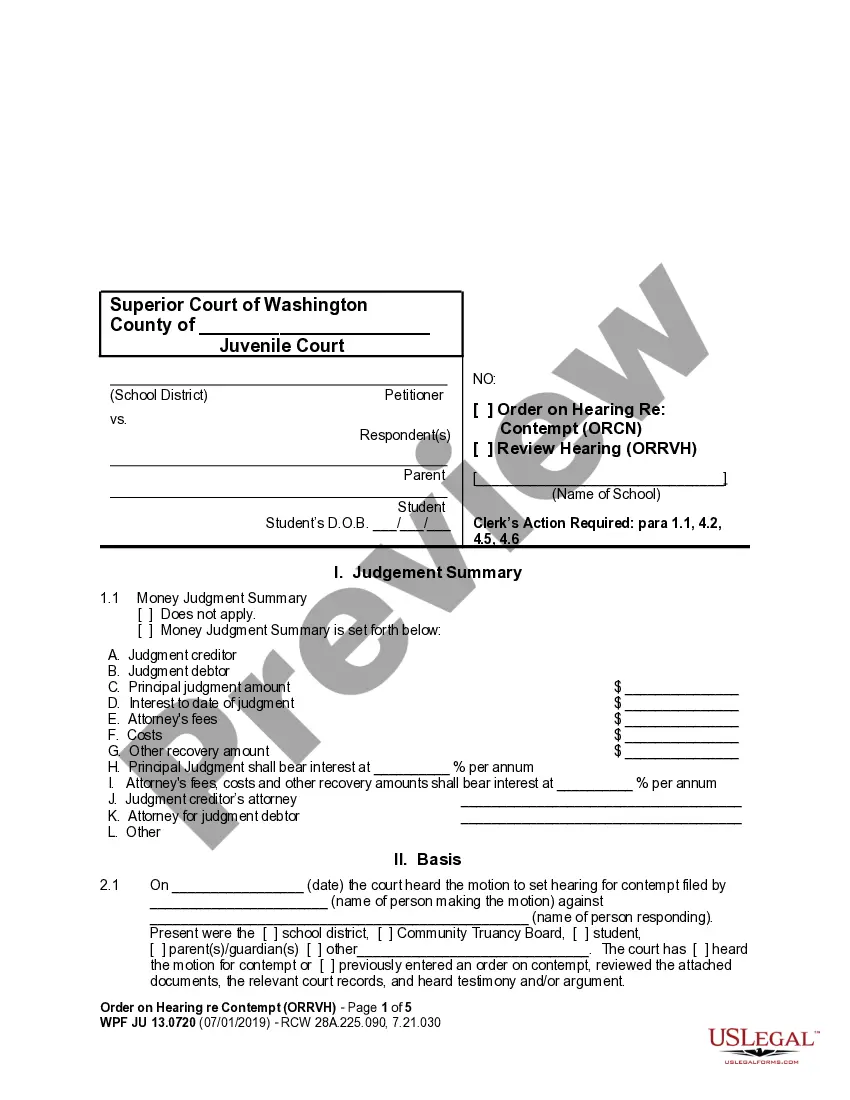

- Take advantage of the Review switch to check the form.

- Look at the explanation to ensure that you have chosen the appropriate form.

- If the form isn`t what you`re seeking, use the Look for industry to discover the form that fits your needs and specifications.

- Once you get the right form, click on Acquire now.

- Opt for the rates prepare you want, complete the necessary information and facts to generate your account, and pay money for the transaction with your PayPal or credit card.

- Pick a practical file file format and obtain your version.

Find all the document templates you have bought in the My Forms food selection. You can aquire a more version of Indiana Clauses Relating to Venture Ownership Interests anytime, if required. Just select the needed form to obtain or print out the document design.

Use US Legal Forms, the most considerable selection of legitimate kinds, to conserve some time and stay away from errors. The service gives skillfully produced legitimate document templates which you can use for a range of reasons. Produce your account on US Legal Forms and initiate creating your daily life a little easier.

Form popularity

FAQ

Section 32-17-14-12 - Transfer on death transfers of tangible personal property (a) A deed of gift, bill of sale, or other writing intended to transfer an interest in tangible personal property is effective on the death of the owner and transfers ownership to the designated transferee beneficiary if the document: (1) ...

Code § 32-34-1.5-4. Subject to section 11 of this chapter, the following property is presumed abandoned if it is unclaimed by the apparent owner during the period specified as follows: (1) For a traveler's check, fifteen (15) years after issuance.

Section 12-27-5-2 - Involuntary patients; petitioning committing court or hearing officer (a) An involuntary patient who wants to refuse to submit to treatment or a habilitation program may petition the committing court or hearing officer for consideration of the treatment or program.

Section 32-21-2-3 - Notarial acts; recording requirements; statement of mailing address; translations (a) Any instrument to be recorded must have one (1) of the following notarial acts: (1) An acknowledgment (as defined in IC 33-42-0.5-2) . (2) A proof.

?The prospective buyer and the owner may wish to obtain professional advice or inspections of the property and provide for appropriate provisions in a contract between them concerning any advice, inspections, defects, or warranties obtained on the property.?.

Section 32-21-7-1 - Establishing title; payment of taxes and special assessments by adverse possessor; exception for governmental entities and exempt organizations (a) Except as provided in subsection (b), in an action to establish title to real property, possession of the real property is not adverse to the owner in a ...

Indiana Code. Title 32 - PROPERTY Article 34 - LOST OR UNCLAIMED PERSONAL PROPERTY. Chapter 1.5 - REVISED UNCLAIMED PROPERTY ACT. Section 32-34-1.5-4 - Presumption of abandonment.

(a) When a person dies, the person's real and personal property passes to persons to whom it is devised by the person's last will or, in the absence of such disposition, to the persons who succeed to the person's estate as the person's heirs; but it shall be subject to the possession of the personal representative and ...