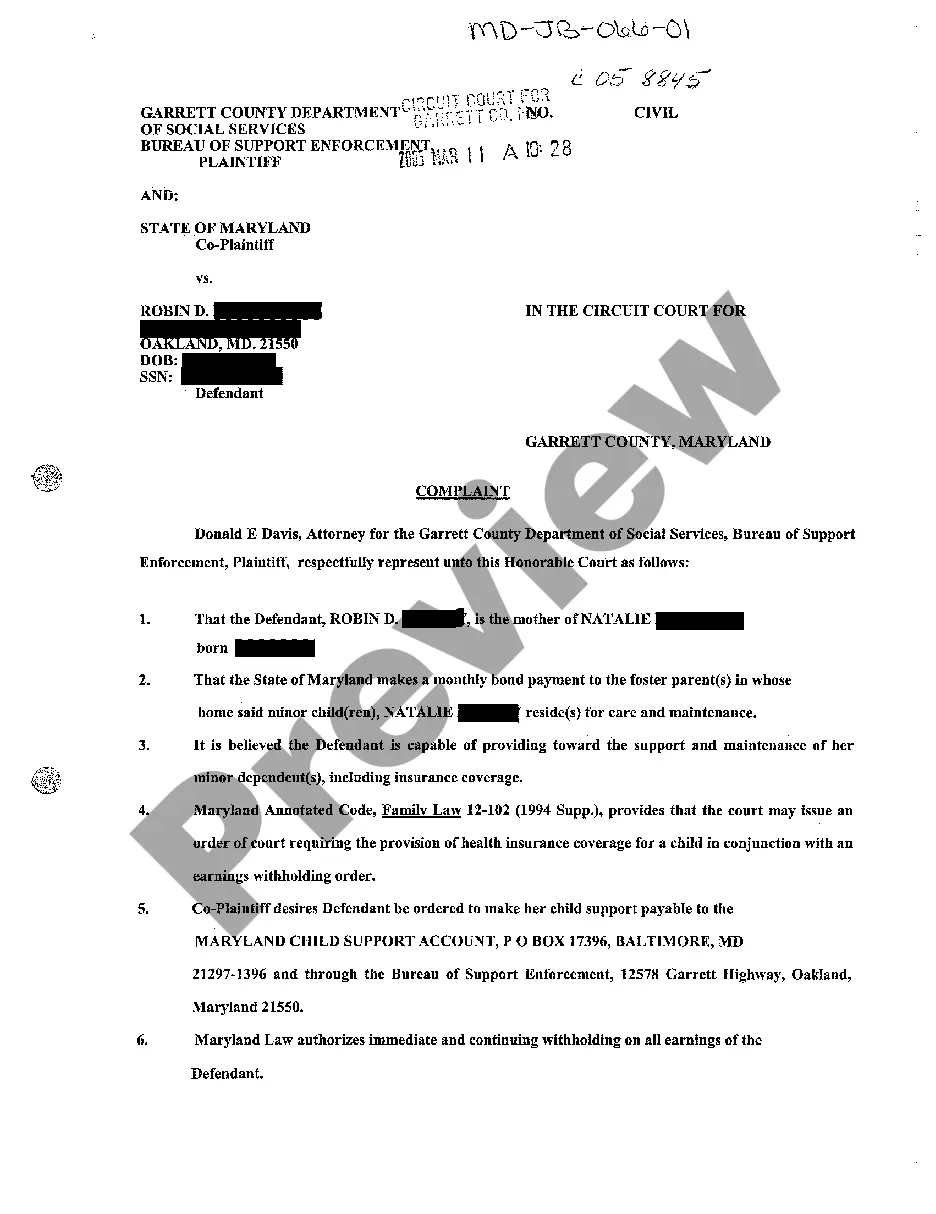

Kansas Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description Kansas Civil

