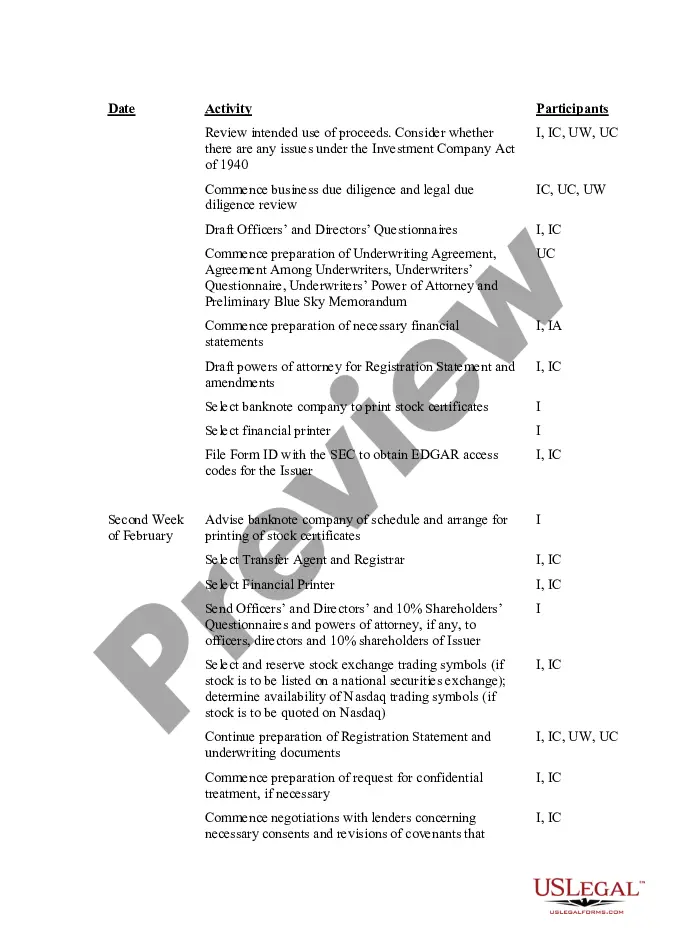

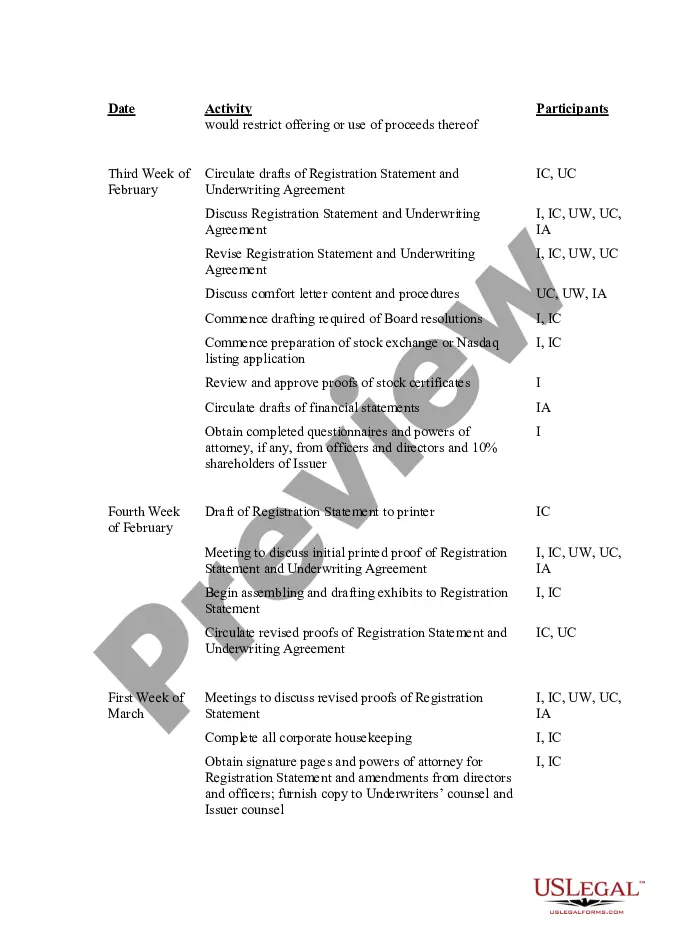

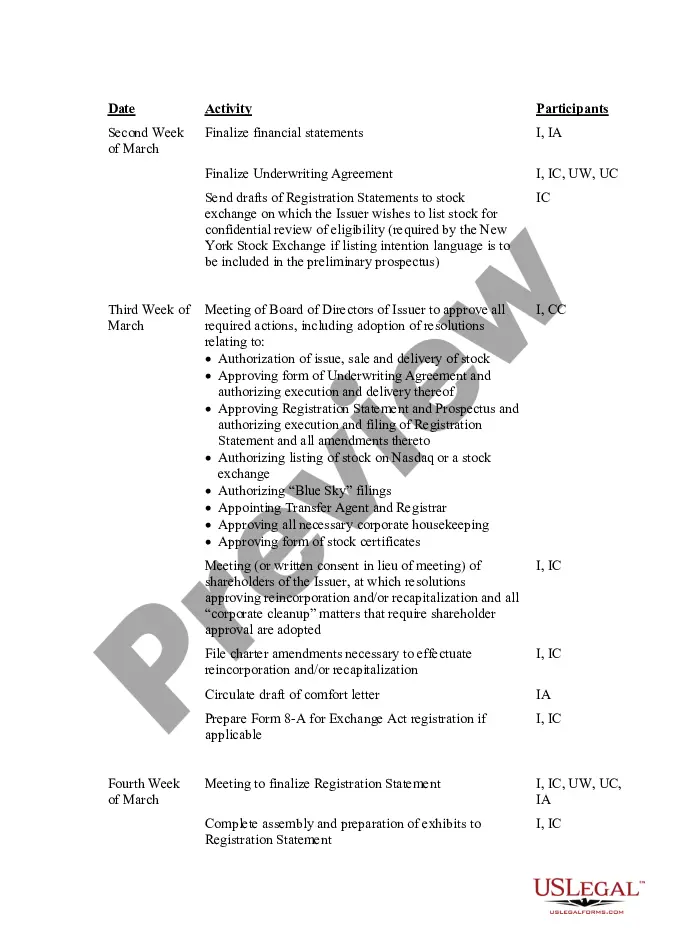

