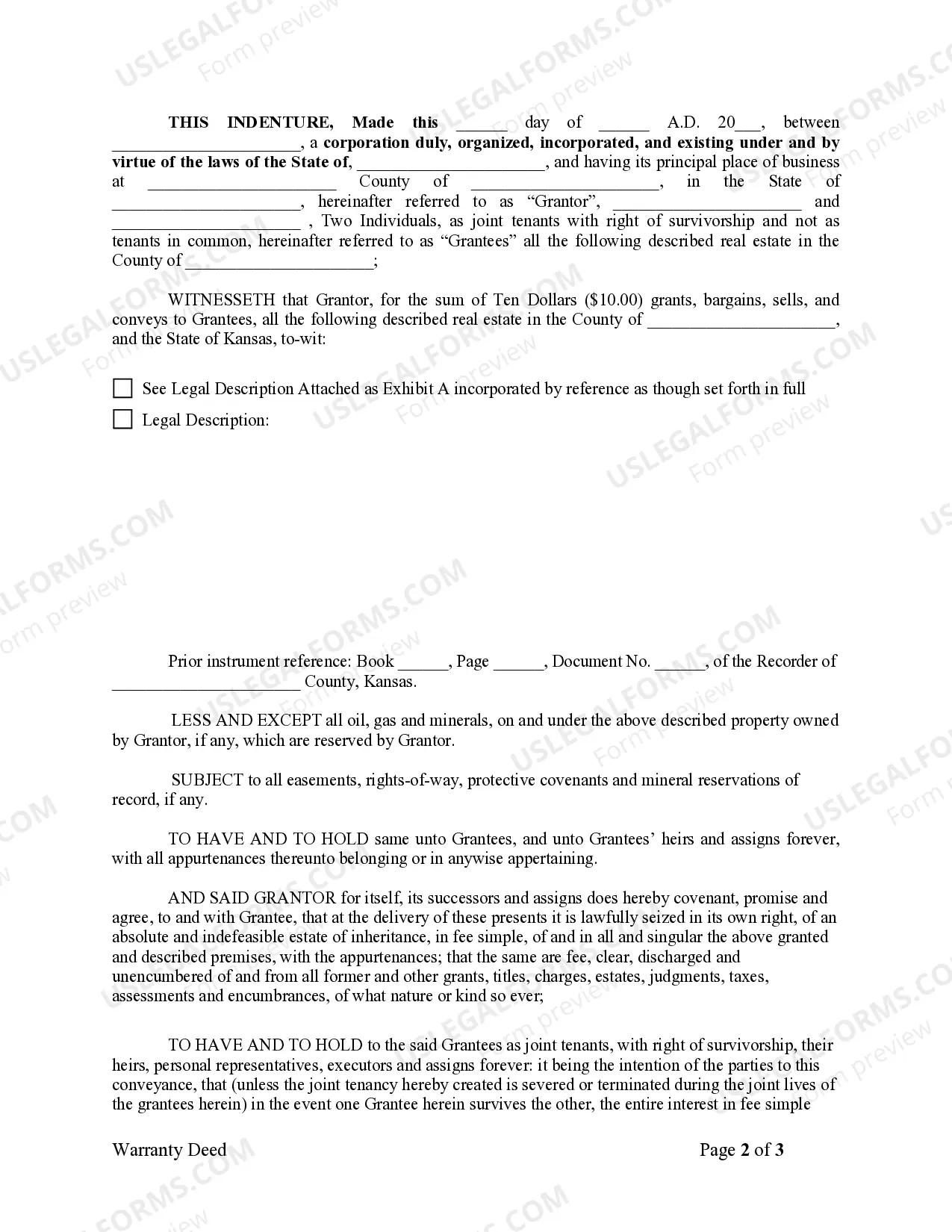

Kansas Warranty Deed from Corporation to Two Individuals

Description

How to fill out Kansas Warranty Deed From Corporation To Two Individuals?

In search of Kansas Warranty Deed from Corporation to Two Individuals templates and completing them can be a problem. To save time, costs and effort, use US Legal Forms and find the appropriate template specially for your state in a couple of clicks. Our attorneys draw up all documents, so you simply need to fill them out. It truly is so simple.

Log in to your account and come back to the form's web page and save the sample. All of your saved templates are stored in My Forms and are available at all times for further use later. If you haven’t subscribed yet, you need to register.

Have a look at our comprehensive guidelines on how to get the Kansas Warranty Deed from Corporation to Two Individuals template in a few minutes:

- To get an qualified sample, check out its validity for your state.

- Look at the sample using the Preview function (if it’s offered).

- If there's a description, read through it to know the details.

- Click Buy Now if you found what you're seeking.

- Choose your plan on the pricing page and make an account.

- Choose you would like to pay out by a card or by PayPal.

- Download the sample in the preferred format.

Now you can print the Kansas Warranty Deed from Corporation to Two Individuals template or fill it out utilizing any web-based editor. No need to concern yourself with making typos because your template may be utilized and sent, and printed out as many times as you want. Check out US Legal Forms and access to around 85,000 state-specific legal and tax files.

