Kansas Limited Liability Company LLC Formation Package

Description

How to fill out Kansas Limited Liability Company LLC Formation Package?

In search of Kansas Limited Liability Company LLC Formation Package forms and filling out them might be a problem. To save time, costs and effort, use US Legal Forms and find the appropriate template specifically for your state within a couple of clicks. Our attorneys draw up every document, so you just need to fill them out. It really is that simple.

Log in to your account and come back to the form's page and download the document. Your downloaded examples are kept in My Forms and they are accessible all the time for further use later. If you haven’t subscribed yet, you need to register.

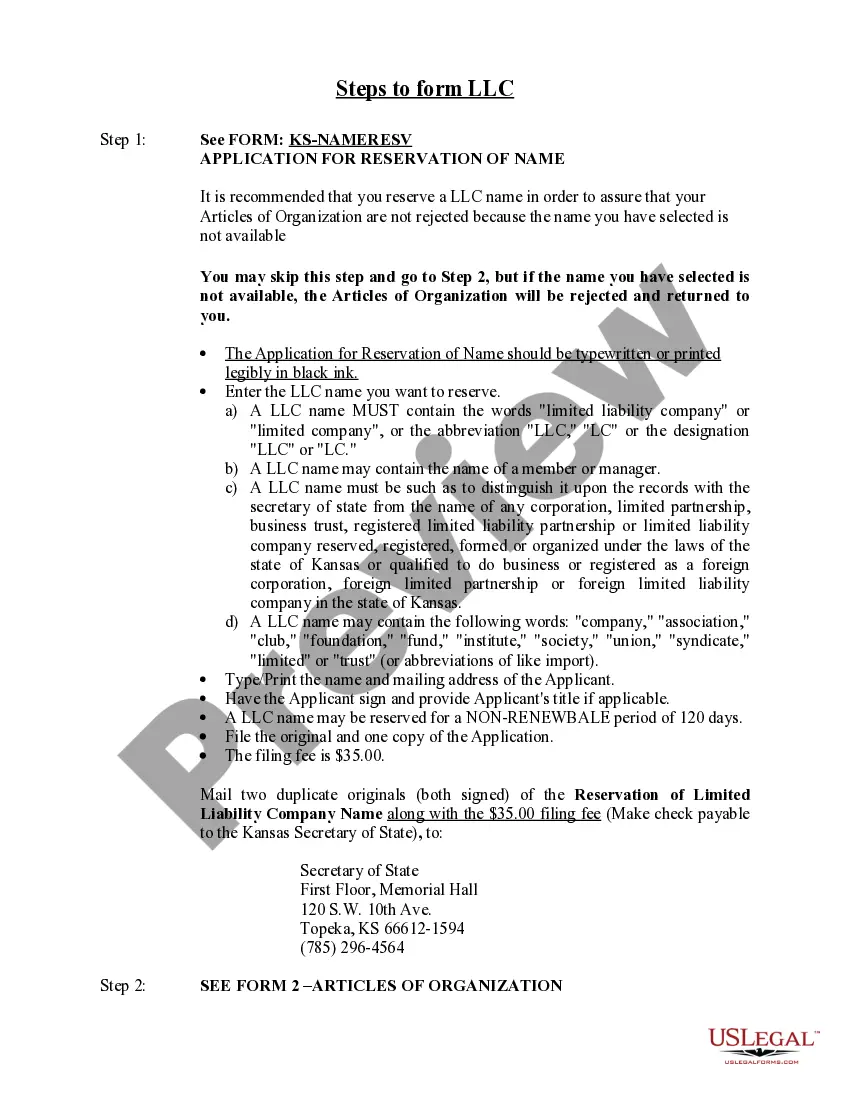

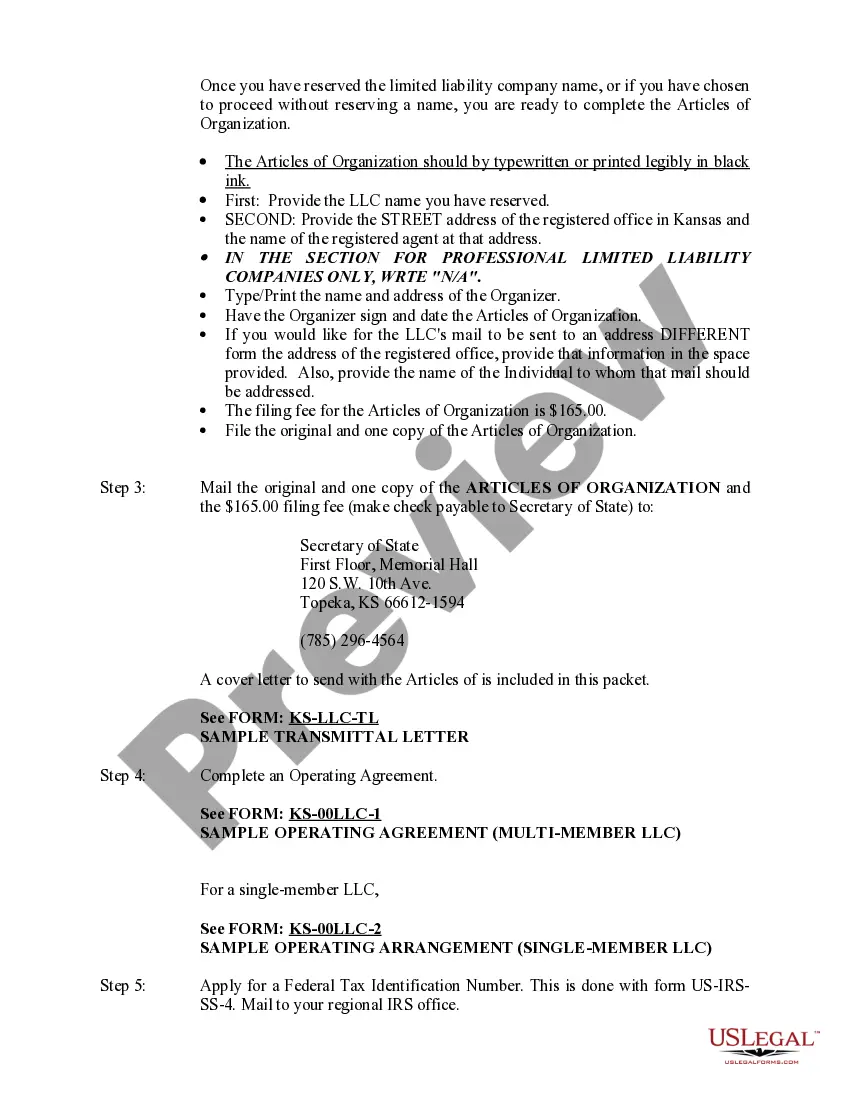

Take a look at our detailed guidelines concerning how to get the Kansas Limited Liability Company LLC Formation Package form in a couple of minutes:

- To get an entitled sample, check out its applicability for your state.

