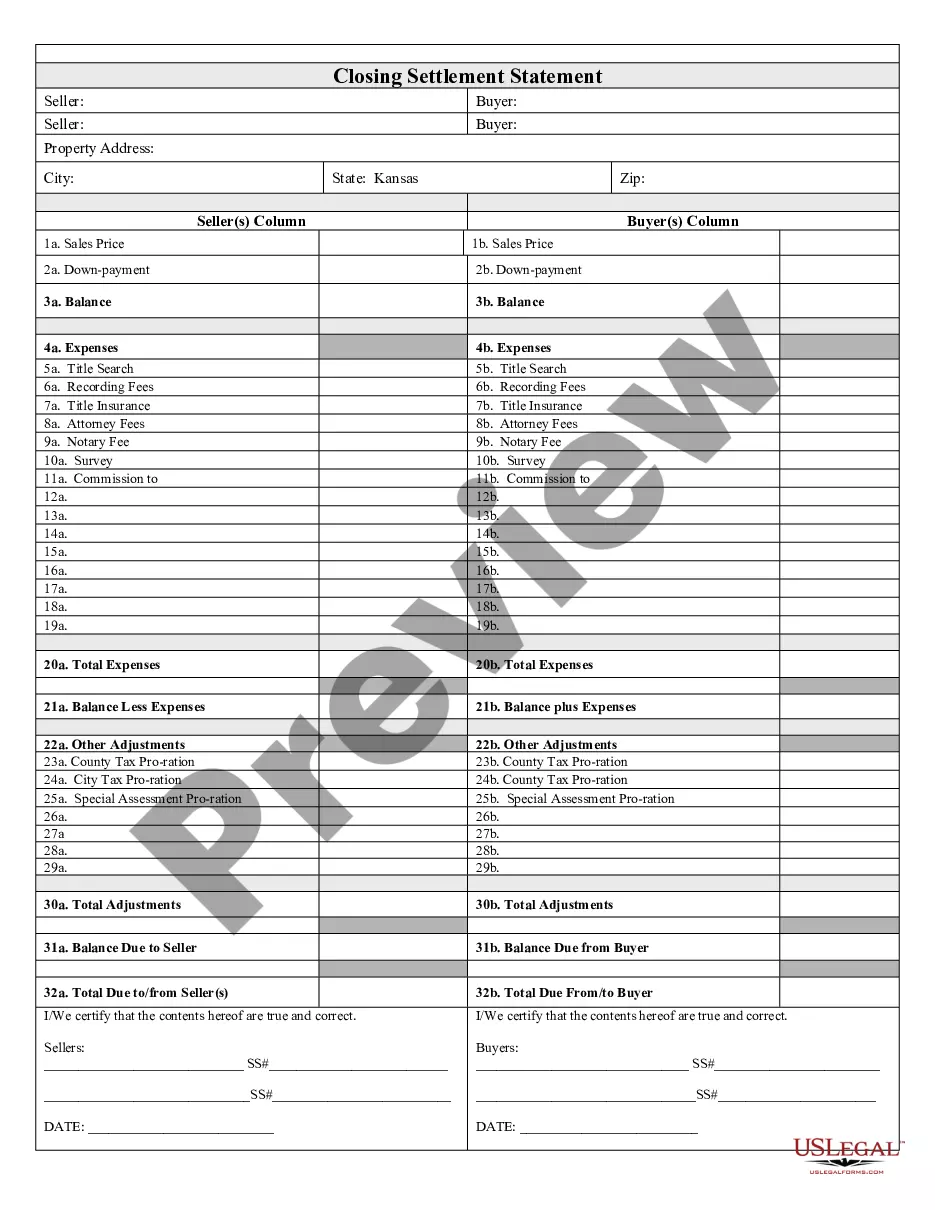

Kansas Closing Statement

Description Kansas Closing Settlement

How to fill out Kansas Closing Statement?

