Kansas Commercial Mortgage and Security Agreement

Description

How to fill out Kansas Commercial Mortgage And Security Agreement?

Searching for Kansas Commercial Mortgage and Security Agreement templates and filling out them can be quite a challenge. To save lots of time, costs and energy, use US Legal Forms and choose the right template specifically for your state within a couple of clicks. Our legal professionals draft all documents, so you just need to fill them out. It really is that simple.

Log in to your account and come back to the form's page and download the document. All your downloaded samples are saved in My Forms and they are available all the time for further use later. If you haven’t subscribed yet, you need to register.

Have a look at our thorough recommendations on how to get your Kansas Commercial Mortgage and Security Agreement form in a couple of minutes:

- To get an entitled sample, check out its applicability for your state.

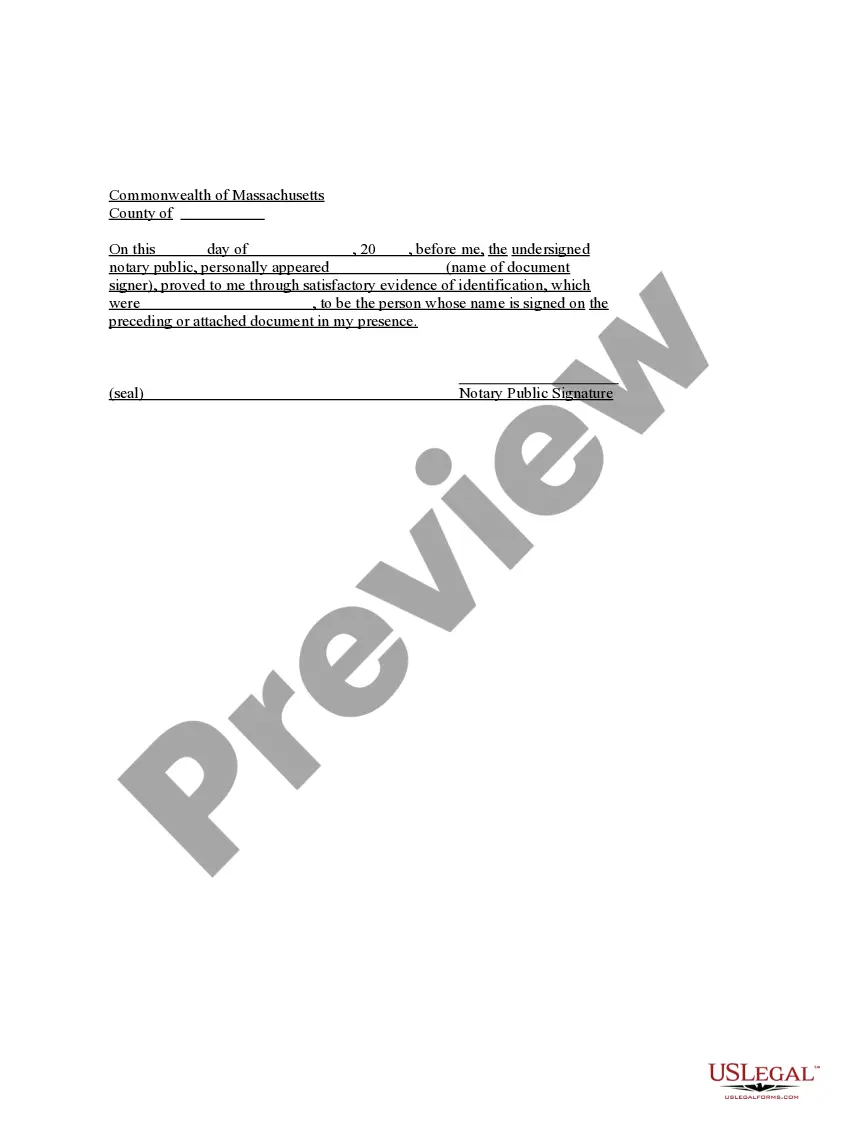

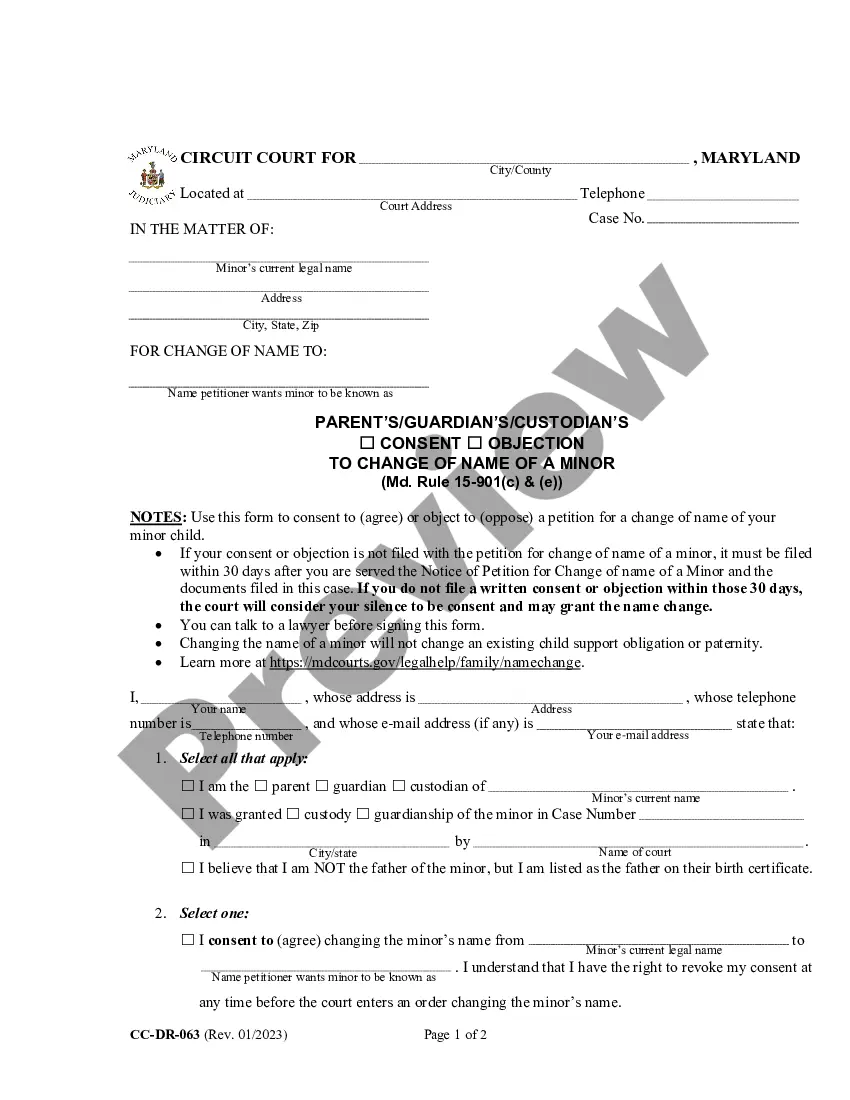

- Have a look at the form making use of the Preview option (if it’s accessible).

- If there's a description, read it to learn the details.

- Click on Buy Now button if you found what you're seeking.

- Select your plan on the pricing page and make your account.

- Pick how you would like to pay with a card or by PayPal.

- Save the sample in the favored format.

You can print out the Kansas Commercial Mortgage and Security Agreement form or fill it out utilizing any web-based editor. Don’t concern yourself with making typos because your sample can be utilized and sent, and printed out as many times as you would like. Try out US Legal Forms and access to over 85,000 state-specific legal and tax files.

Form popularity

FAQ

How much deposit is required for a commercial mortgage? You should expect to pay a deposit of between 20% and 40%, but bear in mind that many factors can affect this figure.

