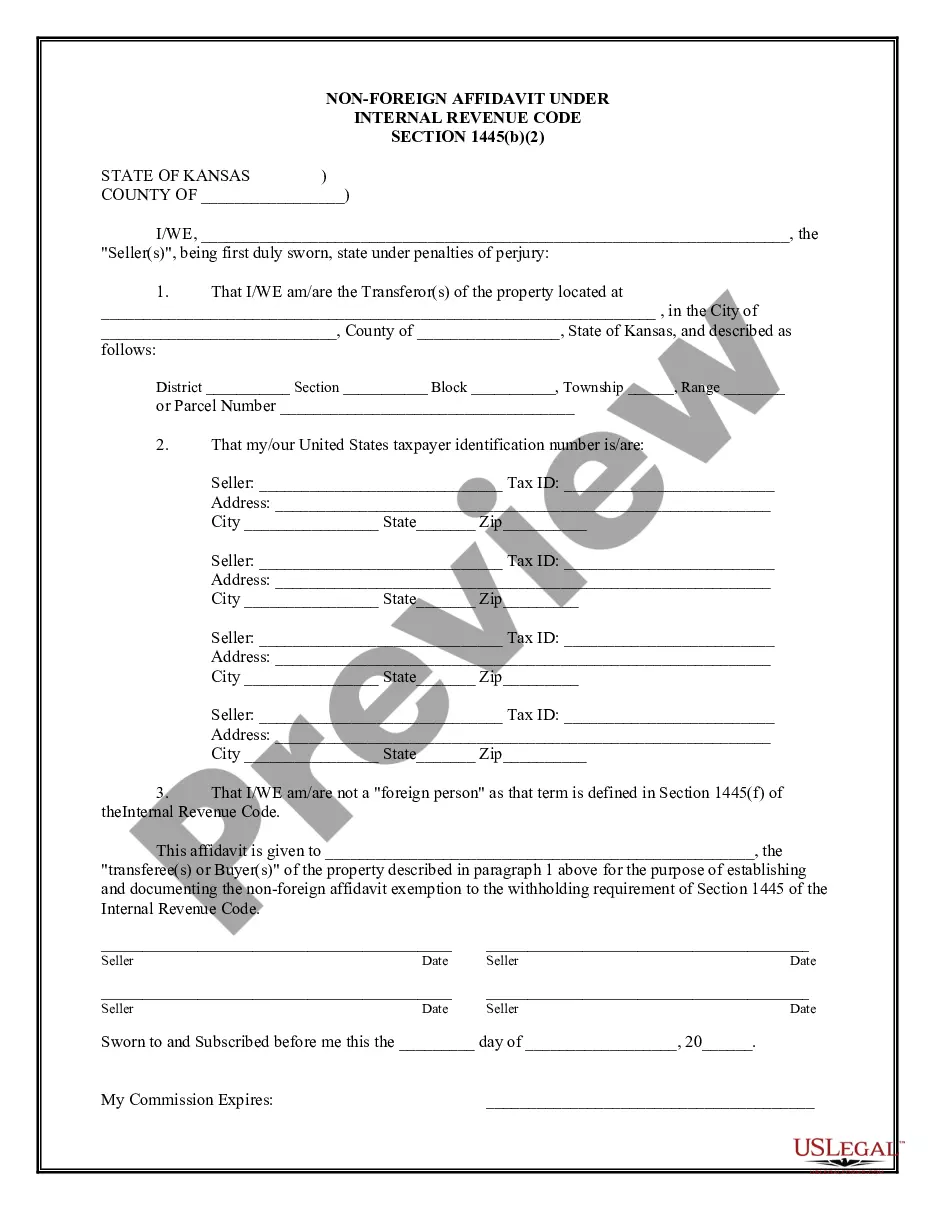

Kansas Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Kansas Non-Foreign Affidavit Under IRC 1445?

In search of Kansas Non-Foreign Affidavit Under IRC 1445 forms and filling out them can be quite a challenge. To save lots of time, costs and energy, use US Legal Forms and find the right example specially for your state in just a few clicks. Our attorneys draw up each and every document, so you just need to fill them out. It truly is so simple.

Log in to your account and return to the form's page and save the sample. All of your downloaded samples are kept in My Forms and are available all the time for further use later. If you haven’t subscribed yet, you need to register.

