Kansas Limited Liability Company LLC Operating Agreement

Description Liability Company Llc

How to fill out Llc In Kansas?

Looking for Kansas Limited Liability Company LLC Operating Agreement templates and completing them can be quite a problem. To save lots of time, costs and energy, use US Legal Forms and find the correct template specially for your state within a couple of clicks. Our attorneys draft every document, so you just have to fill them out. It truly is that easy.

Log in to your account and come back to the form's web page and download the sample. Your saved templates are stored in My Forms and are available always for further use later. If you haven’t subscribed yet, you need to register.

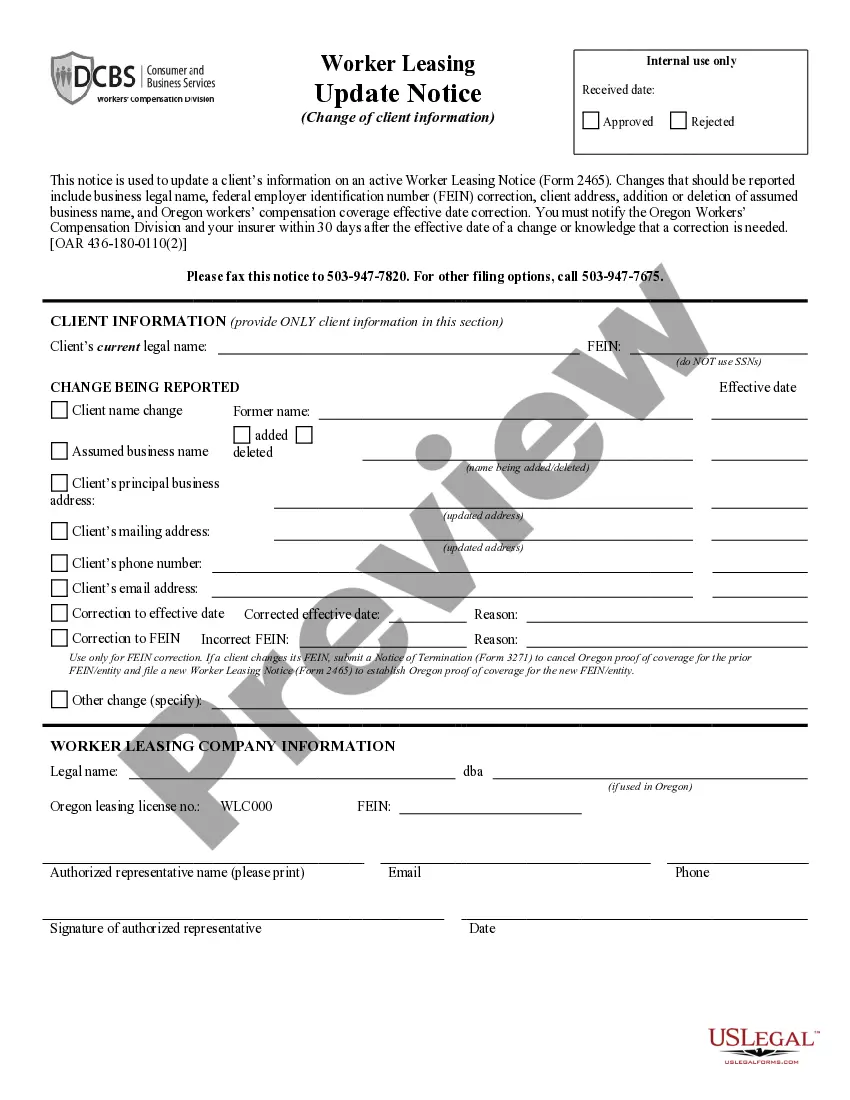

Check out our thorough instructions concerning how to get your Kansas Limited Liability Company LLC Operating Agreement sample in a couple of minutes:

- To get an qualified example, check out its applicability for your state.

