Kansas Landscape Contract for Contractor

Description

How to fill out Kansas Landscape Contract For Contractor?

In search of Kansas Landscape Contract for Contractor templates and filling out them can be quite a challenge. To save time, costs and energy, use US Legal Forms and find the correct example specifically for your state in just a few clicks. Our legal professionals draw up every document, so you just need to fill them out. It truly is so simple.

Log in to your account and come back to the form's page and save the sample. All of your saved samples are kept in My Forms and they are accessible all the time for further use later. If you haven’t subscribed yet, you need to sign up.

Look at our detailed instructions on how to get your Kansas Landscape Contract for Contractor form in a few minutes:

- To get an qualified example, check out its validity for your state.

- Check out the form using the Preview function (if it’s offered).

- If there's a description, read it to learn the important points.

- Click on Buy Now button if you found what you're looking for.

- Choose your plan on the pricing page and create an account.

- Select you would like to pay out with a credit card or by PayPal.

- Save the sample in the preferred format.

Now you can print the Kansas Landscape Contract for Contractor template or fill it out utilizing any online editor. Don’t concern yourself with making typos because your sample may be utilized and sent away, and published as many times as you would like. Try out US Legal Forms and access to around 85,000 state-specific legal and tax documents.

Form popularity

FAQ

The procedure for e-filing has been laid down in the Sales Tax General Order No. 4/2007. Aregistered person shall obtain a unique identifier and password by visiting FBR's web portal at e.fbr.gov.pk. He can then file the return by selecting declaration sales tax from the web portal.

People in Kansas have to pay state sales tax at six and a half percent, but not all out of state internet purchases have had that charge.South Dakota Supreme Court case allowing state taxes on internet sales. That case protected small businesses that sell less than $100,000 to state buyers.

KS WebFile. KS WebFile is a FREE online application for filing Kansas Individual Income tax returns. IRS E-File. Kansas Customer Service Center.

