Kansas Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out Kansas Living Trust For Husband And Wife With Minor And Or Adult Children?

Trying to find Kansas Living Trust for Husband and Wife with Minor and or Adult Children sample and completing them might be a challenge. To save lots of time, costs and energy, use US Legal Forms and find the appropriate example specifically for your state within a couple of clicks. Our legal professionals draft all documents, so you just need to fill them out. It really is that simple.

Log in to your account and return to the form's page and save the document. All your downloaded templates are kept in My Forms and are accessible always for further use later. If you haven’t subscribed yet, you have to sign up.

Check out our detailed guidelines on how to get the Kansas Living Trust for Husband and Wife with Minor and or Adult Children template in a couple of minutes:

- To get an qualified form, check out its applicability for your state.

- Have a look at the form utilizing the Preview option (if it’s accessible).

- If there's a description, read through it to learn the specifics.

- Click Buy Now if you found what you're searching for.

- Select your plan on the pricing page and create your account.

- Choose you would like to pay out with a card or by PayPal.

- Download the file in the favored format.

Now you can print out the Kansas Living Trust for Husband and Wife with Minor and or Adult Children template or fill it out utilizing any web-based editor. No need to worry about making typos because your form can be utilized and sent away, and printed out as many times as you wish. Check out US Legal Forms and access to more than 85,000 state-specific legal and tax files.

Form popularity

FAQ

A trust is created by a settlor, who transfers title to some or all of his or her property to a trustee, who then holds title to that property in trust for the benefit of the beneficiaries.

Trust property refers to assets that have been placed into a fiduciary relationship between a trustor and trustee for a designated beneficiary. Trust property may include any type of asset, including cash, securities, real estate, or life insurance policies.

The trustee is the person who owns the assets in the trust. They have the same powers a person would have to buy, sell and invest their own property. It's the trustees' job to run the trust and manage the trust property responsibly.

In this article: A living trust is a type of estate planning tool that allows you to transfer ownership of your assets to a separate fund while you're still alive.In some circumstances, you can use a living trust to protect money you owe to creditors.

A trustee typically cannot take any funds from the trust for him/her/itself although they may receive a stipend in the form of a trustee fee for the time and efforts associated with managing the trust.

A living trust does not protect your assets from a lawsuit. Living trusts are revocable, meaning you remain in control of the assets and you are the legal owner until your death.

Legally your Trust now owns all of your assets, but you manage all of the assets as the Trustee. This is the essential step that allows you to avoid Probate Court because there is nothing for the courts to control when you die or become incapacitated.

When they pass away, the assets are distributed to beneficiaries, or the individuals they have chosen to receive their assets. A settlor can change or terminate a revocable trust during their lifetime. Generally, once they die, it becomes irrevocable and is no longer modifiable.

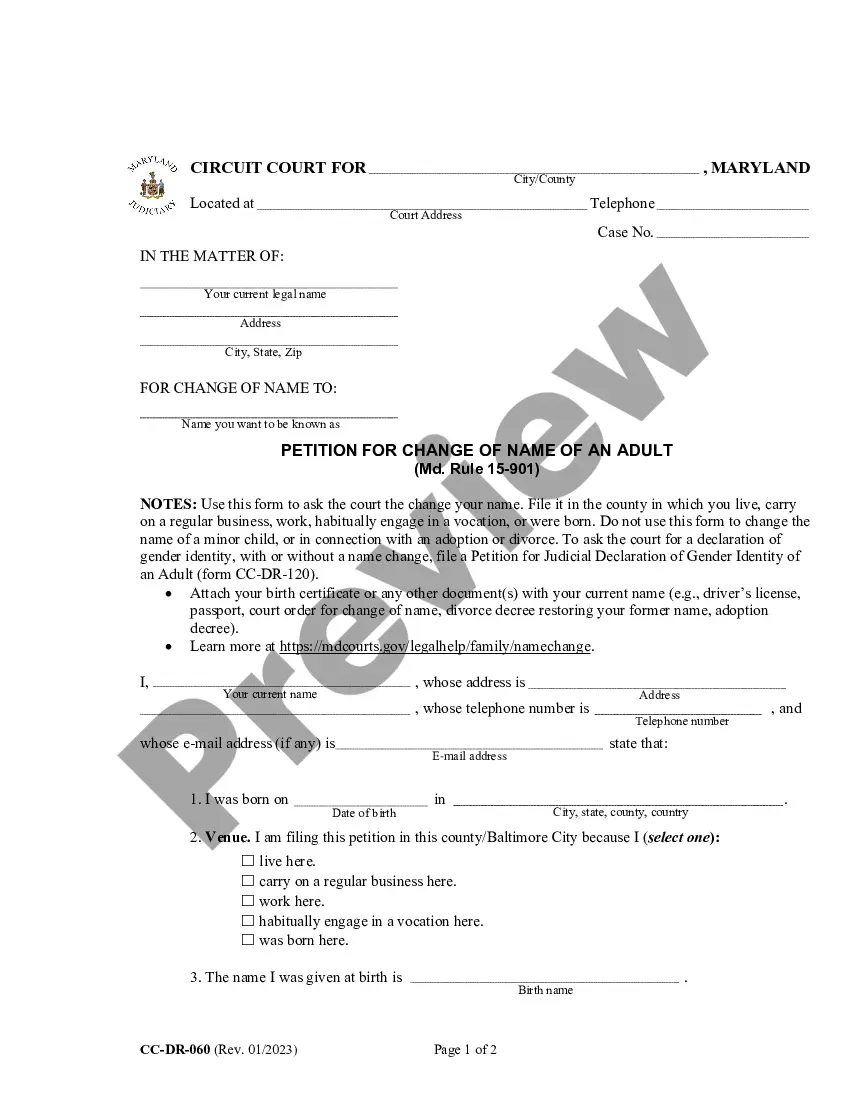

Select the type of trust that best suits your current situation. Take inventory on your property. Select your trust's trustee. Create a trust document. Sign the trust document in front of a notary public. Fund the trust by transferring property and assets into it.