Trying to find Kansas Closing Statement forms and completing them can be a challenge. In order to save time, costs and energy, use US Legal Forms and choose the right sample specially for your state in a few clicks. Our legal professionals draw up all documents, so you simply need to fill them out. It is really that simple.

Log in to your account and return to the form's page and save the document. All of your saved samples are saved in My Forms and therefore are available always for further use later. If you haven’t subscribed yet, you need to sign up.

Look at our detailed instructions concerning how to get the Kansas Closing Statement sample in a few minutes:

- To get an entitled example, check its applicability for your state.

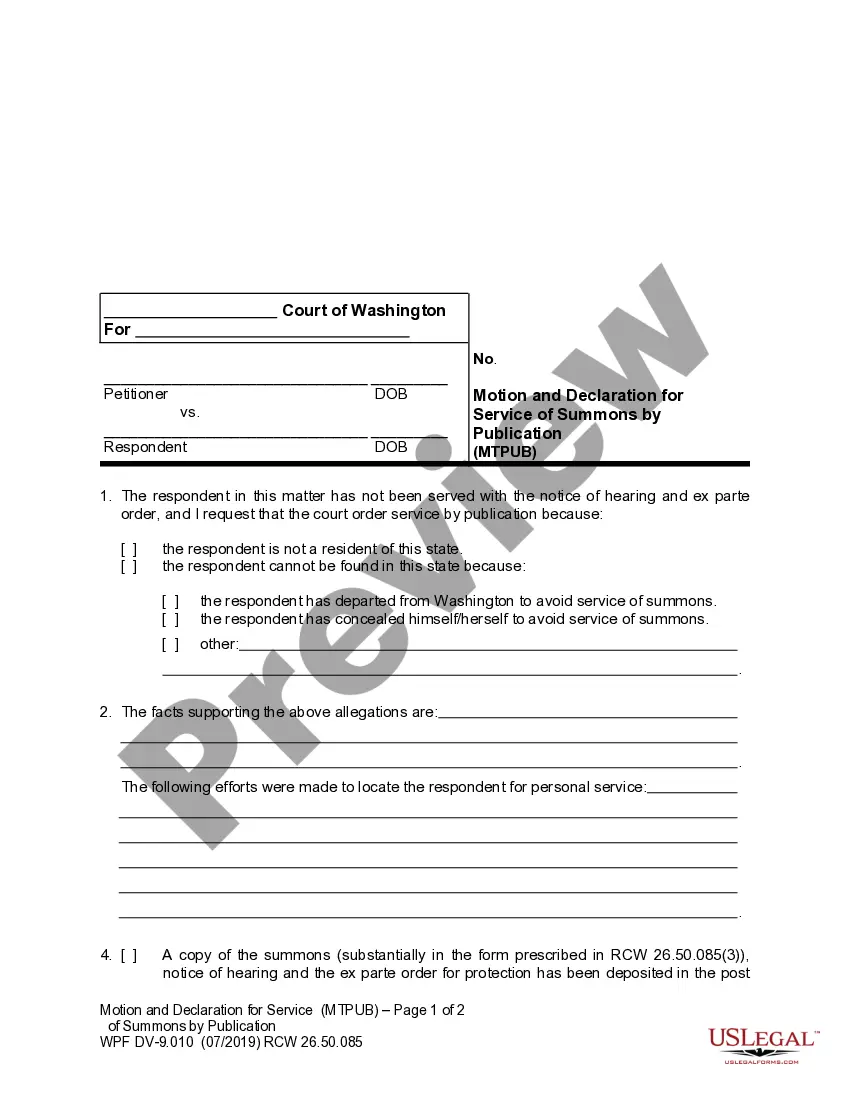

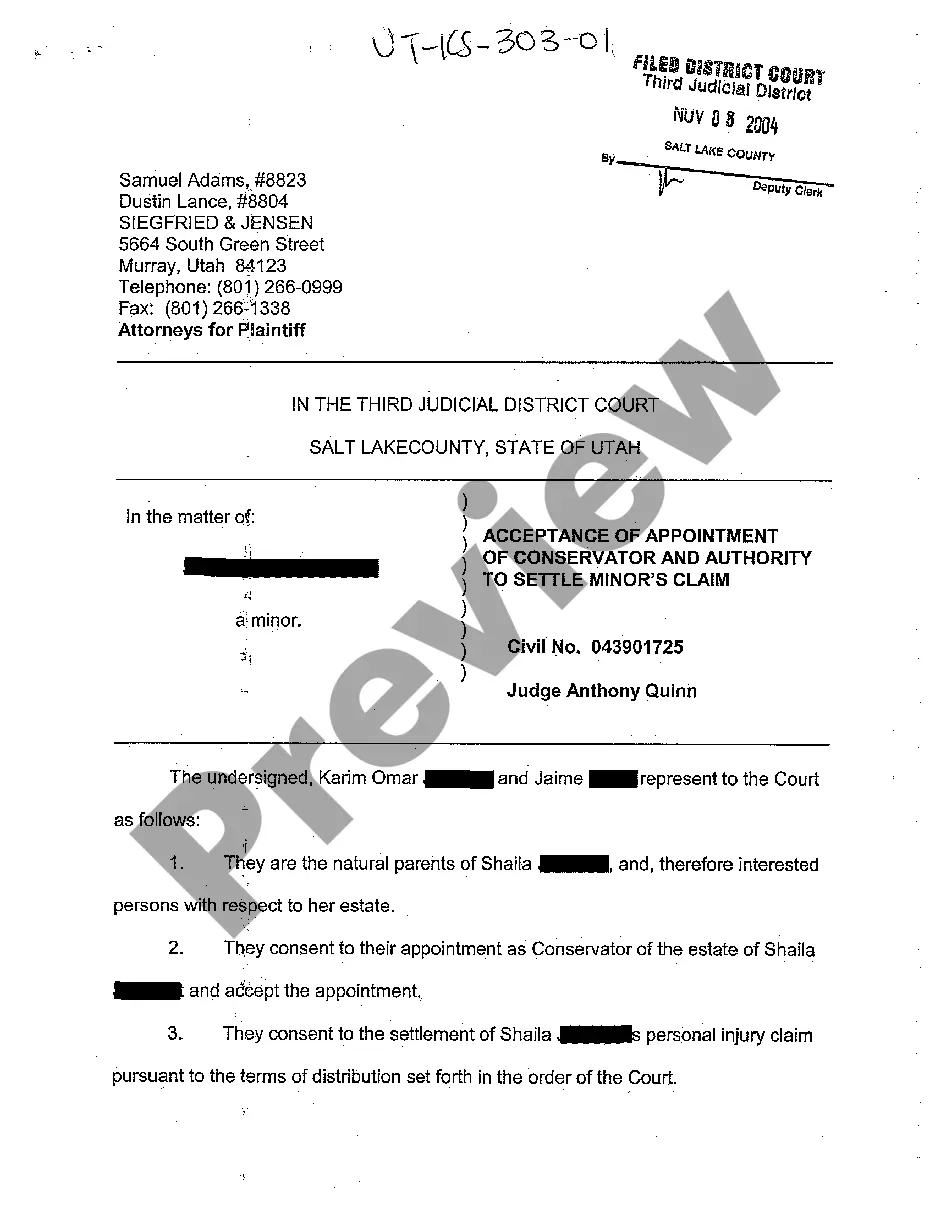

- Have a look at the example making use of the Preview option (if it’s offered).

- If there's a description, read it to learn the details.

- Click on Buy Now button if you found what you're seeking.

- Select your plan on the pricing page and create an account.

- Choose you would like to pay by a credit card or by PayPal.

- Download the file in the preferred format.

Now you can print out the Kansas Closing Statement form or fill it out utilizing any web-based editor. No need to worry about making typos because your form can be used and sent away, and printed as often as you wish. Try out US Legal Forms and get access to more than 85,000 state-specific legal and tax files.

