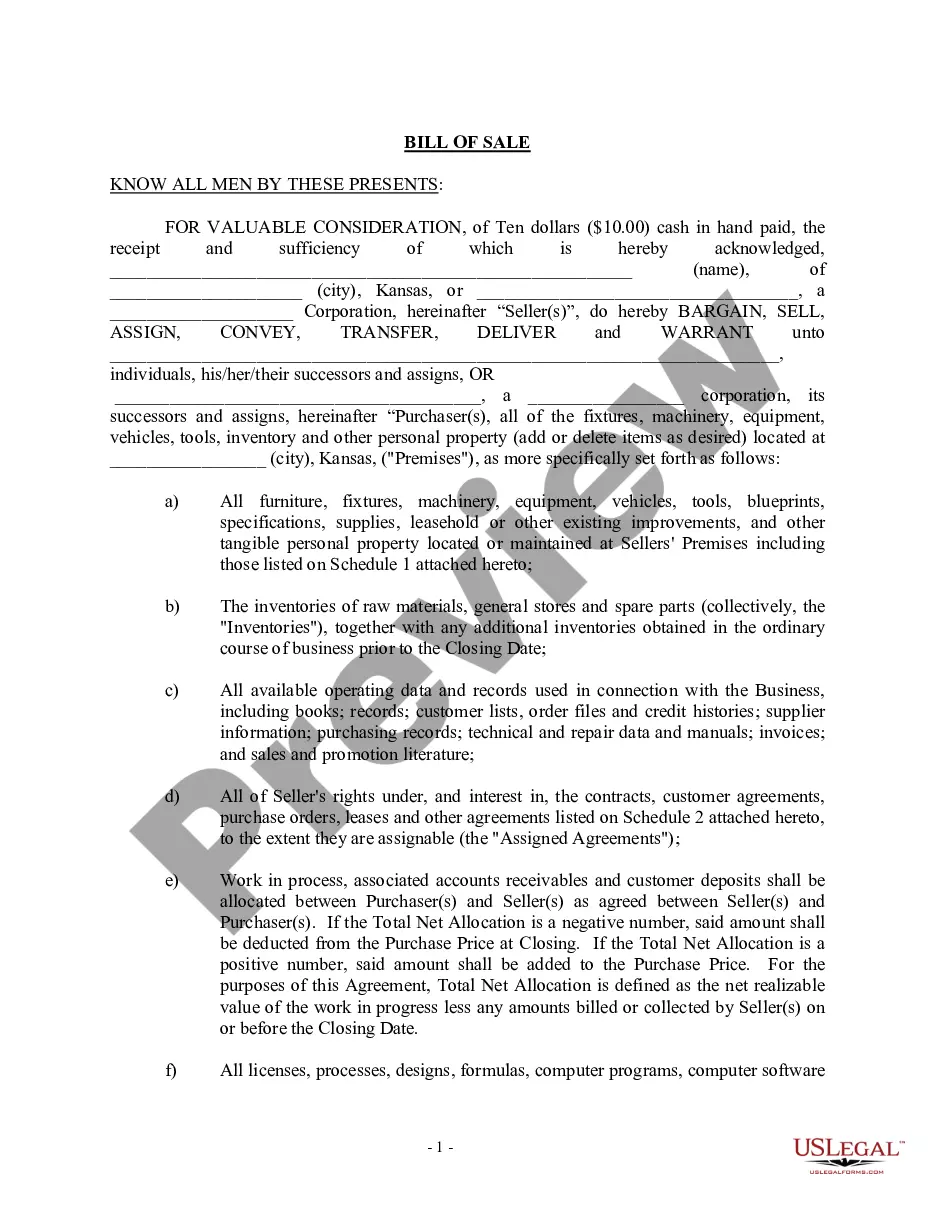

Kansas Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller

Description Register A Car In Kansas

How to fill out Kansas Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller?

Trying to find Kansas Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller forms and completing them can be a problem. To save time, costs and energy, use US Legal Forms and choose the right template specially for your state in just a few clicks. Our lawyers draft every document, so you just need to fill them out. It truly is so simple.

Log in to your account and return to the form's web page and save the document. Your downloaded samples are kept in My Forms and they are accessible at all times for further use later. If you haven’t subscribed yet, you should sign up.

