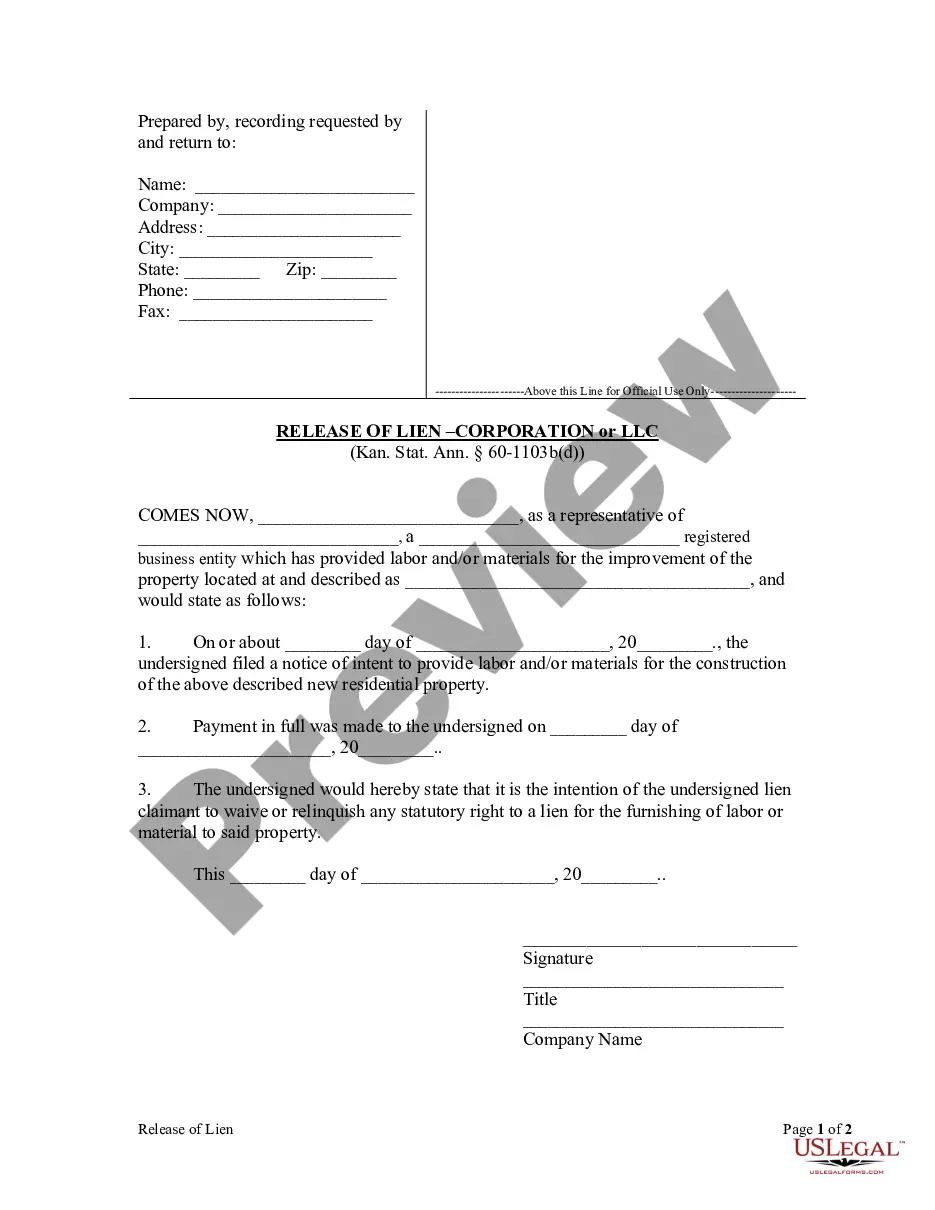

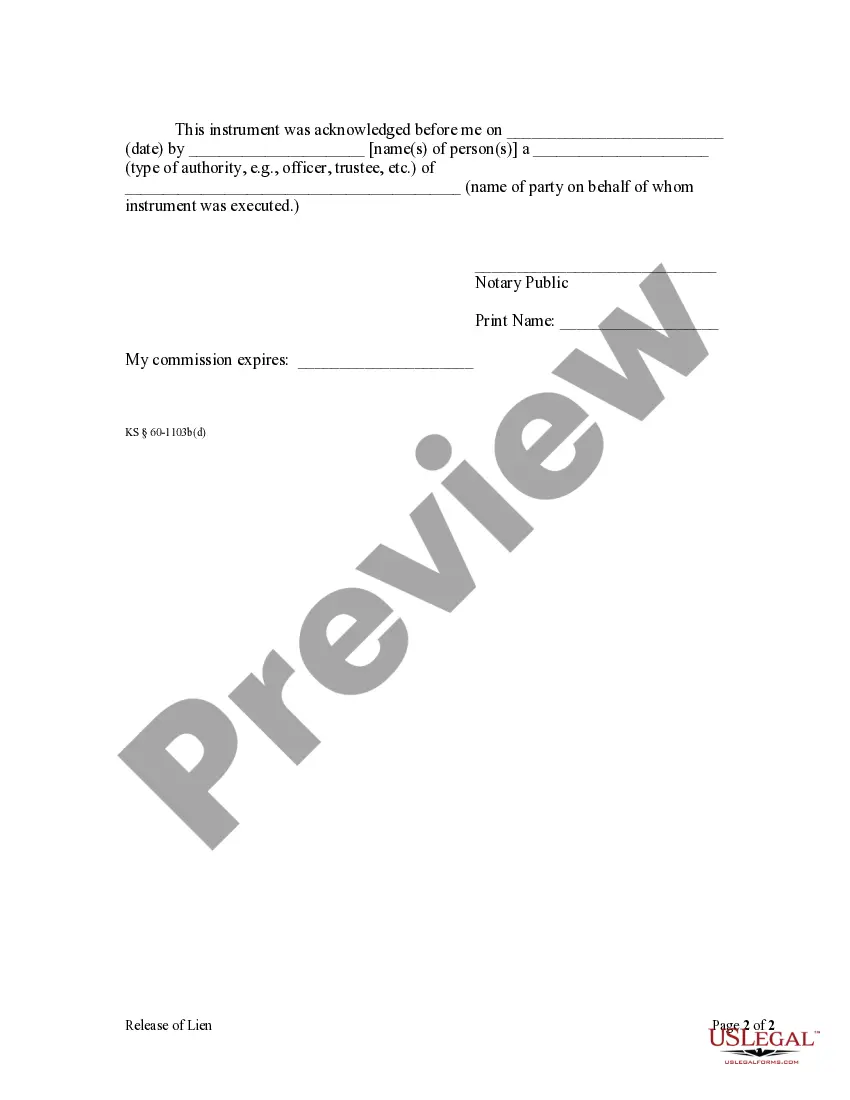

This form is used to release a lien after payment in full.

Kansas Release of Lien by Corporation or LLC

Description Limited Liability Company Application

How to fill out Kansas Lien Corporation?

Searching for Kansas Release of Lien by Corporation or LLC templates and completing them can be quite a challenge. To save lots of time, costs and effort, use US Legal Forms and find the appropriate sample specially for your state in just a few clicks. Our attorneys draft every document, so you just have to fill them out. It really is so easy.

Log in to your account and come back to the form's web page and download the sample. All your downloaded templates are stored in My Forms and are accessible always for further use later. If you haven’t subscribed yet, you should register.

Take a look at our comprehensive recommendations concerning how to get the Kansas Release of Lien by Corporation or LLC form in a few minutes:

- To get an eligible form, check out its applicability for your state.

- Check out the form using the Preview function (if it’s offered).

- If there's a description, go through it to understand the important points.

- Click Buy Now if you identified what you're searching for.

- Pick your plan on the pricing page and create an account.

- Choose you wish to pay by a card or by PayPal.

- Save the file in the preferred format.

Now you can print out the Kansas Release of Lien by Corporation or LLC template or fill it out making use of any online editor. No need to concern yourself with making typos because your template can be used and sent, and printed out as many times as you would like. Try out US Legal Forms and access to over 85,000 state-specific legal and tax documents.

Llc Company Form Form popularity

Release Lien Form Other Form Names

Llc Limited Liability Form FAQ

The release of lien for an electronic title may be accomplished by providing this completed form to the person who satisfied the lien, purchased the vehicle, or requested the release, and/or by faxing it to the Title & Registration Bureau at (785) 296-2383 or e-mail to KDOR_TR@ks.gov.

