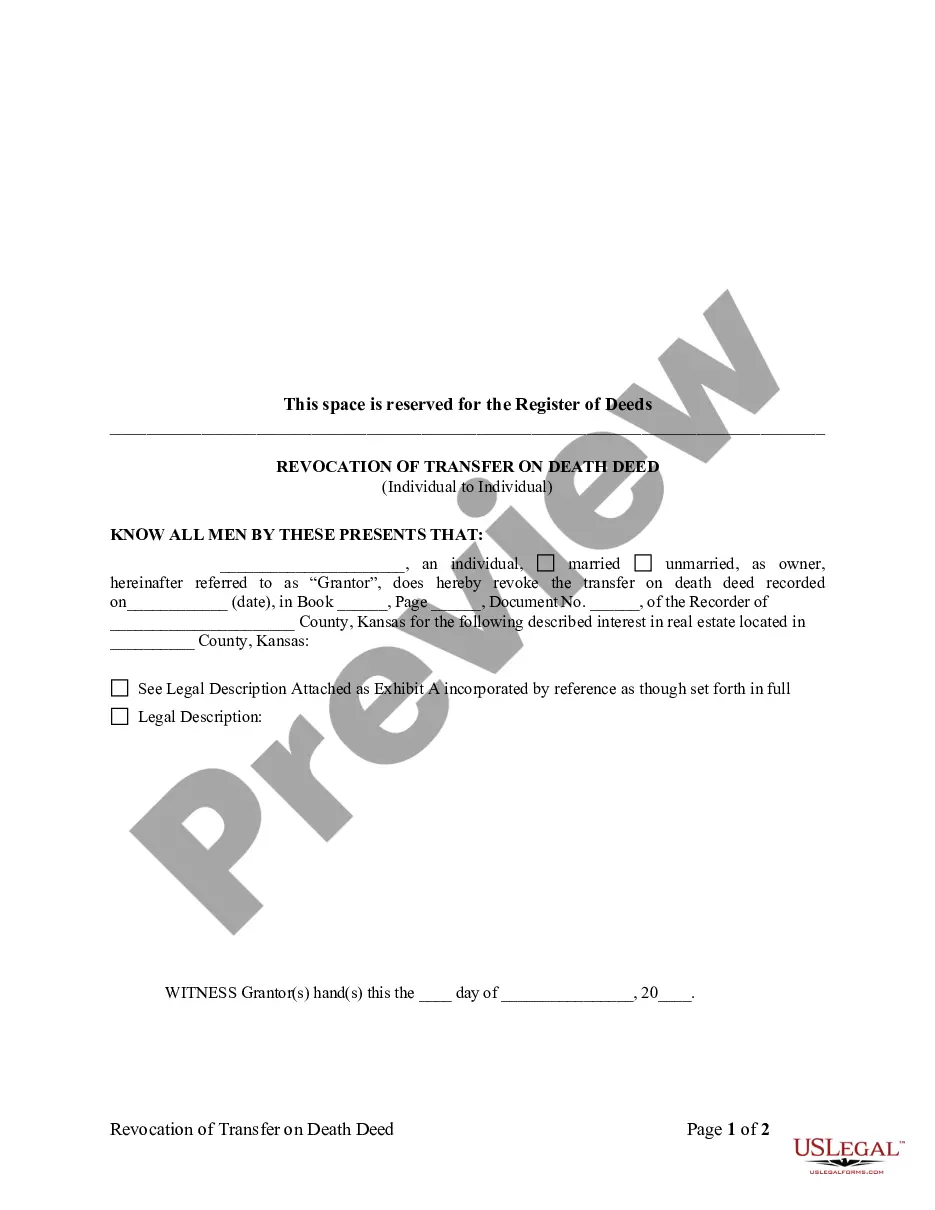

Revocation of Transfer on Death Deed - Beneficiary Deed for Individual to Individual

Kansas Statutes

Chapter 59. � PROBATE CODE

Article 35. � TRANSFER-ON-DEATH

59-3501. Real estate; transfer-on-death.

