Kansas Construction Contract Cost Plus or Fixed Fee

Description

How to fill out Kansas Construction Contract Cost Plus Or Fixed Fee?

Trying to find Kansas Construction Contract Cost Plus or Fixed Fee sample and filling out them might be a challenge. To save time, costs and effort, use US Legal Forms and find the right template specially for your state within a few clicks. Our attorneys draw up each and every document, so you just have to fill them out. It truly is that simple.

Log in to your account and return to the form's web page and save the sample. Your saved templates are saved in My Forms and are accessible always for further use later. If you haven’t subscribed yet, you need to sign up.

Look at our detailed guidelines on how to get the Kansas Construction Contract Cost Plus or Fixed Fee sample in a few minutes:

- To get an eligible sample, check out its validity for your state.

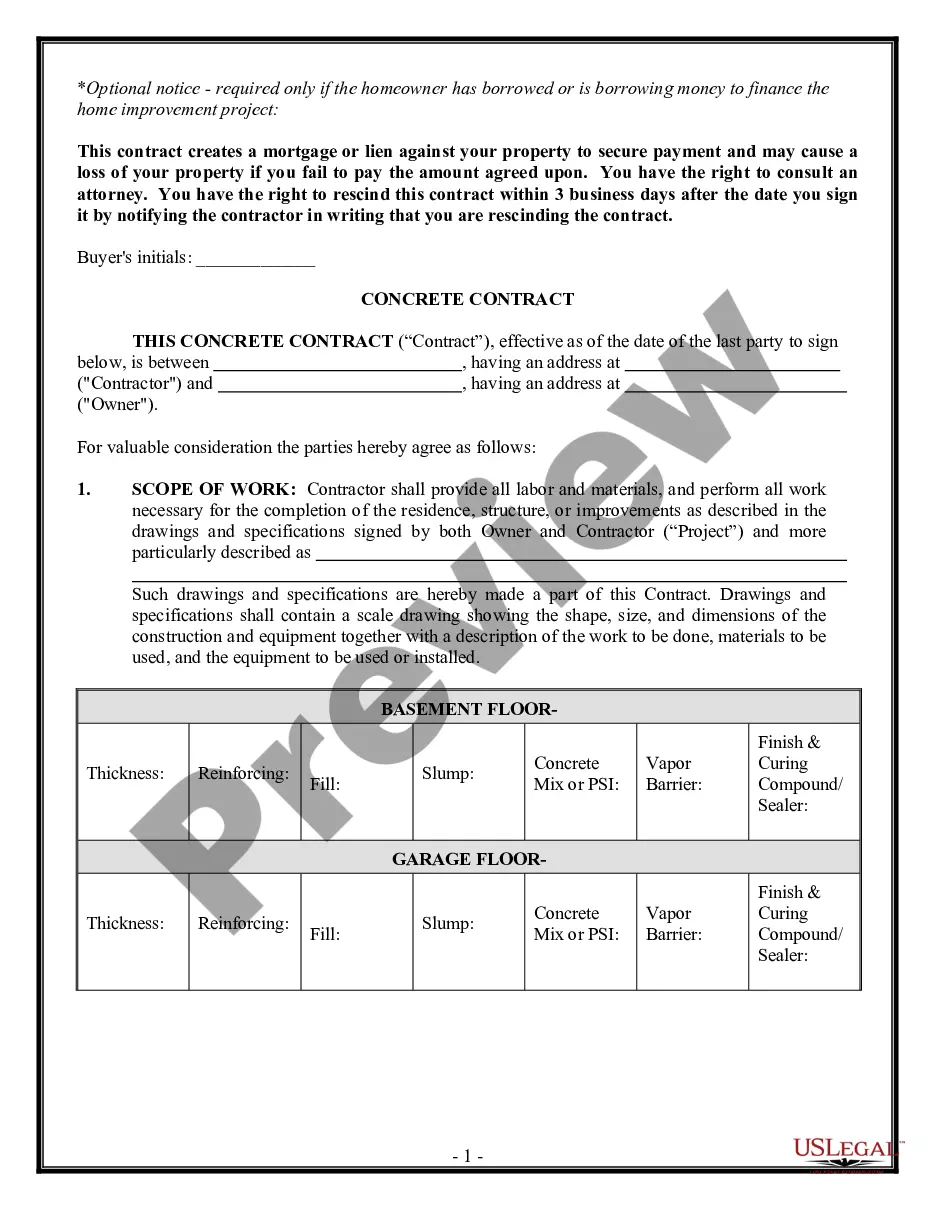

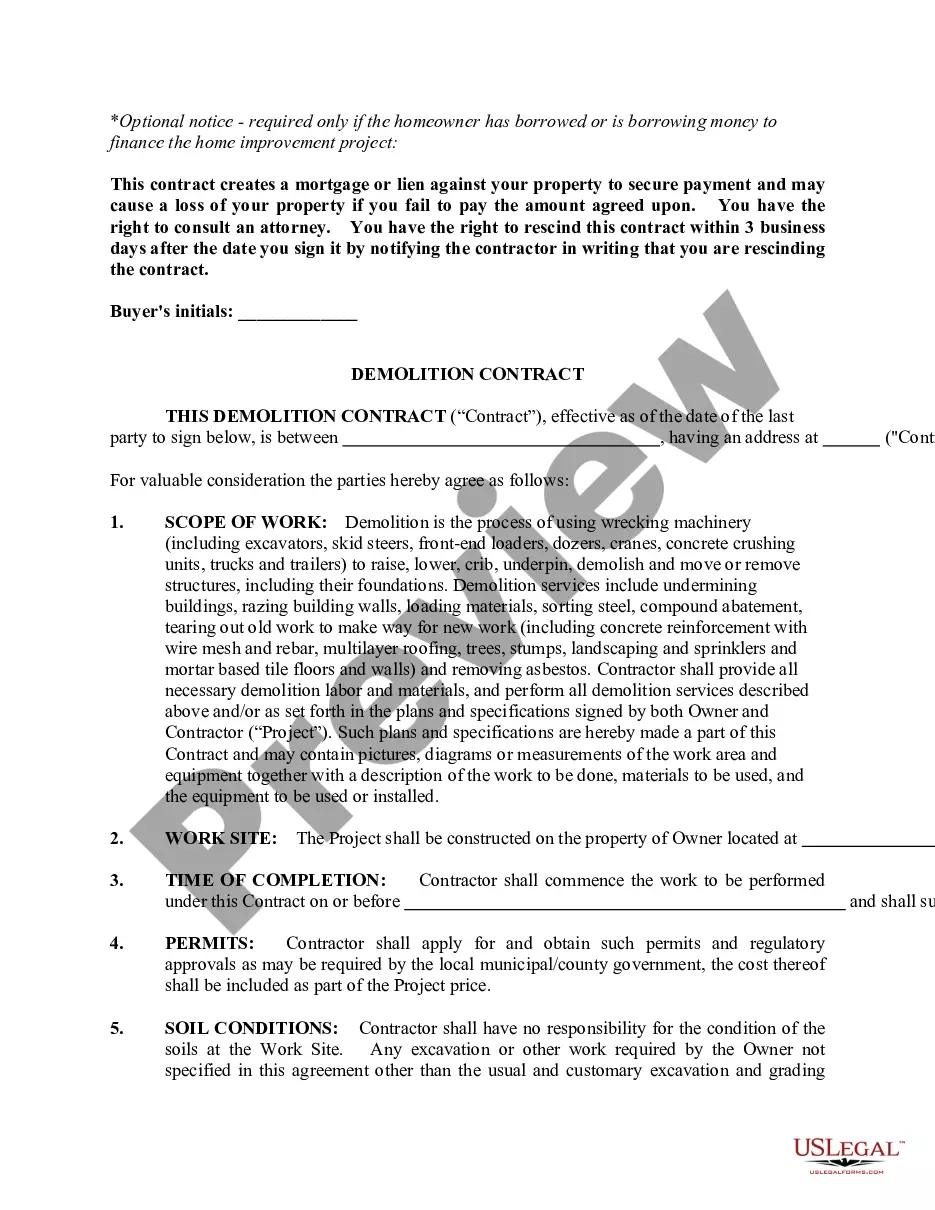

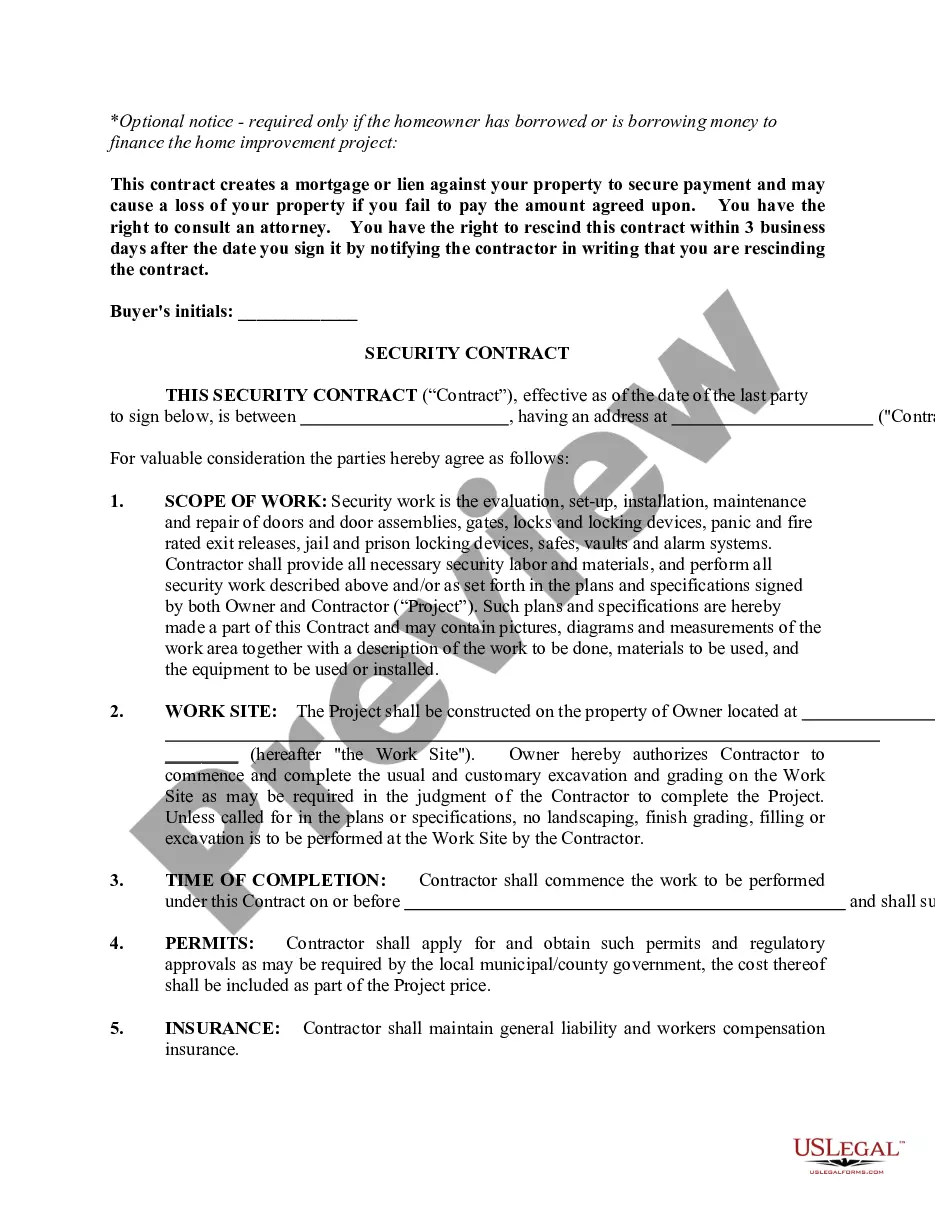

