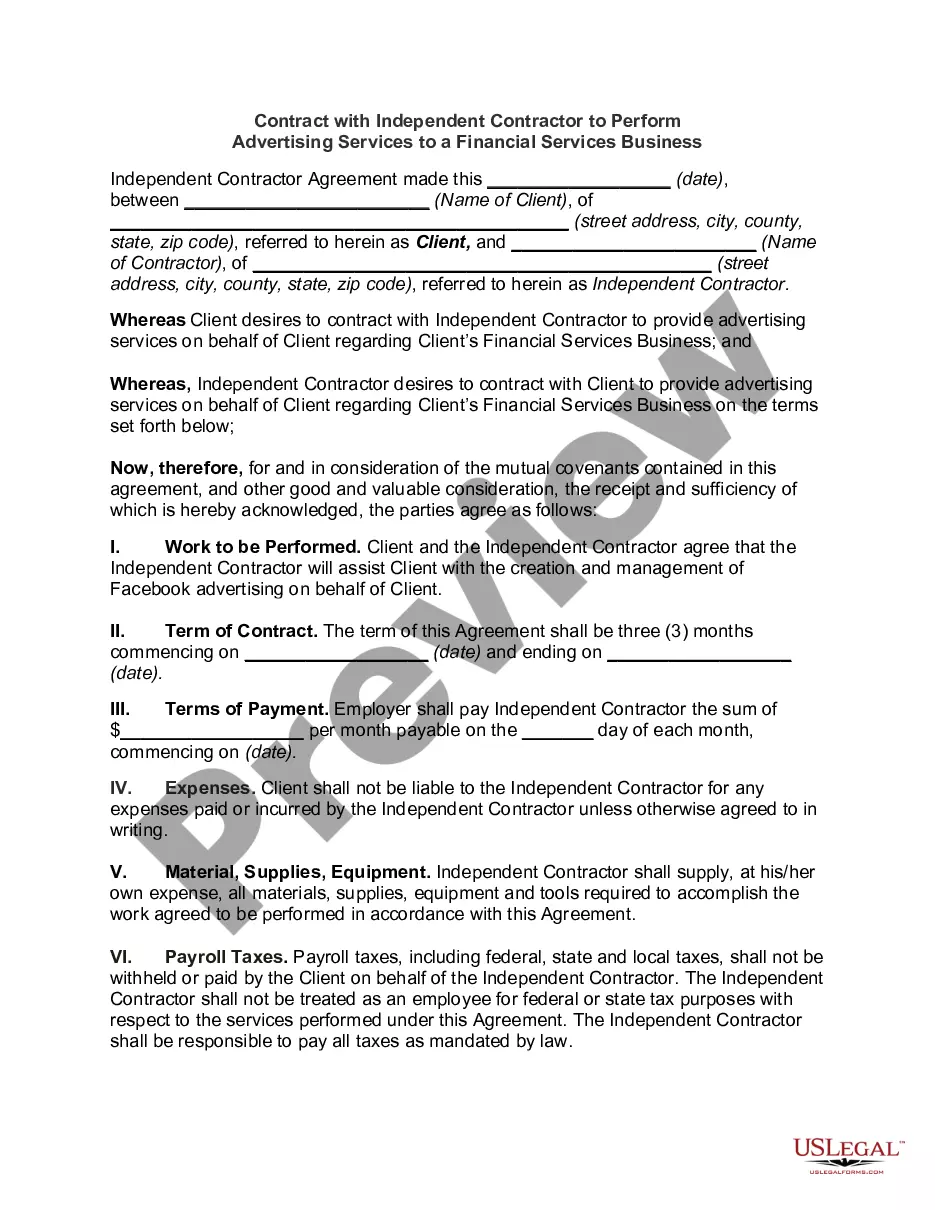

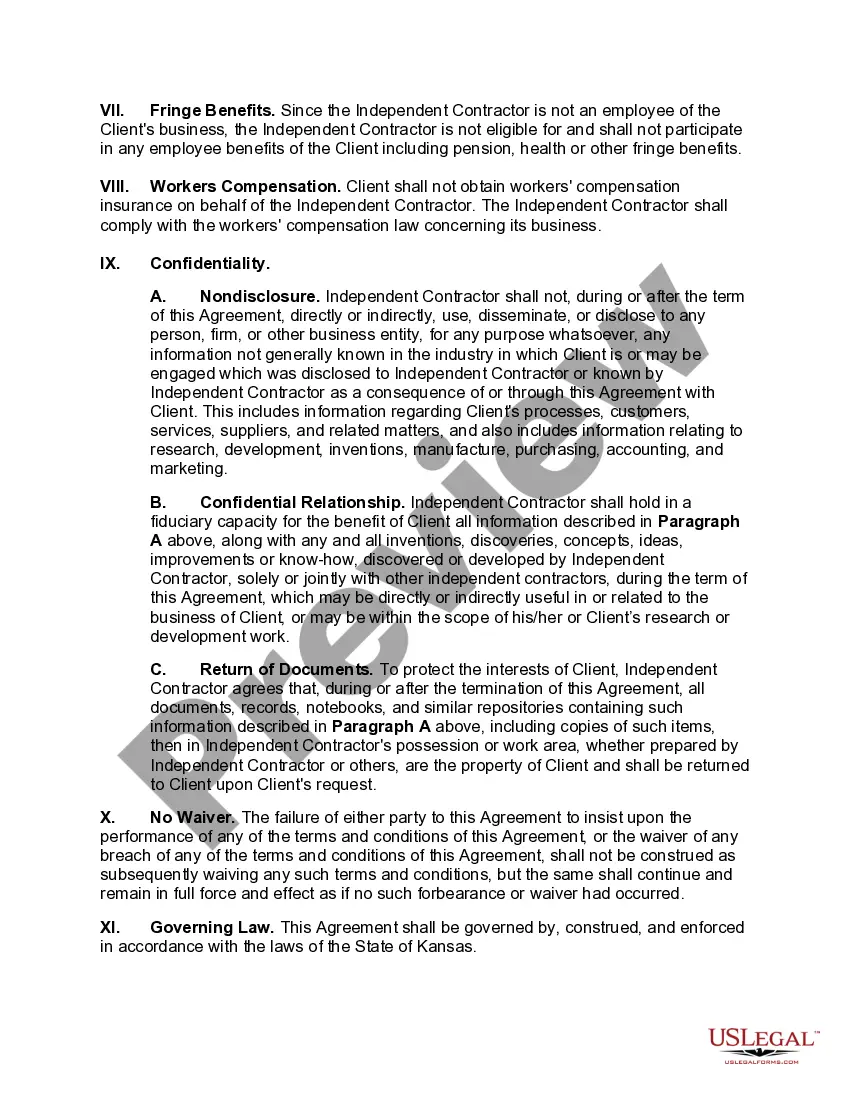

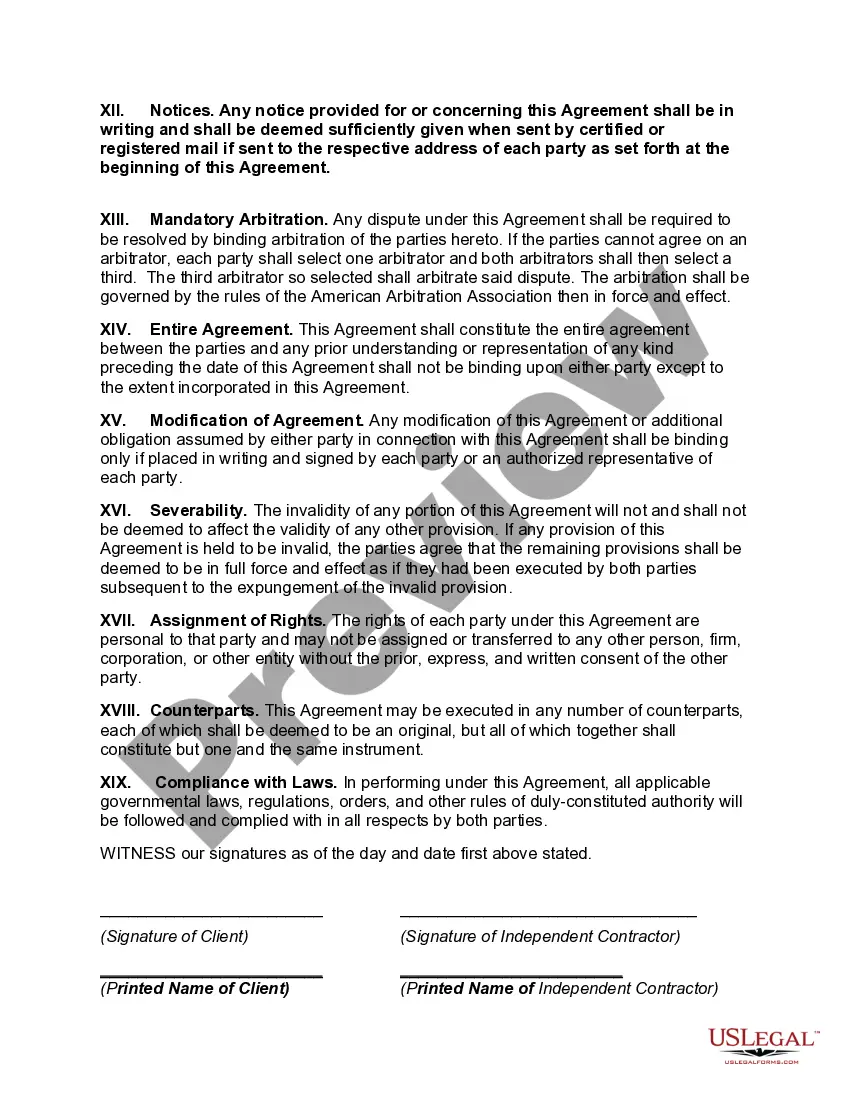

Kansas Contract with Independent Contractor to Perform Advertising Services to a Financial Services Business