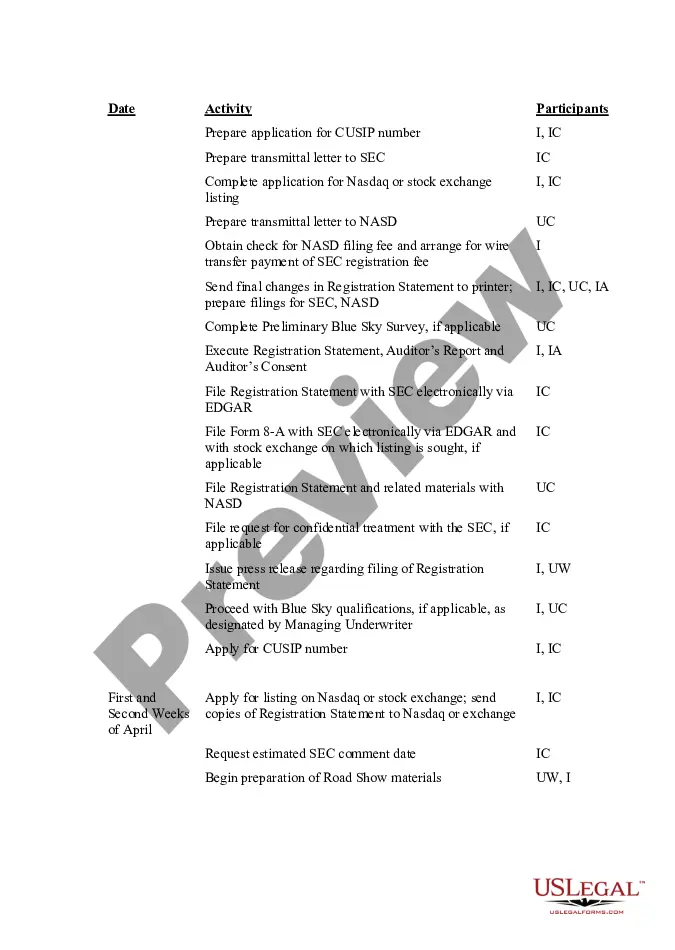

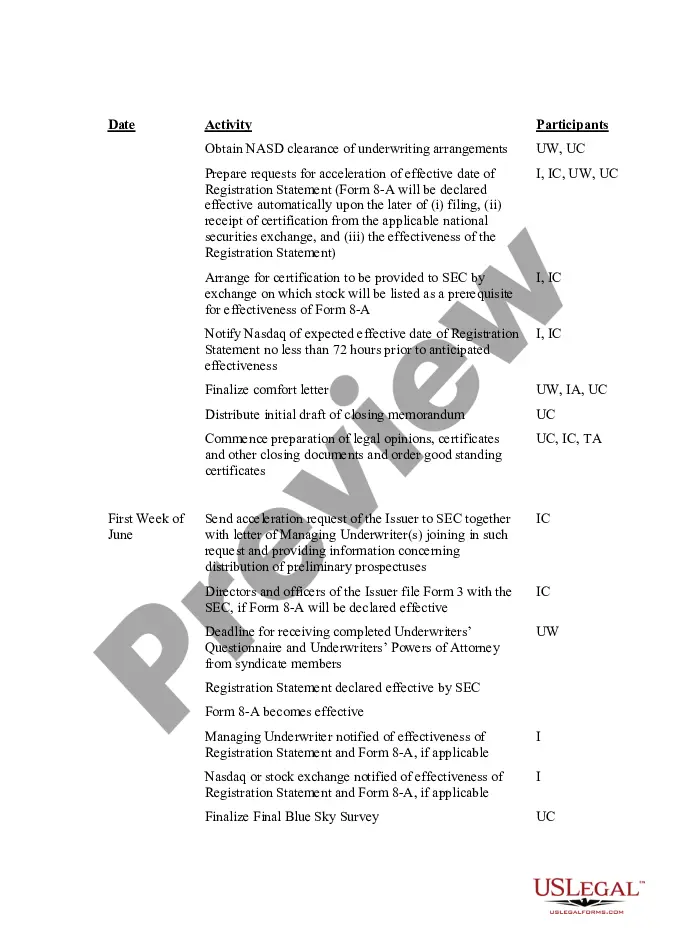

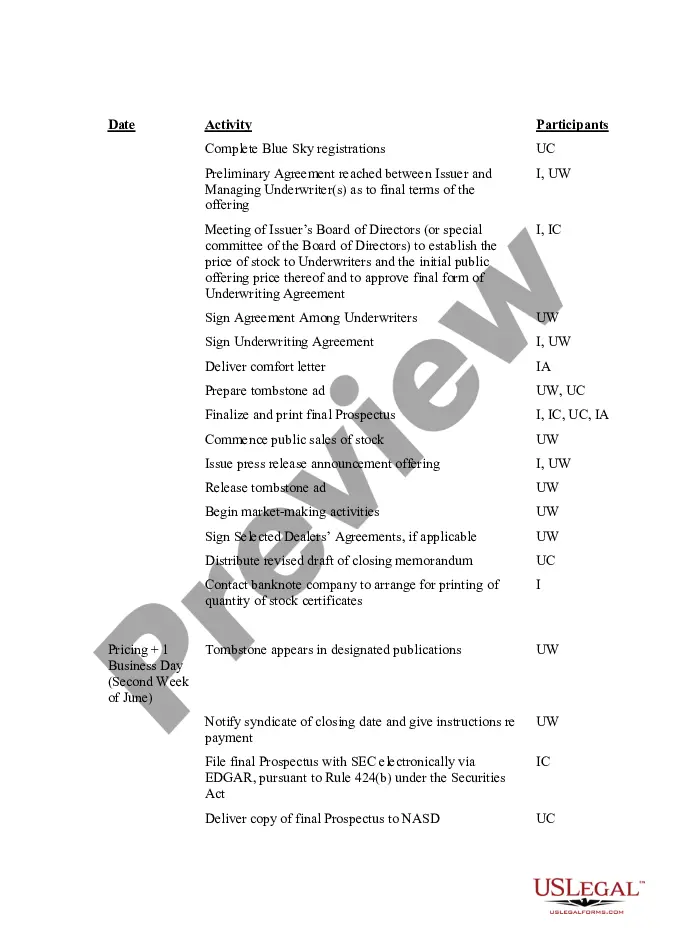

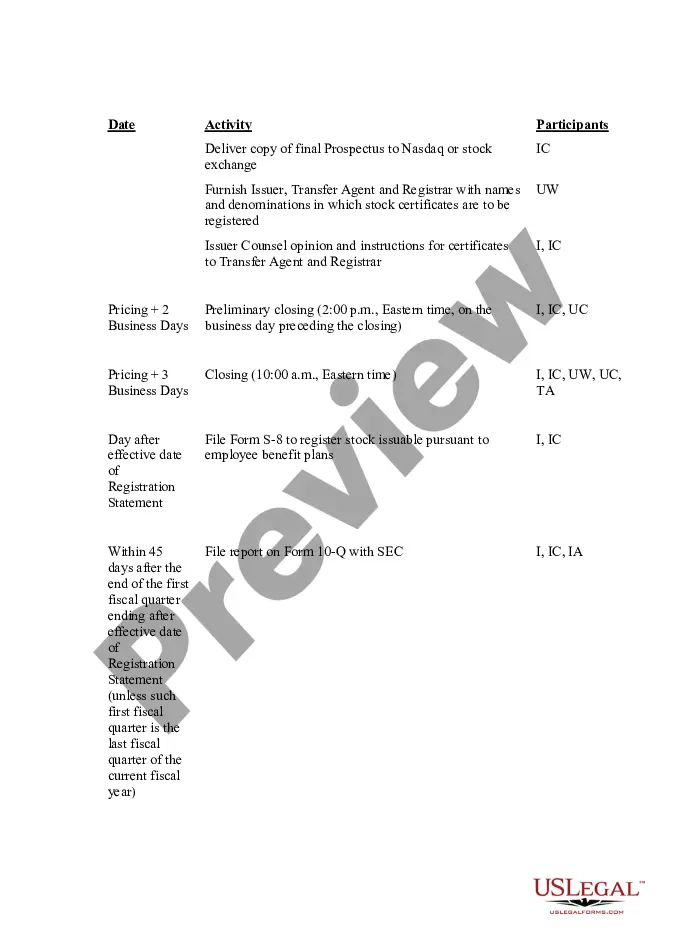