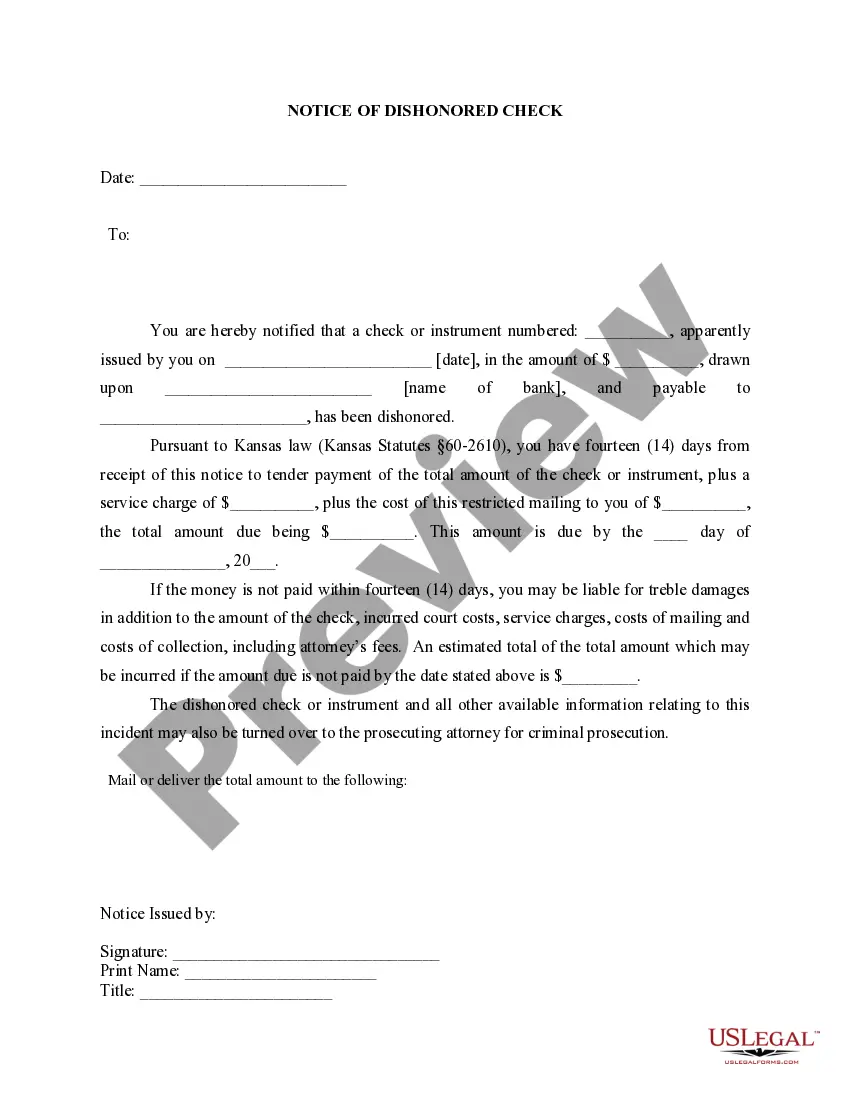

How to fill out Kansas Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

Searching for Kansas Notice of Dishonored Check - Civil - Keywords: bad check, bounced check templates and completing them could be a challenge. In order to save time, costs and energy, use US Legal Forms and choose the right example specially for your state in just a few clicks. Our attorneys draft each and every document, so you just have to fill them out. It really is so easy.

Log in to your account and come back to the form's web page and download the sample. All of your downloaded templates are stored in My Forms and they are available all the time for further use later. If you haven’t subscribed yet, you should sign up.

Look at our thorough guidelines regarding how to get the Kansas Notice of Dishonored Check - Civil - Keywords: bad check, bounced check form in a couple of minutes:

- To get an entitled sample, check out its validity for your state.