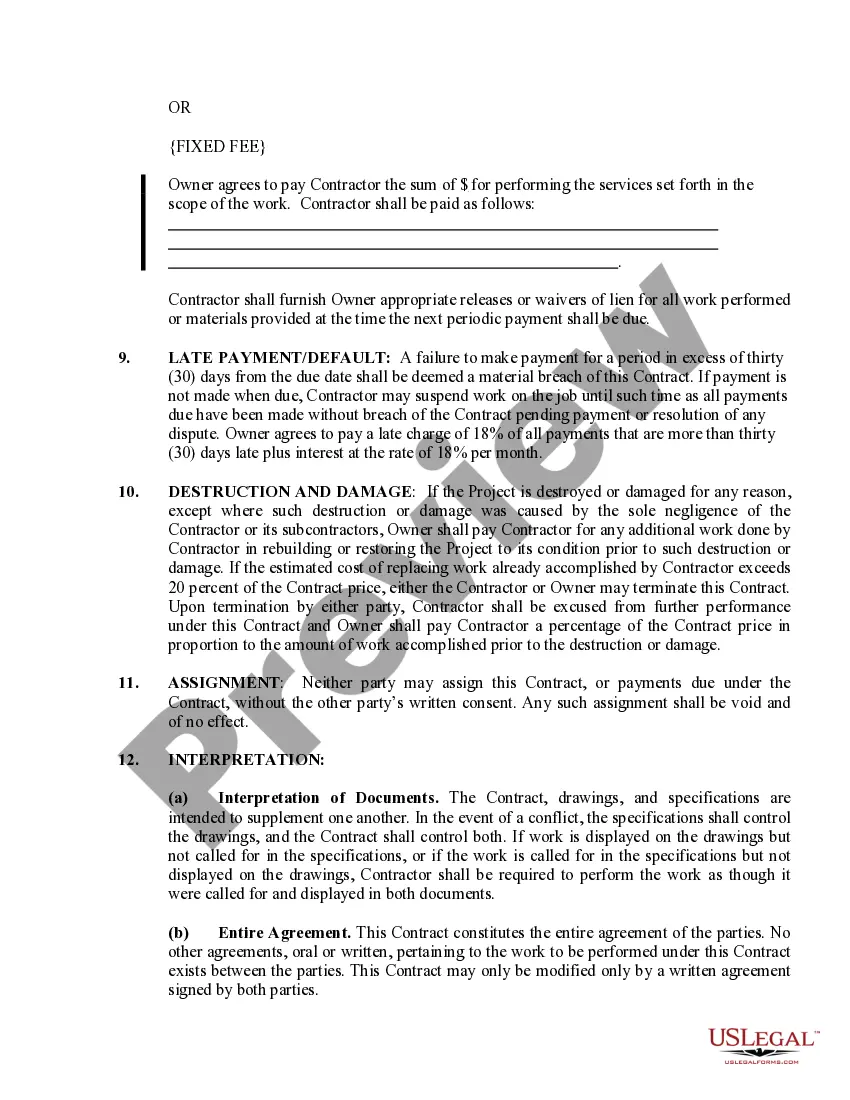

1Get it in writing.2Keep it simple.3Deal with the right person.4Identify each party correctly.5Spell out all of the details.6Specify payment obligations.7Agree on circumstances that terminate the contract.8Agree on a way to resolve disputes.Ten Tips for Making Solid Business Agreements and Contracts Nolo\nwww.nolo.com > make-business-contract-agreement-30313

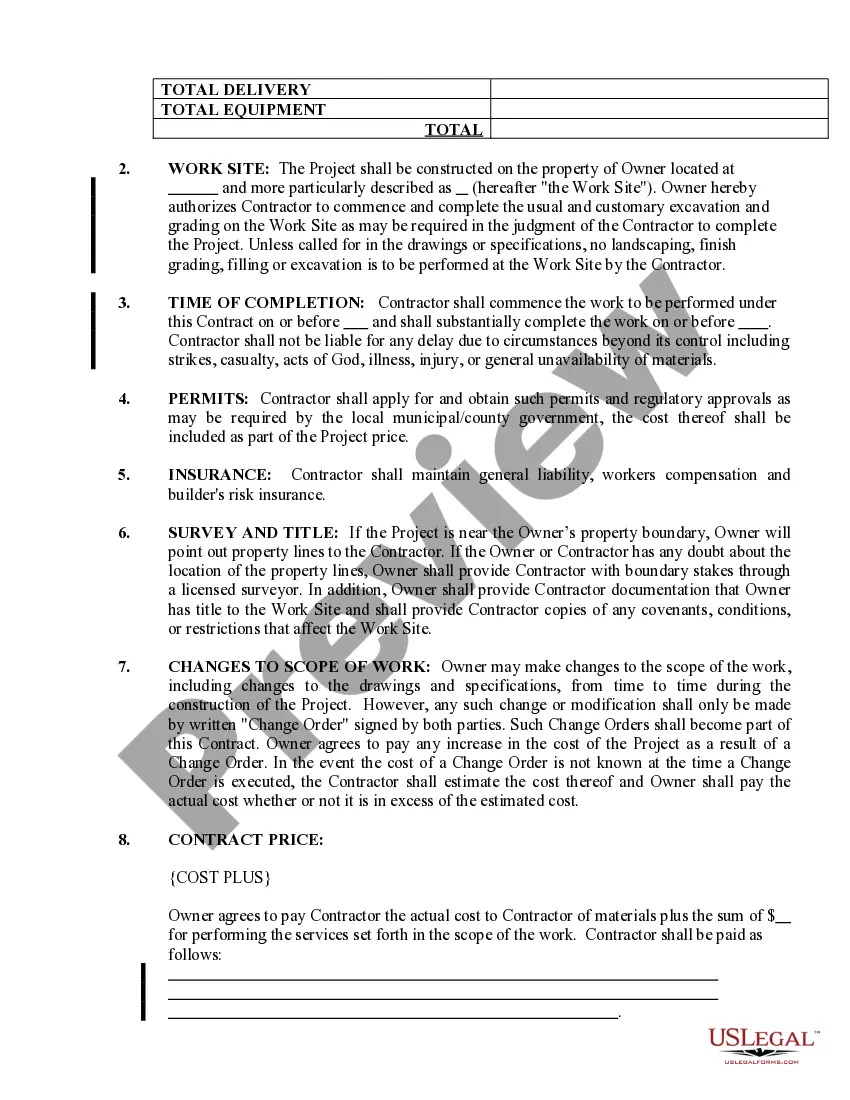

A lawn care contract allows a client to make an agreement with a landscaper for commercial or residential services in exchange for payment.The services are usually on a scheduled basis, especially for commercial clients, with the client paying a recurring weekly or monthly amount.