Closing Settlement Form Statement Form popularity

Real Estate Closing Statement Form Other Form Names

Operating Statement Real Estate FAQ

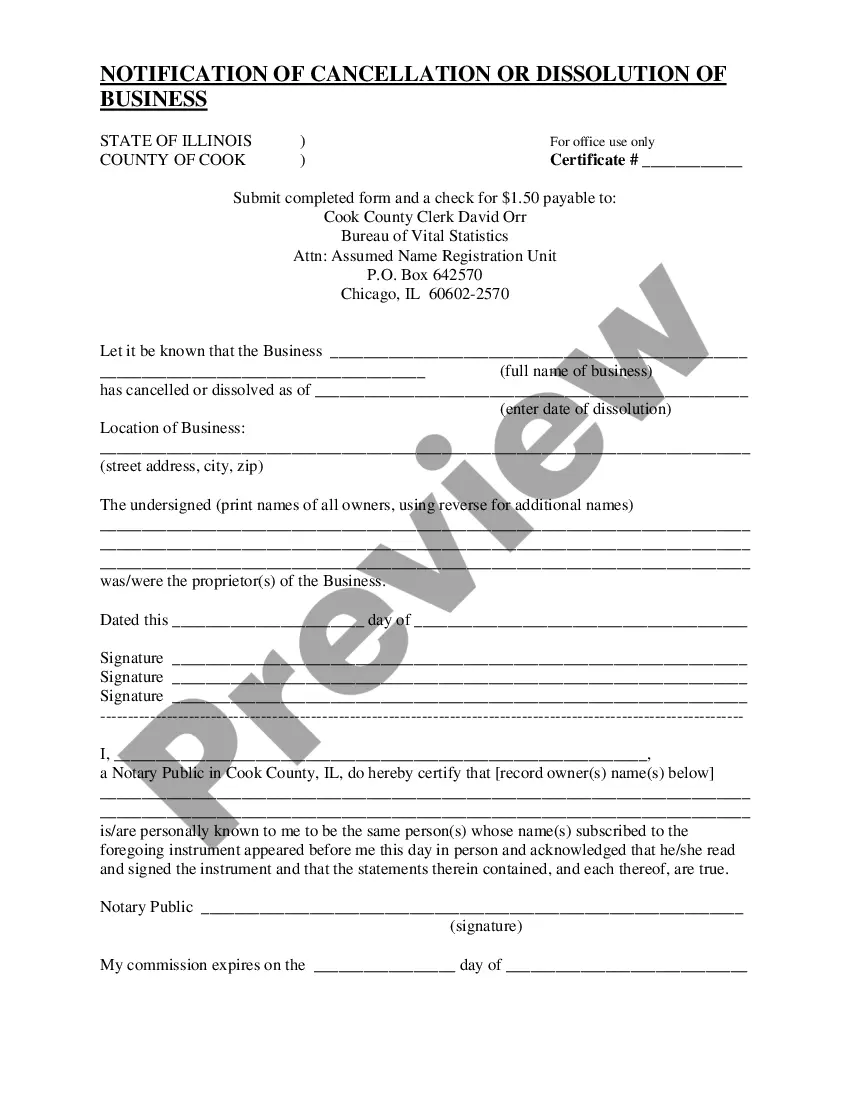

You'll need to formally close your LLC or Corporation. Otherwise, you can still be on the hook for filing your inactive business' annual reports, filing state/federal tax returns, and keeping up any business licenses.

Complete the Notice of Business Closure (CR-108) Return the completed form to: Kansas Department of Revenue, PO Box 3506, Topeka, KS 66625-3506 or FAX to 785-291-3614. Include information on the date the business was closed. Make sure all tax filings are current.