Look at our comprehensive instructions on how to get your Kansas Non-Foreign Affidavit Under IRC 1445 sample in a few minutes:

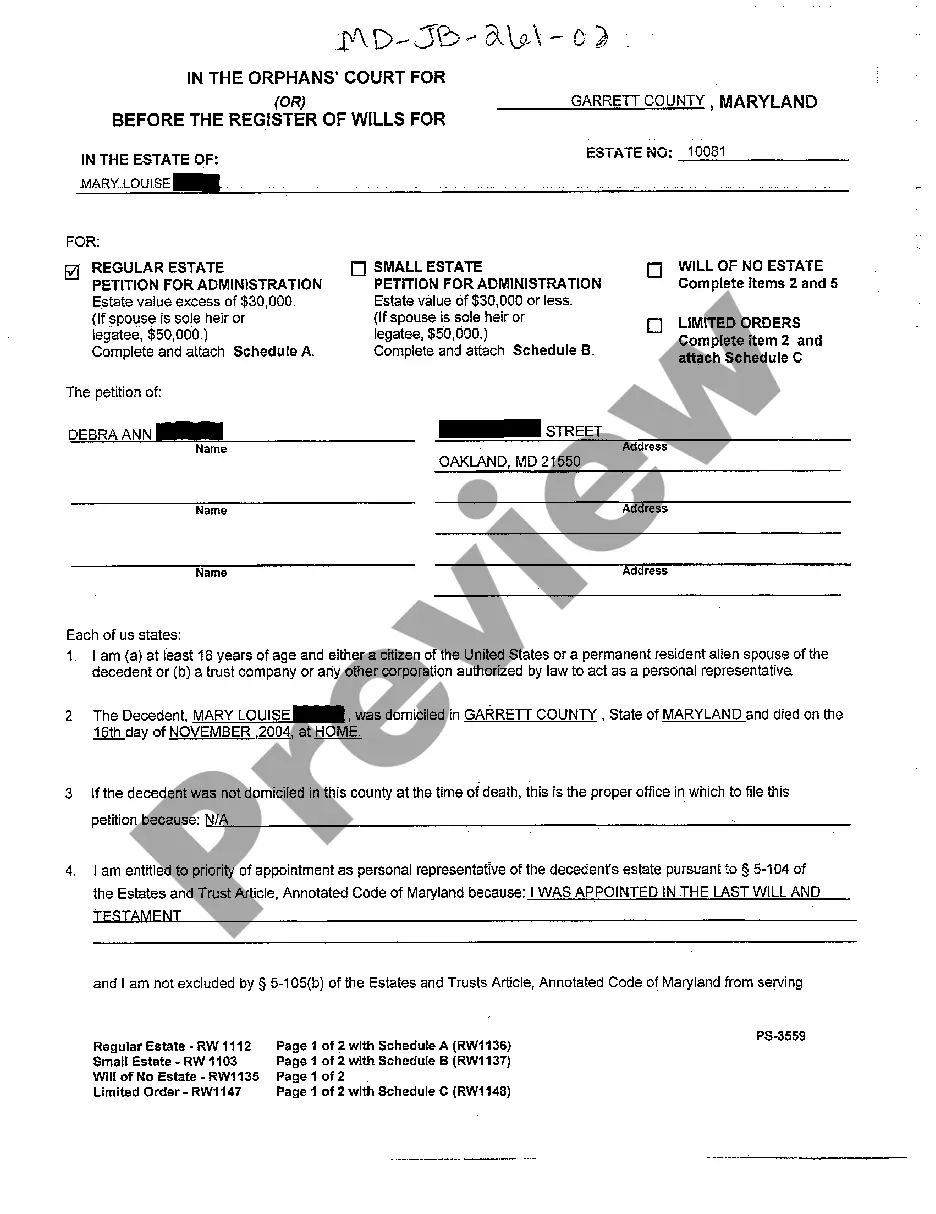

- To get an qualified form, check out its validity for your state.