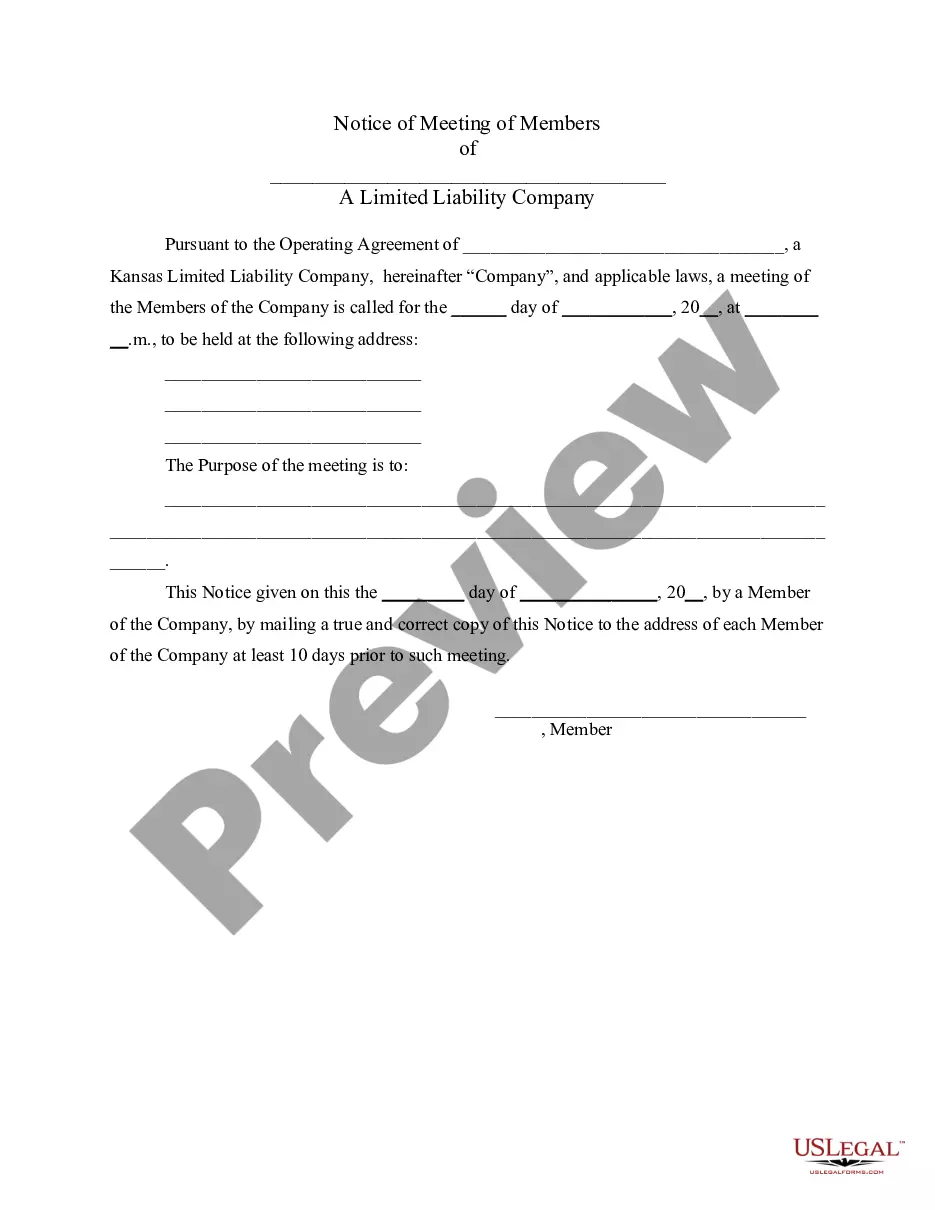

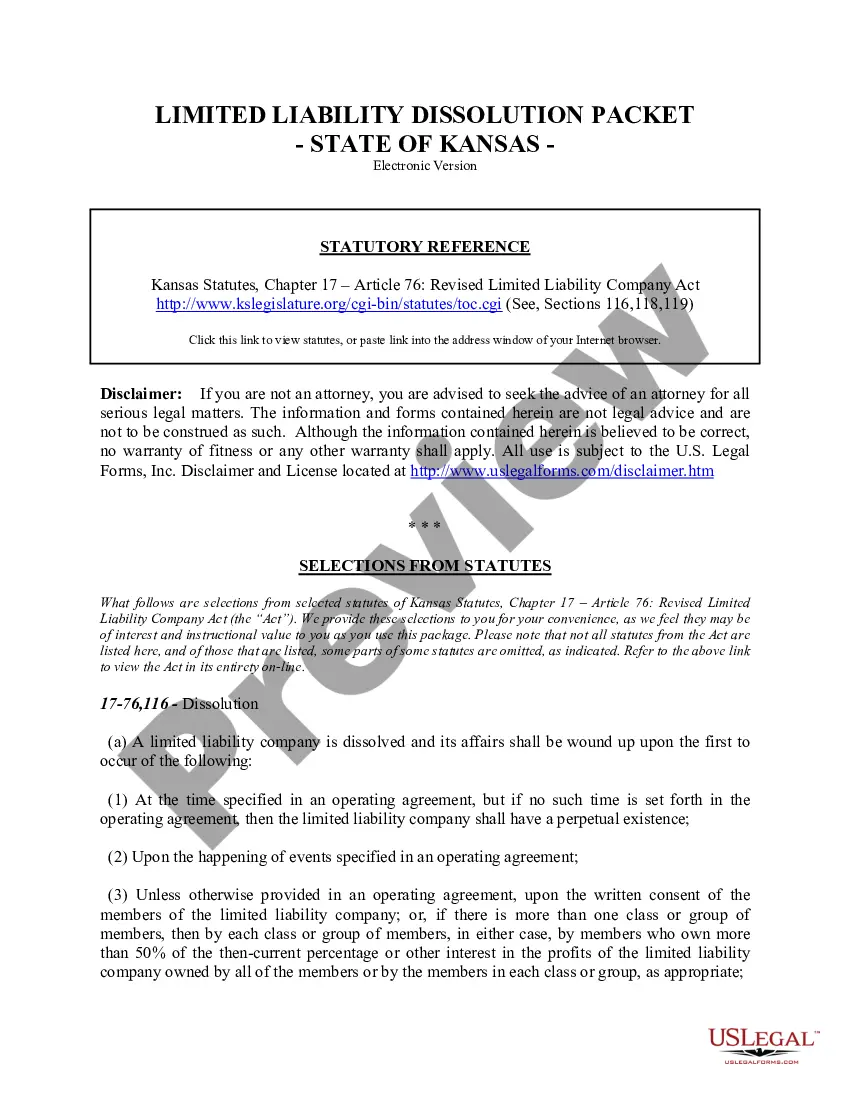

- Look at the example using the Preview option (if it’s available).

- If there's a description, read through it to understand the specifics.

- Click on Buy Now button if you identified what you're trying to find.

- Choose your plan on the pricing page and create an account.

- Select you want to pay by way of a card or by PayPal.

- Save the file in the favored format.

Now you can print the Kansas Limited Liability Company LLC Formation Package template or fill it out utilizing any web-based editor. Don’t concern yourself with making typos because your form can be utilized and sent, and published as often as you would like. Try out US Legal Forms and get access to over 85,000 state-specific legal and tax files.

Form popularity

FAQ

Business Name. Your LLC must have a name that is unique and is not the same or confusingly similar to another business. Registered Agent. Operating Agreement. Articles of Organization. Business Licenses and Permits. Statement of Information Form. Tax Forms.

