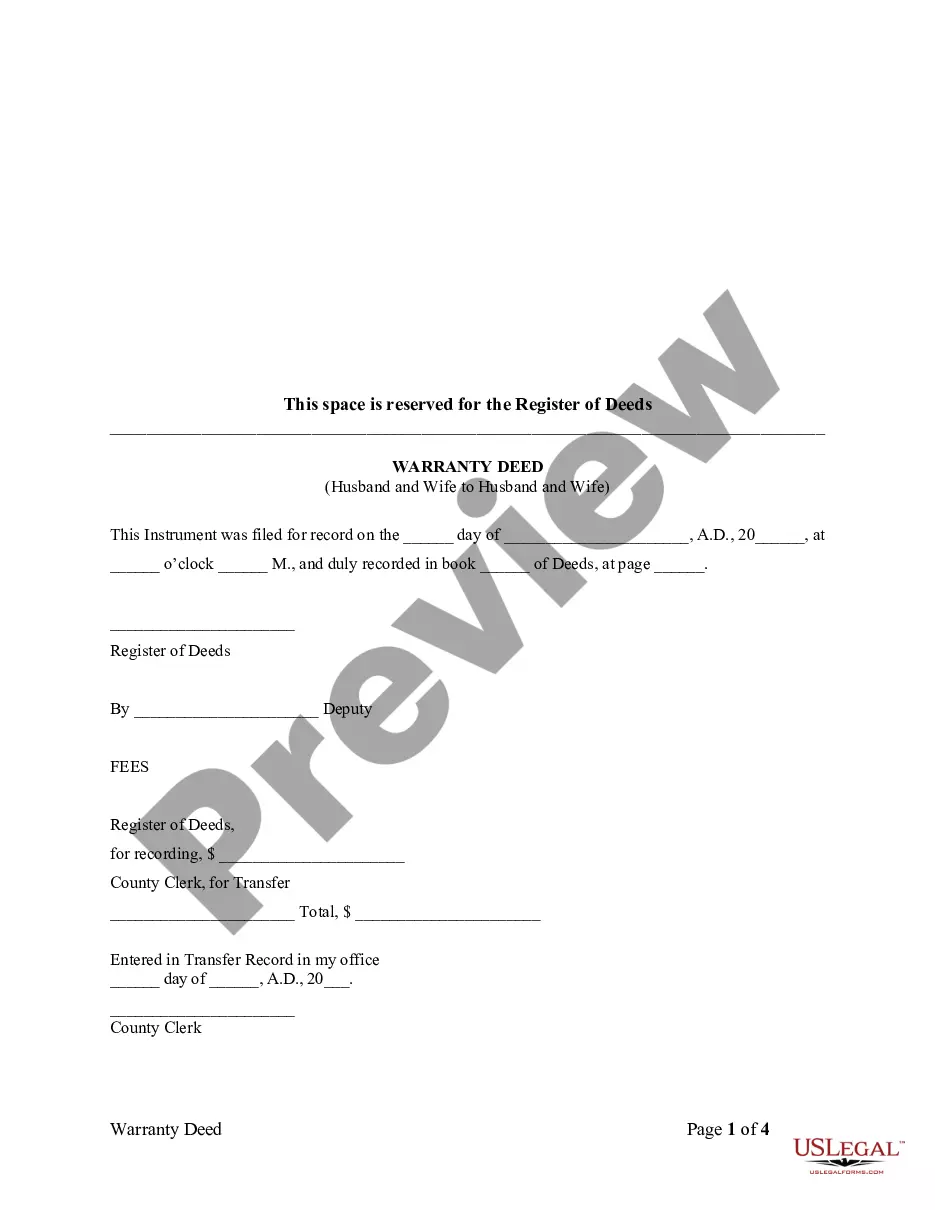

Kansas Warranty Deed from Husband and Wife to Husband and Wife

Description

How to fill out Kansas Warranty Deed From Husband And Wife To Husband And Wife?

Searching for Kansas Warranty Deed from Husband and Wife to Husband and Wife sample and filling out them could be a challenge. In order to save time, costs and effort, use US Legal Forms and choose the right sample specially for your state in just a few clicks. Our attorneys draft all documents, so you just need to fill them out. It truly is so simple.

Log in to your account and return to the form's page and download the document. All your downloaded templates are saved in My Forms and therefore are accessible at all times for further use later. If you haven’t subscribed yet, you need to sign up.

Take a look at our comprehensive guidelines regarding how to get the Kansas Warranty Deed from Husband and Wife to Husband and Wife form in a couple of minutes:

- To get an qualified form, check out its validity for your state.

- Look at the sample utilizing the Preview function (if it’s accessible).