Write your name and return address in the top three lines of the letter. Insert the complete date (month, day, year). Enter the recipient's name, title, company name and address on the next five lines. Greet the reader by writing "Dear (recipient's name):" Skip two lines. State the subject in a subject line.

The 2002 Kansas Legislature authorized electronic lien and title by passing Senate Bill 449, making Kansas a paperless title state. As of January 1, 2003, Kansas vehicle owners who borrow money for their cars, trucks, motorcycles, trailers and other motor vehicles will not receive printed, paper titles.

If the lien has been paid off, use the assignment portion of the Lienholder Consent to Transfer Ownership, Form TR-128, attach the lien release in lieu of the lienholder's portion of the consent and go to your local county treasurer's motor vehicle office and make application for title.

If the vehicle owner wishes to remove a lien holder's name from a registration receipt, an application for reissued title must be made at the local county treasurer's motor vehicle office. Bring the notarized lien release and a title will be requested and mailed to you within 5 to 7 days.

If the vehicle owner wishes to remove a lien holder's name from a registration receipt, an application for reissued title must be made at the local county treasurer's motor vehicle office. Bring the notarized lien release and a title will be requested and mailed to you within 5 to 7 days.

The release of lien for an electronic title may be accomplished by providing this completed form to the person who satisfied the lien, purchased the vehicle, or requested the release, and/or by faxing it to the Title & Registration Bureau at (785) 296-2383 or e-mail to KDOR_TR@ks.gov.

Lien releases may be faxed to (913) 715-2510, emailed to dmv@jocogov.org, or mailed to 111 S. Cherry St, Suite 1500, Olathe, KS 66061. Be sure to indicate the mailing address that the title is to be mailed to, along with a phone number in case there are questions.

Satisfy the terms of the loan by paying the balance of the loan back to the lender, including any interest incurred. If you don't receive the lien release, submit a request to your lender for proof that the loan has been satisfied.