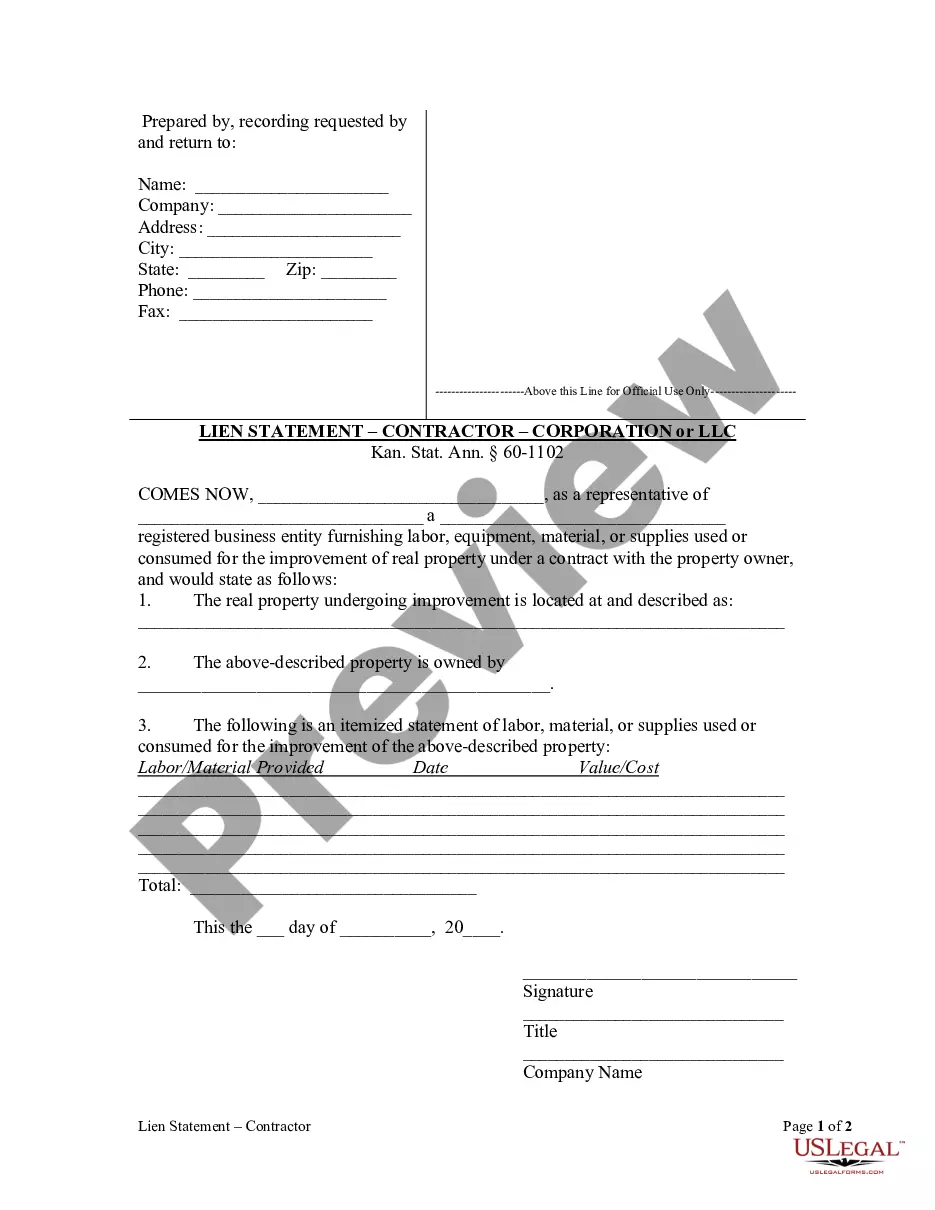

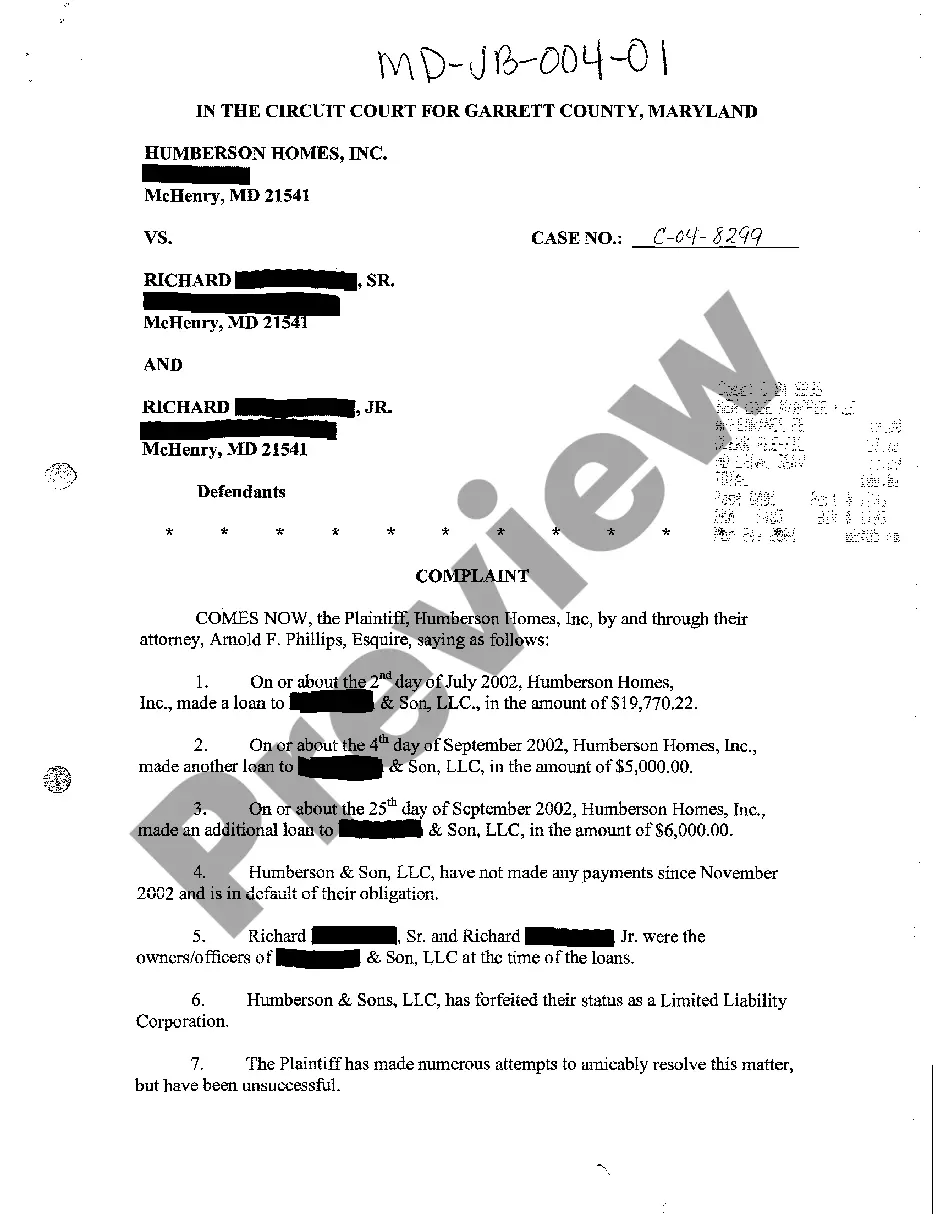

Kansas law makes a distinction between the lien statement to be filed by a contractor and a subcontractor. Both lien statements serve to inform the property owner that a lien is being claimed against his property for labor or materials provided. A contractor must file his lien statement within four months after the date the last labor was performed or material furnished.

Kansas Lien Statement by Contractor as Corporation or LLC

Description Limited Liability Company Application

How to fill out Kansas Lien Buy?

In search of Kansas Lien Statement by Contractor as Corporation templates and completing them can be a challenge. To save time, costs and effort, use US Legal Forms and find the correct example specially for your state within a few clicks. Our legal professionals draw up each and every document, so you just need to fill them out. It is really that easy.

Log in to your account and come back to the form's page and download the sample. Your downloaded examples are saved in My Forms and therefore are available all the time for further use later. If you haven’t subscribed yet, you should register.

Take a look at our comprehensive recommendations concerning how to get the Kansas Lien Statement by Contractor as Corporation form in a few minutes:

- To get an entitled form, check its applicability for your state.

- Take a look at the sample using the Preview function (if it’s available).

- If there's a description, go through it to learn the important points.

- Click on Buy Now button if you identified what you're seeking.

- Select your plan on the pricing page and create an account.

- Select you want to pay out by way of a card or by PayPal.

- Save the sample in the preferred format.

Now you can print the Kansas Lien Statement by Contractor as Corporation template or fill it out making use of any web-based editor. Don’t worry about making typos because your form may be employed and sent away, and published as often as you wish. Try out US Legal Forms and access to around 85,000 state-specific legal and tax files.

Kansas Limited Liability Company Form popularity

Limited Liability Company Agreement Other Form Names

Ks Statement Contractor FAQ

A mortgage creates a lien on your property that gives the lender the right to foreclose and sell the home to satisfy the debt. A deed of trust (sometimes called a trust deed) is also a document that gives the lender the right to sell the property to satisfy the debt should you fail to pay back the loan.