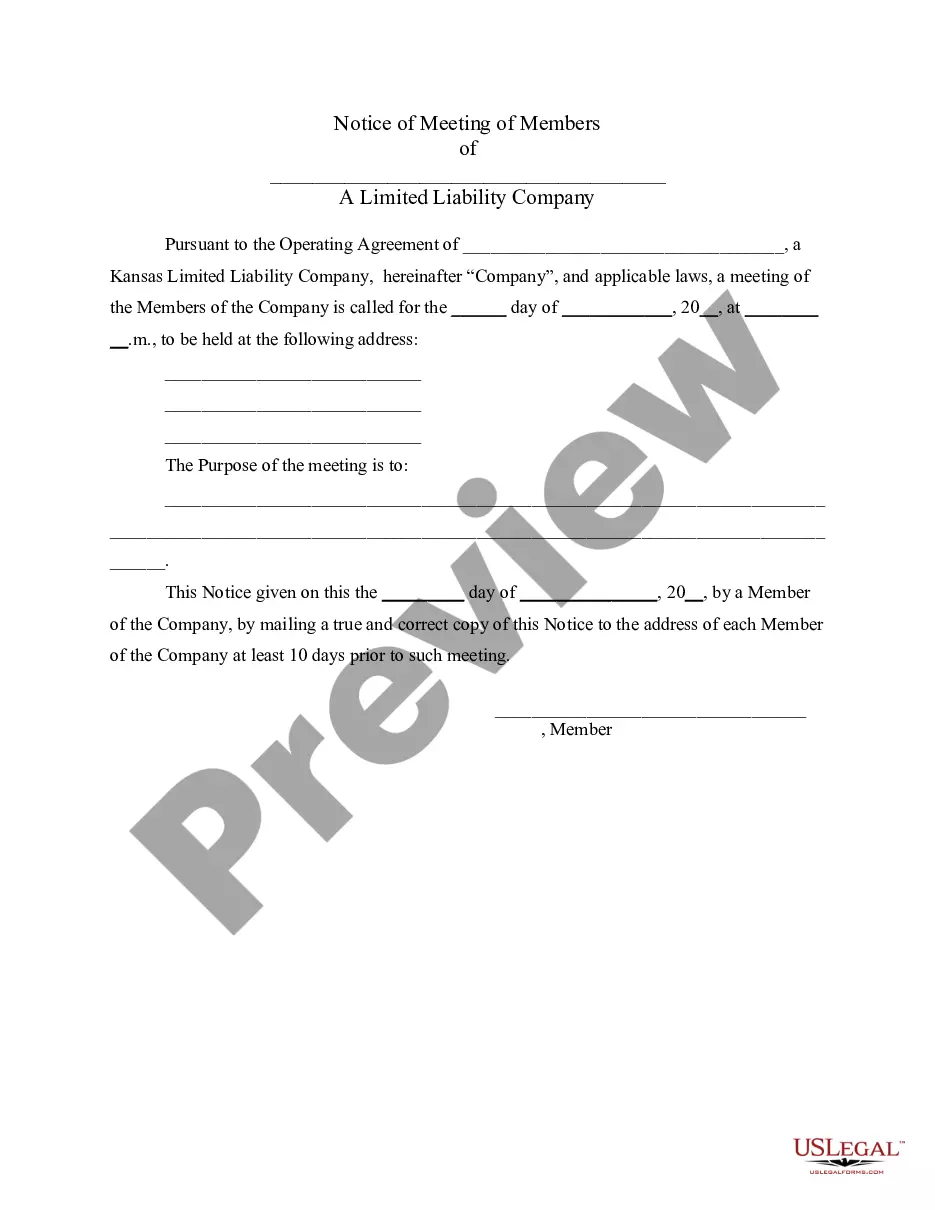

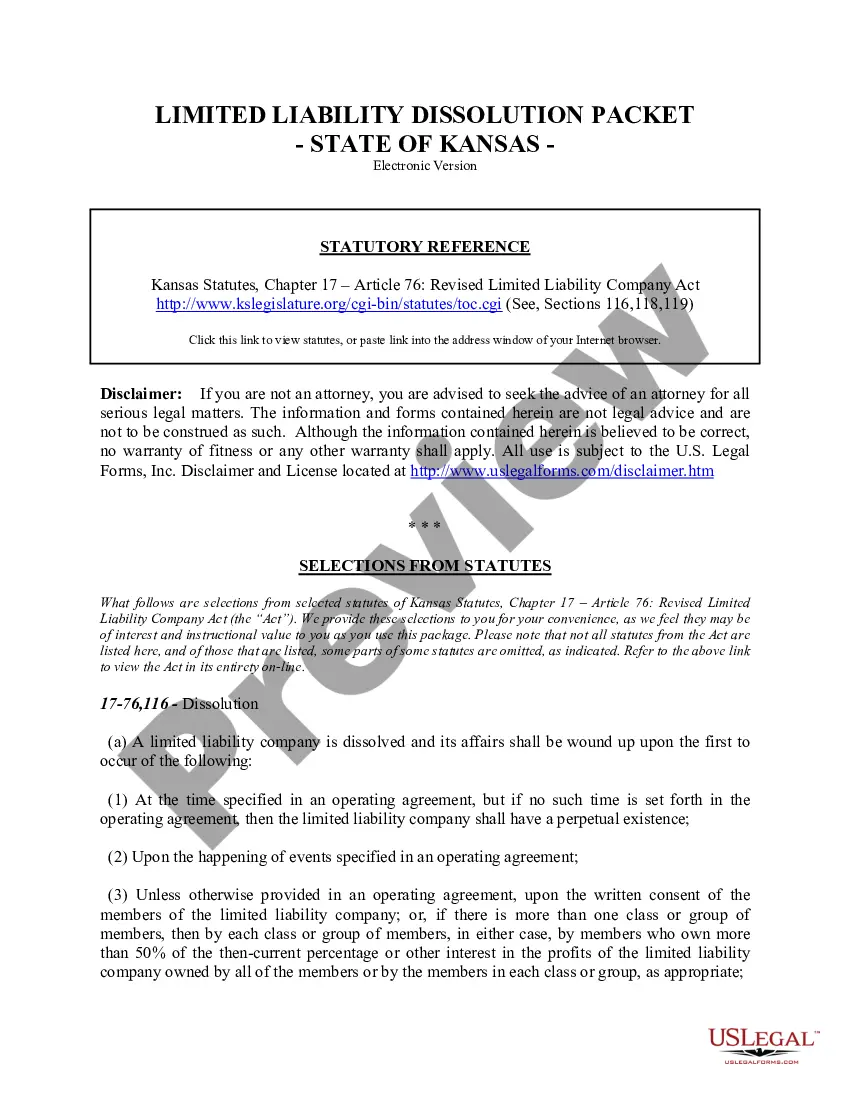

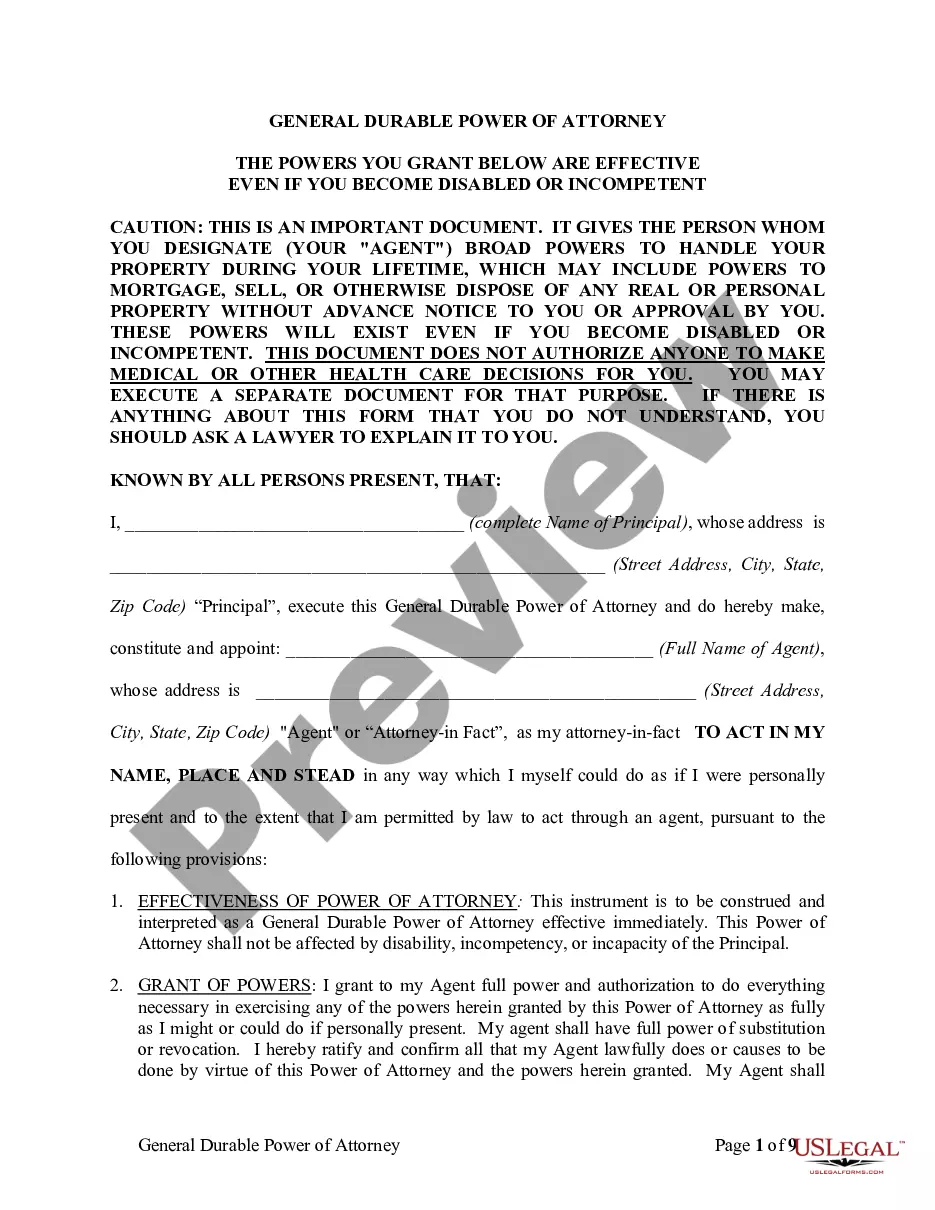

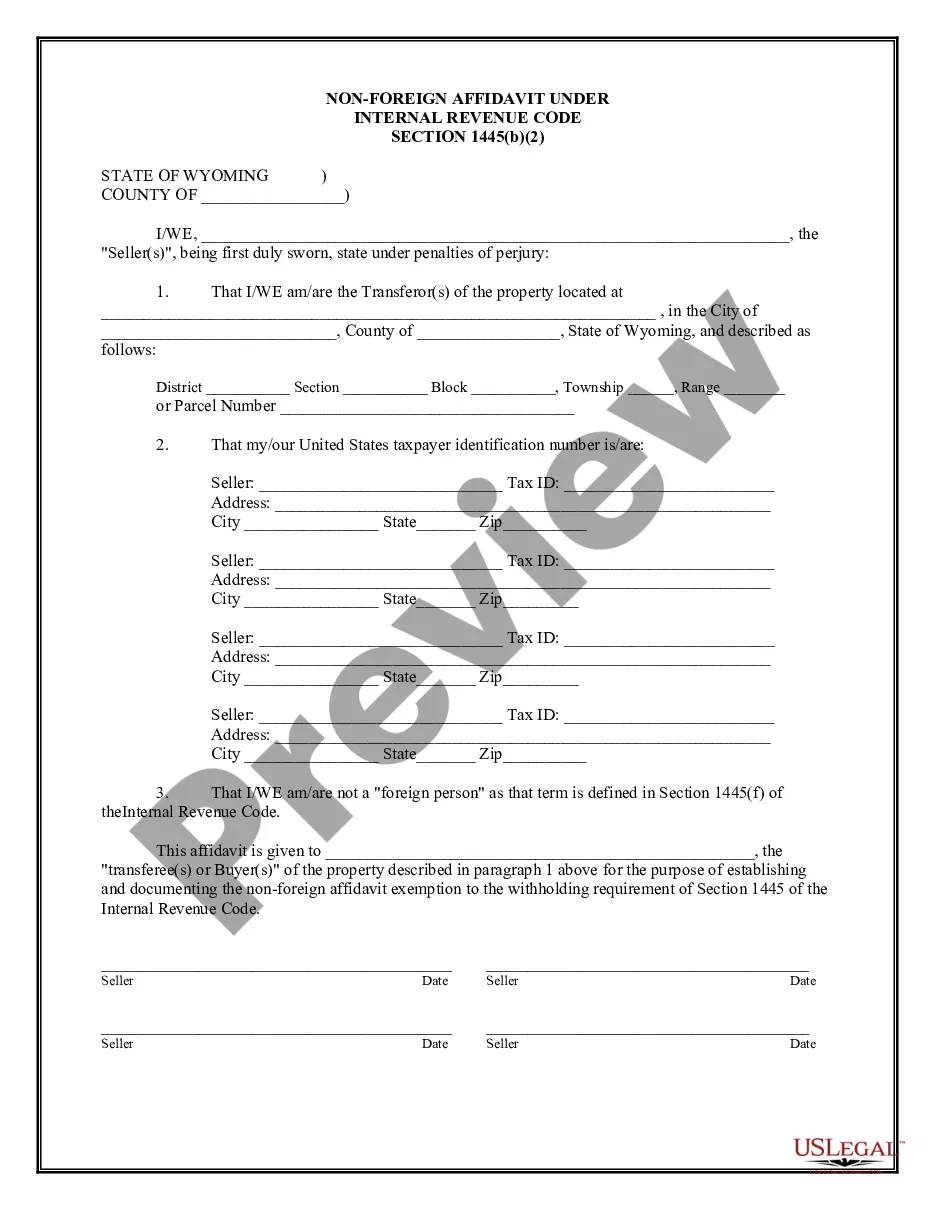

- Look at the sample making use of the Preview option (if it’s available).

- If there's a description, read it to learn the important points.

- Click on Buy Now button if you found what you're trying to find.

- Select your plan on the pricing page and make an account.

- Select you wish to pay out with a card or by PayPal.

- Download the sample in the preferred format.

You can print the Kansas Limited Liability Company LLC Operating Agreement form or fill it out using any web-based editor. Don’t worry about making typos because your sample can be utilized and sent away, and printed out as often as you want. Check out US Legal Forms and get access to around 85,000 state-specific legal and tax documents.

