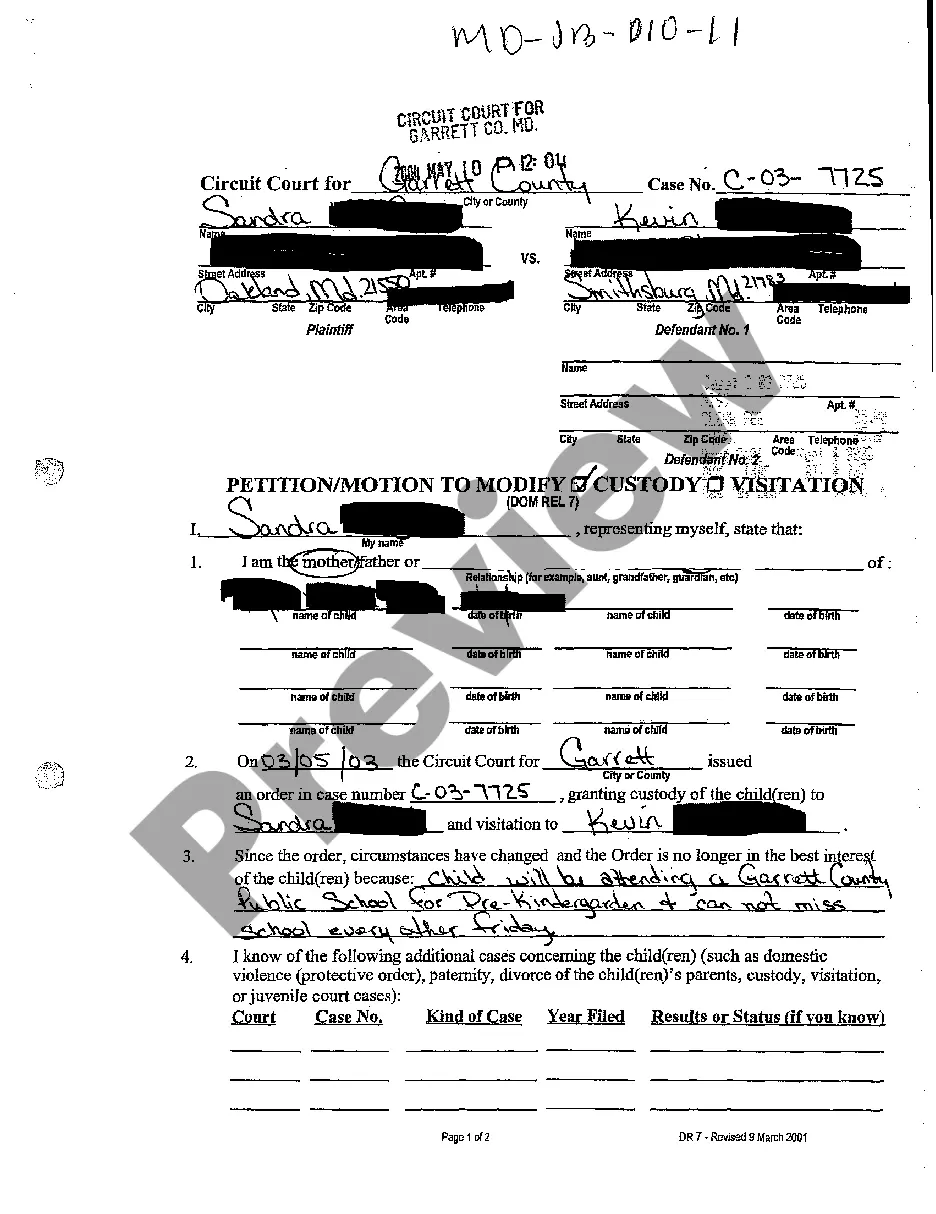

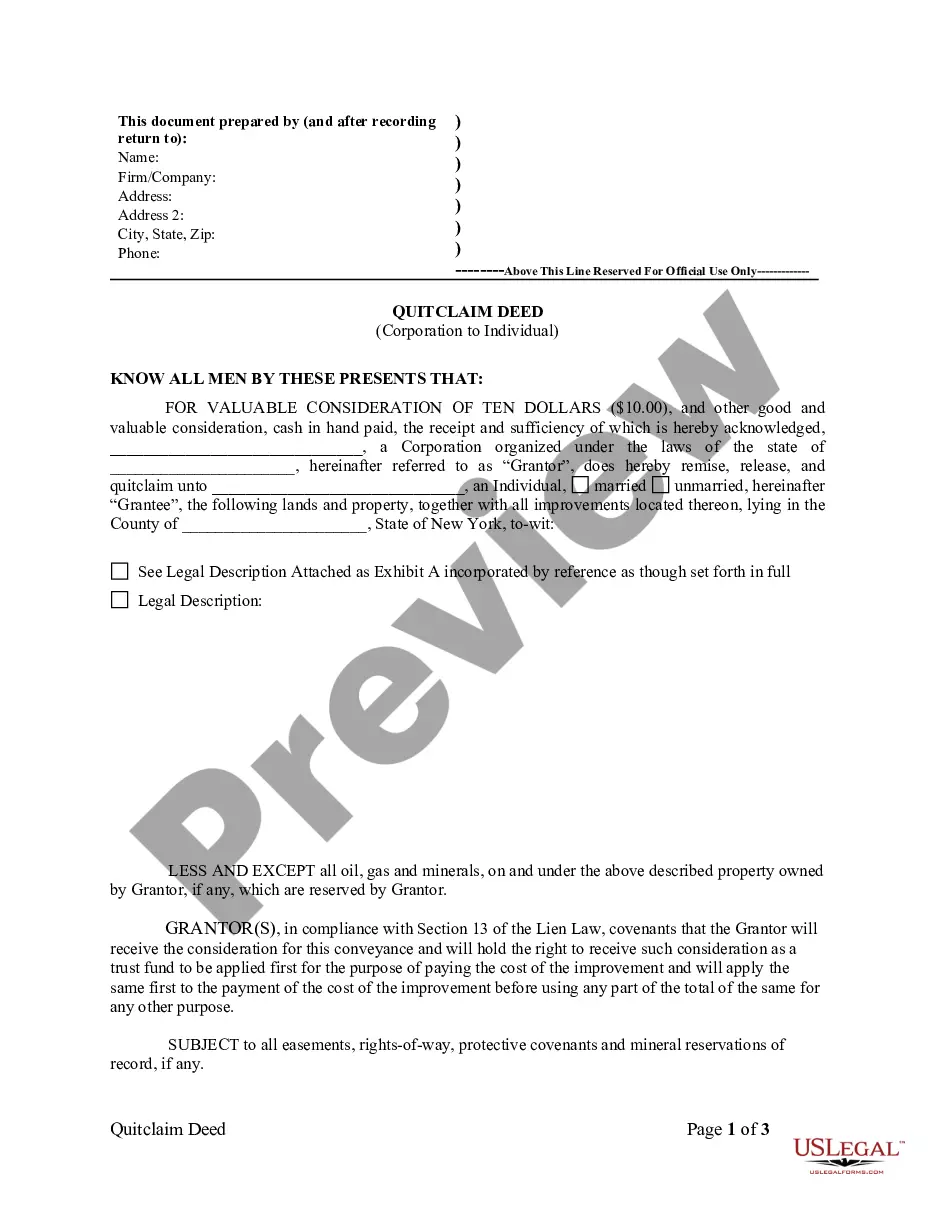

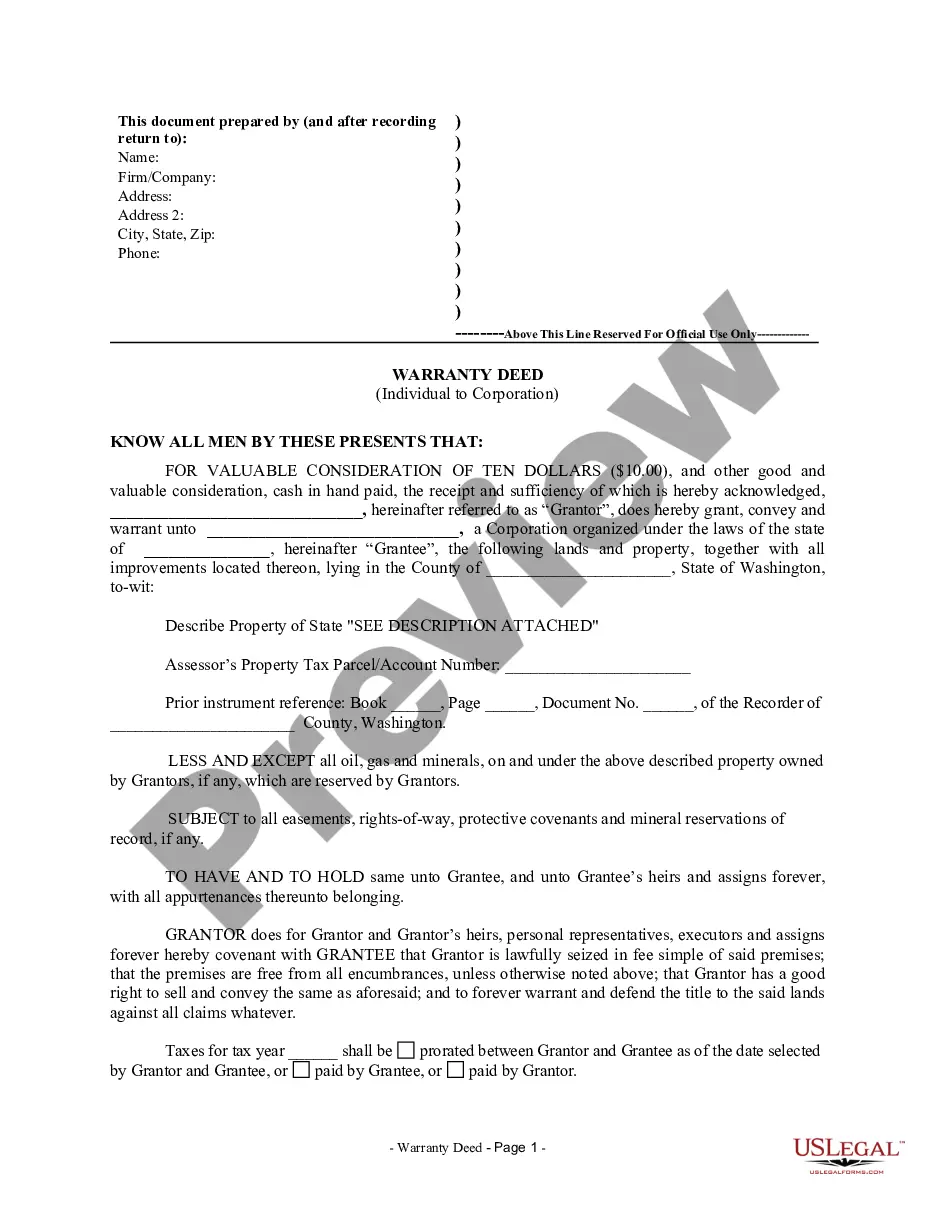

This form is a Quitclaim Deed where the Grantors are two co-trustees and the Grantee is a limited liability company. Grantors convey and quitclaim the described property to Grantee. This deed complies with all state statutory laws.

Kansas Quitclaim Deed – Trust (2 Co--Trustees) to LLC

Description Kansas Trust Real Estate

How to fill out Kansas Quitclaim Deed – Trust (2 Co--Trustees) To LLC?

In search of Kansas Quitclaim Deed – Trust (2 Co--Trustees) to LLC templates and completing them could be a problem. To save lots of time, costs and effort, use US Legal Forms and find the right example specially for your state within a couple of clicks. Our legal professionals draw up every document, so you just have to fill them out. It truly is so easy.

Log in to your account and come back to the form's page and download the document. All of your saved samples are kept in My Forms and are accessible always for further use later. If you haven’t subscribed yet, you have to sign up.