(a) An interest in real estate may be titled in transfer-on-death, TOD,

form by recording a deed signed by the record owner of such interest,

designating a grantee beneficiary or beneficiaries of the interest. Such

deed shall transfer ownership of such interest upon the death of the owner.

A transfer-on-death deed need not be supported by consideration.

(b) The signature, consent or agreement of or notice to a grantee

beneficiary of a transfer-on-death deed shall not be required for any

purpose during the lifetime of the record owner.

History: L. 1997, ch. 176, § 1; July 1.

59-3502. Same; filing of form with register of deeds.

An interest in real estate is titled in transfer-on-death form by executing, acknowledging and recording in the office of the register of

deeds in the county where the real estate is located, prior to the death of

the owner, a deed in substantially the following form:

___(Name of owner)___ as owner transfers on death to ___(name of beneficiary)___, as grantee beneficiary, the following described interest

in real estate: (here insert description of the interest in real estate).

THIS TRANSFER ON DEATH DEED IS REVOCABLE. IT DOES NOT TRANSFER ANY

OWNERSHIP UNTIL THE DEATH OF THE OWNER. IT REVOKES ALL PRIOR BENEFICIARY

DESIGNATIONS BY THIS OWNER FOR THIS INTEREST IN REAL ESTATE.

Instead of the words "transfer-on-death" the abbreviation "TOD" may be used.