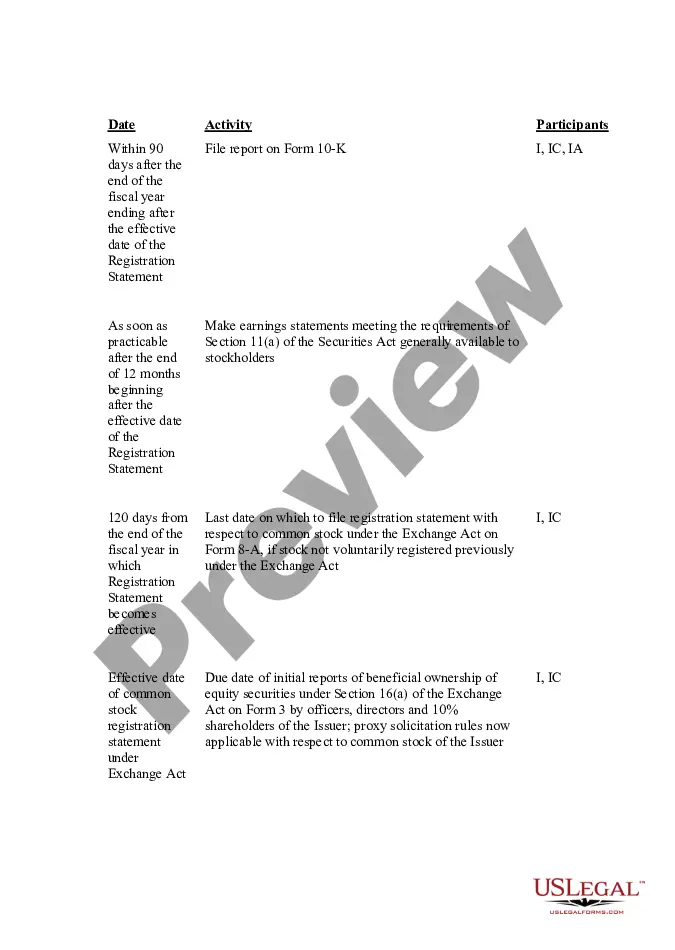

This IPO Time and Responsibility Schedule details, week by week, the tasks to be performed in the months leading up to the IPO. It lists the activities to be undertaken and the participants assigned to each task.