Description

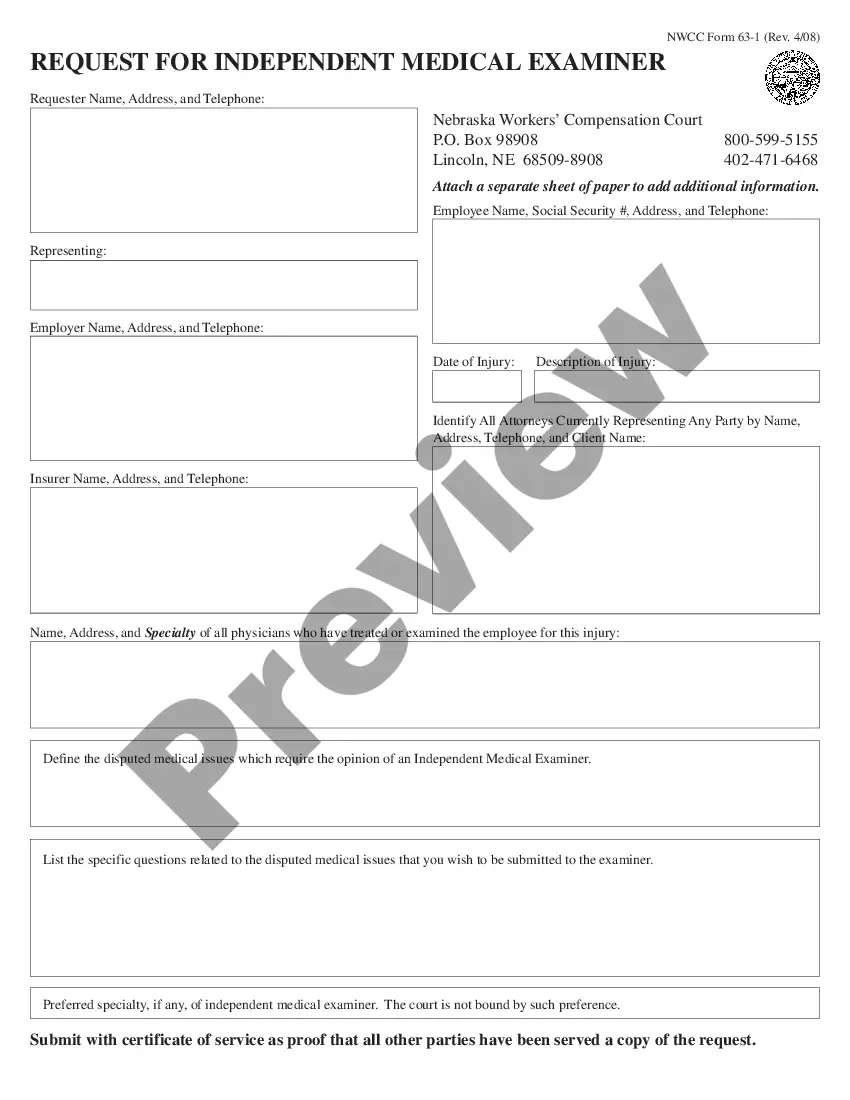

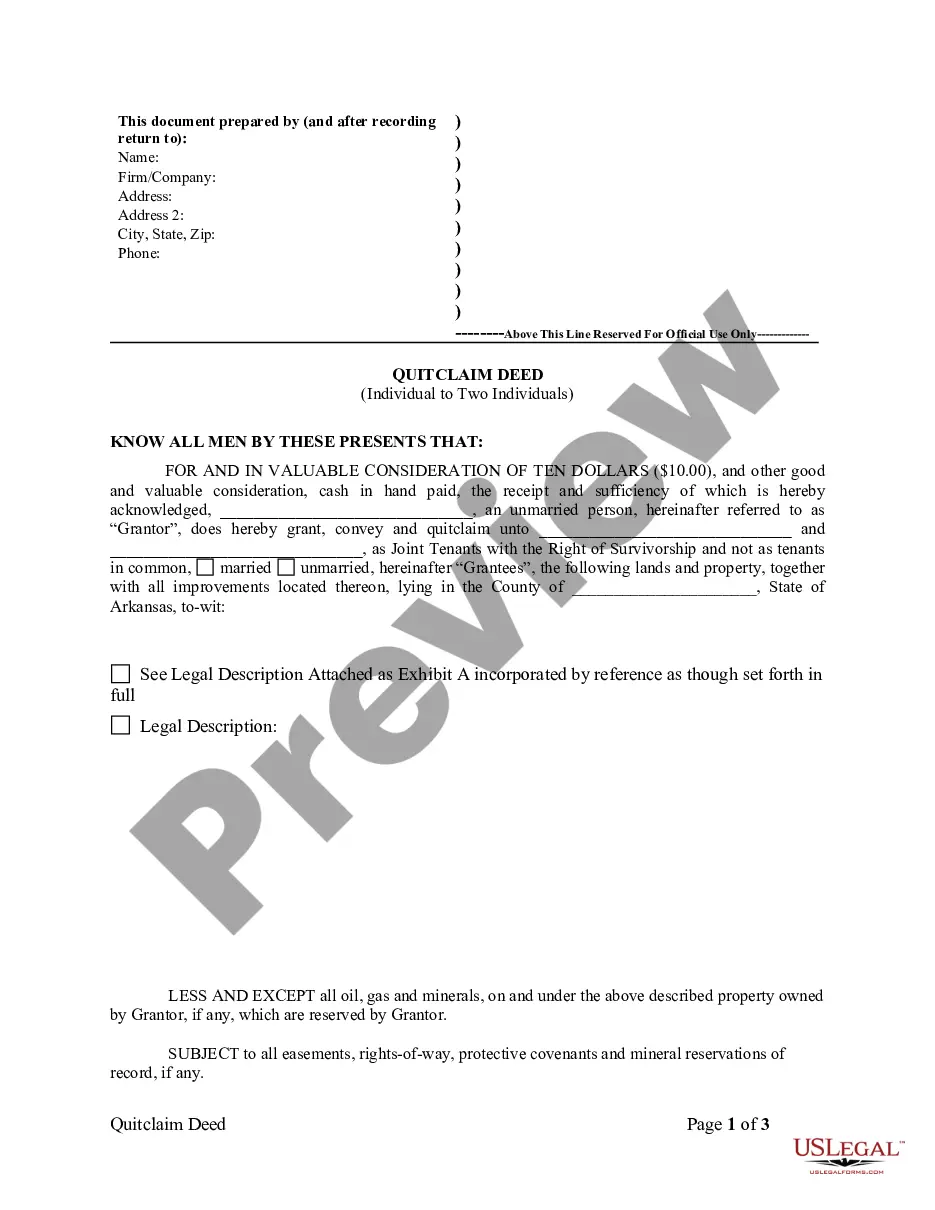

How to fill out Kansas Contract With Independent Contractor To Perform Advertising Services To A Financial Services Business?

Looking for Kansas Contract with Independent Contractor to Perform Advertising Services to a Financial Services Business templates and filling out them could be a problem. To save time, costs and energy, use US Legal Forms and find the appropriate template specifically for your state in a few clicks. Our legal professionals draw up all documents, so you simply need to fill them out. It truly is that easy.

Log in to your account and return to the form's page and download the sample. All of your saved samples are saved in My Forms and are available at all times for further use later. If you haven’t subscribed yet, you have to register.

Look at our thorough guidelines concerning how to get your Kansas Contract with Independent Contractor to Perform Advertising Services to a Financial Services Business template in a few minutes:

- To get an qualified example, check out its validity for your state.

- Look at the example making use of the Preview option (if it’s available).

- If there's a description, read through it to understand the important points.

- Click Buy Now if you identified what you're trying to find.

- Choose your plan on the pricing page and make your account.

- Select you wish to pay by way of a credit card or by PayPal.

- Download the sample in the preferred format.

You can print out the Kansas Contract with Independent Contractor to Perform Advertising Services to a Financial Services Business form or fill it out utilizing any online editor. No need to worry about making typos because your template can be utilized and sent away, and published as often as you wish. Try out US Legal Forms and access to over 85,000 state-specific legal and tax documents.

Form popularity

FAQ

Get established as a business. Obtain professional materials like business cards and fliers. Build a social media presence. Set up a website.

The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax. If you are an independent contractor, you are self-employed.You are not an independent contractor if you perform services that can be controlled by an employer (what will be done and how it will be done).

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.An independent contractor is someone who provides a service on a contractual basis.

Do not designate someone as a 1099 Employee if: Company provides training on a certain method of job performance. Tools and materials are provided. Employees must follow set schedule. You provide benefits such as vacation, overtime pay, etc.

Liaising with the client to elucidate job requirements, as needed. Gathering the materials needed to complete the assignment. Overseeing the assignment, from inception to completion. Tailoring your approach to work to suit the job specifications, as required.