- If there's a description, read it to learn the details.

- Click on Buy Now button if you found what you're looking for.

- Pick your plan on the pricing page and create an account.

- Pick how you would like to pay by way of a credit card or by PayPal.

- Download the form in the favored format.

You can print the Kansas Warranty Deed from Husband and Wife to Husband and Wife form or fill it out making use of any web-based editor. No need to concern yourself with making typos because your form may be employed and sent away, and printed out as many times as you want. Try out US Legal Forms and access to more than 85,000 state-specific legal and tax documents.

Form popularity

FAQ

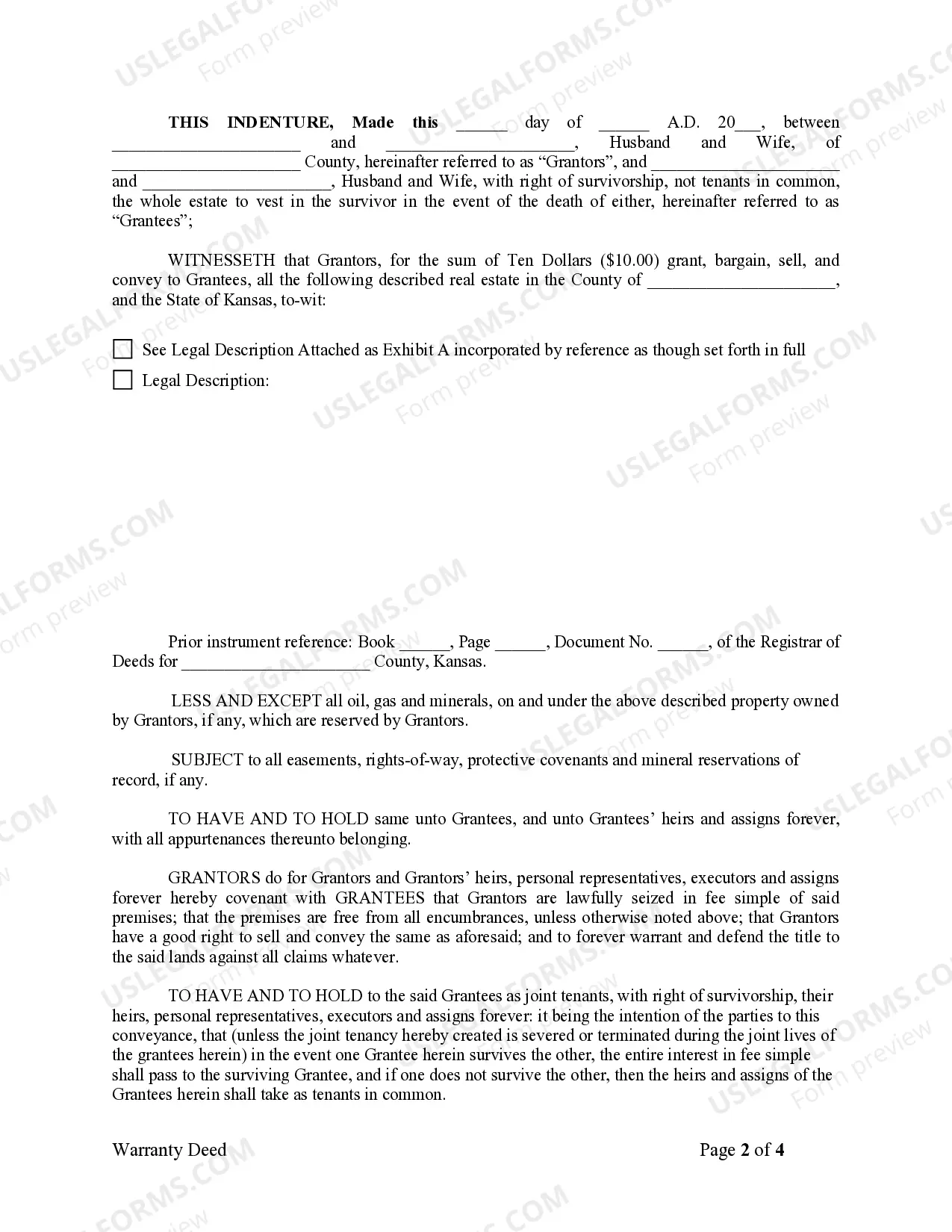

A In order to make your partner a joint owner you will need to add his name at the Land Registry, for which there is a fee of £280 (assuming you transfer half the house to him). You won't, however, have to pay capital gains tax, as gifts between civil partners (and spouses) are tax free.