How much deposit is required for a commercial mortgage? You should expect to pay a deposit of between 20% and 40%, but bear in mind that many factors can affect this figure. It can move up as well as down!

For a traditional commercial mortgage, the minimum down payment varies between 15% and 35% of the overall purchase price, depending on the lender. With SBA 7(a) and CDC/SBA 504 loans, the range is more standardized, falling between 10% and 15% of the purchase price.

Not all Commercial Loans Have Balloon Payments A commercial loan featuring a balloon payment is not the only option for investors. Depending on the lender, you could secure a fixed rate or hybrid loan that does not include a lump sum payment at the end of the term.

Before considering or approving a loan application, most commercial lenders ask for a minimum 30% down payment.If you're looking for a commercial real estate loan for a property worth between $250,000 and $5 million with a Conventional Commercial Loan, you'll need a down payment of 25-30% down payment to qualify.

For a traditional commercial mortgage, the minimum down payment varies between 15% and 35% of the overall purchase price, depending on the lender. With SBA 7(a) and CDC/SBA 504 loans, the range is more standardized, falling between 10% and 15% of the purchase price.

30 yr term loans fixed for commercial properties are available but not from the traditinal sources whether that be banks, portfolio lenders, or commercial banks. The 30 yr fixed is offered through alternative lenders. An alternative lender is a private non-bank commercial lender.

Commercial property loans usually need a deposit of at least 30% of the purchase price.

Do you need money down (a deposit) for a business loan? No. A secured loan will require some form of collateral (property or other assets) but no money from you. An unsecured loan does not require any collateral, so there's no money down (deposit) to get a business loan.