Limited Liability Llc Form popularity

Limited Liability Llc Form Other Form Names

Forming An Llc In Kansas FAQ

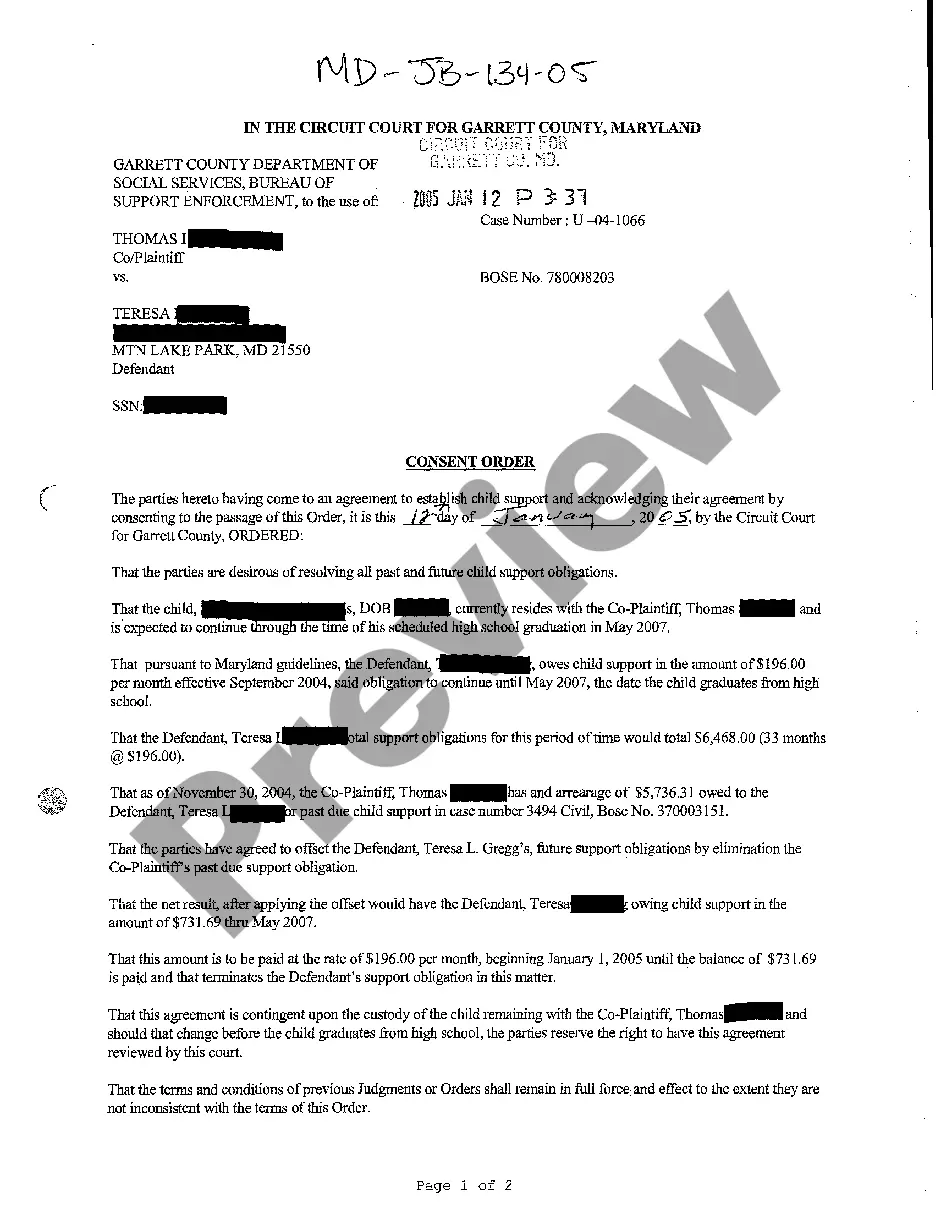

An LLC Operating Agreement is Not Compulsory, but it is Highly Recommended. An LLC operating agreement is not necessarily compulsory, although this depends on the state where your business is based. You could get into a lot of unnecessary strife if situations change in your LLC.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one.

An operating agreement is a document which describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. All LLC's with two or more members should have an operating agreement. This document is not required for an LLC, but it's a good idea in any case.