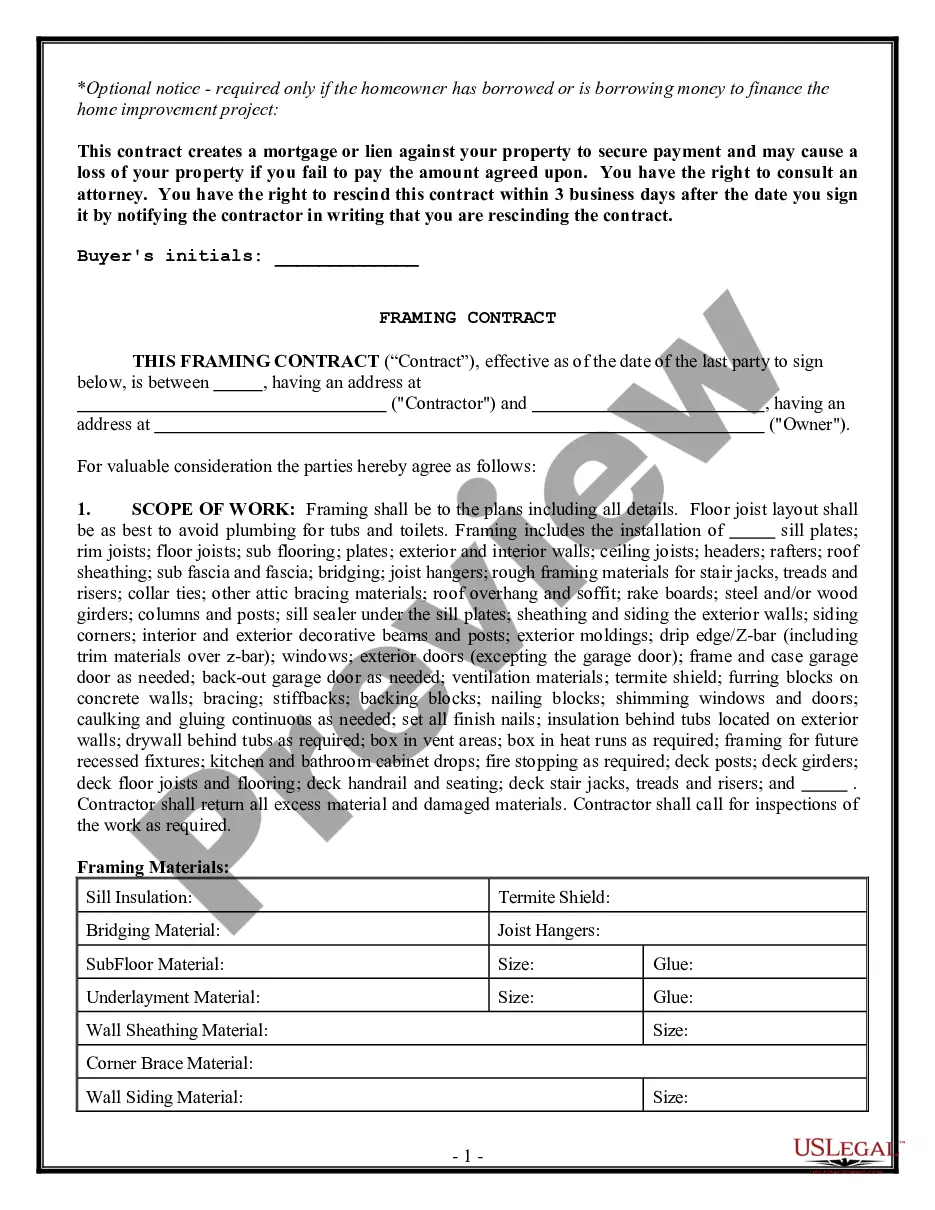

- Have a look at the form utilizing the Preview function (if it’s offered).

- If there's a description, go through it to learn the important points.

- Click on Buy Now button if you identified what you're looking for.

- Choose your plan on the pricing page and create your account.

- Choose you wish to pay out with a card or by PayPal.

- Download the file in the preferred format.

You can print the Kansas Construction Contract Cost Plus or Fixed Fee form or fill it out using any web-based editor. No need to concern yourself with making typos because your form can be used and sent away, and printed out as often as you would like. Check out US Legal Forms and get access to above 85,000 state-specific legal and tax files.

Form popularity

FAQ

In the cost plus a percentage arrangement, the contractor bills the client for his direct costs for labor, materials, and subs, plus a percentage to cover his overhead and profit. Markups might range anywhere from 10% to 25%.