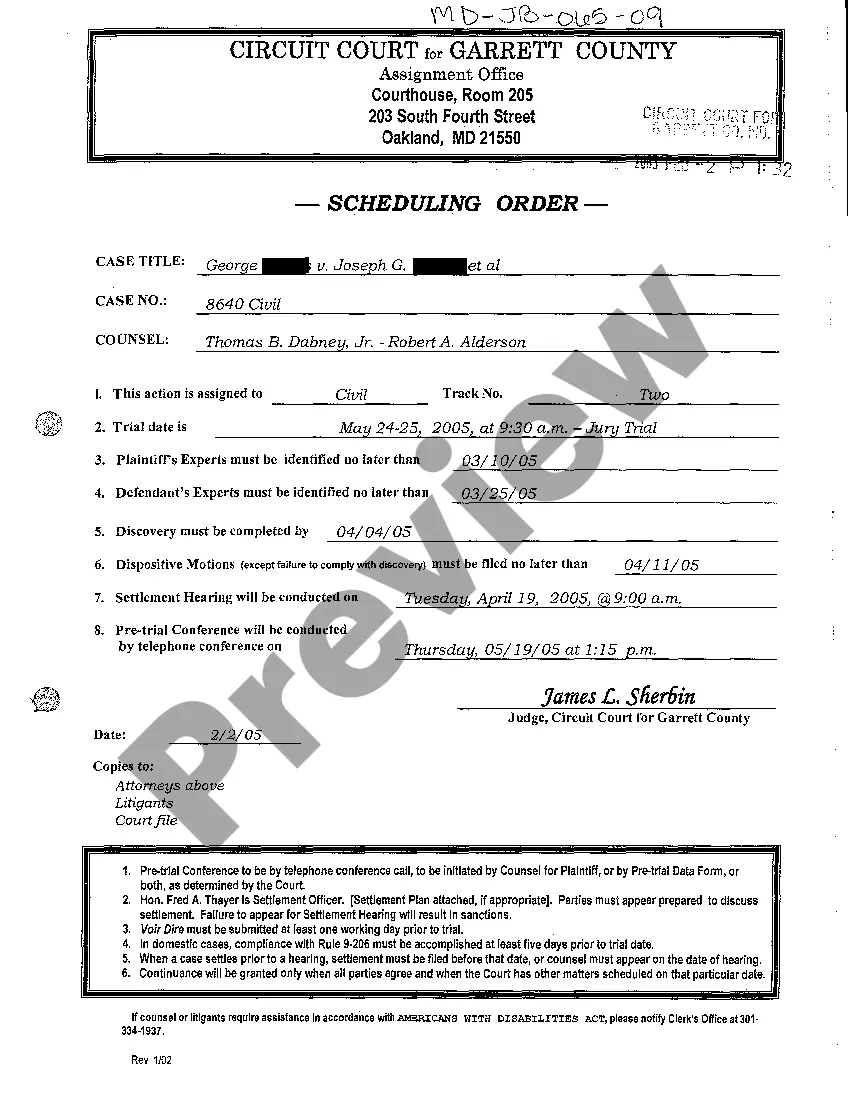

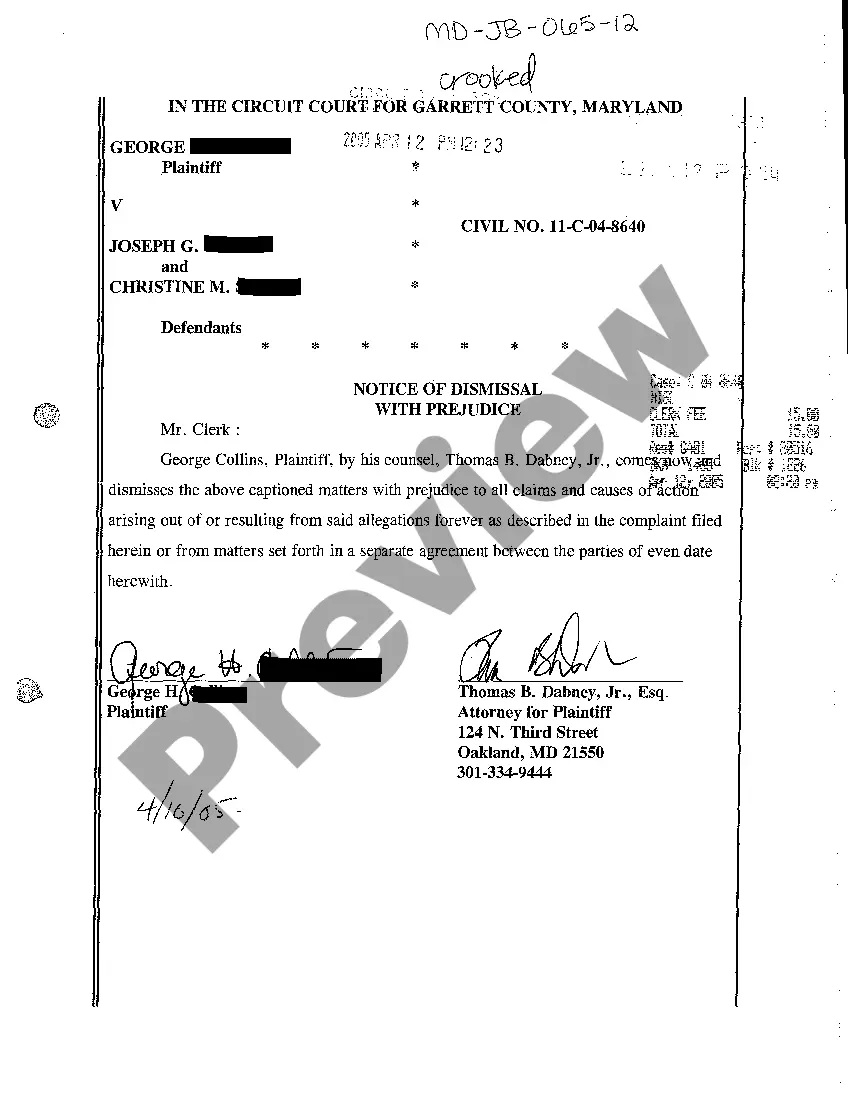

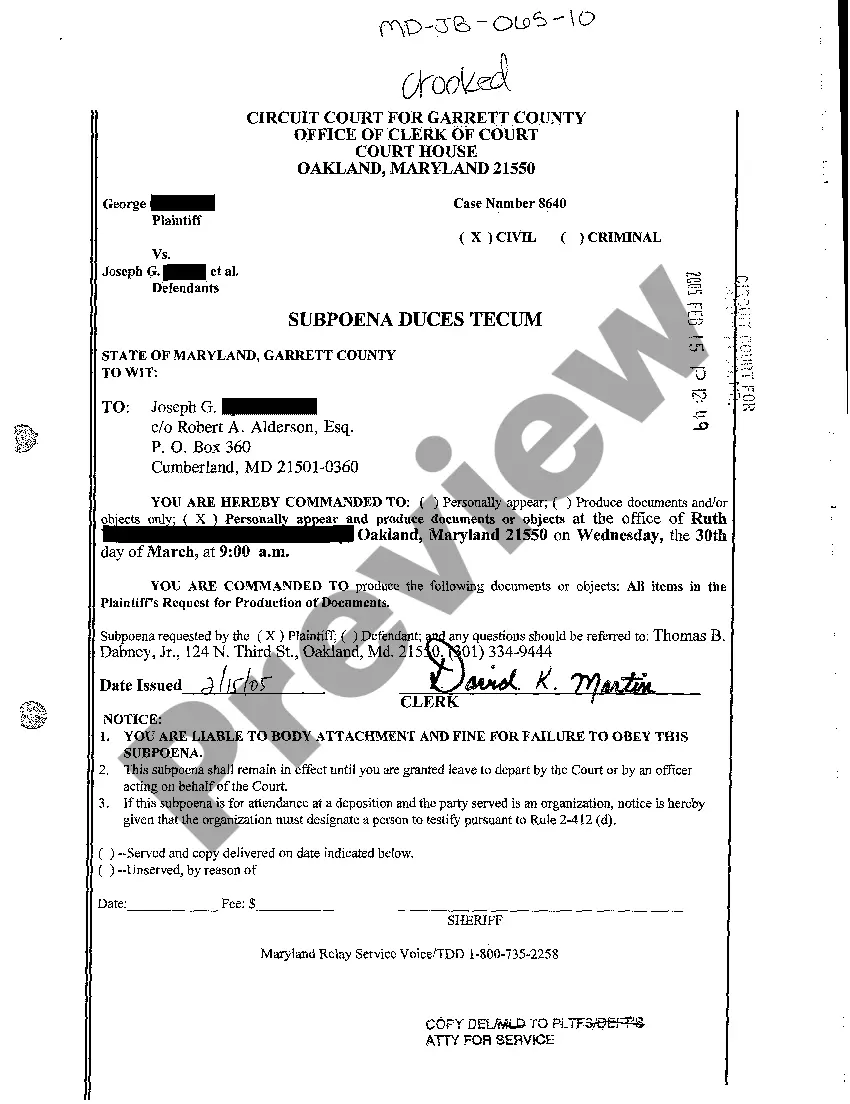

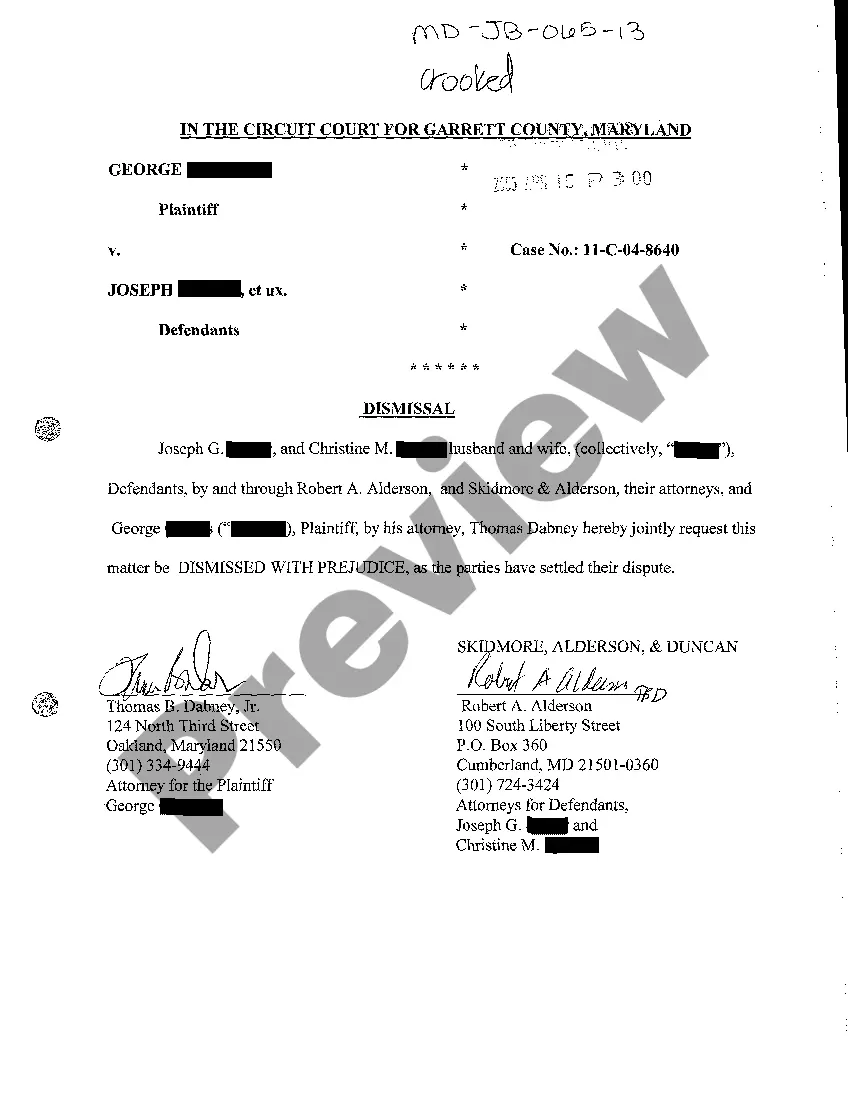

- Check out the example making use of the Preview function (if it’s offered).

- If there's a description, read through it to understand the important points.

- Click on Buy Now button if you identified what you're seeking.

- Select your plan on the pricing page and make an account.

- Select you want to pay by way of a card or by PayPal.

- Save the sample in the preferred format.

Now you can print out the Kansas Notice of Dishonored Check - Civil - Keywords: bad check, bounced check form or fill it out utilizing any web-based editor. No need to worry about making typos because your form can be used and sent away, and published as many times as you would like. Check out US Legal Forms and access to more than 85,000 state-specific legal and tax files.

Form popularity

FAQ

Contact the district attorney. Some states have a bad-check restitution program where the DA's office has someone contact the check writer and urge them to pay up. Work through a collection agency. Use a check recovery service. Take your customer to court if they refuse to resolve things.

