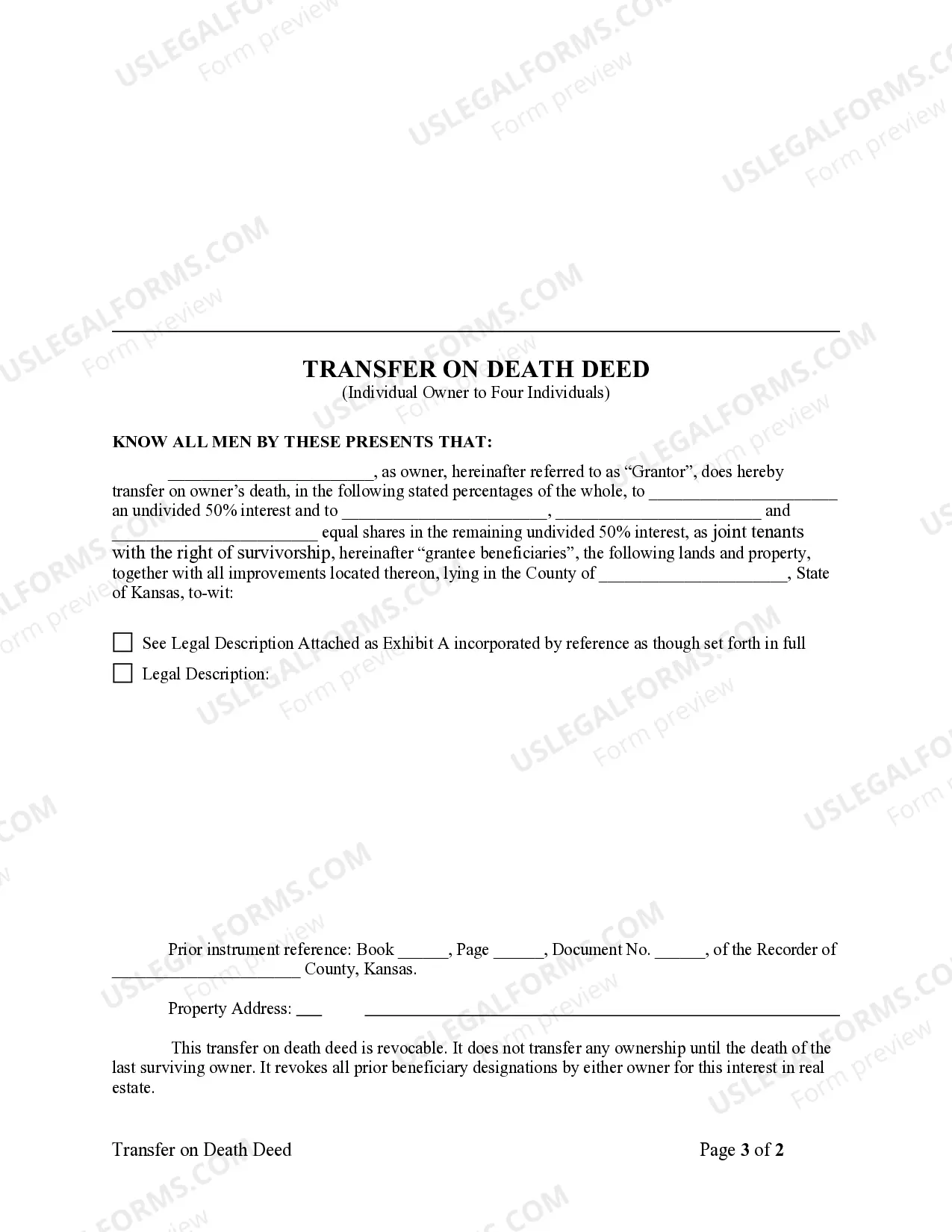

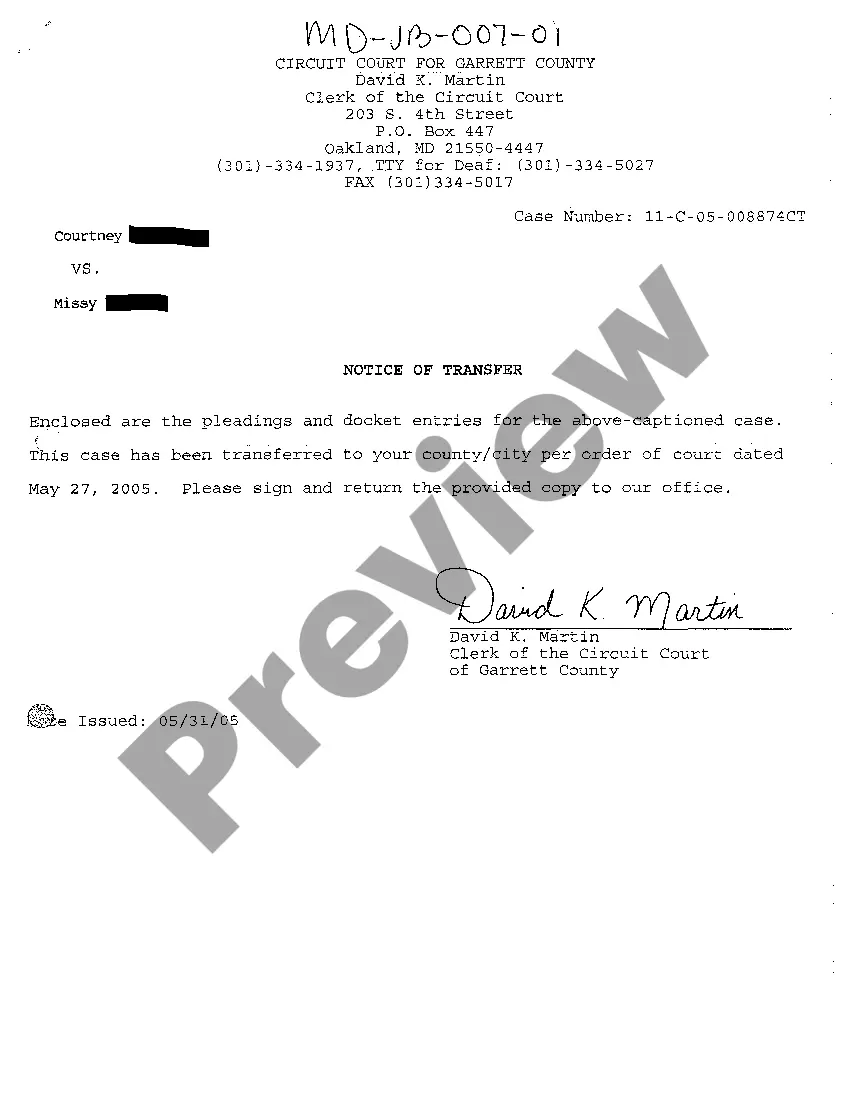

This form is a Transfer on Death Deed where the Owner is an individual and the beneficiaries are four individuals. One beneficiary takes a 50% interest and the remaining 50% interest goes to the remaining three beneficiaries in equal shares. This transfer is revocable by Owner/Grantor until death and effective only upon the death of the Owner/Grantor. The grantees take the property as tenants in common. This deed complies with all state statutory laws.

Kansas Transfer on Death Deed - Individual to Four Individuals in Stated Shares - TOD