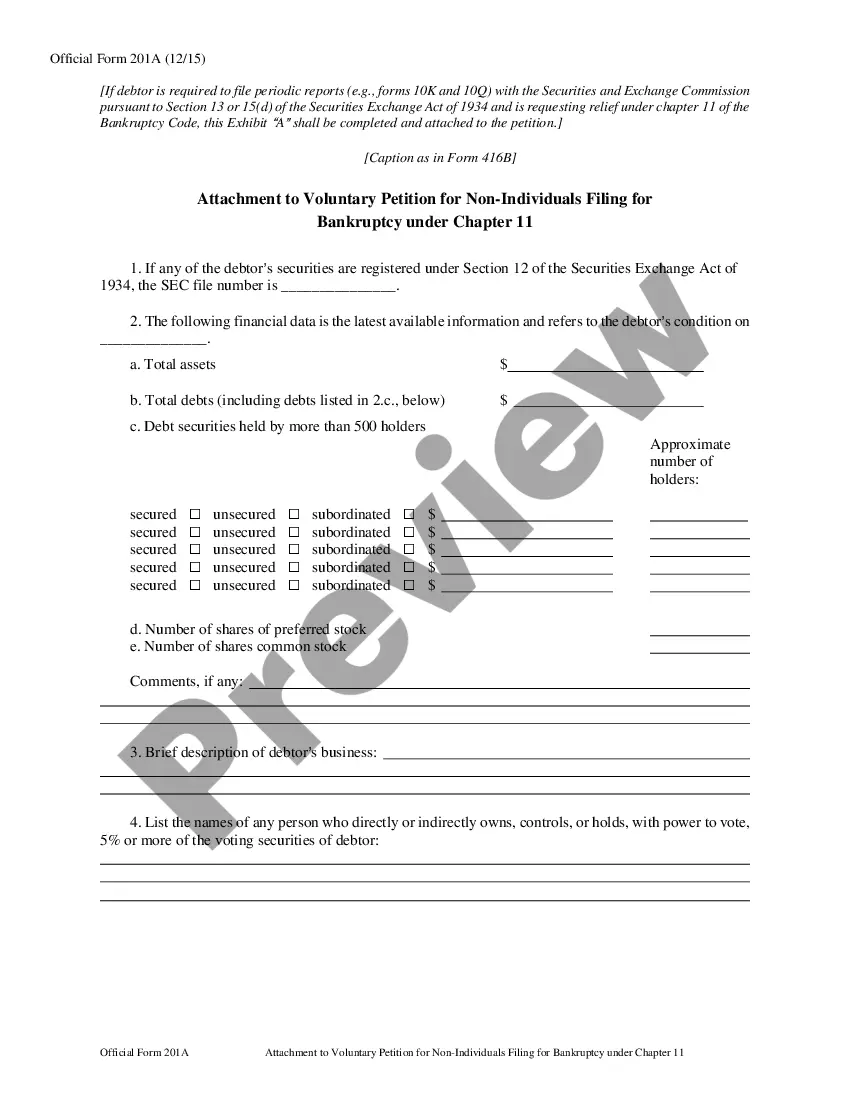

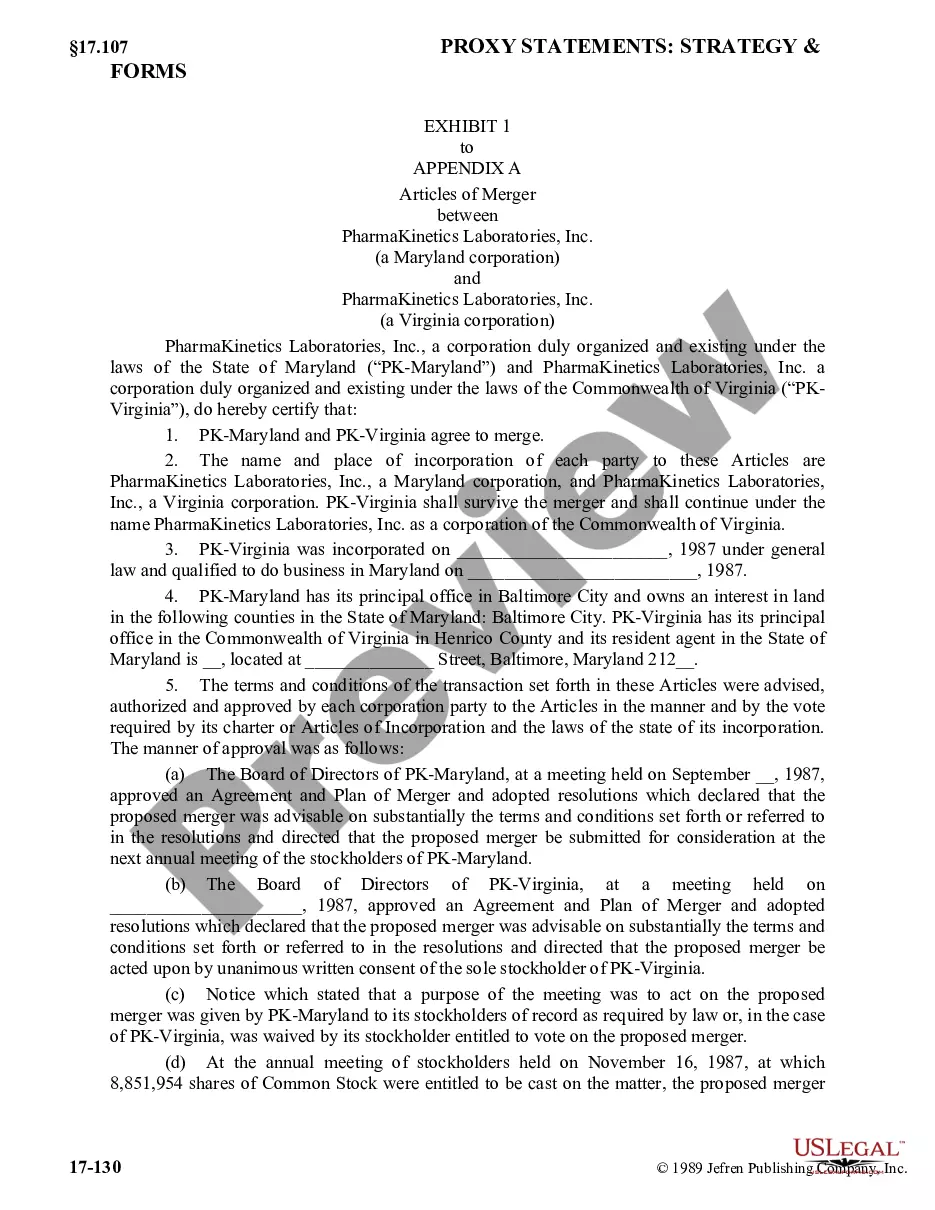

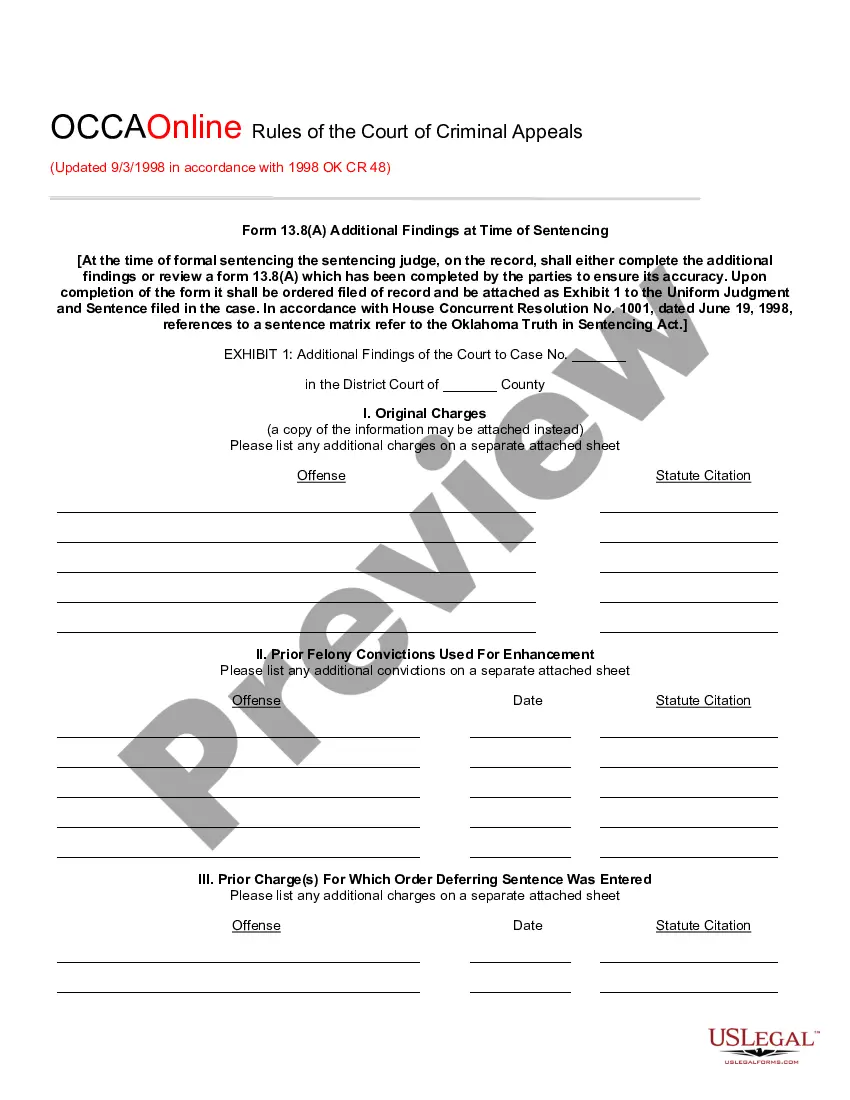

- Look at the example using the Preview option (if it’s available).

- If there's a description, read it to understand the specifics.

- Click on Buy Now button if you found what you're seeking.

- Choose your plan on the pricing page and create your account.