If you don't pay the amount of a bounced check within the time frame your bank specifies, it can close your account.If your financial institution doesn't cover the check, it bounces and is returned to the depositor's bank. You'll likely be charged a nonsufficient funds fee, also known as an NSF or returned item fee.

If you are given a bad check, you can sue for the amount of the check plus bank fees. You can also add damages to your claim.

Whether you write or receive a bounced check also called a nonsufficient funds, or NSF, check it will cost you. Write one and you'll owe your bank an NSF fee of between $27 and $35, and the recipient of the check is permitted to charge a returned-check fee of between $20 and $40 or a percentage of the check amount.

When determining your bounced check fee, consider this: On average, a bank will charge YOU about $30 for a bad check, so you should charge a penalty of $35-$50. Why? Because it's likely you will be (or you should, anyway) immediately sending out notice to the tenant regarding the bad check.

Bouncing a check is usually a crime only if you intend to defraud the payee. In other words, the payee must be able to prove that you knew your check would bounce and therefore you intended to commit check fraud. Fortunately, most consumers don't wait long to repay bad checks and aren't charged with criminal penalties.

The amount of time merchants can allot for you to pay off a bounced check is rooted mainly in state laws. Familiarize yourself with your state's law and act accordingly in terms of paying of the bad check. In general, laws allow for bad check writers to be given anywhere from two to three years to pay their debt.

If a cheque bounces due to insufficient funds or any other technical reason, such as signature mismatch, their respective banks charges for both the defaulter and the payee. The penalty charges for cheque outward return are close to Rs. 300 for most banks, while charges for cheque inward return are about Rs. 100.

If the check amount exceeds certain thresholds, the crime may be treated as a felony. Civil penalties apply in all cases, with a common penalty amount equivalent to the check's face value, a multiple of the check amount with a cap, or the check amount plus court and attorney fees.