Description Kansas Tod Deed

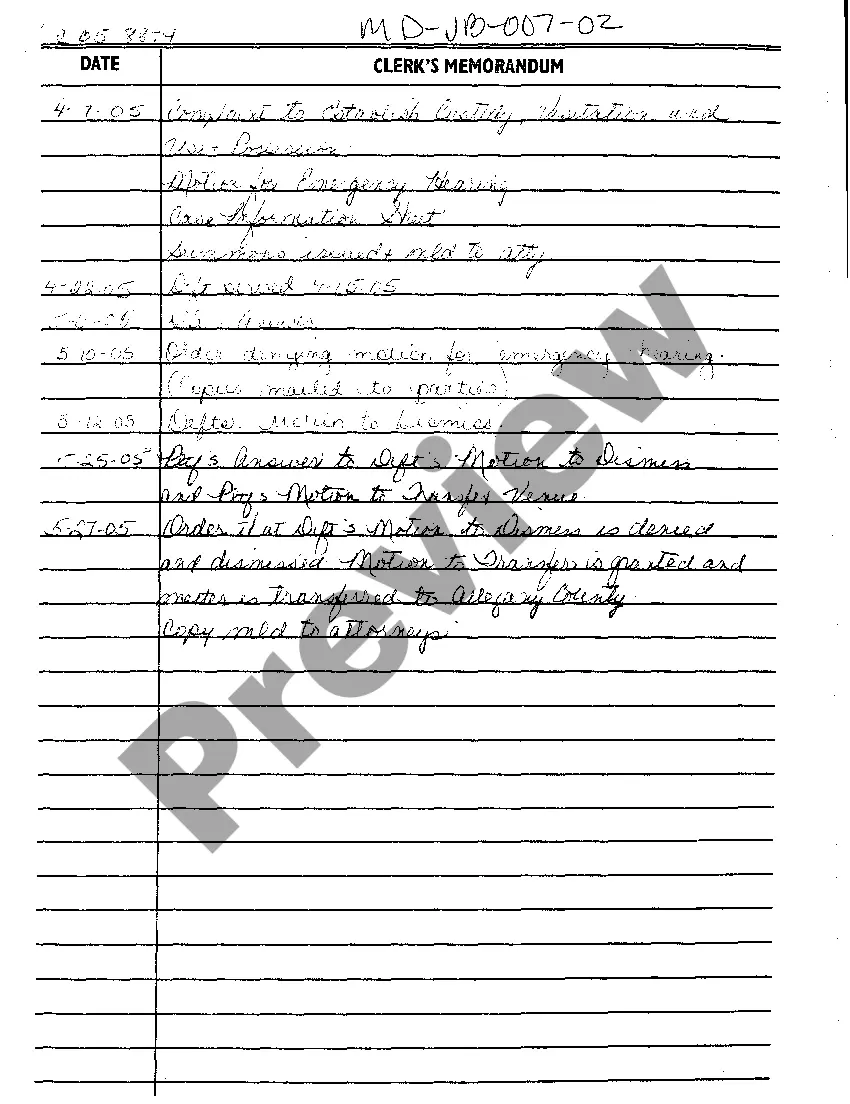

How to fill out Transfer Death Deed Document?

