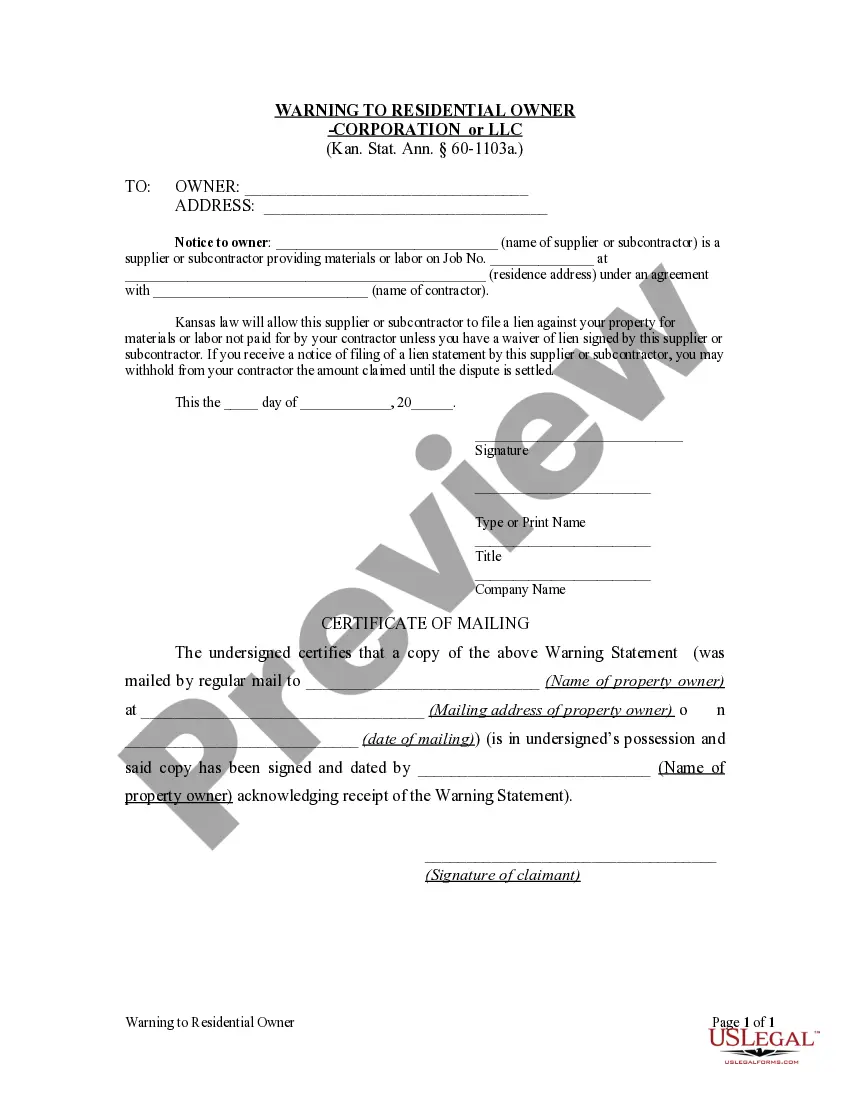

Kansas law requires that a subcontractor performing improvements on residential property must provide the property owner with a warning statement as set out in Kan. Stat. Ann. § 60-1103a(c). If the warning statement is required, the lien claimant must attach an affidavit to any lien statement filed attesting to the fact that said warning was provided.

Kansas Warning to Residential Owner by Corporation or LLC

Description

How to fill out Kansas Warning To Residential Owner By Corporation Or LLC?

Trying to find Kansas Warning to Residential Owner by Corporation or LLC templates and completing them could be a problem. To save lots of time, costs and energy, use US Legal Forms and find the correct template specially for your state in a couple of clicks. Our lawyers draw up each and every document, so you simply need to fill them out. It truly is so simple.

Log in to your account and come back to the form's page and save the document. All your downloaded samples are stored in My Forms and therefore are accessible all the time for further use later. If you haven’t subscribed yet, you should register.

Take a look at our comprehensive recommendations regarding how to get the Kansas Warning to Residential Owner by Corporation or LLC form in a couple of minutes:

- To get an eligible example, check its applicability for your state.

- Take a look at the sample making use of the Preview option (if it’s offered).

- If there's a description, read it to learn the details.

- Click on Buy Now button if you identified what you're searching for.

- Pick your plan on the pricing page and create an account.

- Select you wish to pay by way of a card or by PayPal.

- Download the form in the favored file format.

You can print the Kansas Warning to Residential Owner by Corporation or LLC template or fill it out making use of any web-based editor. Don’t concern yourself with making typos because your sample may be applied and sent, and printed as often as you would like. Try out US Legal Forms and get access to around 85,000 state-specific legal and tax documents.

Form popularity

FAQ

As a member of an LLC, either a single member or one of the multiple members in the business, you are a business owner, not an employee of your company. When you form an LLC, each owner puts in something of value, usually money, so each member has ownership in the business.

The owners of a limited liability company (LLC) are called members. Each member is an owner of the company; there are no owner shares, as in a corporation. An LLC is formed in a state by filing Articles of Organization or similar document in some states.

Limited liability companies shield their owners from personal debts and obligations. If the debt is personal -- such as a personal loan made to you as an individual rather than as an agent of your LLC -- the LLC account cannot be garnished, unless an exception applies.

The main LLC protection deals with any liabilities or debts that the business incurs. In most situations, you are safe from having your personal assets seized in order to pay any debts that your business takes out and cannot repay, unless you have put up a personal guarantee when you took out the loan.

Personal Liability for Actions by LLC Co-Owners and Employees. In all states, having an LLC will protect owners from personal liability for any wrongdoing committed by the co-owners or employees of an LLC during the course of business.

By default, LLCs with more than one member are treated as partnerships and taxed under Subchapter K of the Internal Revenue Code. However, an LLC can elect to be treated as an association taxable as a corporation by filing Form 8832, Entity Classification Election.

Forming an LLC or a corporation will allow you to take advantage of limited personal liability for business obligations. LLCs are favored by small, owner-managed businesses that want flexibility without a lot of corporate formality. Corporations are a good choice for a business that plans to seek outside investment.

If someone sues your LLC, a judgment against the LLC could bankrupt your business or deprive it of its assets. Likewise, as discussed above, if the lawsuit was based on something you didsuch as negligently injuring a customerthe plaintiff could go after you personally if the insurance doesn't cover their damages.

If you set up an LLC for yourself and conduct all your business through it, the LLC will be liable in a lawsuit but you won't.Conducting your personal business through an LLC provides no protection against a tort verdict, the type of liability that most people are worried about.