- Pick how you want to pay out by a credit card or by PayPal.

- Download the sample in the favored file format.

You can print the Kansas Non-Foreign Affidavit Under IRC 1445 template or fill it out utilizing any web-based editor. No need to worry about making typos because your form may be utilized and sent away, and published as many times as you want. Try out US Legal Forms and access to around 85,000 state-specific legal and tax files.

Form popularity

FAQ

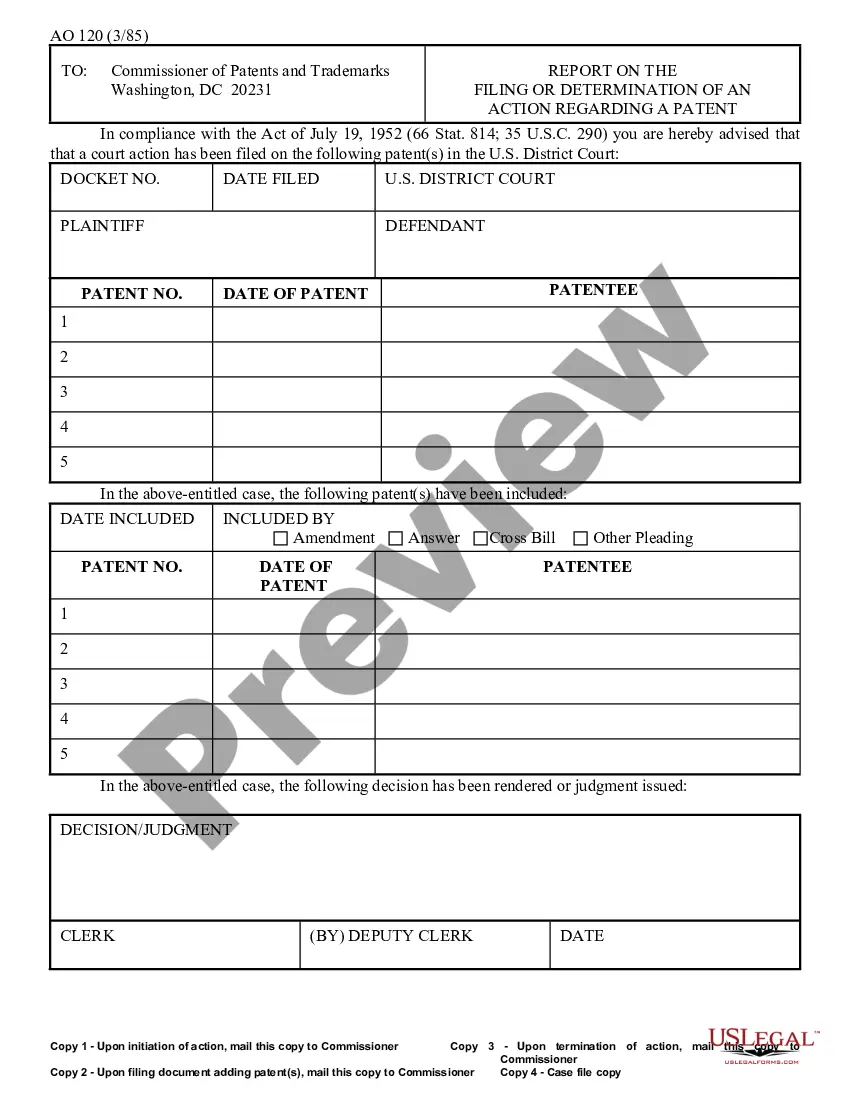

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) income tax withholding. FIRPTA authorized the United States to tax foreign persons on dispositions of U.S. real property interests.

