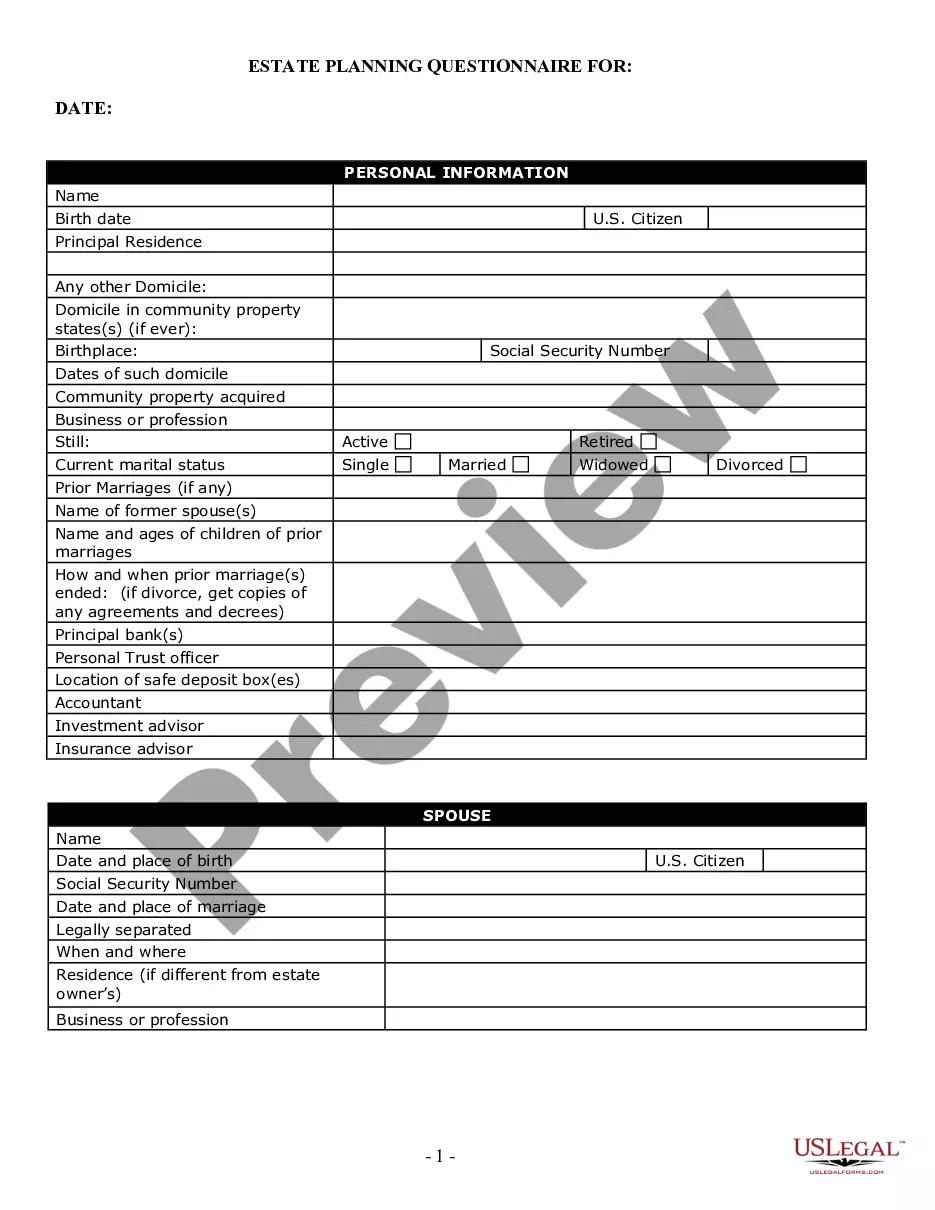

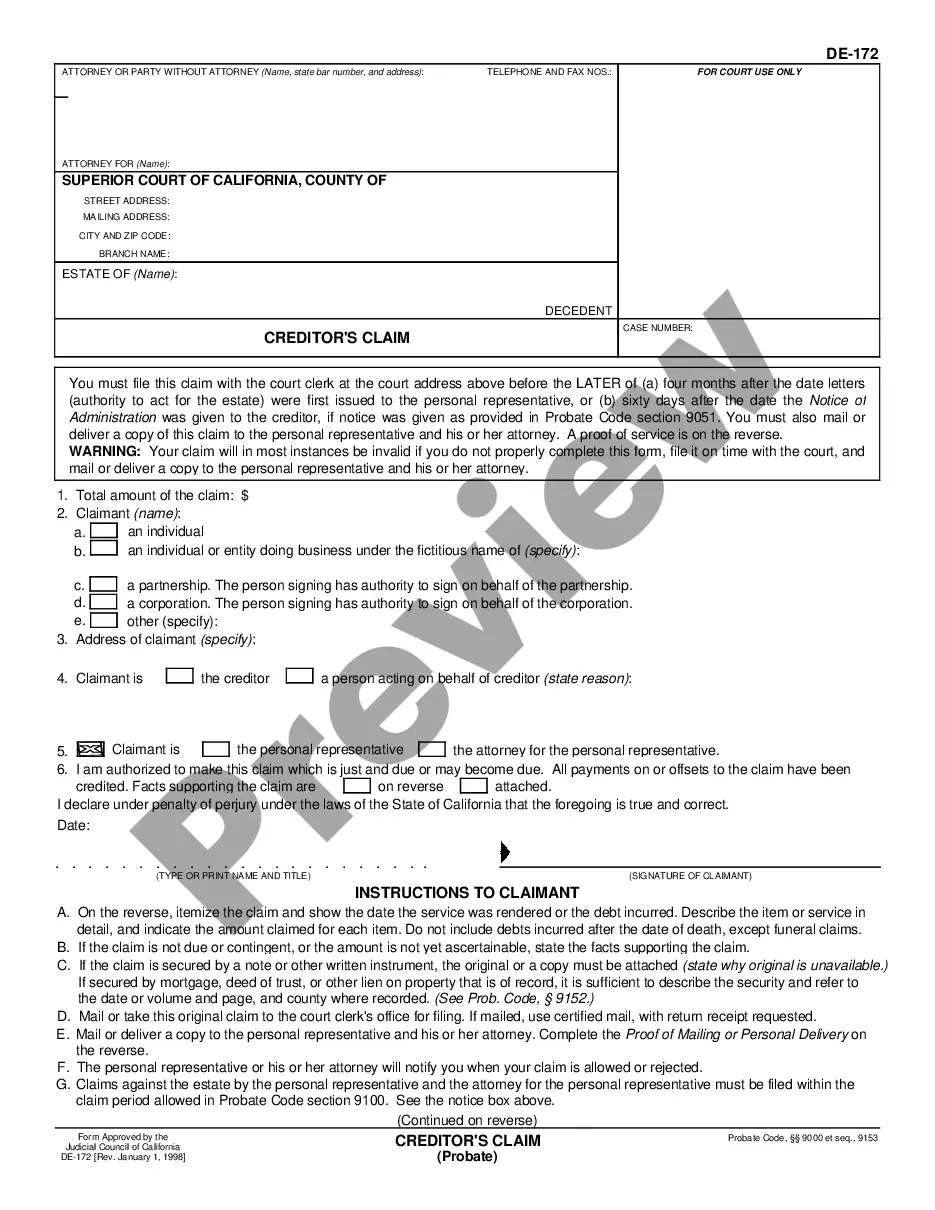

This form is for completing information relevant to an estate. It contains questions for personal and financial information. You may use this form for client interviews. It is also ideal for a person to complete to view their overall financial situation for estate planning purposes.

Indiana Estate Planning Questionnaire and Worksheets

Description

How to fill out Indiana Estate Planning Questionnaire And Worksheets?

In search of Indiana Estate Planning Questionnaire and Worksheets forms and filling out them can be a challenge. In order to save time, costs and effort, use US Legal Forms and find the right template specially for your state within a couple of clicks. Our legal professionals draw up every document, so you just need to fill them out. It truly is that simple.

Log in to your account and return to the form's page and download the sample. Your saved examples are kept in My Forms and therefore are accessible always for further use later. If you haven’t subscribed yet, you have to sign up.

Look at our comprehensive guidelines on how to get the Indiana Estate Planning Questionnaire and Worksheets template in a couple of minutes:

- To get an entitled example, check out its validity for your state.

- Check out the sample making use of the Preview function (if it’s offered).

- If there's a description, read it to know the details.

- Click on Buy Now button if you found what you're trying to find.

- Pick your plan on the pricing page and create an account.

- Choose you would like to pay out by a credit card or by PayPal.

- Save the file in the favored file format.

