This non-employee director option agreement grants the optionee (the non-employee director) a non-qualified stock option under the company's non-employee director stock option plan. The option allows optionee to purchase shares of the company's common stock up to the number of shares listed in the agreement.

Indiana Non Employee Director Stock Option Agreement

Description

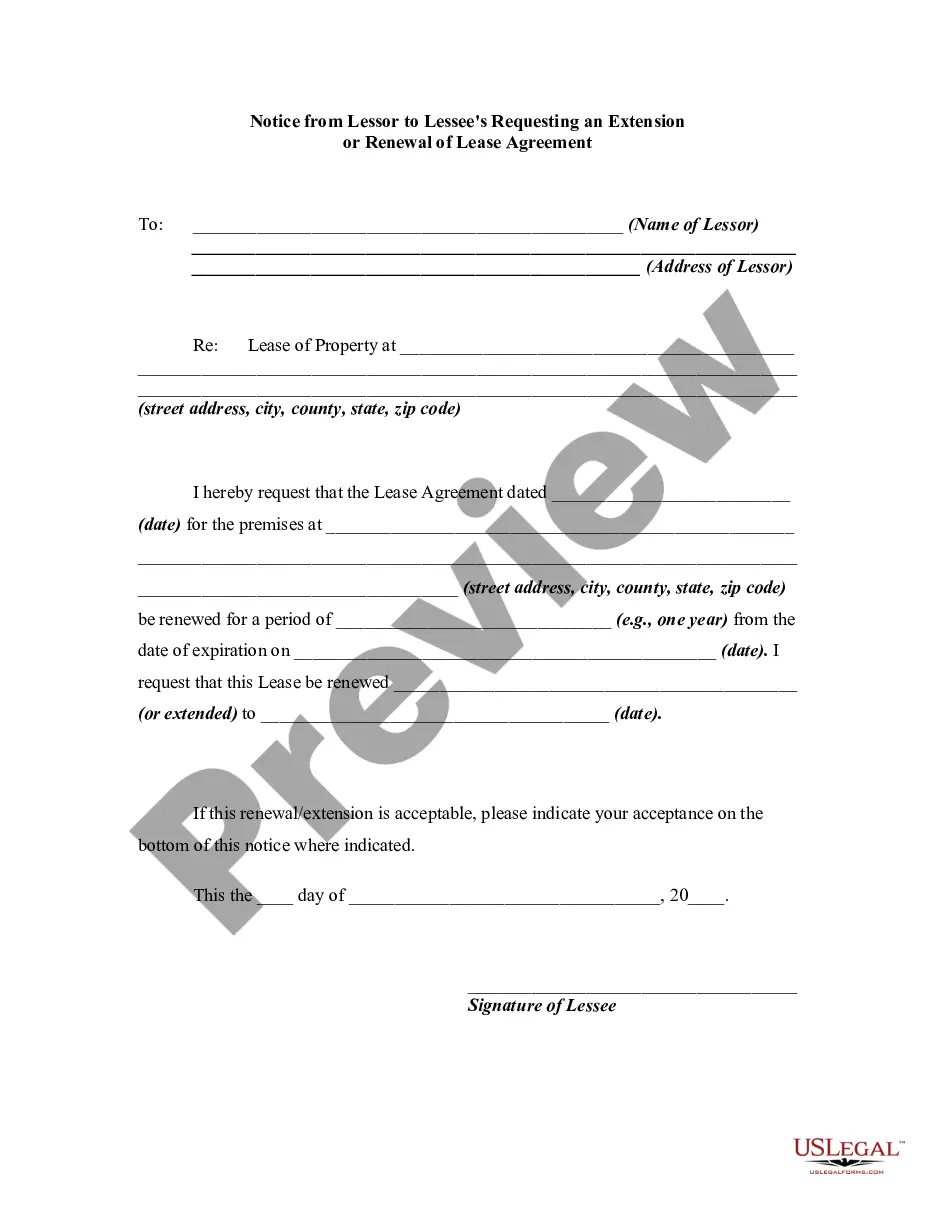

How to fill out Non Employee Director Stock Option Agreement?