Out-of-State Sales If the retailers sells merchandise to be shipped or delivered to the purchaser out-of-state, then the sales is considered to occur out-of-state, and no Kansas sales tax is due.

File online - File online at the Kansas Department of Revenue. File by mail - You can use Form ST-16 for single jurisdiction filers or Form ST-36 for multiple jurisdiction filers and file and pay through the mail. AutoFile - Let TaxJar file your sales tax for you.

Kansas Retailers' Sales Tax generally applies to: 1) the retail sale, rental, or lease of tangible personal property, and, 2) the sale of labor services to install, apply, repair, service, alter, or maintain tangible personal property.Sales tax is not imposed on the sale of real or intangible property.

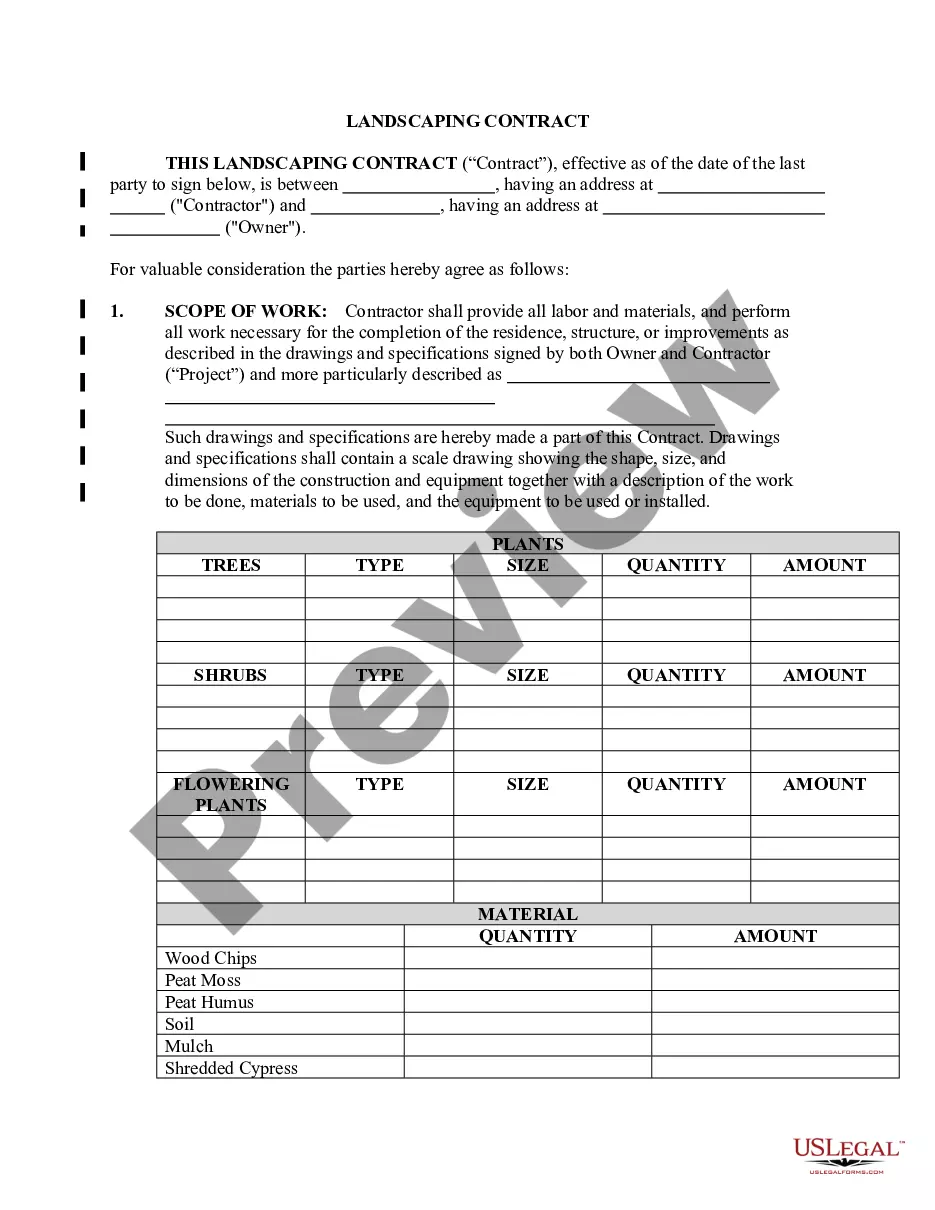

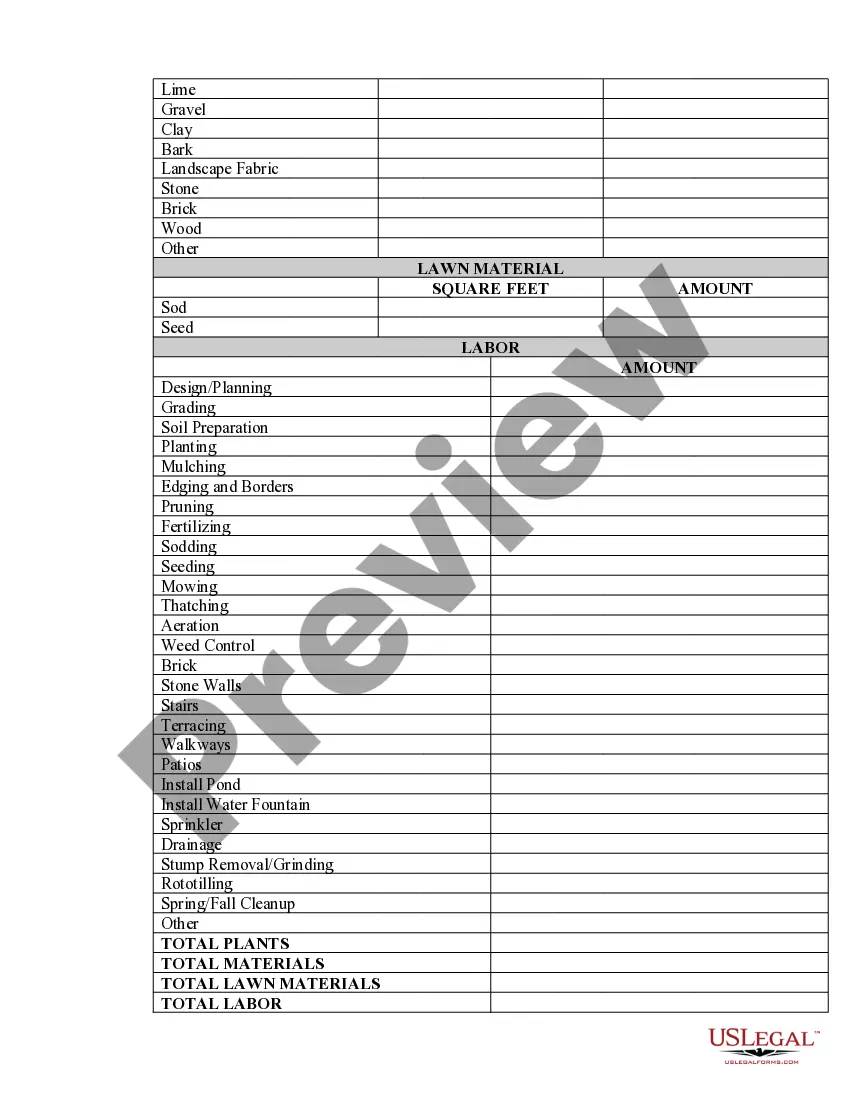

Landscaping contracts should include a detailed description of the project and what exactly you will be doing. Put in writing the basic services that will be performed and also additional ones, those that will be provided for an added cost if desired.