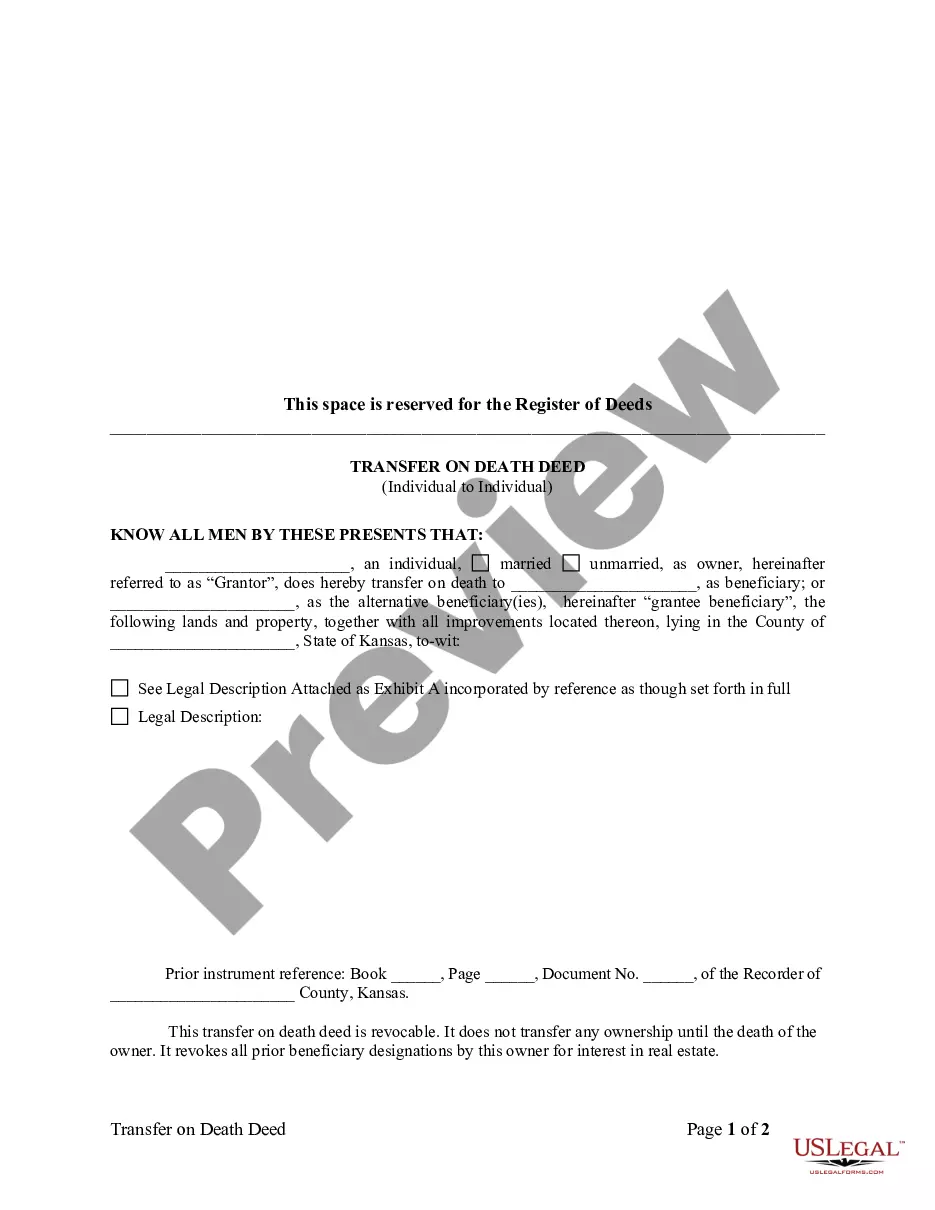

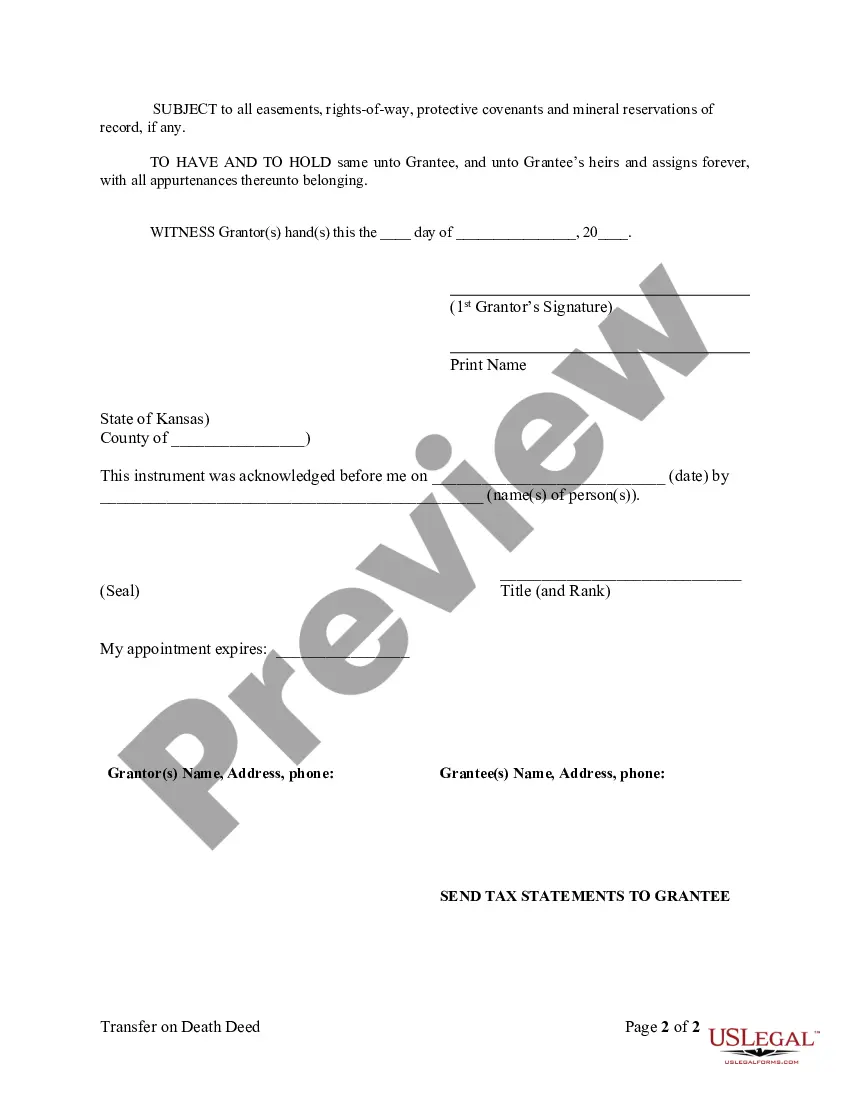

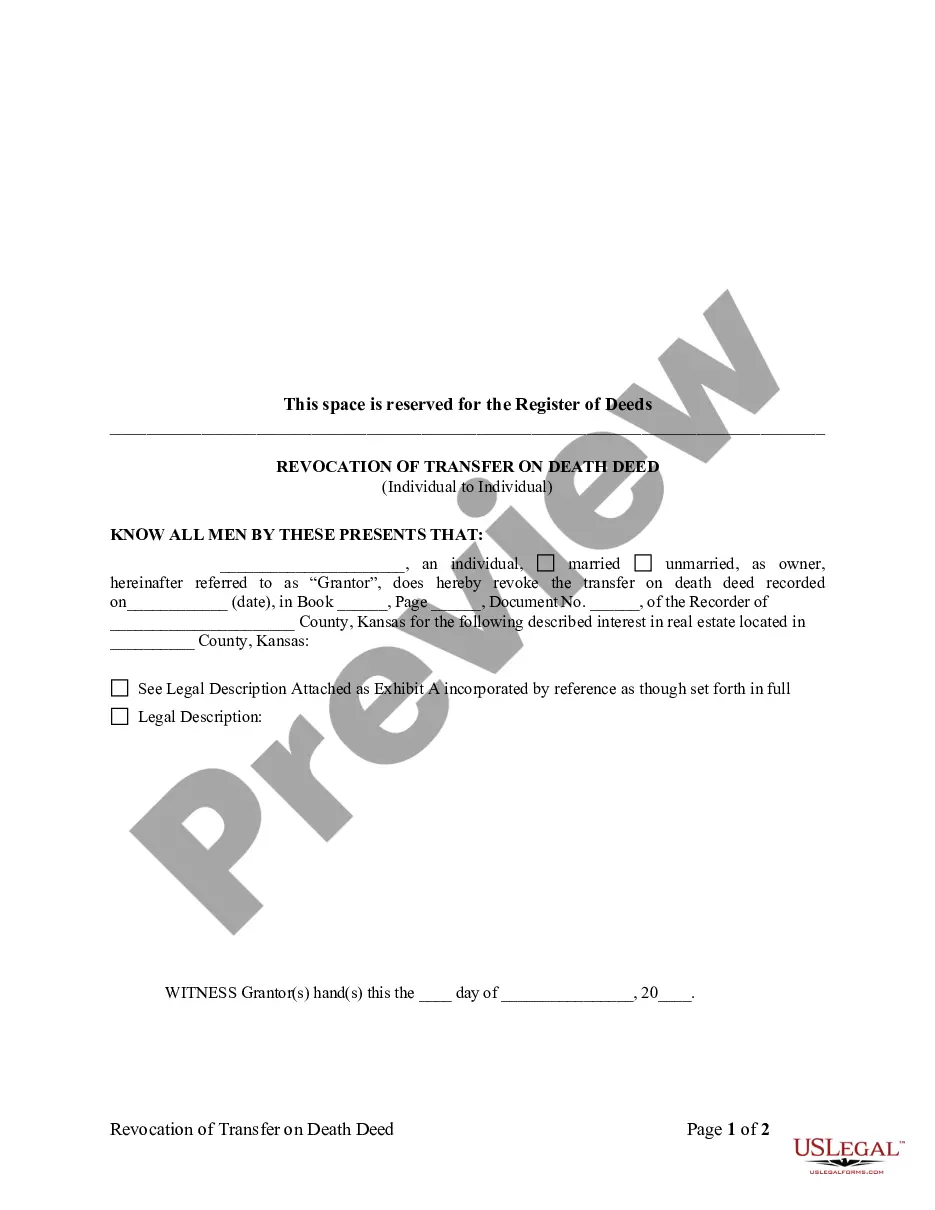

Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual

Description Kansas Unemployment Application

How to fill out Transfer Deed Tod?

Searching for Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual sample and filling out them might be a challenge. To save time, costs and energy, use US Legal Forms and find the correct example specially for your state in a couple of clicks. Our lawyers draft every document, so you simply need to fill them out. It truly is that simple.

Log in to your account and return to the form's page and save the document. All your saved examples are saved in My Forms and are accessible at all times for further use later. If you haven’t subscribed yet, you need to sign up.

Look at our detailed guidelines regarding how to get your Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual template in a few minutes:

- To get an entitled sample, check its validity for your state.

- Look at the sample making use of the Preview option (if it’s offered).

- If there's a description, read it to understand the specifics.

- Click Buy Now if you found what you're searching for.

- Pick your plan on the pricing page and create your account.

- Pick how you want to pay with a card or by PayPal.

- Save the sample in the preferred format.

Now you can print the Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual template or fill it out making use of any online editor. No need to worry about making typos because your template may be employed and sent away, and printed as many times as you want. Try out US Legal Forms and get access to more than 85,000 state-specific legal and tax documents.

Transfer On Death Form Form popularity

Death Deed Tod Other Form Names

Deed Tod Beneficiary FAQ

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

Receiving an inheritance can be an unexpected windfall. In fact, transfer on death accounts are exposed to all the same income and capital gains taxes when the account owner is alive, as well as estate and inheritance taxes upon the owner's death.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

A transfer on death deed (TOD) lets a property owner pass land or real estate to a designated beneficiary outside of the probate process. A transfer on death deed can be a helpful estate planning tool but it is not permitted in every state.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

A transfer on death (TOD) account automatically transfers its assets to a named beneficiary when the holder dies For example, if you have a savings account with $100,000 in it and name your son as its beneficiary, that account would transfer to him upon your death.

Transfer on death applies to certain assets that have a named beneficiary. The beneficiaries (or a spouse) receive the assets without having to go through probate. Beneficiaries of the TOD don't have access to the assets prior to the owner's death.