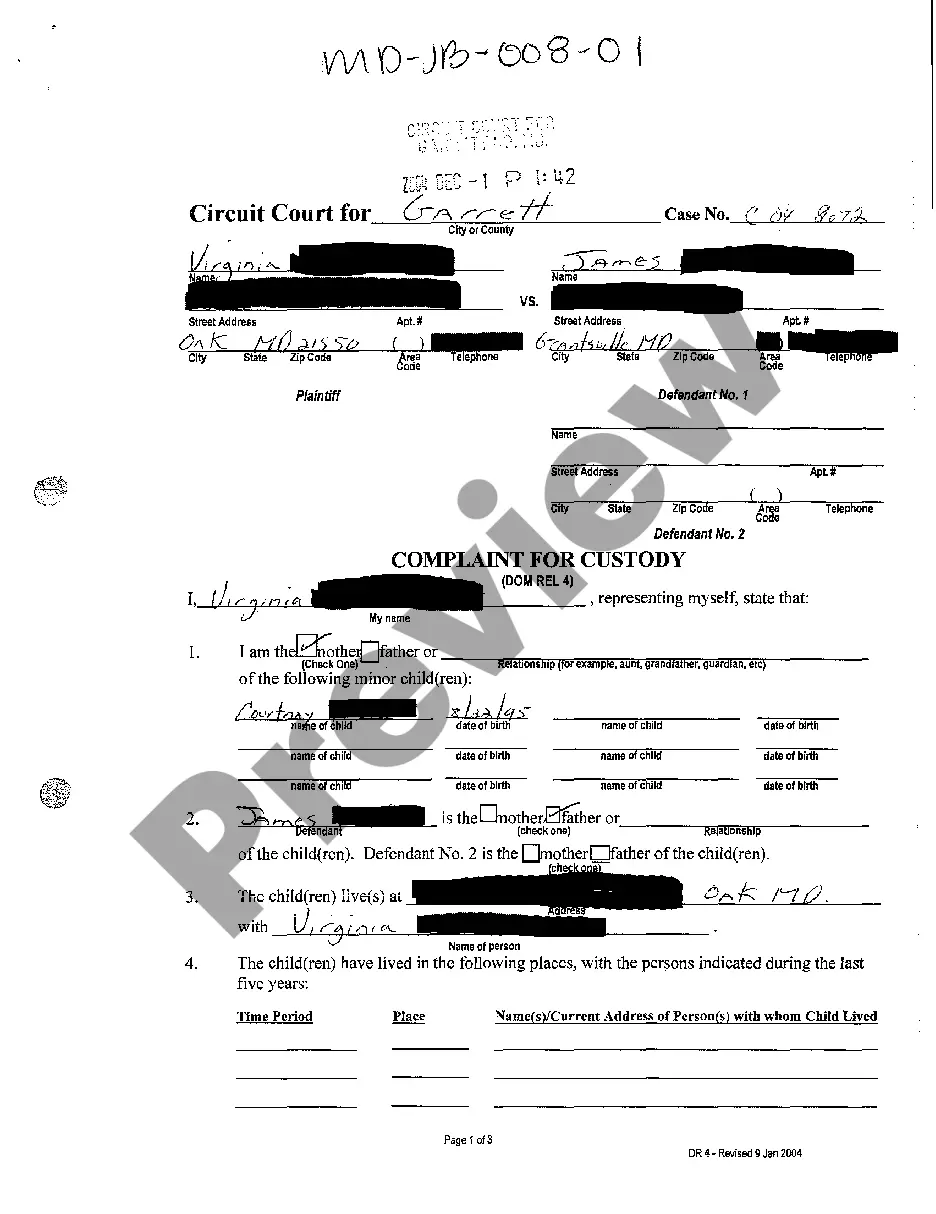

Searching for Kansas Transfer on Death Deed - Individual to Four Individuals in Stated Shares - TOD templates and filling out them can be a problem. To save lots of time, costs and energy, use US Legal Forms and find the right sample specifically for your state in a few clicks. Our attorneys draw up all documents, so you simply need to fill them out. It is really that simple.

Log in to your account and come back to the form's page and save the sample. All of your downloaded templates are stored in My Forms and are accessible always for further use later. If you haven’t subscribed yet, you have to sign up.

Look at our detailed recommendations on how to get the Kansas Transfer on Death Deed - Individual to Four Individuals in Stated Shares - TOD form in a couple of minutes:

- To get an eligible form, check out its validity for your state.