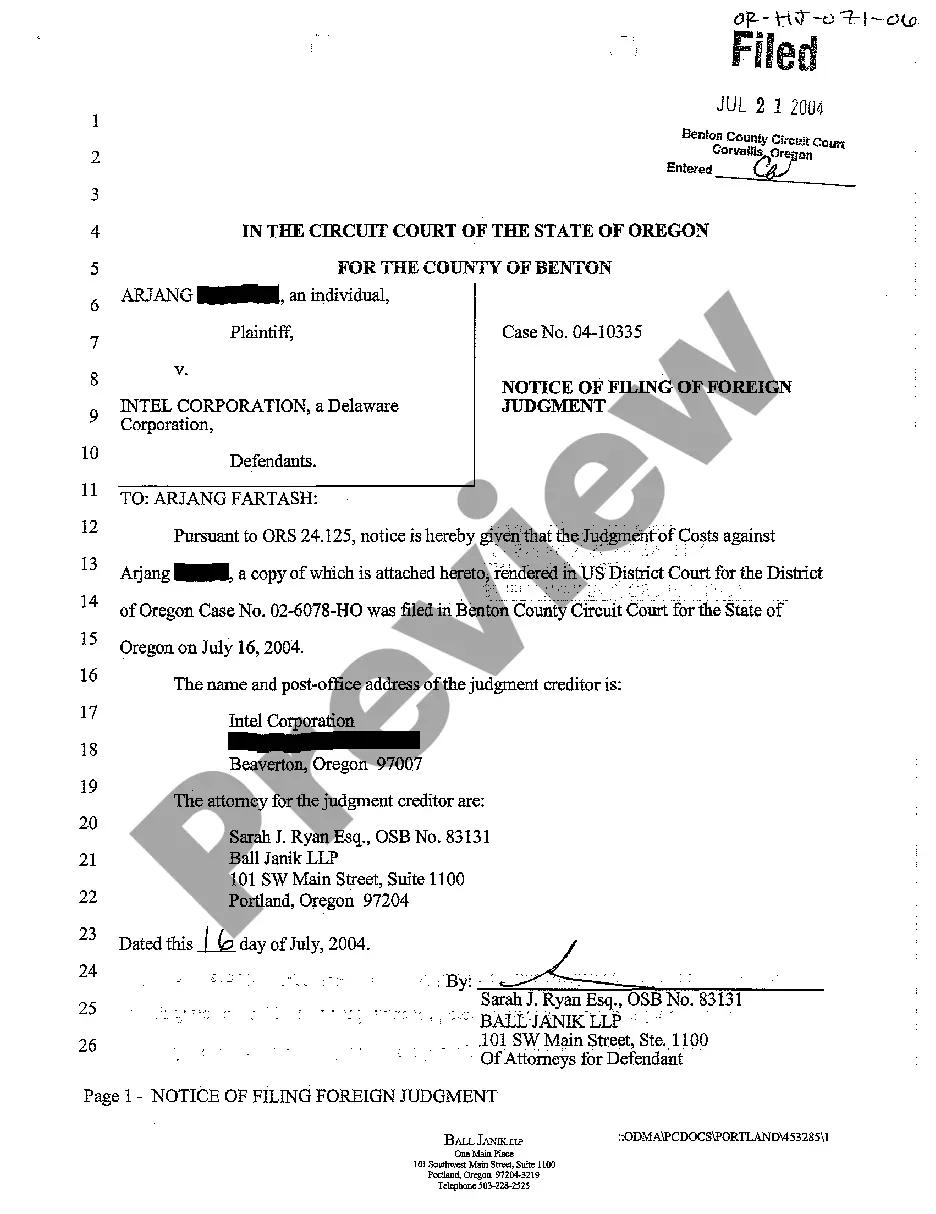

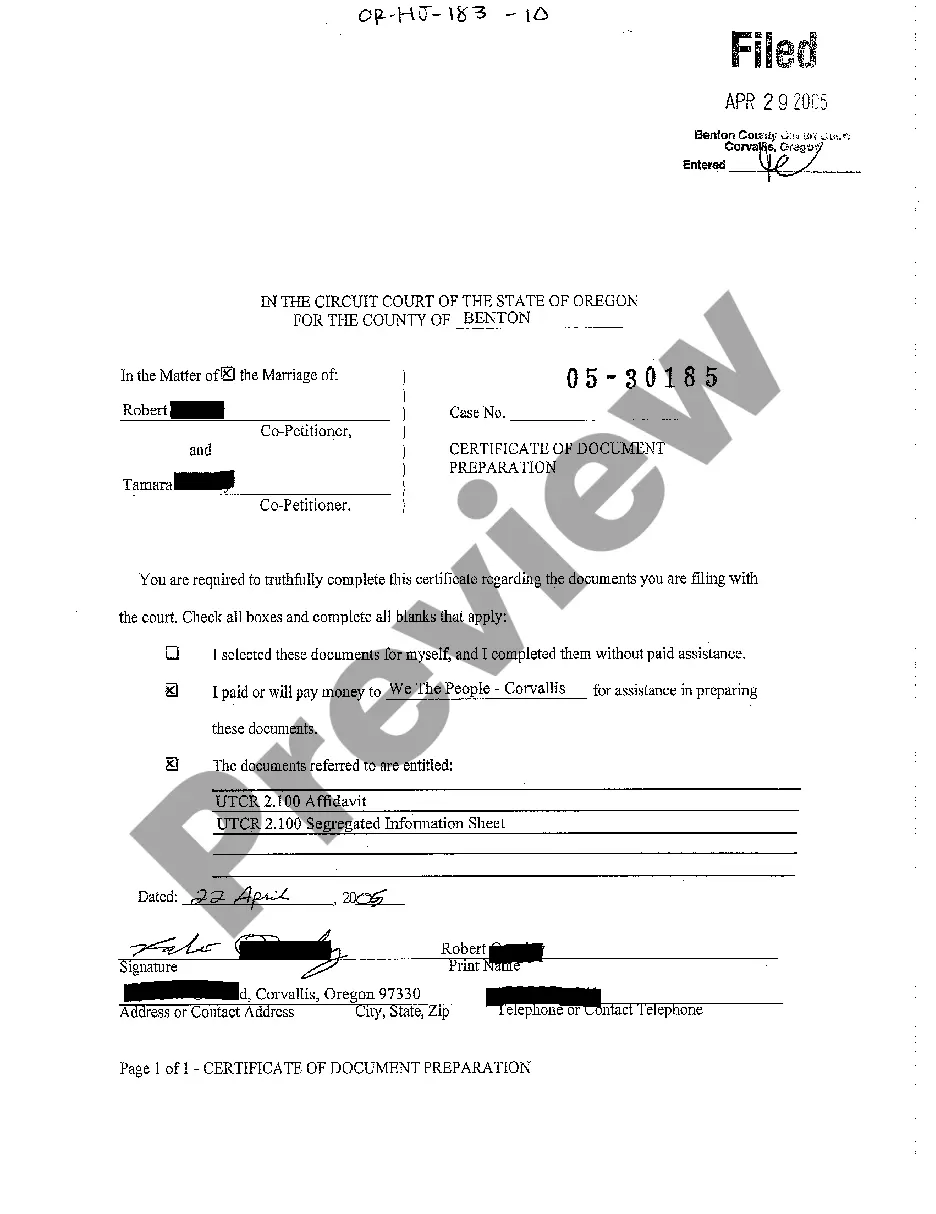

If you live where a title or escrow company agent handles closing and there are two meetings, it's likely that the seller and the seller's agent or attorney will sign paperwork at one meeting and the buyer, accompanied by her agent or attorney, will sign at a separate meeting.

Call a Board Meeting. File a Certificate of Dissolution With the Secretary of State. Notify the Internal Revenue Service (IRS) Close Accounts and Credit Lines, Cancel Licenses, Etc.

Unlike the buyer, who may have to attend the closing to sign original loan documents delivered by the lender to the closing, you, as the seller, may or may not need to attend. For either a conventional escrow closing or a table closing, you may be able to pre-sign the deed and other transfer documents.