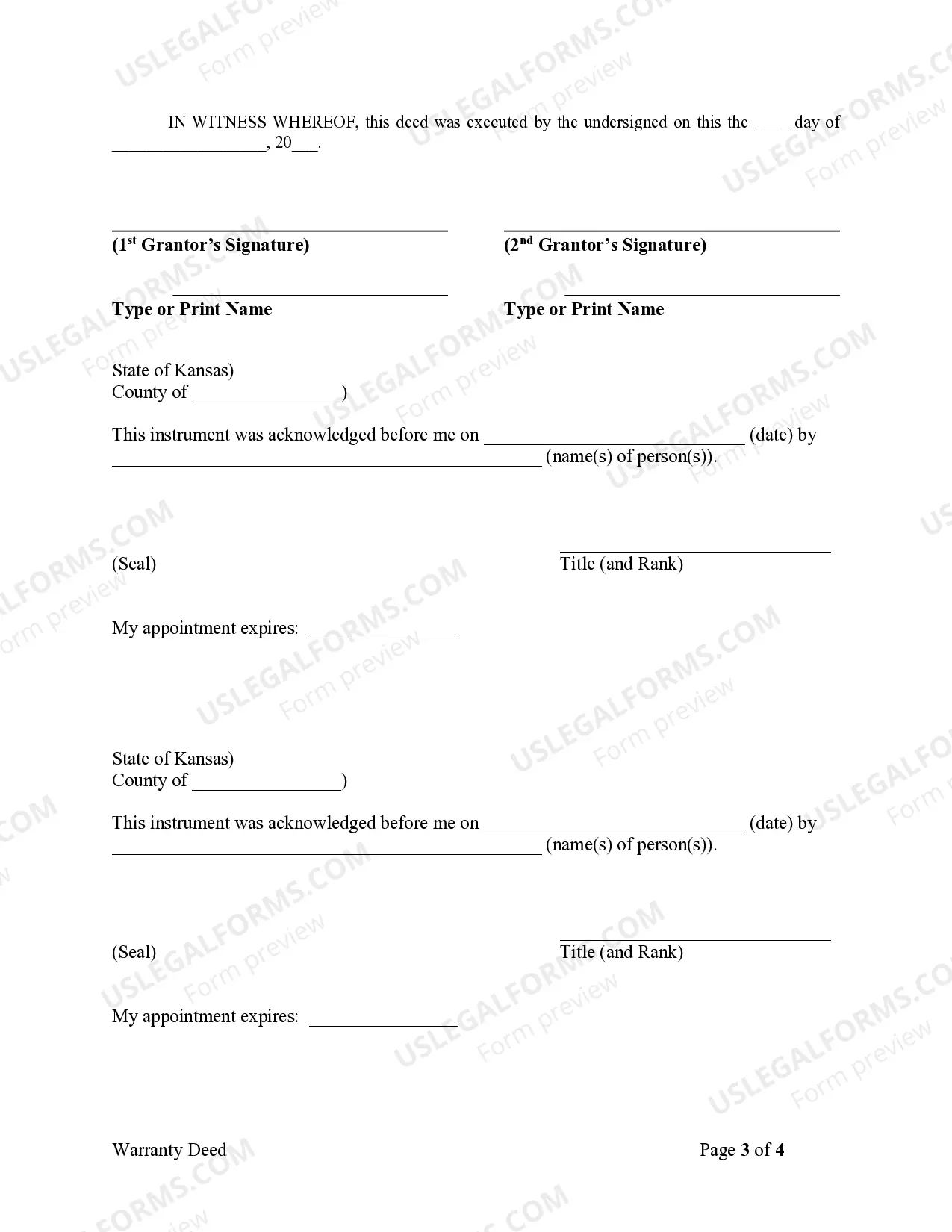

Recording A quitclaim deed must be filed with the County Recorder's Office where the real estate is located. Go to your County Website to locate the office nearest you. Signing (§ 58-2205) A quitclaim deed is required to be authorized with a notary public present.

If you live in a common-law state, you can keep your spouse's name off the title the document that says who owns the property.You can put your spouse on the title without putting them on the mortgage; this would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.

You can transfer the property from your sole and separate property to mutual tenancy, such as joint tenants with right of survivorship, with your wife.The two other easy ways to transfer property into your wife's name, which is by grant deed or quitclaim deed, don't automatically trigger tax exemptions.

An interspousal transfer deed can be useful when one spouse has poor credit, and the couple wants to refinance their home. To receive a better mortgage interest rate, the couple may decide to use an interspousal transfer deed to transfer title to their home to the spouse with better credit.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

You can gift property to spouse, child or any relative and register the same. Under section 122 of the Transfer of Property Act, 1882, you can transfer immovable property through a gift deed. The deed should contain your details as well as those of the recipient.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.