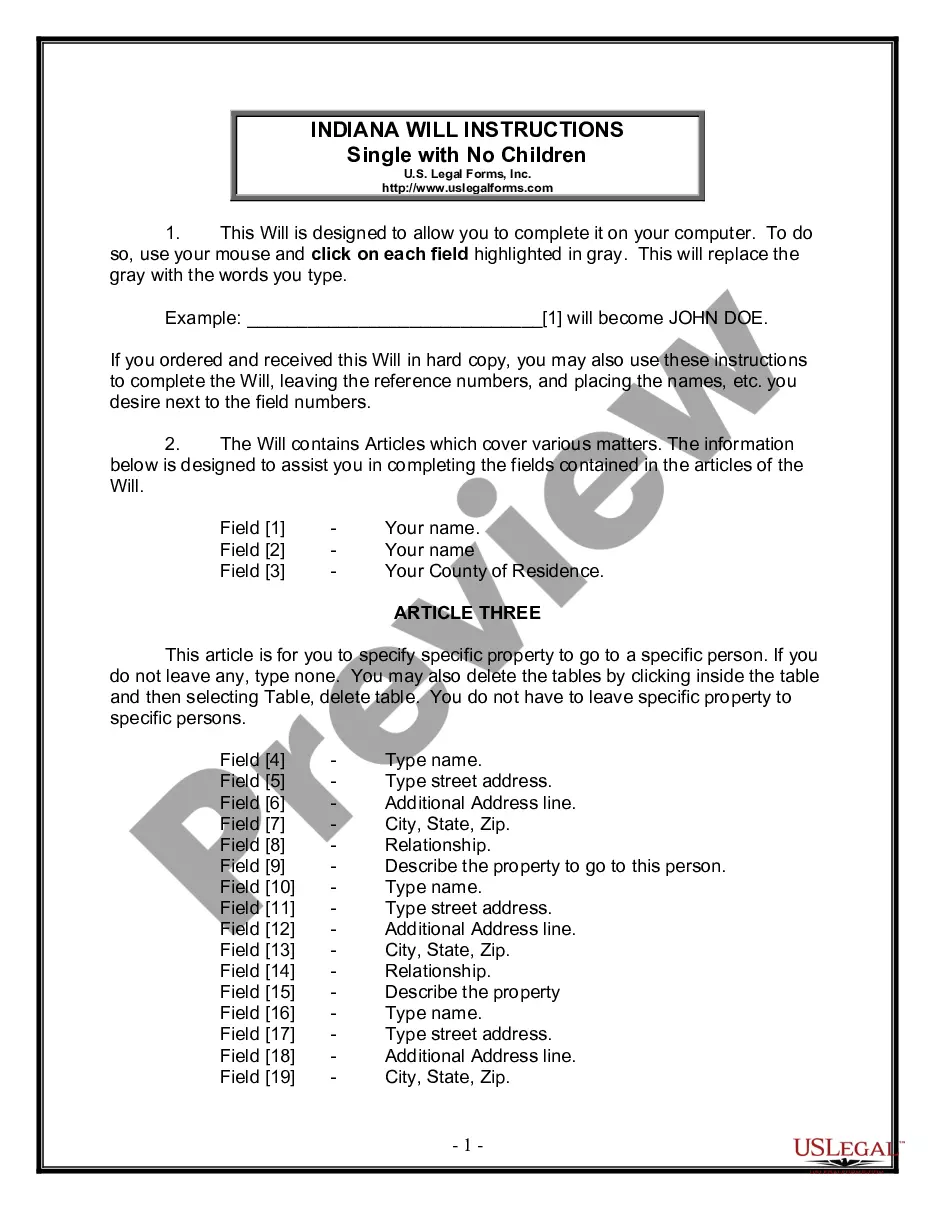

Step 1 Name Your LLC. Step 2 State of Jurisdiction (Choose Your State) Step 3 Select Type. Step 4 Principal Place of Business. Step 5 Registered Agent and Office. Step 6 Member Contributions. Step 7 Member Meetings. Step 8 Assignment of Interests.

If there is no operating agreement, you and the co-owners will not be suitably equipped to reach any settlements concerning misunderstandings over management and finances. Worse still, your LLC will be required to follow any of your state's default operating conditions.

Pursuant to California Corporation's Code §17050, every California LLC is required to have an LLC Operating Agreement. Next to the Articles of Organization, the LLC Operating Agreement is the most important document in the LLC.

An LLC can be structured to be taxed in the same manner as a partnership however the owners or partners of a partnership are jointly and severally liable for the debts and obligations of the partnership.The operating agreement is a separate document and is an agreement between the owners of the LLC.

Call, write or visit the secretary of state's office in the state in which the LLC does business. Call, email, write or visit the owner of the company for which you want to see the LLC bylaws or operating agreement.