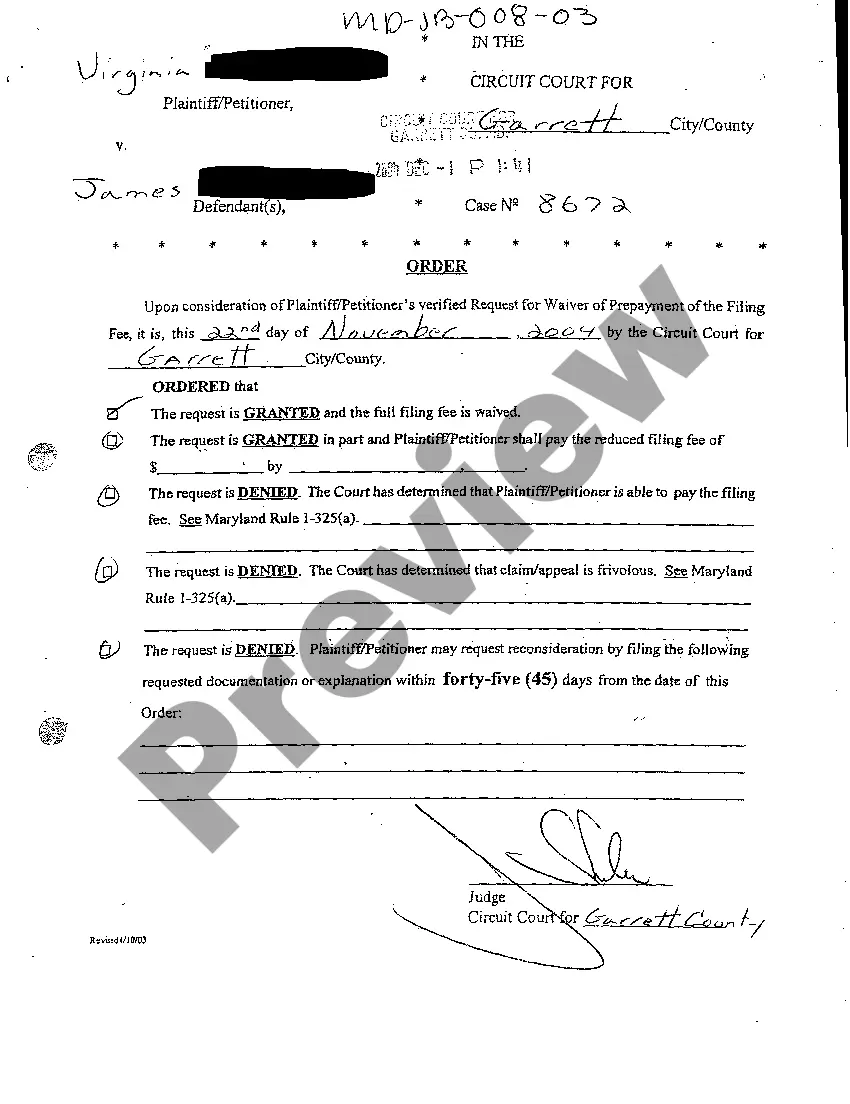

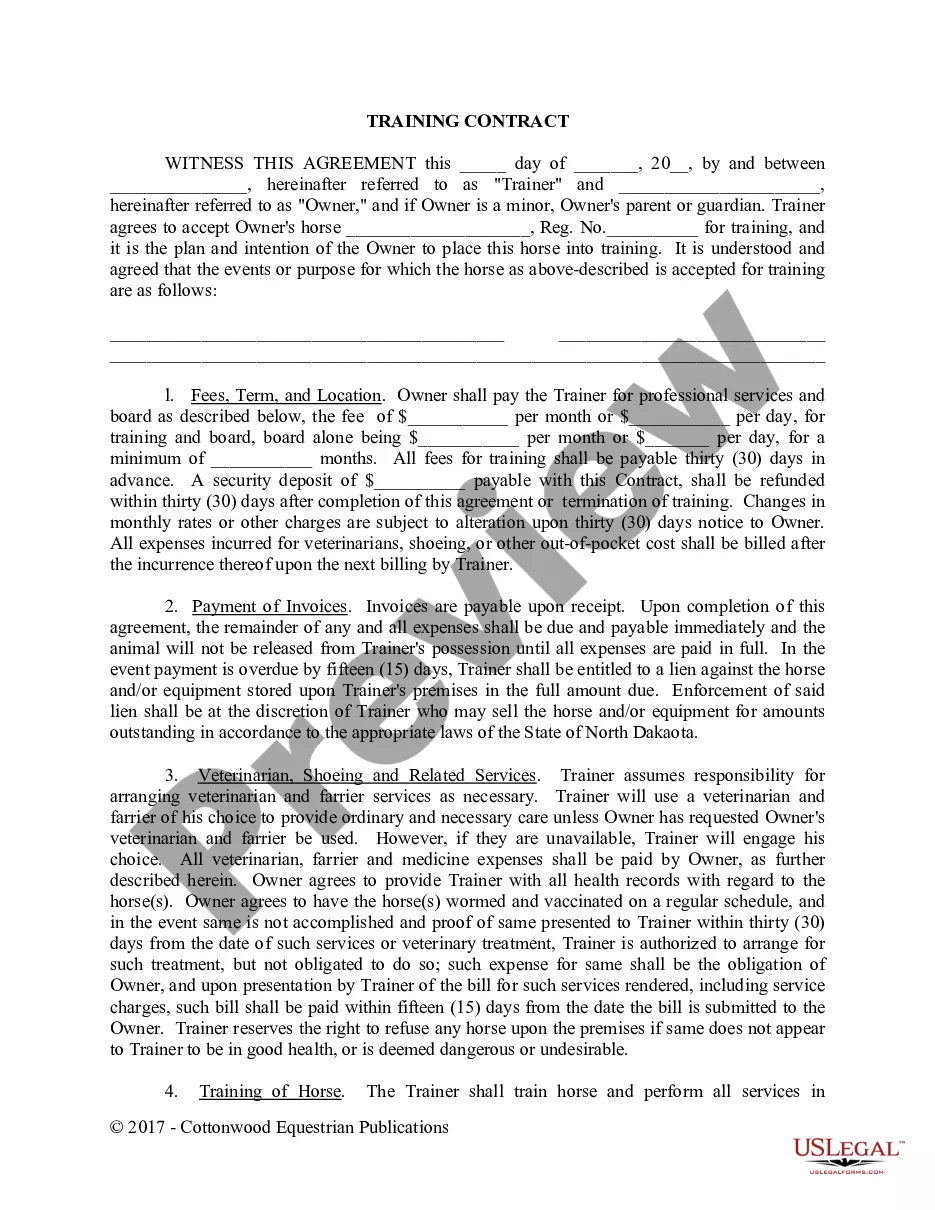

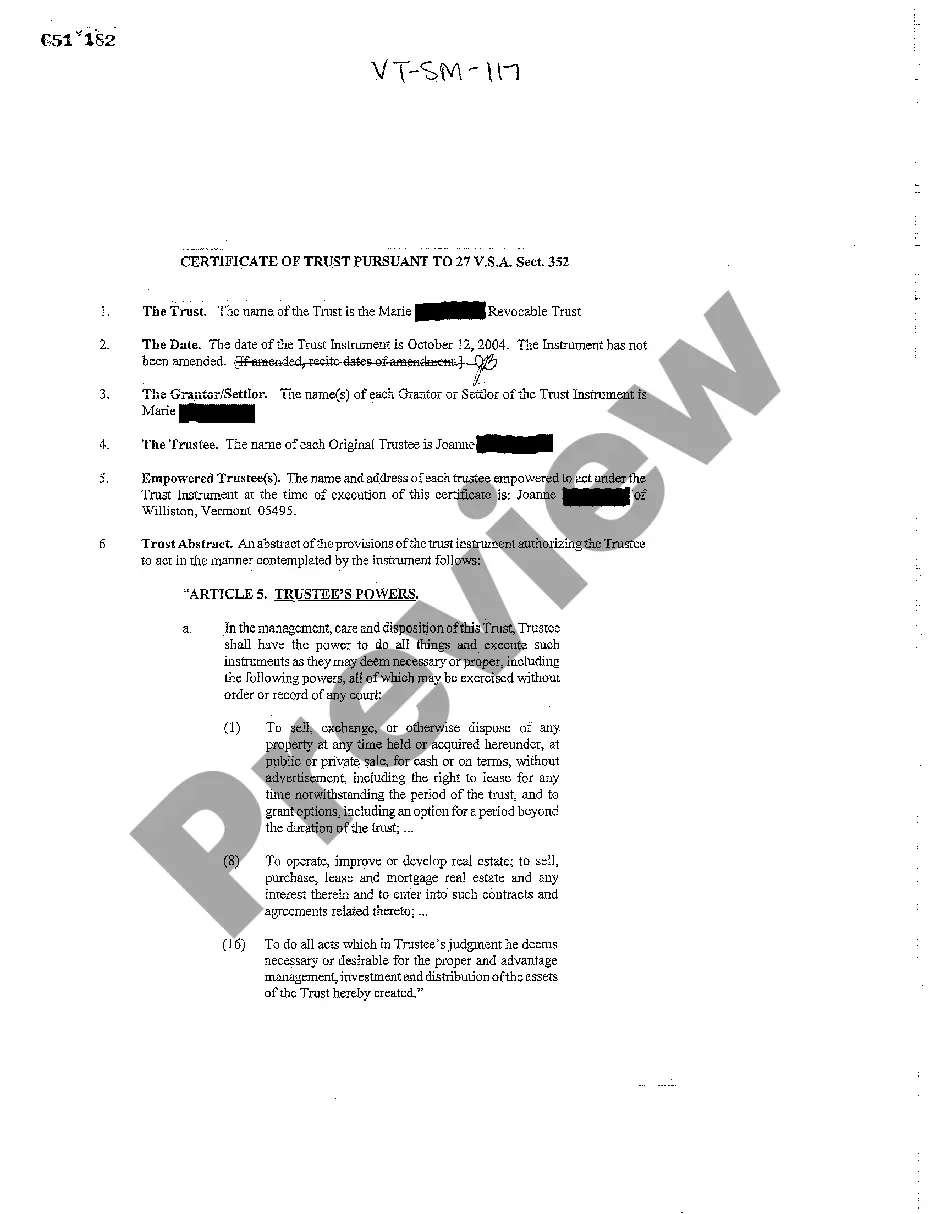

- Look at the sample making use of the Preview option (if it’s available).

- If there's a description, read through it to know the details.

- Click Buy Now if you identified what you're searching for.

- Select your plan on the pricing page and make your account.

- Pick how you wish to pay out with a card or by PayPal.

- Save the form in the preferred file format.

Now you can print the Kansas Transfer on Death Deed - Individual to Four Individuals in Stated Shares - TOD template or fill it out utilizing any online editor. Don’t worry about making typos because your sample may be employed and sent, and printed out as many times as you would like. Try out US Legal Forms and get access to over 85,000 state-specific legal and tax files.

Tod Deed Form Kansas Form popularity

What Is Individual Tod Other Form Names

Kansas Transfer Death FAQ

On a nonretirement account, designating a beneficiary or beneficiaries establishes a transfer on death (TOD) registration for the account. For an individual account, a TOD registration generally allows ownership of the account to be transferred to the designated beneficiary upon your death.

You can sidestep probate entirely by naming a beneficiary on stocks. Beneficiaries can be individuals or organizations like charities. To name a beneficiary for stocks, you must register the shares in what is known as transfer-on-death form.

TOD account holders can name multiple beneficiaries and divide assets any way they like.However, the beneficiaries have no access or rights to a TOD account while its owner is alive. Those beneficiaries can also be changed at any time, so long as the TOD account holder is deemed mentally competent.

An account holder may choose to list both of their children as equal beneficiaries. However, an account holder can also choose to list individuals in unequal amounts. For example, you could designate a primary beneficiary to receive 50 percent of the funds and two secondary beneficiaries who receive 25 percent each.