Once the first lienholder has been paid off, they may submit their lien release electronically (if they are members of the KS E-Lien system), or by providing it to the owner who will then submit it to the local county treasurer's office or fax it to the Titles and Registrations Bureau at 785-296-2383.

While it's unlikely that just anyone can put a lien on your home or land, it's not unheard of for a court decision or a settlement to result in a lien being placed against a property.

If you want to place a lien on a commercial rental property and you are not the landlord, you may need to put a lien on the property by filing with the court of record in the jurisdiction where the property is actually located.

2. States where the lien law doesn't require a written contract. In these states, contractors and suppliers are generally allowed to file a lien even if they don't have a written contract.These states typically permit parties with verbal, oral, or even implied contracts to claim lien rights.

The lien can be released on the title, a notarized lien release, Form TR-150, or a letter from the lienholder releasing the lien. If the title for the vehicle was issued from another state (not a Kansas title) or the Bill of Sale is from an out of state owner, a vehicle inspection is required.

If the vehicle owner wishes to remove a lien holder's name from a registration receipt, an application for reissued title must be made at the local county treasurer's motor vehicle office. Bring the notarized lien release and a title will be requested and mailed to you within 5 to 7 days.

The release of lien for an electronic title may be accomplished by providing this completed form to the person who satisfied the lien, purchased the vehicle, or requested the release, and/or by faxing it to the Title & Registration Bureau at (785) 296-2383 or e-mail to KDOR_TR@ks.gov.

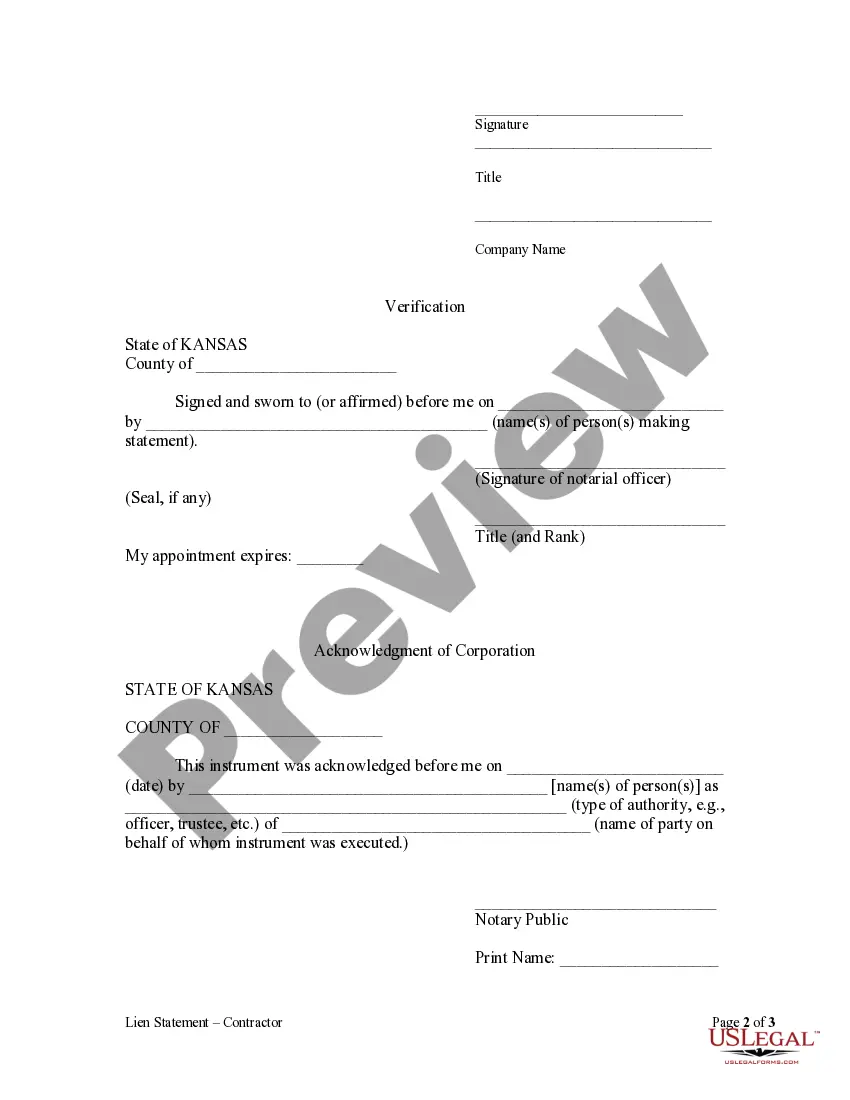

Prepare lien form, taking care to include the necessary information as set forth above, and sign the document with the verification statement. Send the original notarized copy to the office of the clerk of the district court of the county in which property is located.