Indiana IPO Time and Responsibility Schedule, also known as the Initial Public Offering Time and Responsibility Schedule, is a crucial document that outlines the timeline and duties associated with the IPO process in the state of Indiana. This schedule serves as a guideline for companies and their legal advisors, ensuring a smooth and compliant IPO journey. Companies going public in Indiana must adhere to the requirements and regulations set forth by the Indiana Secretary of State. The Indiana IPO Time and Responsibility Schedule typically includes the following essential elements: 1. Initial Consultation: This stage involves the initial meeting between the company and its legal team to discuss the IPO process, compliance requirements, and timelines. 2. Preparing the Registration Statement: The company, with the assistance of legal advisors, prepares the registration statement, which includes financial disclosures, business information, and other relevant details required by the Indiana Secretary of State. 3. Conducting Due Diligence: Thorough due diligence is crucial to ensure accurate and complete disclosure of information. It involves reviewing and verifying financial records, contracts, intellectual property rights, and other relevant documents. 4. Drafting the Prospectus: The prospectus is a comprehensive document provided to potential investors, detailing the offering terms, risk factors, financial information, business operations, and other information pertinent to making an investment decision. 5. SEC Review and Filing: The completed registration statement and prospectus are submitted to the Indiana Secretary of State for review and approval, adhering to the timelines established. 6. Roadshow Preparation: Companies planning an IPO need to prepare for investor roadshows, where they present their business to potential investors. This involves creating presentations, rehearsing speeches, and developing strategies to generate investor interest. 7. Investor Roadshow and Pricing: During the investor roadshow, company representatives meet with potential investors to pitch the offering and gather indications of interest. Based on investor feedback and market conditions, the IPO pricing is determined. 8. Finalizing and Pricing the Offering: The company, together with underwriters and legal advisors, sets the final IPO price, determines the number of shares to be offered, and allocates shares to institutional and retail investors. 9. Post-IPO Compliance: Following the IPO, the company must comply with ongoing reporting and disclosure obligations, including filing periodic reports with the Indiana Secretary of State, adhering to financial reporting standards, and ensuring proper corporate governance. The Indiana IPO Time and Responsibility Schedule vary based on the specific requirements and circumstances of the company going public. Additionally, different types of IPOs exist, such as traditional IPOs, where companies issue new shares to raise capital, and SPAC IPOs (Special Purpose Acquisition Company), where a blank-check company goes public with the intent to merge with an existing business. However, the general framework and responsibilities outlined in the Indiana IPO Time and Responsibility Schedule apply to all types of IPOs conducted within the state.Indiana IPO Time and Responsibility Schedule, also known as the Initial Public Offering Time and Responsibility Schedule, is a crucial document that outlines the timeline and duties associated with the IPO process in the state of Indiana. This schedule serves as a guideline for companies and their legal advisors, ensuring a smooth and compliant IPO journey. Companies going public in Indiana must adhere to the requirements and regulations set forth by the Indiana Secretary of State. The Indiana IPO Time and Responsibility Schedule typically includes the following essential elements: 1. Initial Consultation: This stage involves the initial meeting between the company and its legal team to discuss the IPO process, compliance requirements, and timelines. 2. Preparing the Registration Statement: The company, with the assistance of legal advisors, prepares the registration statement, which includes financial disclosures, business information, and other relevant details required by the Indiana Secretary of State. 3. Conducting Due Diligence: Thorough due diligence is crucial to ensure accurate and complete disclosure of information. It involves reviewing and verifying financial records, contracts, intellectual property rights, and other relevant documents. 4. Drafting the Prospectus: The prospectus is a comprehensive document provided to potential investors, detailing the offering terms, risk factors, financial information, business operations, and other information pertinent to making an investment decision. 5. SEC Review and Filing: The completed registration statement and prospectus are submitted to the Indiana Secretary of State for review and approval, adhering to the timelines established. 6. Roadshow Preparation: Companies planning an IPO need to prepare for investor roadshows, where they present their business to potential investors. This involves creating presentations, rehearsing speeches, and developing strategies to generate investor interest. 7. Investor Roadshow and Pricing: During the investor roadshow, company representatives meet with potential investors to pitch the offering and gather indications of interest. Based on investor feedback and market conditions, the IPO pricing is determined. 8. Finalizing and Pricing the Offering: The company, together with underwriters and legal advisors, sets the final IPO price, determines the number of shares to be offered, and allocates shares to institutional and retail investors. 9. Post-IPO Compliance: Following the IPO, the company must comply with ongoing reporting and disclosure obligations, including filing periodic reports with the Indiana Secretary of State, adhering to financial reporting standards, and ensuring proper corporate governance. The Indiana IPO Time and Responsibility Schedule vary based on the specific requirements and circumstances of the company going public. Additionally, different types of IPOs exist, such as traditional IPOs, where companies issue new shares to raise capital, and SPAC IPOs (Special Purpose Acquisition Company), where a blank-check company goes public with the intent to merge with an existing business. However, the general framework and responsibilities outlined in the Indiana IPO Time and Responsibility Schedule apply to all types of IPOs conducted within the state.