Form popularity

FAQ

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

Special warranties allow the transfer of property title between seller and buyer. The purchase of title insurance can mitigate the risk of prior claims to the special warranty deed.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

Yes you can. This is called a transfer of equity but you will need the permission of your lender. If you are not married or in a civil partnership you may wish to consider creating a deed of trust and a living together agreement which we can explain to you.

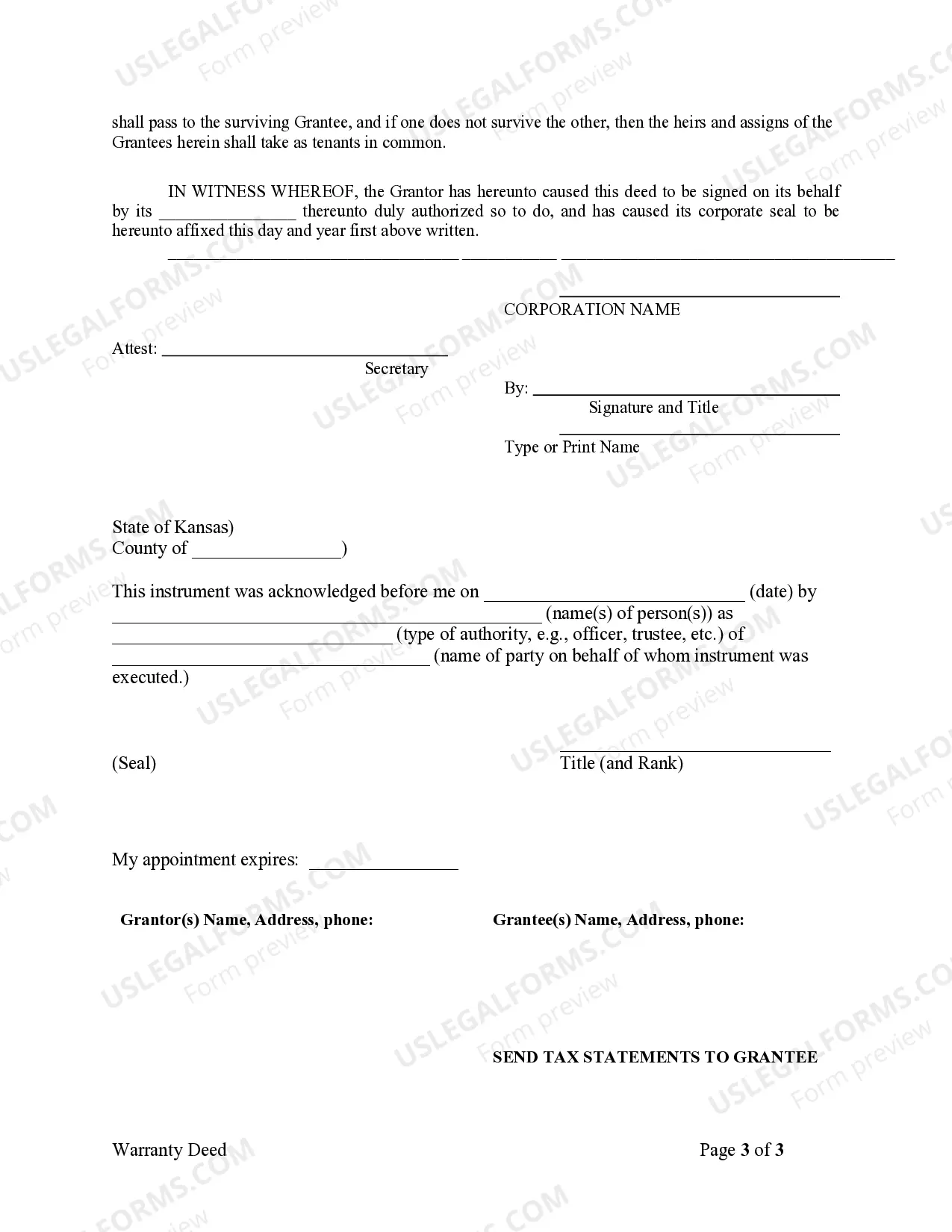

Contrary to normal expectations, the Deed DOES NOT have to be recorded to be effective or to show delivery, and because of that, the Deed DOES NOT have to be signed in front of a Notary Public. However, if you plan to record it, then it does have to be notarized as that is a County Recorder requirement.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

To add a co-owner, the bank would have to create a new home loan agreement, which must be registered after paying the due stamp duty and registration charges. The bank would also insist on making the co-owner a co-borrower in the home loan applicable.

Failure to record a deed effectively makes it impossible for the public to know about the transfer of a property. That means the legal owner of the property appears to be someone other than the buyer, a situation that can generate serious ramifications.

It is possible to be named on the title deed of a home without being on the mortgage. However, doing so assumes risks of ownership because the title is not free and clear of liens and possible other encumbrances. Free and clear means that no one else has rights to the title above the owner.