Look at our detailed recommendations concerning how to get the Kansas Quitclaim Deed – Trust (2 Co--Trustees) to LLC template in a few minutes:

- To get an qualified form, check out its applicability for your state.

- Check out the sample utilizing the Preview option (if it’s available).

- If there's a description, read through it to know the important points.

- Click on Buy Now button if you identified what you're trying to find.

- Choose your plan on the pricing page and make an account.

- Pick how you wish to pay out by way of a credit card or by PayPal.

- Save the form in the preferred format.

Now you can print out the Kansas Quitclaim Deed – Trust (2 Co--Trustees) to LLC form or fill it out using any web-based editor. No need to concern yourself with making typos because your form may be employed and sent, and printed out as often as you wish. Try out US Legal Forms and get access to above 85,000 state-specific legal and tax files.

Kansas Deed Estate Form popularity

FAQ

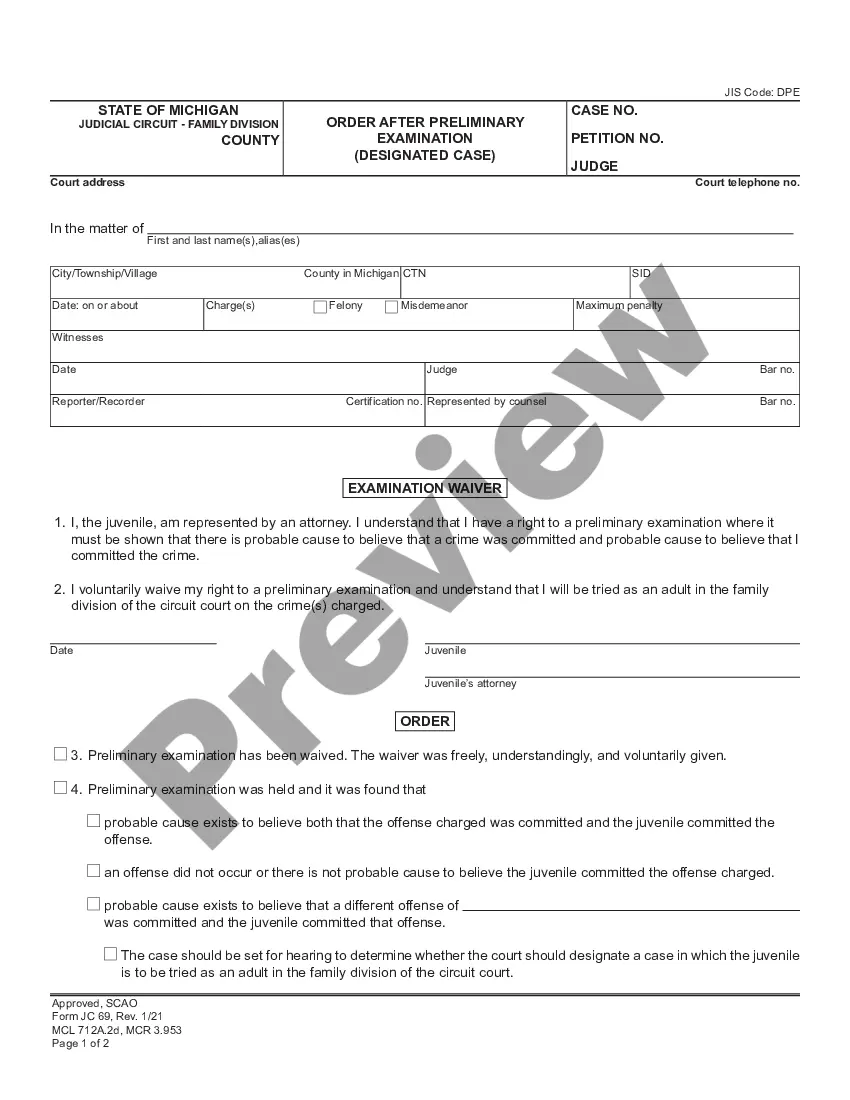

Yes, a quit claim deed supercedes the trust. The only thing that can be done is to file a suit in court challenging the deed as the product of fraud and undue influence. A court action like that will cost thousands of dollars, but might be worth it if the house was owned free and clear.