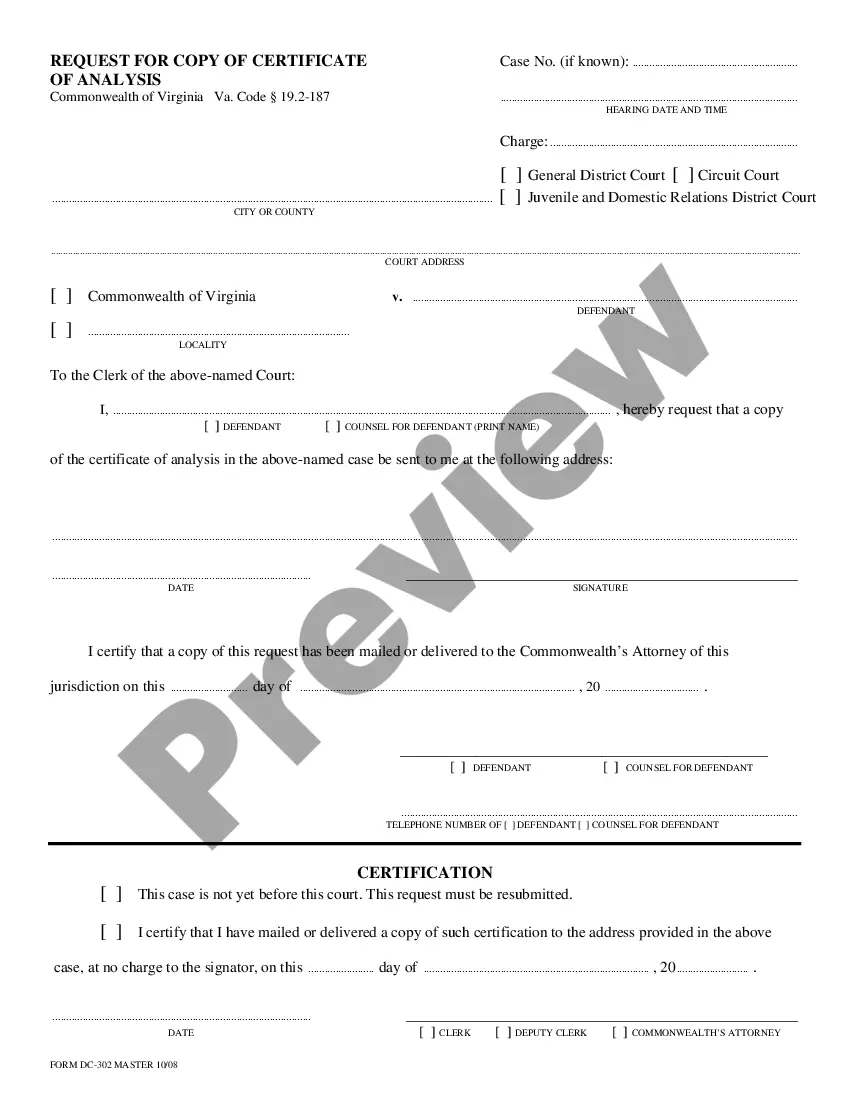

File a Final Return and Related Forms. Take Care of Your Employees. Pay the Tax You Owe. Report Payments to Contract Workers. Cancel Your EIN and Close Your IRS Business Account. Keep Your Records.

A closing agent prepares the closing statement, which is settlement sheet. It's a comprehensive list of every expense that the buyer and seller must pay to complete the real estate transaction. Fees listed on this sheet include commissions, mortgage insurance, and property tax deposits.

Complete the Notice of Business Closure (CR-108) Return the completed form to: Kansas Department of Revenue, PO Box 3506, Topeka, KS 66625-3506 or FAX to 785-291-3614. Include information on the date the business was closed. Make sure all tax filings are current.

The Mortgage Promissory Note. The Mortgage / Deed of Trust / Security Instrument. The deed (for property transfer). The Closing Disclosure. The initial escrow disclosure statement. The transfer tax declaration (in some states)