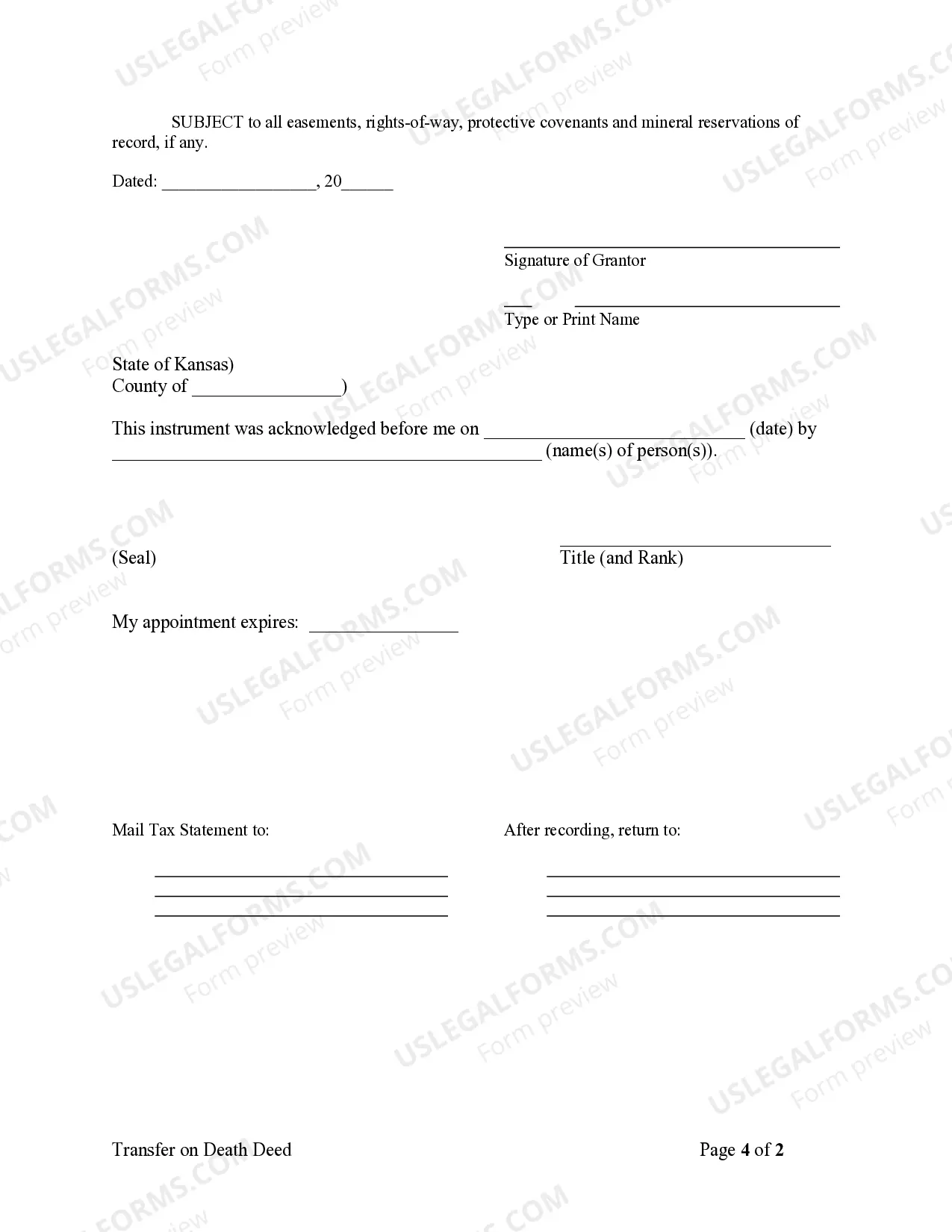

Get a Deed Form or Prepare Your Own. You can buy a state-specific TOD deed form for your state or type up your own document. Name the Beneficiary. Describe the Property. Sign the Deed. Record the Deed.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

Accounts or assets with named beneficiaries may be transferred without going through the probate process.If there is a TOD on the account, the assets will only go to the beneficiary if both joint owners pass away. In either case, the asset will not likely go through probate.

All you need to do is fill out a simple form, provided by the bank, naming the person you want to inherit the money in the account at your death. As long as you are alive, the person you named to inherit the money in a payable-on-death (POD) account has no rights to it.