Recording A quitclaim deed must be filed with the County Recorder's Office where the real estate is located. Go to your County Website to locate the office nearest you. Signing (§ 58-2205) A quitclaim deed is required to be authorized with a notary public present.

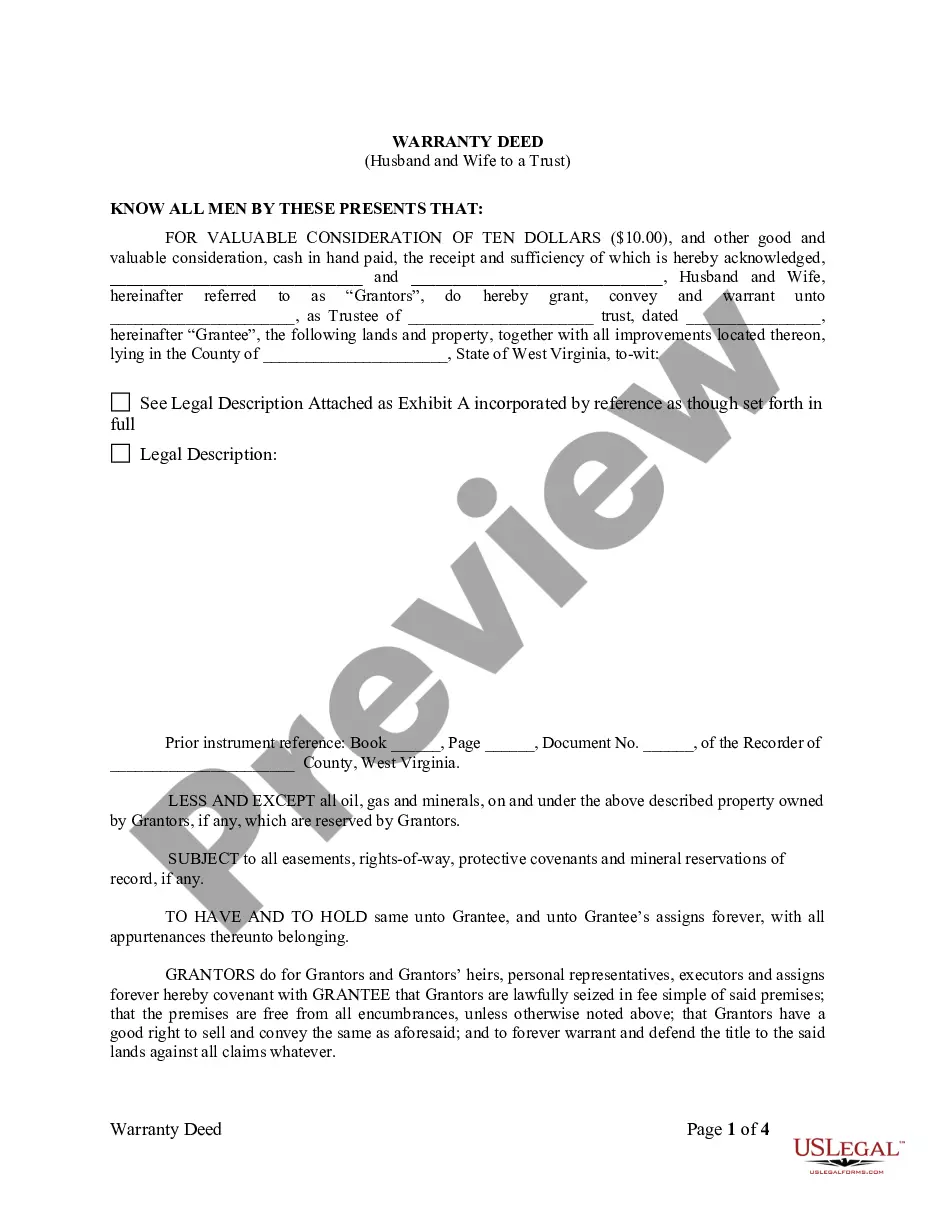

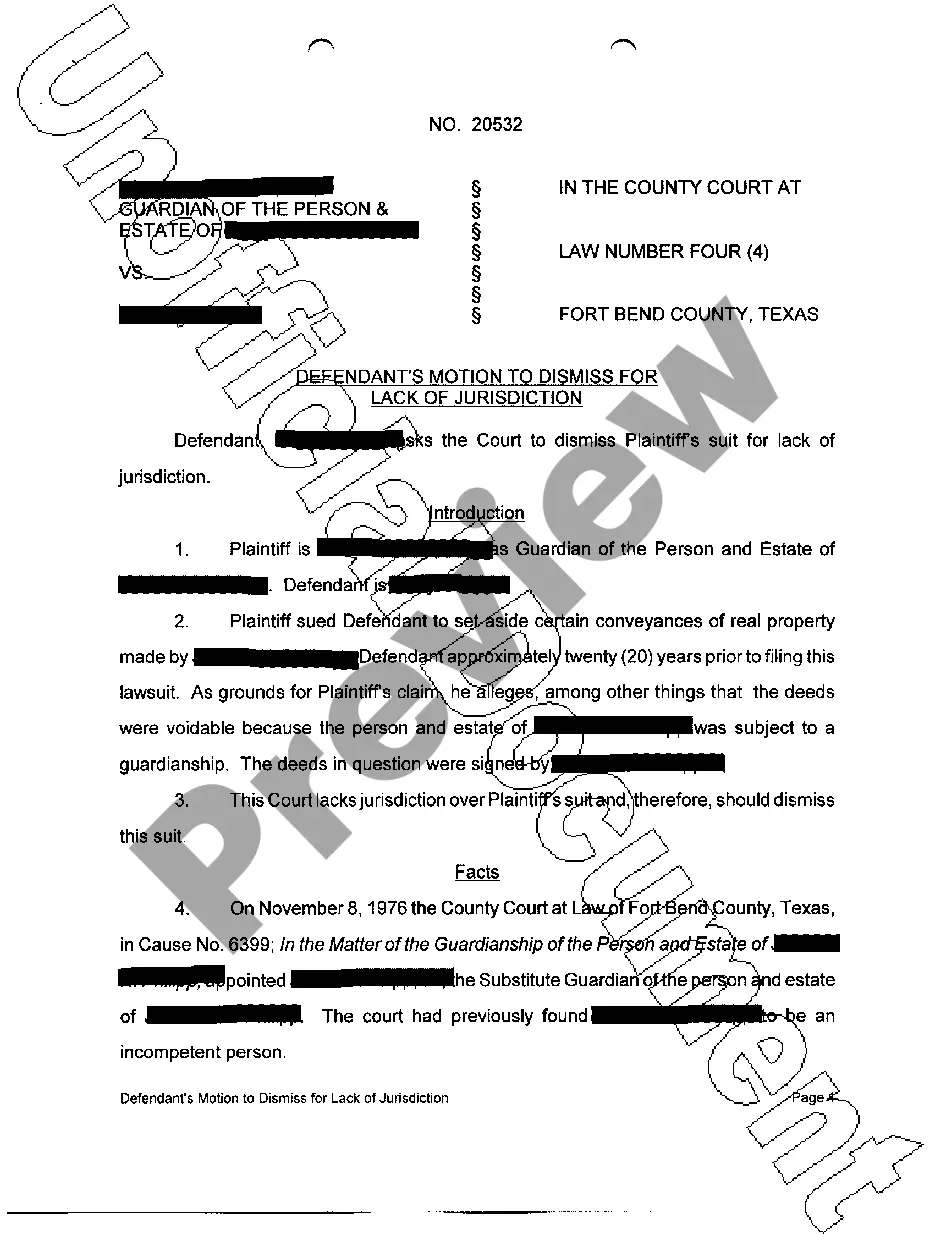

A quitclaim deed can be used to transfer property from a trust, but a Special Warranty Deed seems to be a more common way to do this.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.

California Property TaxesTransferring real property to yourself as trustee of your own revocable living trust -- or back to yourself -- does not trigger a reassessment for property tax purposes. (Cal. Rev. & Tax Code § 62(d).)

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.