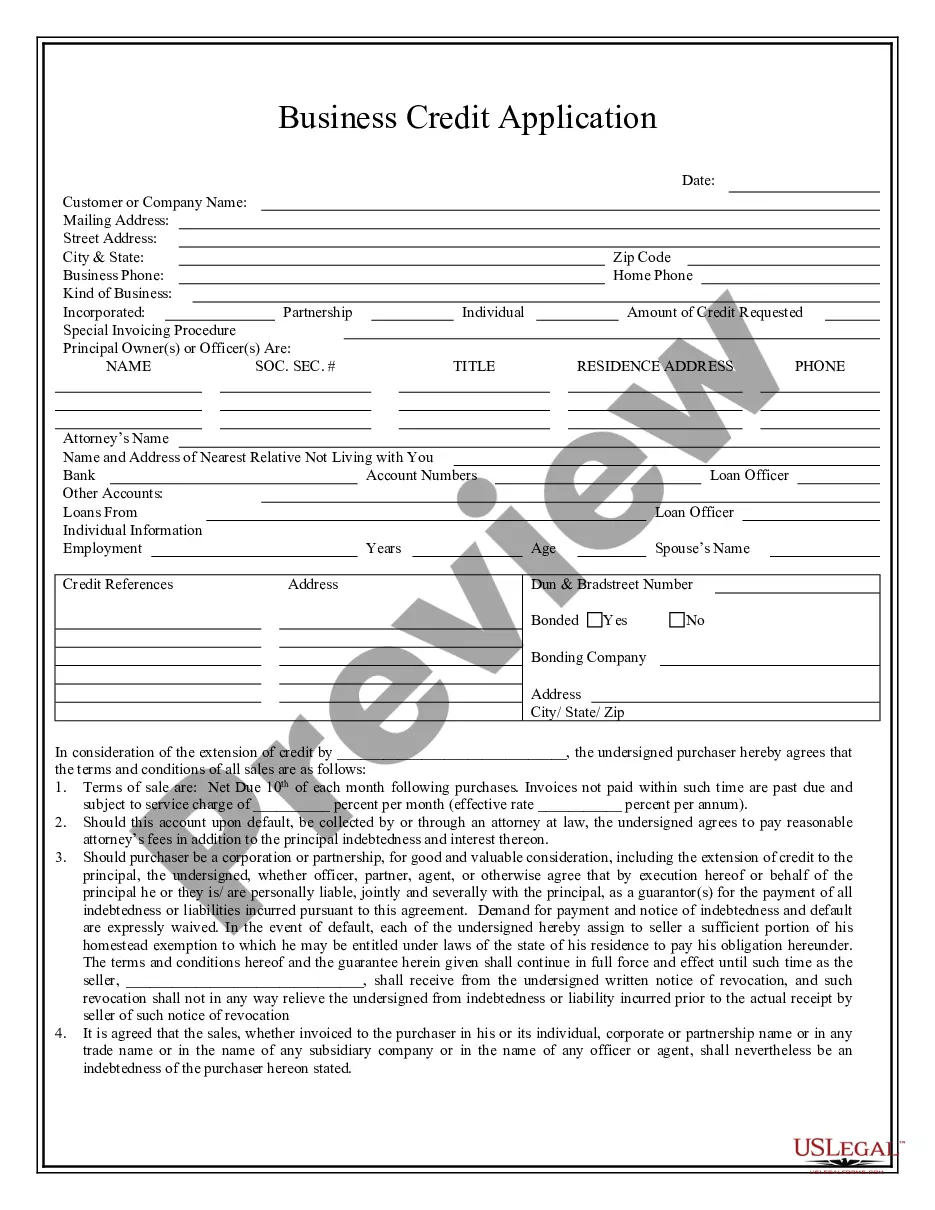

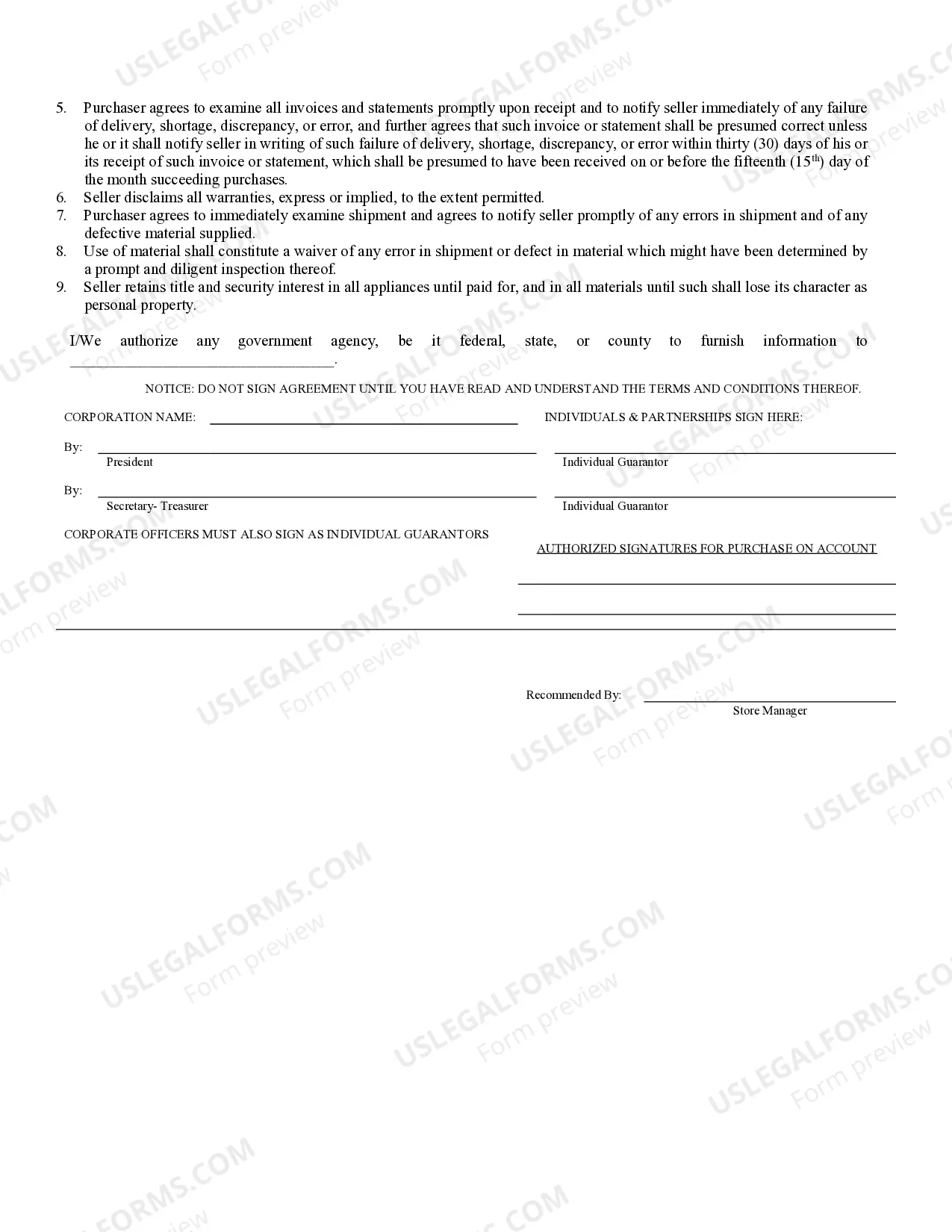

Kansas Business Credit Application

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Kansas Business Credit Application?

Looking for a Kansas Business Credit Application example and completing it can be quite challenging.

To conserve time, expenses, and effort, utilize US Legal Forms and locate the appropriate template specifically for your state in just a few clicks.

Our attorneys prepare all documents, so you only need to complete them. It truly is that straightforward.

Select your plan on the pricing page and create an account. Choose how you would like to pay via credit card or PayPal. Download the file in your preferred format. You can now print the Kansas Business Credit Application template or complete it using any online editor. No need to worry about making errors, as your sample can be utilized, submitted, and printed as many times as you desire. Check out US Legal Forms and access over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to save the example.

- All your saved templates are stored in My documents and are always available for future use.

- If you haven’t registered yet, you should sign up.

- Review our comprehensive instructions on how to obtain the Kansas Business Credit Application template in minutes.

- To access a legitimate example, verify its applicability for your state.

- Examine the form using the Preview option (if available).

- If there is a description, read it to comprehend the details.

- Click Buy Now if you found what you are looking for.

Form popularity

FAQ

The Kansas withholding account number typically consists of a 15-digit number, starting with a prefix indicating the type of account. Ensure you provide this correct format when filling out your Kansas Business Credit Application or related tax forms. If you're unsure, the USLegalForms platform can help you find the correct form and additional resources for guidance.