Now you can print the Indiana Estate Planning Questionnaire and Worksheets template or fill it out making use of any online editor. Don’t worry about making typos because your template can be utilized and sent away, and printed as many times as you want. Check out US Legal Forms and access to over 85,000 state-specific legal and tax files.

Form popularity

FAQ

Creating an estate plan is a lot like getting into better shape. Step 1: Sign a will. Step 2: Name beneficiaries. Step 3: Dodge estate taxes. Step 4: Leave a letter. Step 5: Draw up a durable power of attorney. Step 6: Create an advance health care directive.

Step 1: Create a checklist of important documents (and their locations) Step 2: List the names and contact information of key associates. Step 3: Catalog your digital asset inventory. Step 4: Ensure all documents are organized and accessible.

What Property Can Go in a Living Trust? Who Should Be My Trustee? Does a Living Trust Avoid Estate and Probate Taxes? What Are the Benefits of a Living Trust? What Are the Drawbacks of a Living Trust? Do I Still Need a Power of Attorney?

More Than a Last Will. Itemize Your Inventory. Follow with Non-Physical Assets. Assemble a List of Debts. Make a Memberships List. Make Copies of Your Lists. Review Your Retirement Account. Update Your Insurance.

A Last Will and Testament. When it comes to estate planning, having a last will and testament is likely the first thing that will come to mind. A Document Granting Power of Attorney. An Advance Medical Directive. Revocable Living Trust.

Fill out your attorney's intake questionnaire. Gather your financial documents. Bring copies of your current estate plan documents. Divorce agreements, premarital agreements, and other relevant contracts. Choose your executors and health care agents.

Bank accounts. Brokerage or investment accounts. Retirement accounts and pension plans. A life insurance policy.