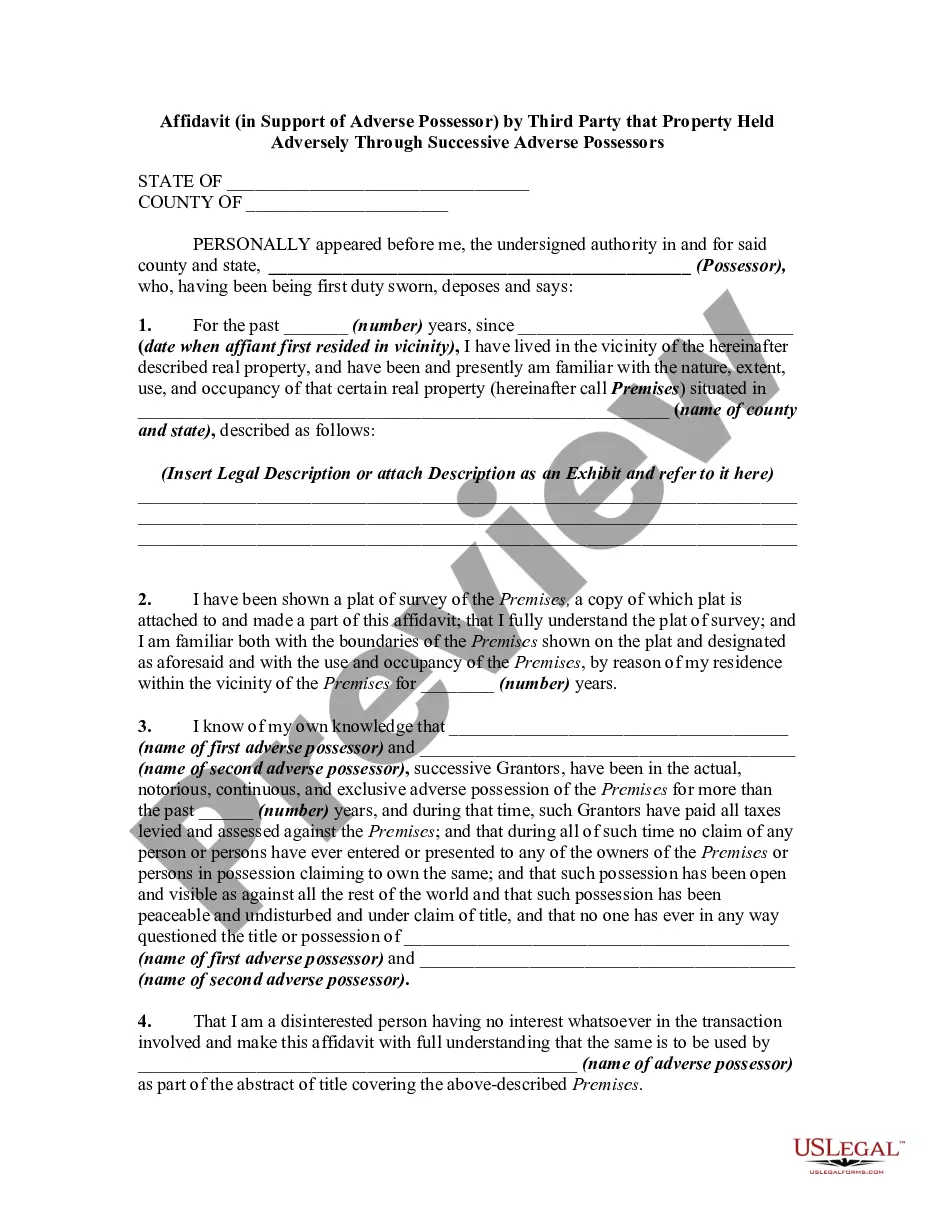

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

FIRPTA is a federal tax law that ensures that foreign sellers pay income tax on the sale of real property in the United States.

A foreign person includes a nonresident alien individual, foreign corporation, foreign partnership, foreign trust, foreign estate, and any other person that is not a U.S. person. It also includes a foreign branch of a U.S. financial institution if the foreign branch is a qualified intermediary.