Choosing the best lawful papers format could be a have difficulties. Needless to say, there are plenty of web templates available on the net, but how can you discover the lawful form you will need? Utilize the US Legal Forms internet site. The assistance provides thousands of web templates, including the Indiana Non Employee Director Stock Option Agreement, that can be used for enterprise and private requires. Every one of the kinds are checked out by pros and meet federal and state requirements.

Should you be currently authorized, log in in your account and then click the Obtain option to obtain the Indiana Non Employee Director Stock Option Agreement. Use your account to search throughout the lawful kinds you have acquired earlier. Visit the My Forms tab of your account and get another duplicate in the papers you will need.

Should you be a new user of US Legal Forms, here are basic guidelines for you to follow:

- Initially, ensure you have selected the appropriate form for the town/area. You can check out the form utilizing the Review option and look at the form description to guarantee it will be the best for you.

- When the form fails to meet your needs, take advantage of the Seach industry to obtain the appropriate form.

- When you are certain the form is acceptable, click the Get now option to obtain the form.

- Choose the rates program you would like and type in the required details. Build your account and buy the order with your PayPal account or Visa or Mastercard.

- Pick the submit structure and obtain the lawful papers format in your product.

- Complete, modify and printing and signal the attained Indiana Non Employee Director Stock Option Agreement.

US Legal Forms is the most significant library of lawful kinds in which you can see a variety of papers web templates. Utilize the service to obtain expertly-made documents that follow state requirements.

Form popularity

FAQ

A share option agreement is an agreement between the holder of shares and a third party giving one party the right (but not the obligation) to purchase or sell shares at a future date, at an agreed price. If the option is exercised, the other party is obliged to purchase or sell those shares. Share Option Agreement - EM Law emlaw.co.uk ? employee-share-options-solicitors emlaw.co.uk ? employee-share-options-solicitors

Stock options are a form of equity compensation that allows an employee to buy a specific number of shares at a pre-set price. Many startups, private companies, and corporations will include them as part of a compensation plan for prospective employees. Stock Options Explained: What You Need to Know - Carta carta.com ? blog ? equity-101-stock-option-basics carta.com ? blog ? equity-101-stock-option-basics

Holders of share purchase rights may or may not buy an agreed number of shares of stock at a pre-determined price, but only if they are an existing stockholder. Options, on the other hand, are the right to buy or sell stocks at a pre-set price called the strike price.

A stock option provides an employee with the opportunity to purchase a set number of shares of company stock at a certain price within a certain period of time. The price is called the ?grant price? or ?strike price.? This price is usually based on a discounted price of the stock at the time of hire.

A stock grant provides the recipient with value?the corporate stock. By contrast, stock options only offer employees the opportunity to purchase something of value. They can acquire the corporate stock at a set price, but the employees receiving stock options still have to pay for those stocks if they want them.

A stock purchase plan involves the actual purchase of the stock, and differs from an option, which is only the right to purchase stock.

A. The Key Documents Stock Option Plan. This is the overarching general plan that is adopted by the startup regarding issuances of stock options. ... Stock Option Agreement. ... Exercise Agreement. ... Dates. ... Number and Type of Shares. ... Exercise Price. ... Type of Option. ... Vesting Schedule. Stock Options for Employees - Startup Legal Stuff startuplegalstuff.com ? stock-options-for-em... startuplegalstuff.com ? stock-options-for-em...

The stock options plan is drafted by the company's board of directors and contains details of the grantee's rights. The options agreement will provide the key details of your option grant such as the vesting schedule, how the ESOs will vest, shares represented by the grant, and the strike price. Employee Stock Options (ESOs): A Complete Guide - Investopedia investopedia.com ? terms ? eso investopedia.com ? terms ? eso