A cost-plus contract is an agreement to reimburse a company for expenses incurred plus a specific amount of profit, usually stated as a percentage of the contract's full price.

A fixed price contract sets a total price for all construction-related activities during a project. Many fixed price contracts include benefits for early termination and penalties for a late termination to give the contractors incentives to ensure the project is completed on time and within scope.

A fixed-price contract is a type of contract where the payment amount does not depend on resources used or time expended. This is opposed to a cost-plus contract, which is intended to cover the costs with additional profit made.

A cost-plus contract, also known as a cost-reimbursement contract, is a form of contract wherein the contractor is paid for all of their construction-related expenses. Plus, the contractor is paid a specific agreed-upon amount for profit.

Disadvantages of fixed-price Therefore the biggest issue is usually around project scope and change requests. Lack of flexibility. A fixed-price project has a defined scope (requirements). As the cost cannot change, the scope of work is much less flexible.

Firm Fixed Price (FFP) The price will be set on the buyer's request. A FFP should be used for a product or service that is a repeated process. As an example, a car manufacturer would enter into a FFP contract for a standard model car. The manufacturer knows what it takes to complete the car and the associated cost.

Fixed-price contracts provide greater incentive than cost-reimbursement contracts for the contractor to control costs and perform efficiently. 2) Fixed price contracting shifts risk from the customer to the service provider.

A cost plus percentage of cost contract or CPPC is a cost reimbursement contract containing some element that obligates the non-state entity to pay the contractor an amount, undetermined at the time the contract was made and to be incurred in the future, based on a percentage of future costs.