Look at our detailed guidelines concerning how to get your Kansas Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller sample in a few minutes:

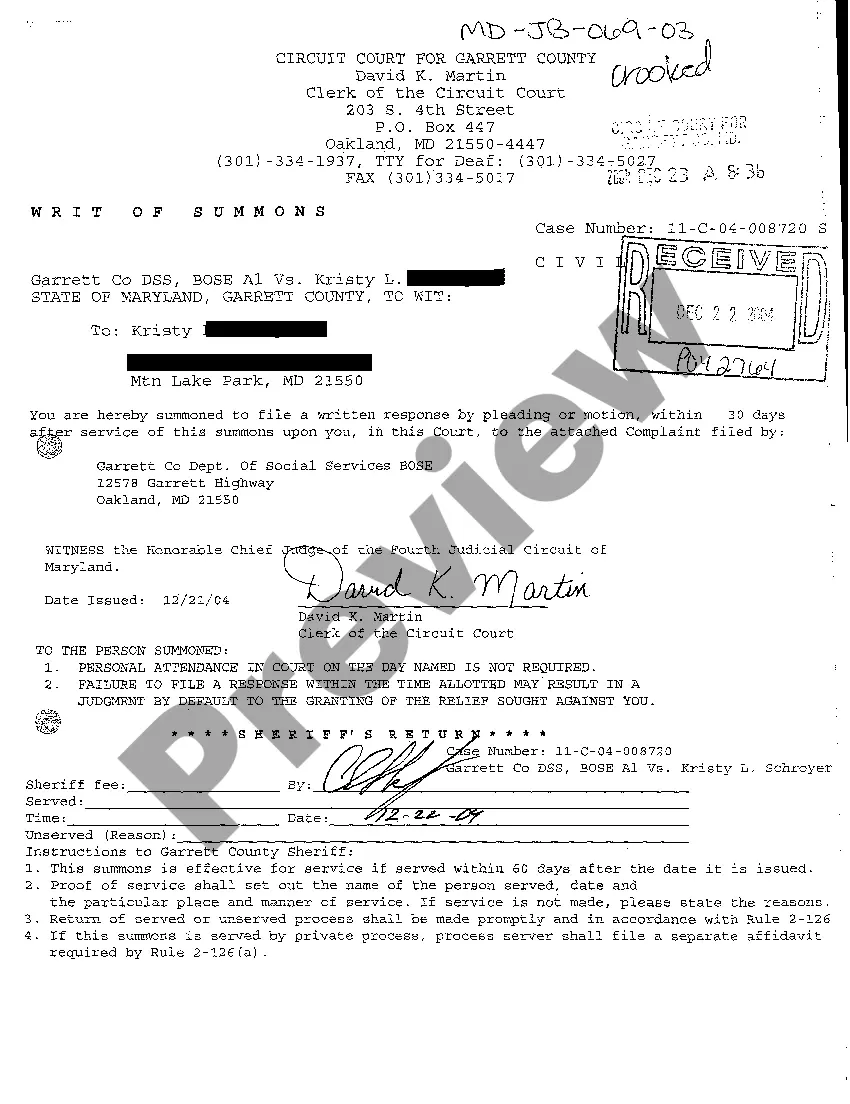

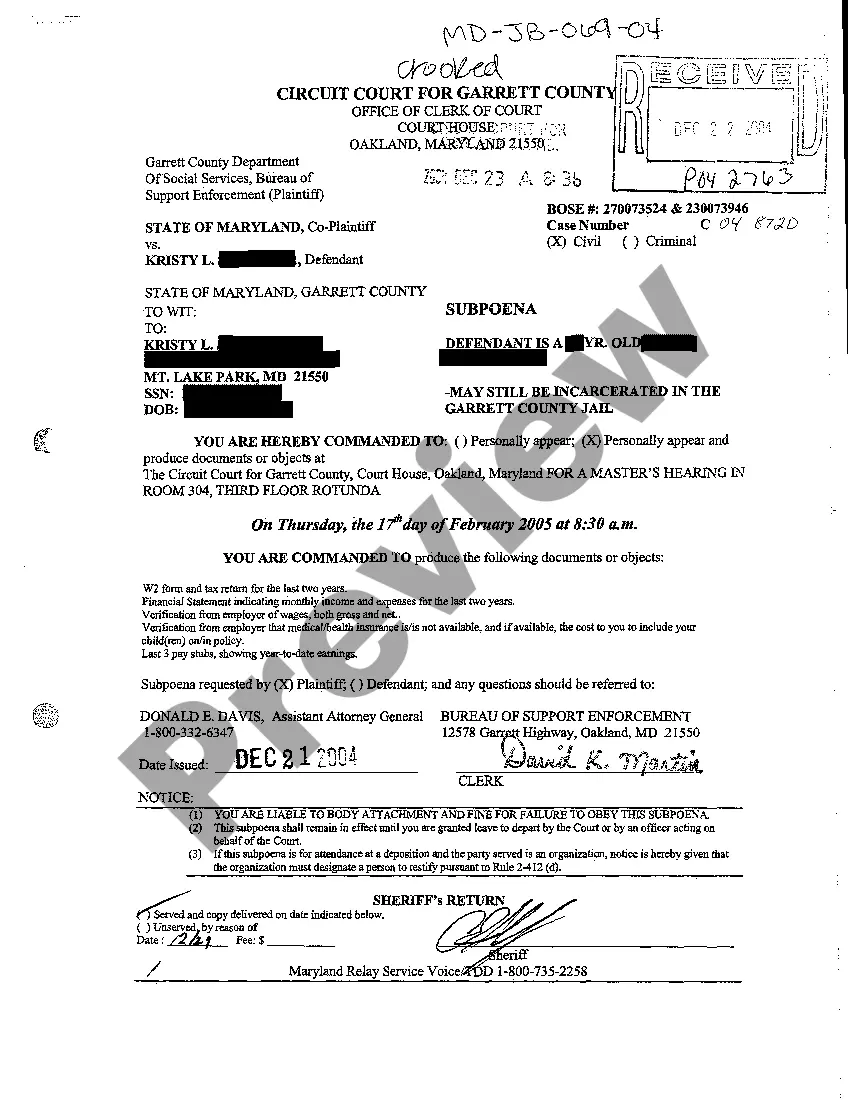

- To get an eligible example, check its validity for your state.

- Take a look at the sample utilizing the Preview option (if it’s accessible).

- If there's a description, read it to understand the important points.

- Click on Buy Now button if you found what you're searching for.

- Pick your plan on the pricing page and create an account.

- Choose you want to pay by a card or by PayPal.

- Download the sample in the preferred file format.