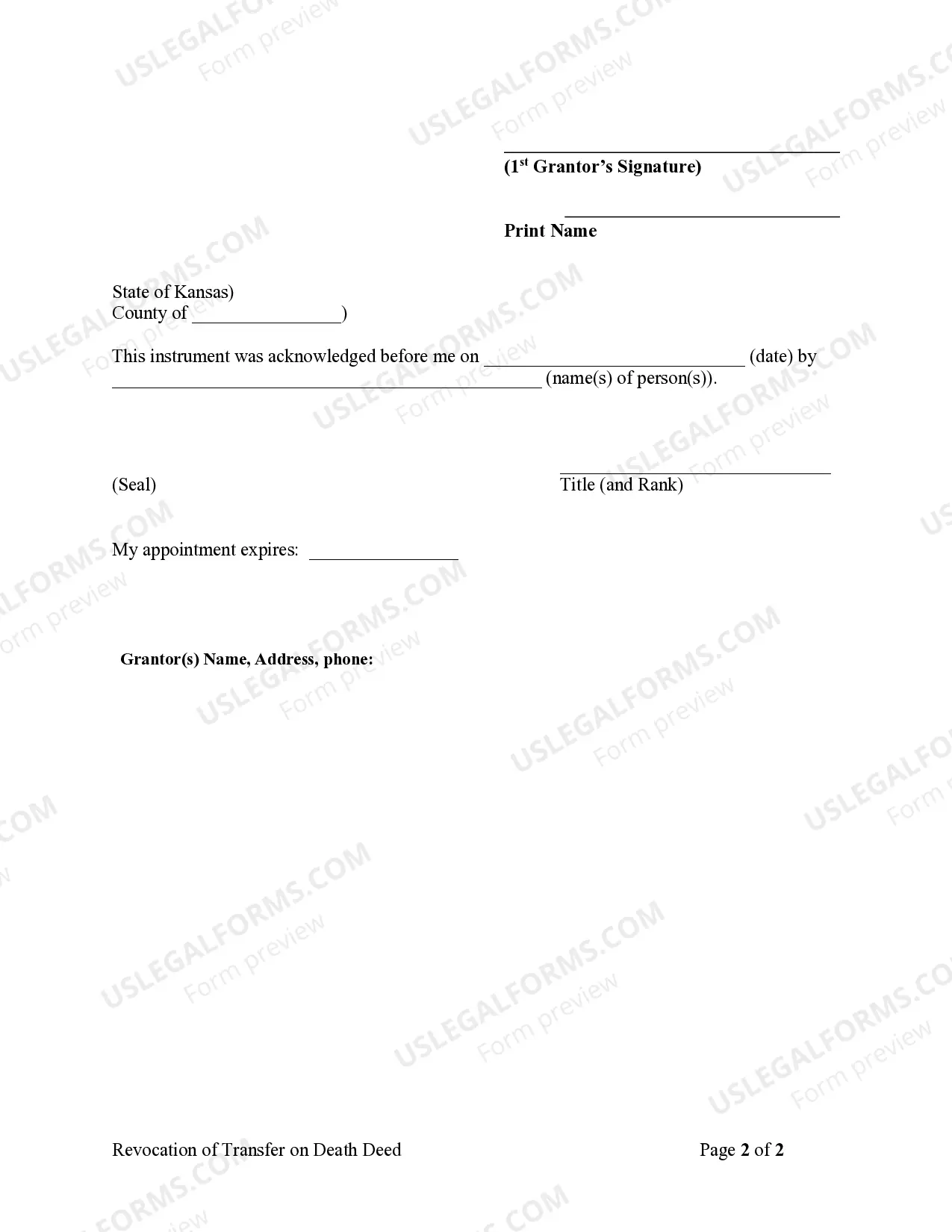

59-3503. Same; beneficiary; revocation; change; revocation by will, prohibited.

(a) A designation of the grantee beneficiary may be revoked at any time prior to the death of the record owner, by executing, acknowledging and recording in the office of the register of deeds in the county where the

real estate is located an instrument describing the interest revoking the

designation. The signature, consent or agreement of or notice to the

grantee beneficiary or beneficiaries is not required.

(b) A designation of the grantee beneficiary may be changed at any time prior to the death of the record owner, by executing, acknowledging and recording a subsequent transfer-on-death deed in accordance with K.S.A.

59-3502. The signature, consent or agreement of or notice to the grantee

beneficiary or beneficiaries is not required. A subsequent

transfer-on-death beneficiary designation revokes all prior designations

of grantee beneficiary or beneficiaries by such record owner for such

interest in real estate.

(c) A transfer-on-death deed executed, acknowledged and recorded in accordance with this act may not be revoked by the provisions of a will.

59-3504. Same; vesting of ownership in beneficiary; grantee beneficiary.

(a) Title to the interest in real estate recorded in transfer-on-death form shall vest in the designated grantee beneficiary or beneficiaries on the death of the record owner.

(b) Grantee beneficiaries of a transfer-on-death deed take the record owner's interest in the real estate at death subject to all conveyances, assignments, contracts, mortgages, liens and security pledges made by the record owner or to which the record owner was subject during the record owner's lifetime including, but not limited to, any executory contract of sale, option to purchase, lease, license, easement, mortgage, deed of trust or lien, claims of the state of Kansas for medical assistance, as defined in K.S.A. 39-702, and amendments thereto, pursuant to subsection (g)(2) of K.S.A. 39-709, and amendments thereto, and to any interest conveyed by the record owner that is less than all of the record owner's interest in the property.

(c) If a grantee beneficiary dies prior to the death of the record owner and an alternative grantee beneficiary has not been designated on the deed, the transfer shall lapse.

History: L. 1997, ch. 176, § 4; July 1.

59-3505. Same; joint owner.

(a) A record joint owner of an interest in real estate may use the procedures in this act to title such interest in transfer-on-death form.

However, title to such interest shall vest in the designated grantee

beneficiary or beneficiaries only if such record joint owner is the last to

die of all of the record joint owners of such interest. A deed in

transfer-on-death form shall not sever a joint tenancy.

(b) As used in this section, "joint owner" means a person who owns an interest in real estate as a joint tenant with right of survivorship.

History: L. 1997, ch. 176, § 5; July 1.

59-3506. Same; application of 58-2414 to grantor.

The provisions of K.S.A. 58-2414, and amendments thereto, apply to the grantor of a transfer-on-death deed.

History: L. 1997, ch. 176, § 6; July 1.

59-3507. Same; nontestamentary disposition.

A deed in transfer-on-death form shall not be considered a testamentary disposition and shall not be invalidated due to nonconformity with the provisions of chapter 59 of the Kansas Statutes Annotated.

History: L. 1997, ch. 176, § 7; July 1.