Kansas Warranty Deed from Husband and Wife to a Trust

Description

How to fill out Kansas Warranty Deed From Husband And Wife To A Trust?

Looking for Kansas Warranty Deed from Husband and Wife to a Trust sample and filling out them might be a problem. To save time, costs and energy, use US Legal Forms and choose the right sample specially for your state in just a couple of clicks. Our legal professionals draw up all documents, so you just need to fill them out. It truly is that simple.

Log in to your account and return to the form's web page and download the sample. All your downloaded samples are kept in My Forms and are accessible at all times for further use later. If you haven’t subscribed yet, you should sign up.

Have a look at our thorough recommendations concerning how to get the Kansas Warranty Deed from Husband and Wife to a Trust template in a couple of minutes:

- To get an eligible example, check out its validity for your state.

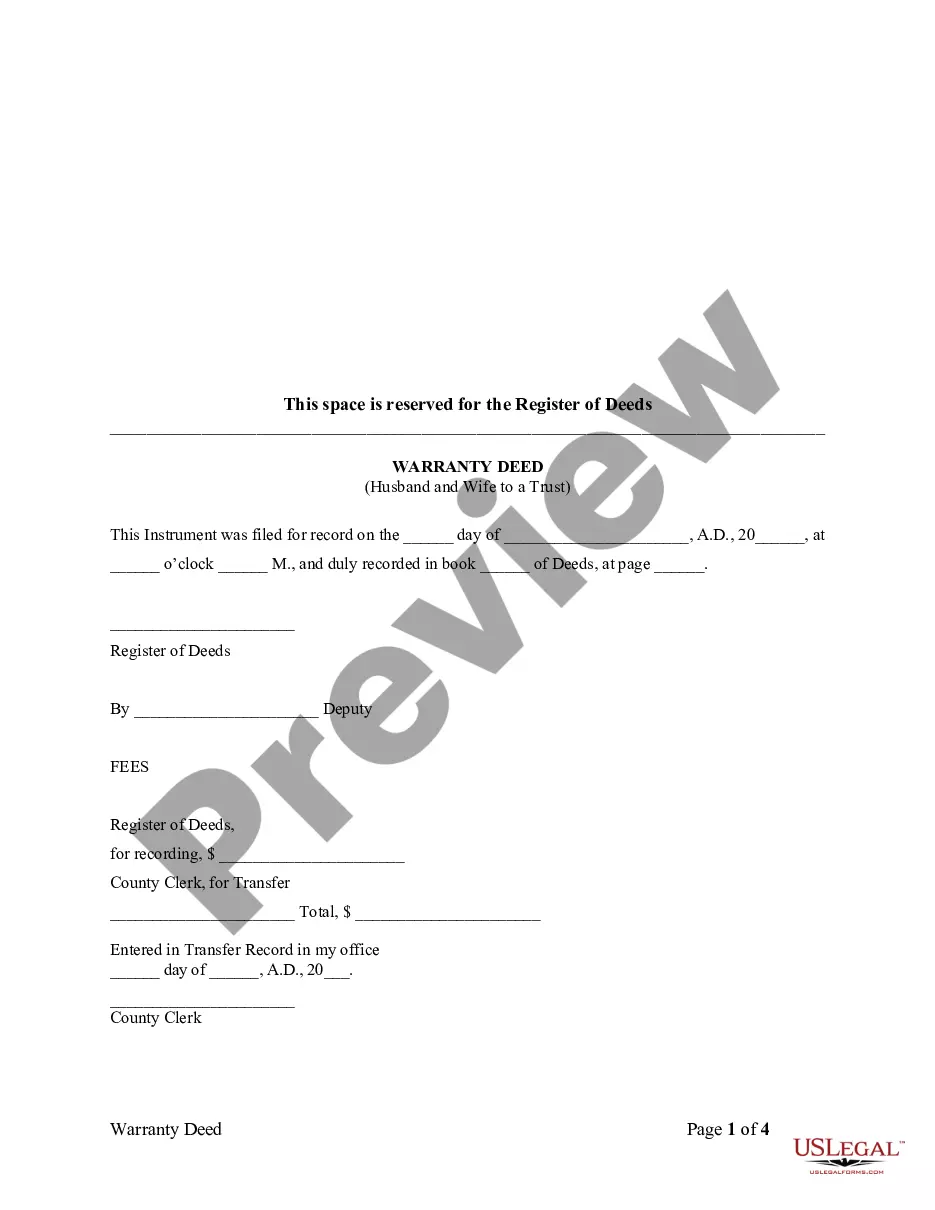

- Have a look at the example utilizing the Preview option (if it’s offered).

- If there's a description, go through it to understand the important points.

- Click on Buy Now button if you identified what you're seeking.

- Choose your plan on the pricing page and create an account.

- Select you wish to pay with a card or by PayPal.

- Save the form in the favored format.

Now you can print the Kansas Warranty Deed from Husband and Wife to a Trust form or fill it out using any online editor. No need to worry about making typos because your template may be used and sent away, and printed as often as you would like. Try out US Legal Forms and access to more than 85,000 state-specific legal and tax documents.

Form popularity

FAQ

A warranty deed is a legal document used to transfer, or convey, rights in real property from a grantor (seller) to a grantee (buyer). For Kansas residential property, the primary methods for holding title in co-ownership are tenancy in common and joint tenancy.

No. And unless the deed identifies the trust as an owner, then father is the owner of an interest. It is a common mistake to set up a trust and then fail to deed property into the trust. However, you cannot force him to make the changes you are...

In a Non-Warranty Deed, the seller gives no warranties.In a Non-Warranty or Quitclaim Deed, the seller merely is giving the buyer whatever rights, if any, that the seller has in the property and the seller makes no warranties of any nature about the seller's rights in the property.

The mortgage company usually prepares this deed as part of the loan package and delivers it to the title company for you to sign at closing. The title company is commonly the trustee to the deed and holds legal title to the property until the loan gets fully repaid.

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee). The deed protects the buyer by pledging that the seller holds clear title to the property and there are no encumbrances, outstanding liens, or mortgages against it.

Let's start with the definition of a deed: DEED: A written instrument by which one party, the Grantor, conveys the title of ownership in property to another party, the Grantee. A Warranty Deed contains promises, called covenants, that the Grantor makes to the Grantee.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

What Is the Difference Between a Warranty Deed & a Survivorship Deed?A warranty deed is the most comprehensive and provides the most guarantees. Survivorship isn't so much a deed as a title. It's a way to co-own property where, upon the death of one owner, ownership automatically passes to the survivor.

Yes, a quit claim deed supercedes the trust. The only thing that can be done is to file a suit in court challenging the deed as the product of fraud and undue influence. A court action like that will cost thousands of dollars, but might be worth it if the house was owned free and clear.