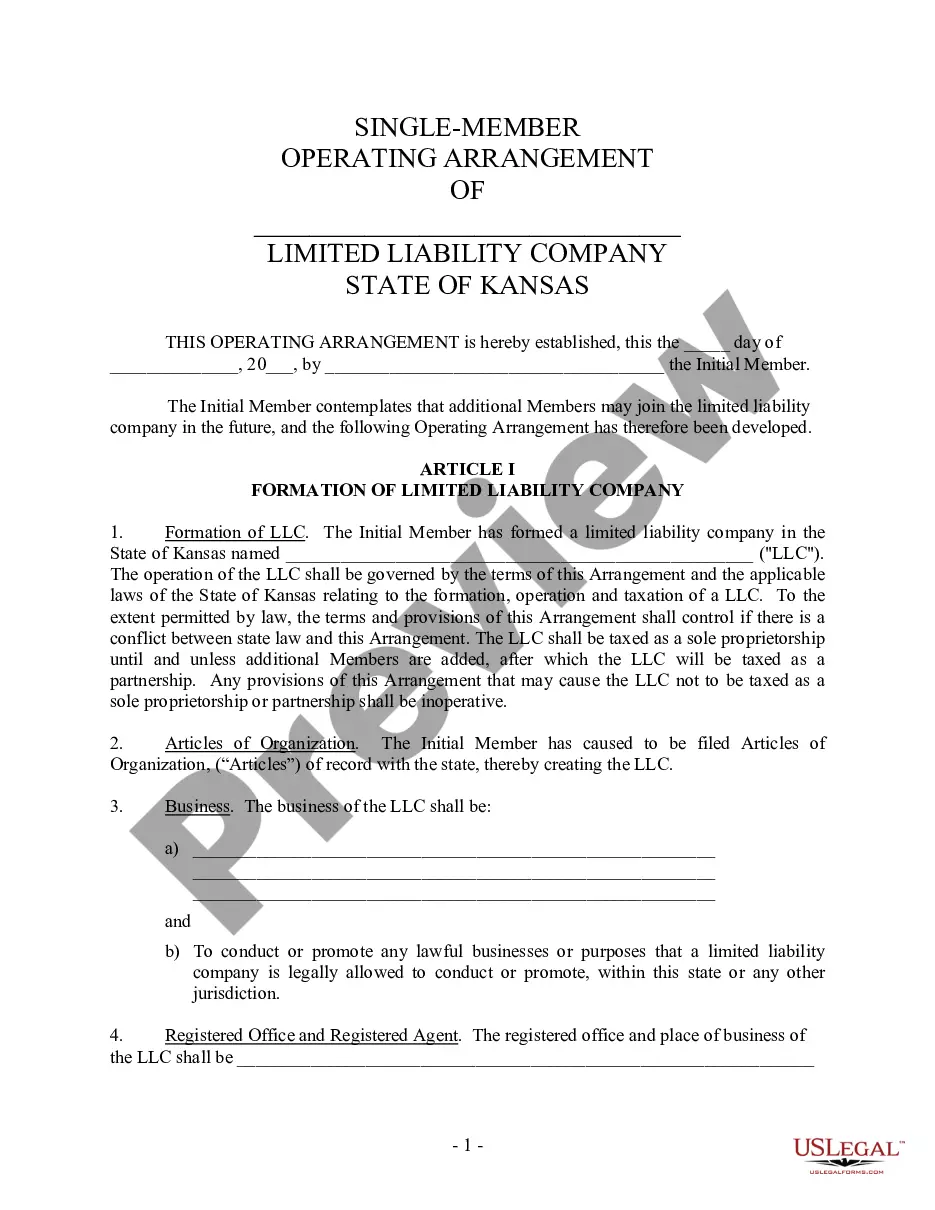

But even though an inactive LLC has no income or expenses for a year, it might still be required to file a federal income tax return.An LLC may be disregarded as an entity for tax purposes, or it may be taxed as a partnership or a corporation.

A separate legal entity created by a state filing. The S corporation is a corporation that has filed a special election with the IRS to be treated like a partnership (or LLC) for tax purposes. Therefore, S corporations are not subject to corporate income tax.

Since the federal government does not recognize an LLC as a classification for federal tax purposes, such entities must figure out how they should file their federal returns. Here are three of the most common questions about LLCs.

How much does it cost to form an LLC in Kansas? The Kansas Secretary of State charges $165 to file the Articles of Organization. You can reserve your LLC name with the Kansas Secretary of State for $30 when filing online or $35 when filing by mail.

LLCs are great because they are flexible when it comes to determining how you want to be taxed. You have the option of taxing your LLC like a sole proprietorship, a partnership or a corporation by filing the appropriate forms with the IRS.

A limited liability company (LLC) is not a separate tax entity like a corporation; instead, it is what the IRS calls a "pass-through entity," like a partnership or sole proprietorship.The LLC itself does not pay federal income taxes, although some states impose an annual tax on LLCs.

In addition to "president" and "CEO," common titles used by LLC chief executives are "principal," "founder," "consultant" and "owner." Along with being correct and true, these titles accurately represent your position in the company.

The President is essentially the highest ranking manager in the LLC. The Operating Agreement typically gives the President general management powers of the business of the LLC, as well as full power to open bank accounts. Other titles of LLC officers and managers are Secretary and Treasurer for example.