You can print out the Kansas Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller form or fill it out making use of any web-based editor. Don’t worry about making typos because your form can be used and sent, and published as many times as you want. Try out US Legal Forms and get access to more than 85,000 state-specific legal and tax documents.

Form popularity

FAQ

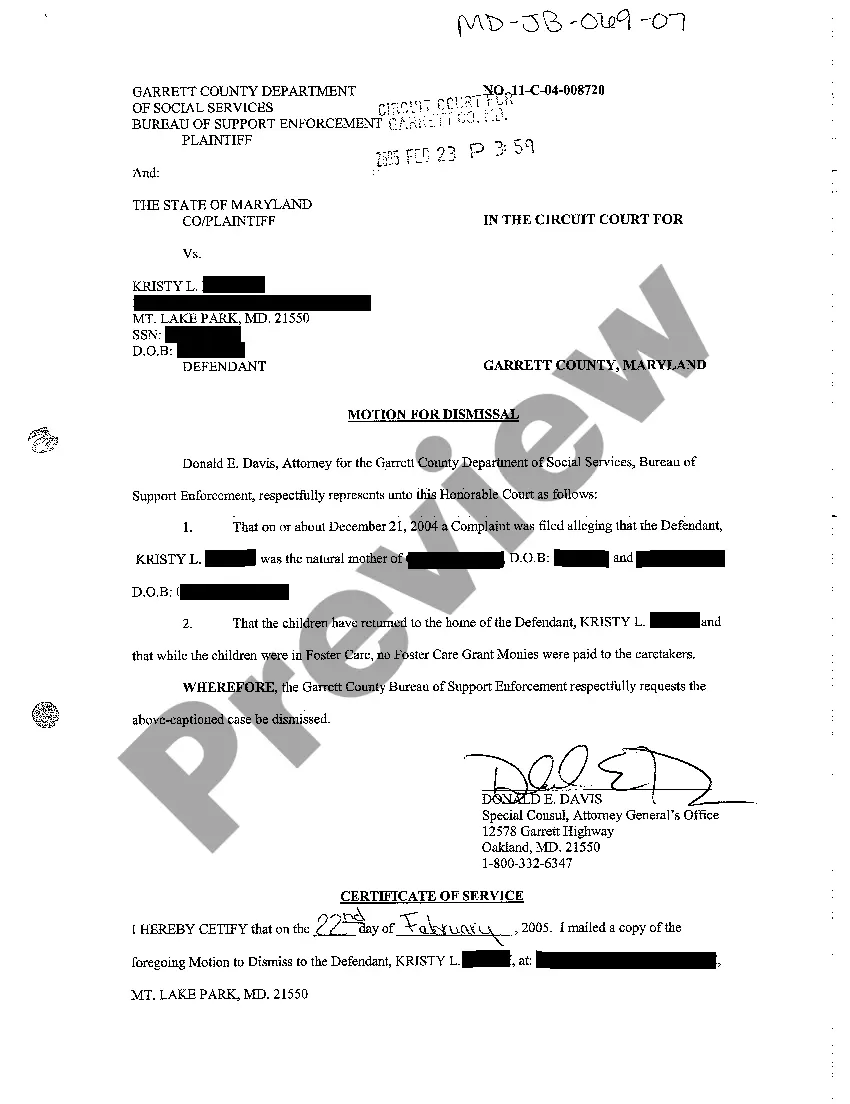

In general, Kansas does not require bills of sale, title assignments, and applications to be notarized. However, it has the right to request notarization in unusual circumstances, such as if document information is incomplete or questionable.