It's possible to get a loan even if you have bad credit. While your credit score will keep you from getting a great APR, you can still find interest rates that are much lower than those you'd likely find on payday loans.

Apply for one of the quickest personal loans. The quickest personal loan provider, LightStream, can fund and approve loans as soon as the same day you apply. Apply for a secured personal loan. Secured personal loans require collateral for approval. Borrow from family/friends. Use a credit card. Use a HELOC.

If you want one, you'll need to apply. You can do this using your Centrelink online account through myGov. Applying for the loan is voluntary. If you're eligible for the loan, you'll be paid twice a year after 1 January and 1 July.

Payday loans are a way for credit-challenged borrowers to get a $1000 loan. There are no credit checks, and it only takes a few minutes to apply online. When you're approved and the funds hit your bank account, you can use the money as you see fit.

Loan aggregators. Loan aggregators are an excellent source of financing when you have bad credit. Personal loan lenders. Peer-to-peer (P2P) lenders. Banks and credit unions. Payday loans. Subprime loans.

Loan aggregators. Loan aggregators are an excellent source of financing when you have bad credit. Personal loan lenders. Peer-to-peer (P2P) lenders. Banks and credit unions. Payday loans. Subprime loans.

You can get a $2,000 loan with bad credit by going to a credit union, consumer finance company or online lender; taking out a loan against your home's equity; borrowing from a family member or friend; getting a payday loan; or pawning some valuables.

CashAdvance.com. 3.9 /5.0 Stars. START NOW » LendUp. LendUp is a direct lender that offers short-term and some installment loans for borrowers of diverse credit types, including consumers with poor credit.

Personal Loans: 500-550 Credit Score Although credit cards are typically the easiest type of credit to get with a low 500 to 550 credit score, it can also be fairly simple to obtain some small personal loans, including both short-term and installment loans.