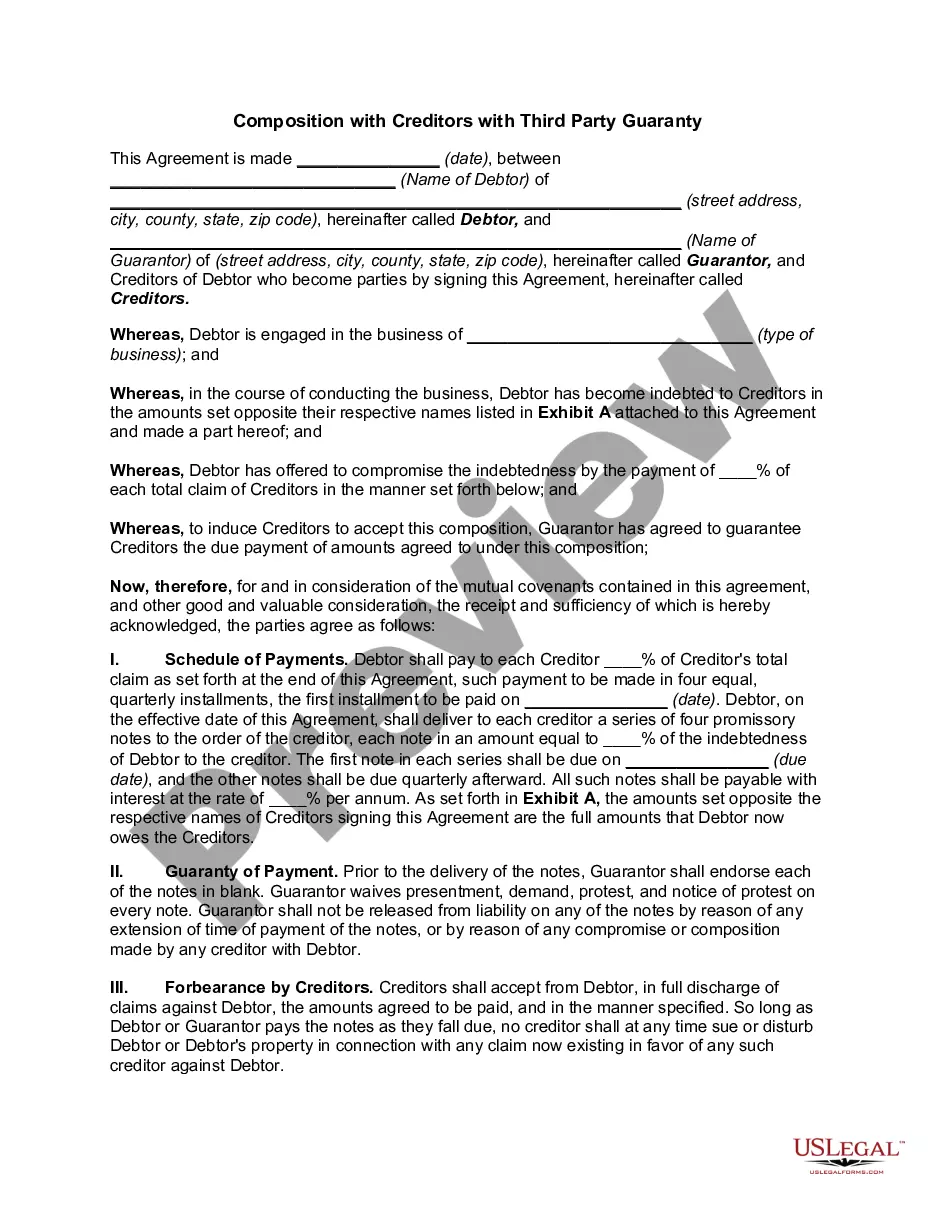

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to income tax withholding (IRC section 1445).Withholding is required on certain distributions and other transactions by domestic or foreign corporations, partnerships, trusts, and estates.

A: The buyer must agree to sign an affidavit stating that the purchase price is under $300,000 and the buyer intends to occupy. The buyer may choose not to sign the form, in which case withholding must be done.

A: The buyer must agree to sign an affidavit stating that the purchase price is under $300,000 and the buyer intends to occupy. The buyer may choose not to sign the form, in which case withholding must be done.

CERTIFICATE OF NON FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a transferee (buyer) of a U.S. real property interest must withhold tax if the transferor (seller) is a foreign person.

The Foreign Investment in Real Property Transfer Act (FIRPTA) requires any buyer of a U.S. real property interest to withhold ten percent of the amount realized by a foreign seller. 26 USC § 1445(a).