Can a bill of sale be handwritten? If your state does not provide a bill of sale form, yes, you can handwrite one yourself. As long as the document includes all of the necessary parts of a bill of sale and is signed by both parties and a notary, it is valid. Some states require a bill of sale while others don't.

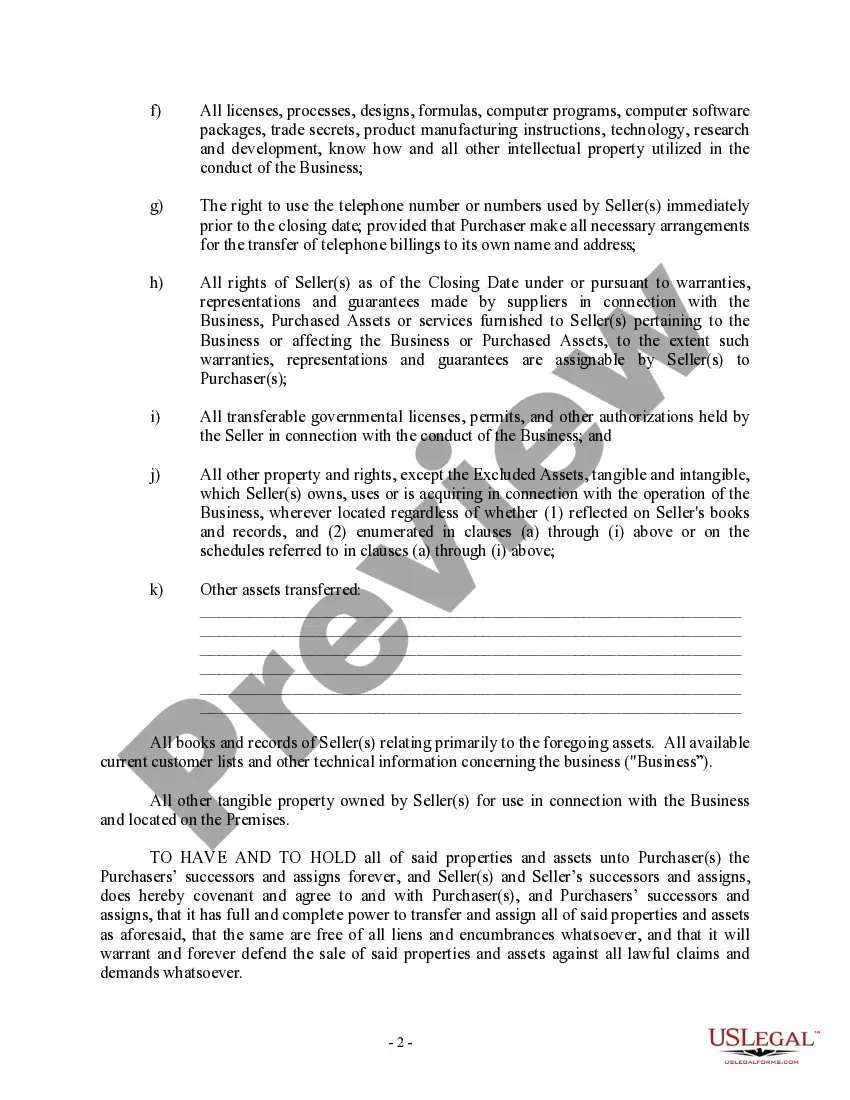

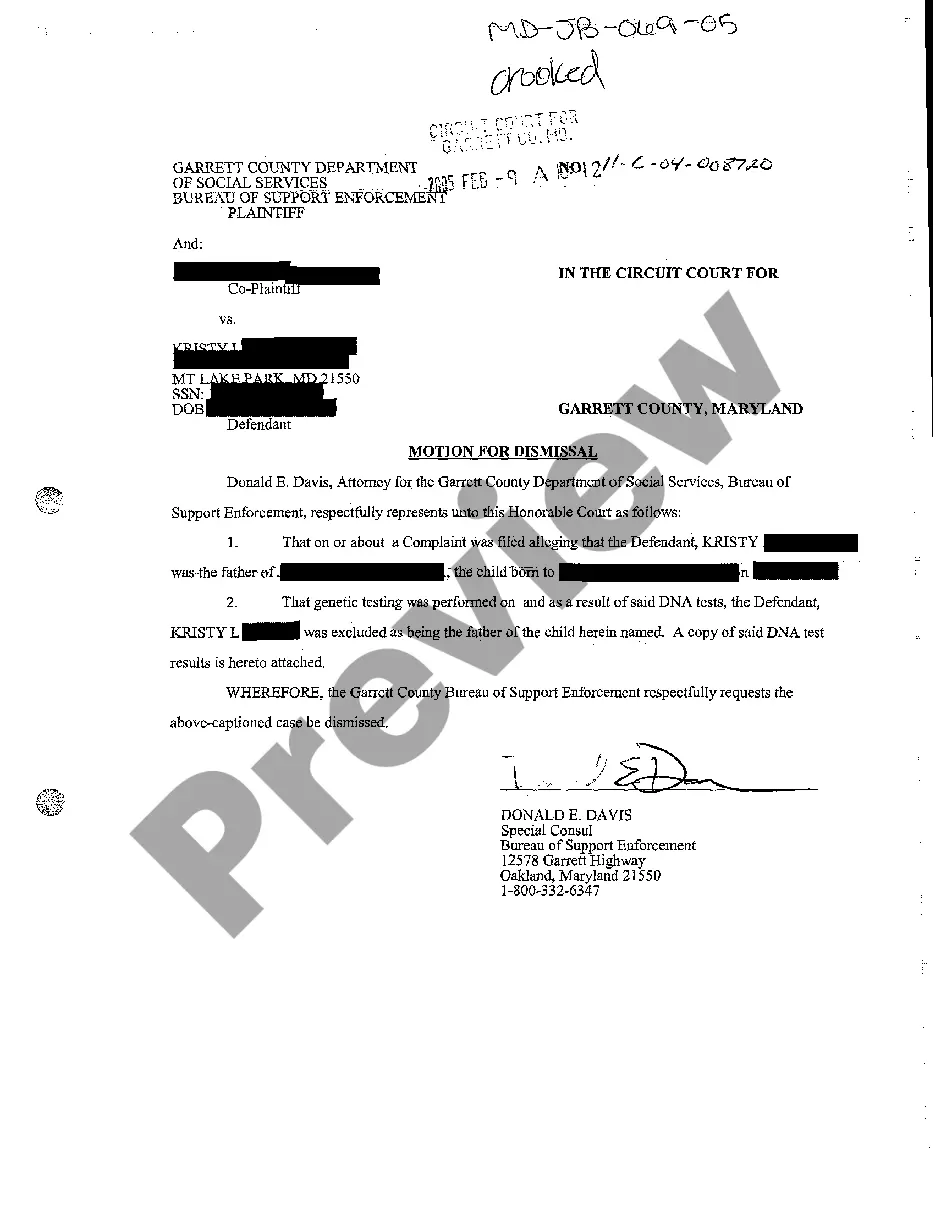

Date of Sale. Buyer's name and address. Seller's name and address. Business name and details, which include: State of incorporation. Address of the business's main headquarters. Assets, shares, personal property and other interests included with the company.

When writing a bill of sale, make sure it contains: the seller's name and address, the buyer's name and address, a description of the item being sold and if it's for a vehicle make sure to include, the vehicle identification number, the date of transaction, the previous owner, the amount paid, the method of payment and

A California Bill of Sale must include both a buyer's and a seller's disclosure. They must be read. If the parties agree to the sale, the document must be signed, witnessed, and notarized. The date of the signatures should also be listed.

Sign two copies of the bill of sale, one for you and one for the other party. Although not strictly required, consider bringing a third party with you when the bill of sale is signed. If questions arise about the sale, that person can serve as a reporter of the transaction.

In Kansas, you need a bill of sale to register a vehicle only if the vehicle is an antique that is 35 years or older and if it doesn't have a title. In that instance, you would complete Form TR-312.For a used vehicle, you will complete the titling and registration process at the County Treasurer's Office.

A bill of sale used as an ownership document does not need to be notarized.If you are using a Kansas title as your primary ownership document, take it to your local county treasurer's motor vehicle office. The Kansas title will be accepted, and your title and registration will be issued.

1Date of Sale.2Buyer's name and address.3Seller's name and address.4Business name and details, which include: State of incorporation. Address of the business's main headquarters. Assets, shares, personal property and other interests included with the company.